Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

You can’t make financial decisions if you don’t know how much money you have to work with. This is a big dilemma for many of us according to a study from OnePoll research that shows half of Americans don’t know how much money is in their bank account. Even worse, of the 2,000 Americans interviewed, 55% said fear keeps them from looking at their bank account.

Don’t let fear keep you from reaching your financial goals. Instead, check out Empower — a powerful and free tool to help you easily manage and understand your personal finance situation.

- About Empower

- How Empower’s Free Personal Dashboard Works

- Why I Use Empower’s Free Dashboard

- How Empower Wealth Management Works

- Additional Features and Benefits

- Empower Cash™

- How to Sign Up with Empower

- Empower Pros and Cons

- Is Empower Safe?

- Empower Alternatives

- Should You Sign Up with Empower?

- Who Is Empower For?

- What Others Are Saying

- Honest Recommendation

- How We Tested the Product

- Bottom Line

About Empower

Empower has risen to become one of the most popular financial management platforms available. It comes in two versions, the free Empower Personal Dashboard and the Wealth Management service. The free Personal Dashboard is a robust budgeting, planning, and investment management tool. The wealth management version is a full investment management service, working somewhat like a robo advisor, but providing a generous amount of live support from financial advisors.

Empower is used by nearly two million people, who primarily use the free version. Many users start out with the free version and then upgrade to the wealth management service if they want direct investment management of their investment portfolios. But even if you don’t upgrade, the free version offers so many investment tools it’s worth having for those alone.

The wealth management service takes in more than 25,000 clients, who have more than $14 billion in assets under management. The company was founded in 2009 as Personal Capital (it changed its name to Empower in 2023) and is headquartered in San Carlos, California.

How Empower’s Free Personal Dashboard Works

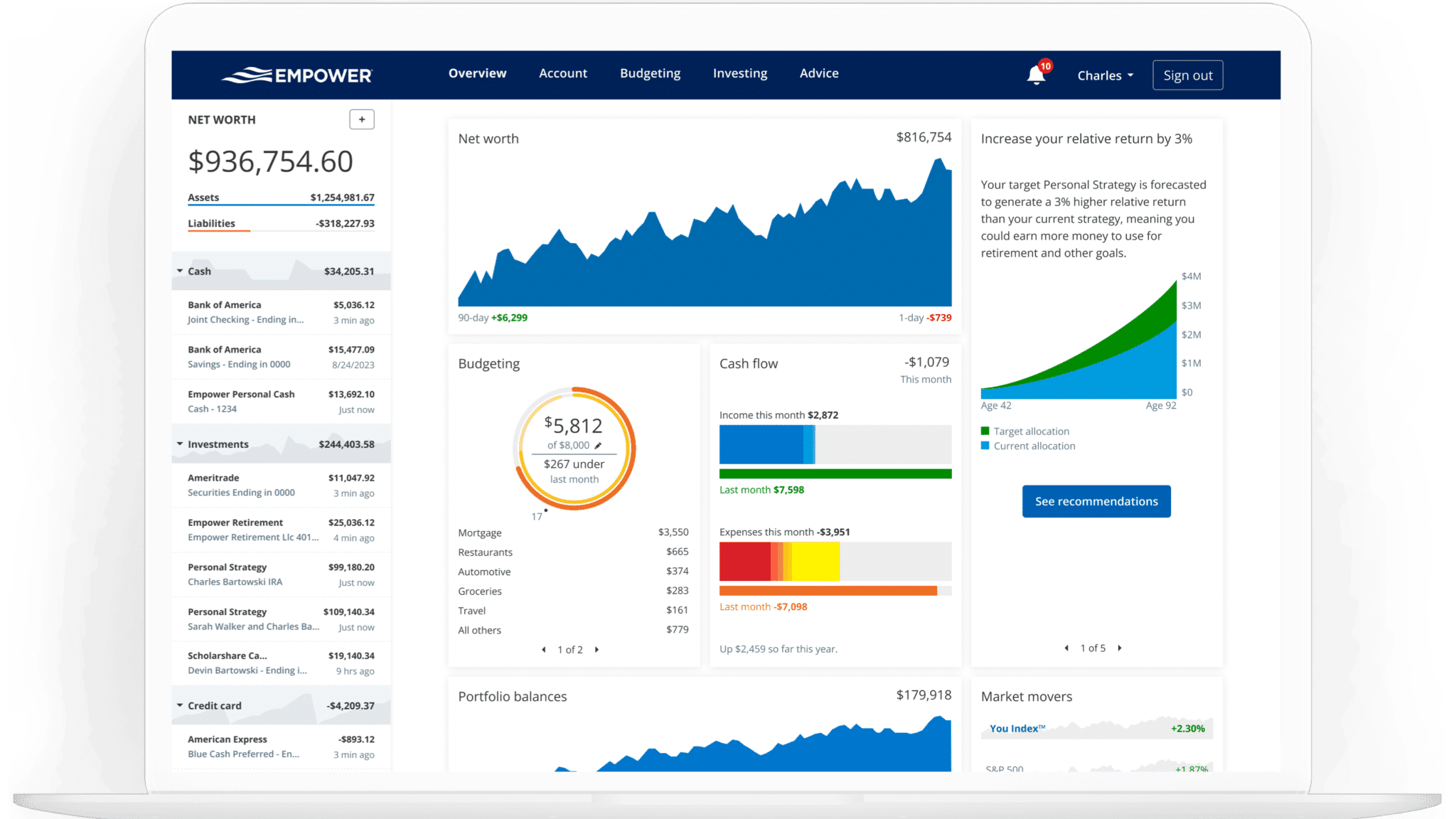

The Empower Personal Dashboard is often seen as a budgeting app, but it’s fairly limited in that regard. However, the investment tools are extensive. Even if you have no intention of using Empower for budgeting, the free Personal Dashboard provides valuable investment support.

The dashboard serves primarily as a financial aggregator, where you can include all your accounts. You can connect your bank accounts, credit cards, mortgages, loans, retirement accounts, and brokerage accounts. It allows you to assemble your entire financial life on a single platform. You can even include any employer-sponsored retirement plans you have–in fact, this is the free version’s specialty.

It’s a highly organized method of asset allocation so that you can view your entire financial situation at once. The user dashboard is easy to read and includes charts and graphs to help you see your cash flow and net worth.

The free Personal Dashboard offers the following capabilities:

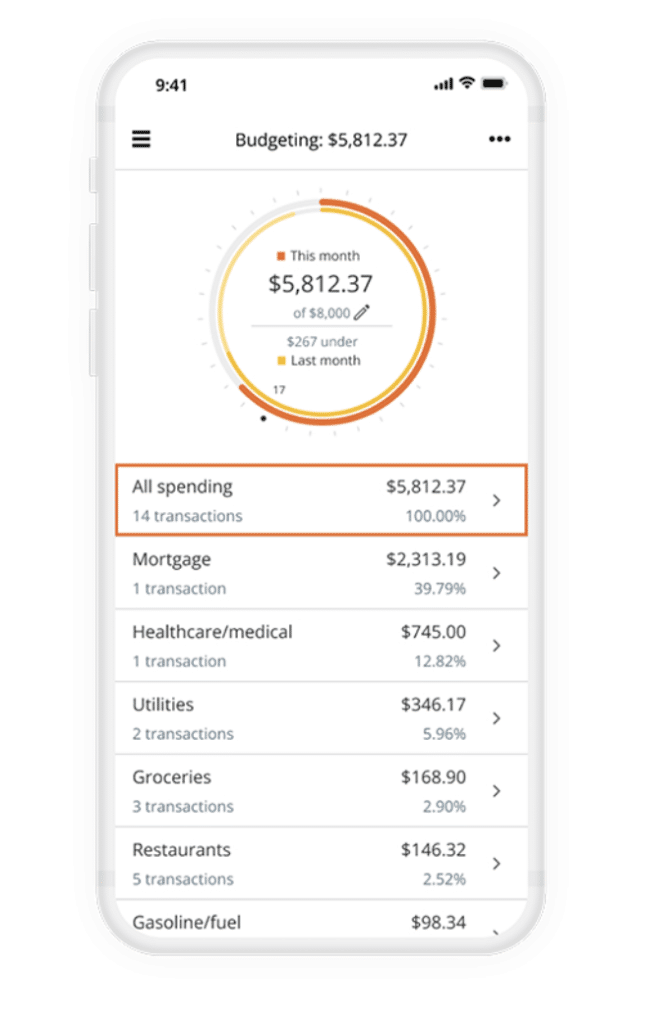

Budgeting. You can use the free version as a budgeting tool to track your cash flow and spending patterns. You can also analyze your spending categories and individual transactions. You’ll get monthly summaries, helping you to know exactly where your money is going. However, if you’re looking primarily for budgeting software, you probably won’t use Empower. For example, while the platform provides alerts of upcoming bills, it does not provide a bill payment function. You will have to continue to pay your bills directly from your bank accounts.

Cash Flow Analyzer. Knowing how much money you bring in and spend each month can help you make better spending decisions. The Cash Flow Analyzer tool creates a budget for you. Once set up, it tracks your income and expenses from the different financial accounts you’ve linked to the platform. You can then set financial goals, like preparing for retirement or paying off debt. The analyzer will help you develop strategies to reach your goals.

Despite the Empower Personal Dashboard’s limits on the budgeting side, it’s an excellent service when it comes to investment management. It offers the following investment tools:

401(k) Analyzer. Millions of people participate in employer-sponsored retirement plans. But, few are aware of the investment fees that are hidden in those plans. The analyzer will show you exactly what each fund in your plan is costing you. It will then suggest alternative allocations for lower-cost funds.

Savings Planner. Check your progress on long-term goals. Empower calculates how much you should save each year to reach your goals and shows you your progress as you go.

Retirement Planner. Keep track of your retirement savings and see if you’re on target to reach your retirement goals. The planner uses a series of what-if scenarios, to help you determine if you’re on track. You can adjust for changes in your situation, such as a job or career change, the birth of a child, or even saving for college. It takes into account outside factors that can have an impact on retirement.

See also: Review of Empower’s Retirement Planner

Cryptocurrency Tracking. Empower now allows you to track your cryptocurrency on hundreds of different crypto exchanges. You can track thousands of different token types, too, including Bitcoin, Ethereum, and Litecoin. This is a great feature for those adding crypto to their portfolio and who want to keep up-to-date on the price.

Investment Checkup. This might be the most important investment tool of all. Once you aggregate your investment accounts on the platform, this tool will help you to optimize those accounts. It can recommend adjusting your portfolio mix to improve your overall investment performance.

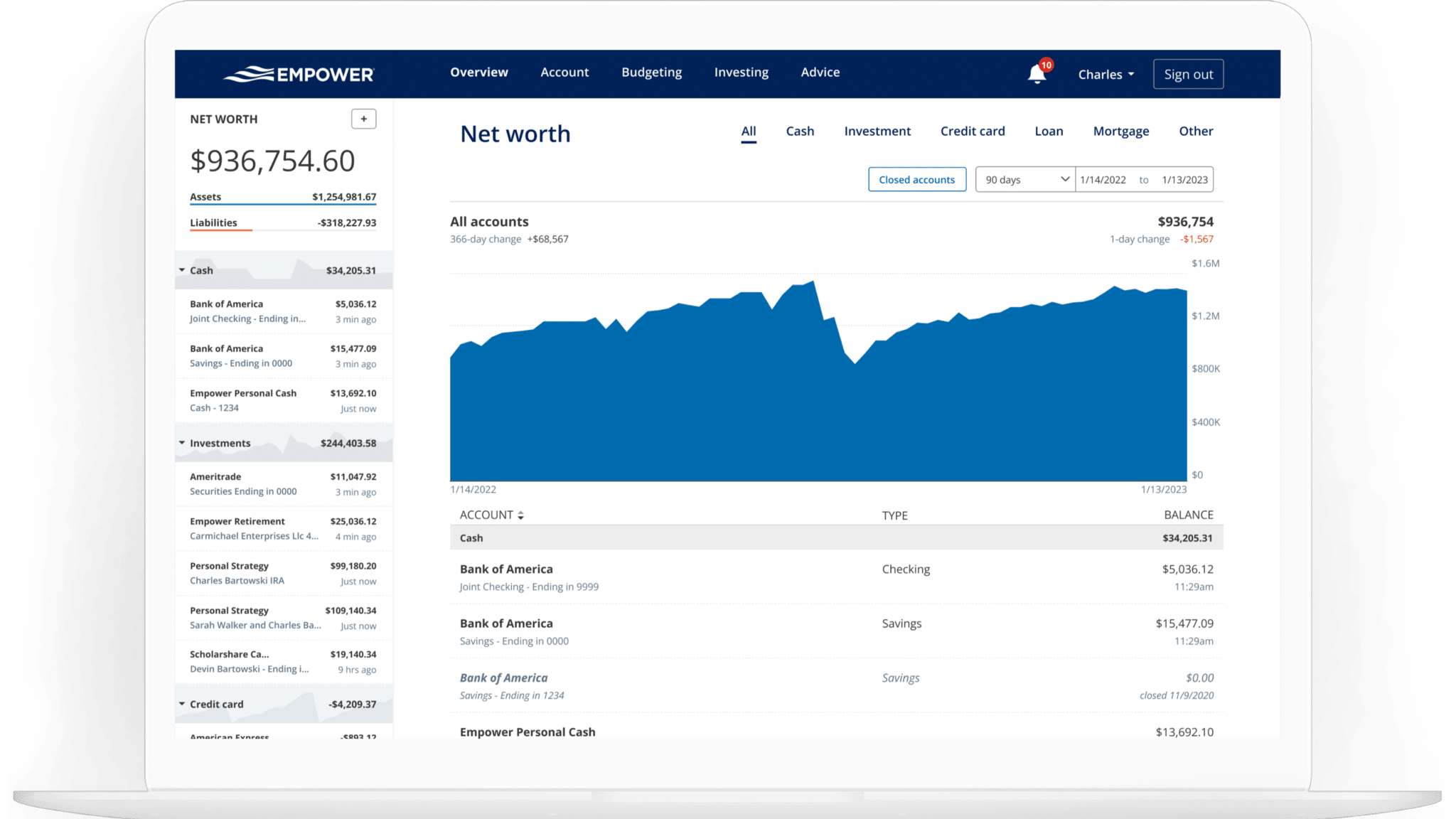

Net Worth Calculator. Your net worth is your total assets minus liabilities. By tracking your assets and liabilities in Empower, you can quickly determine your net worth. Keeping an eye on your net worth and watching it grow can be incredibly motivating. Net worth is also the most significant number in determining your overall financial strength.

Personal advisor. Even though the Personal Dashboard is free to use, you’ll still have the ability to contact a personal advisor. The advisor won’t be able to provide investment advice, but they can help you with questions regarding the service, as well as provide additional information on any recommendations made by Empower.

Why I Use Empower’s Free Dashboard

I personally use Empower to track all my assets. I enjoy having a 360-degree view of my financial picture. It helps me understand where I stand, what to improve, and which changes to make to improve my financial status.

Before Empower, I would only track my income and expenses. I didn’t take it any further, so I never knew my net worth or even if I had a positive cash flow. Empower has opened my eyes regarding my personal finances, allowing me to take an active role in my financial life.

If that’s not enough, here are the top reasons I use Empower to manage my finances.

It’s Free

What better reason does anyone need to use a budgeting and personal finance app than it’s free?

I cannot get over the large number of tools it offers for no cost. Of course, if I wanted to use the wealth management tools, I could, but there’s a fee for that service. So, for now, I’m happy with the personal finance tools that help me understand my net worth and everything that goes into it.

Every feature I use is free of charge, and I only have to endure a few sales calls and emails periodically, but they don’t bother me.

It’s Easy to Track My Budget, Cash Flow, and Bills

I used to spend hours pouring over my finances, trying to make heads or tails out of everything. I had my budgeting and bill pay apps, and honestly, I’m not sure I even knew my true cash flow because I was so overwhelmed.

With Empower, I see everything in one place. I log into the dashboard and know right away where I stand. I can break down my finances into income, expenses, and debt and easily tell what’s dragging my net worth down with just a few clicks.

Because everything is automated, I no longer have to spend much time managing my finances. With my credit cards, checking account, and investments linked, I can take a more passive role, letting Empower track and manage money coming in and out. I log in when I want and reconcile my accounts once a month.

It’s Mobile

I also love that Empower has an app available on iOS and Android. Personally, I have an iPhone and love having access to the app when I’m on the go. I know that no matter where I am, I can check my finances and make important spending decisions at the moment. It has truly stopped me from overspending, thinking I had enough when I didn’t.

I can confidently say it also keeps me from making impulse purchases just by logging in and seeing the progress on my savings account.

I Can Track My Net Worth

My favorite feature of Empower is tracking my net worth. As we mentioned above, net worth is the difference between your assets and liabilities. Not many apps offer this option, and it’s an important piece of the puzzle. No matter how much money you make or cut your expenses, your net worth may not be nearly what you think.

Knowing my net worth helps me determine when I should and shouldn’t take out a loan or whether I should make specific improvements to my home.

I enjoy seeing my net worth increase and it helps me make smarter financial decisions. Before knowing my net worth, it was a matter of whether or not I could afford a loan. If yes, I would take the loan without giving my net worth a thought. Now, my net worth is the first thing I consider, and tracking it will help me into my retirement years.

How Empower Wealth Management Works

Empower Wealth Management is sometimes grouped with robo advisors, which isn’t entirely true. While they do use significant automated investment tools, there’s also a very strong element of active human management. That really puts the service somewhere between traditional human investment advisors and robo advisors.

Similar to robo advisors, Empower starts by determining your risk tolerance, investment goals, and time horizon. But they also consider your personal preferences in constructing your portfolio. Your portfolio is managed according to Modern Portfolio Theory (MPT), by investing across multiple asset classes for proper diversification. They also rebalance your portfolio periodically to maintain target asset allocations.

Your portfolio is invested in six asset classes:

- U.S. stocks

- U.S. bonds

- International stocks

- International bonds

- Alternative investments, including real estate investment trusts, energy, and gold

- Cash

The specific percentage of your portfolio in each asset class will depend on your investor profile, as determined by your risk tolerance, investment goals, time horizon, and personal preferences.

Each asset class is invested in a low-cost index-based exchange-traded fund (ETF), to provide broad market exposure at a low expense ratio. However, the U.S. equities portion will be held in a well-diversified sample of at least 70 individual stocks. This allows Empower to provide tactical weighing and tax optimization (read on for an explanation of both services).

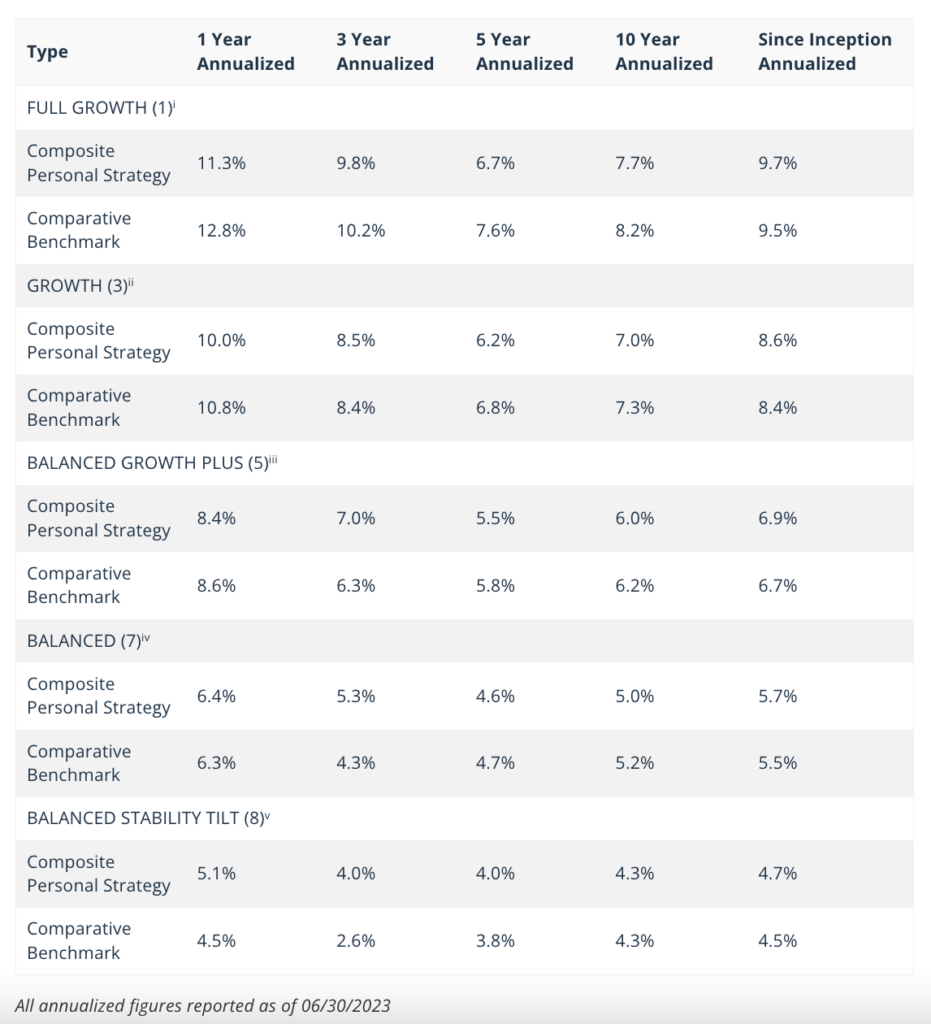

Investment performance. Wealth Management publishes its investment performance on the website. The performance through 6/30/2023 is as follows:

Wealth Management Investment Strategies in Greater Detail

Tactical Weighing. This is an investment approach that improves on traditional indexing by maintaining more evenly weighted exposure to each sector and style. Backtests have indicated the strategy outperforms the S&P 500 by 1.5% per year, and with lower volatility.

Tax optimization. This is an investment strategy designed to lower the income tax liability resulting from your investing activities. It’s a strategy using several techniques:

- Using ETFs rather than mutual funds, since they generate far less in terms of capital gains.

- Using individual stocks, since they can be easily bought and sold to generate tax-loss harvesting.

- Tax allocation is employed in which income-producing assets are held in retirement accounts, while capital gains-generating assets are held in taxable accounts to take advantage of lower long-term capital gains tax rates.

Socially Responsible Investing (SRI). If you choose to incorporate SRI into your investing activities, specific investments are chosen based on their compliance with what is known as environmental, social, and governance, or ESG.

This means investments are chosen in companies based on their environmental impact, social impact (diversity and labor relations), and management. Management, or governance, is determined by management structure, board independence, and executive compensation levels. This will give you an opportunity to invest in what you believe in while avoiding what you don’t.

Empower Wealth Management Features

Minimum initial investment: $100,000 ($250,000 for regular access to financial advisors)

Accounts available. Joint and taxable investment accounts; traditional, Roth, SEP, and rollover IRAs; trusts; advice only on 401(k) and 529 plans

Account custodian. Your Wealth Management portfolio will be held with Pershing Advisor Solutions, one of the largest investment custodians and clearing agencies in the world. The company acts as custodian for more than $1 trillion in assets worldwide.

Account protection. All accounts are protected by SIPC, for up to $500,000 in securities and cash, including up to $250,000 in cash. This coverage protects you against broker failure, and not against monetary losses due to market fluctuations.

Financial advisors. This is a major part of the Wealth Management service. Financial advisors are available by phone, email, live chat, or web conference on a 24/7 basis. As a client of the Wealth Management service, you’ll have two dedicated financial advisors. They’ll provide you with full financial and retirement planning, as well as college savings, and financial decision support on such topics as insurance, home financing, stock options, and even compensation.

Empower Wealth Management Fees. Fees for Empower Wealth Management are as follows:

| Asset under management | Annual advisory fee |

|---|---|

| Up to $1 million | 0.89% |

| First $3 million | 0.79% |

| Next $2 million | 0.69% |

| Next $5 million | 0.59% |

| Over $10 million | 0.49% |

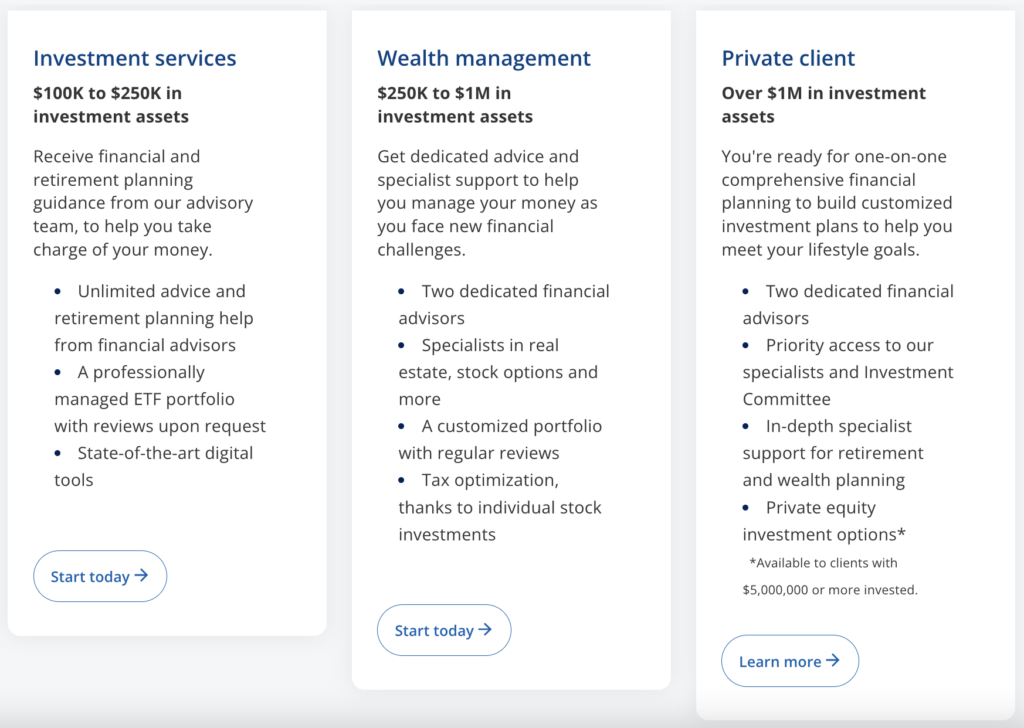

Empower Wealth Management Private Client Service

As you’ll see in the screenshot below, Empower services have four levels:

- Free Personal Dashboard

- Investment Service the basic investment tools and services provided as part of the Personal Dashboard as well as investment management for portfolios of $100,000 to $250,000

- Wealth Management for investors with at least $250,000 to invest

- Private Client for investors with over $1 million to invest

Private Client provides a higher level of service for higher asset clients. In addition to offering lower annual advisory fees, you also get priority access to a certified financial planner and other financial professionals, private banking services, estate services, and collaboration with an estate attorney and CPA. Basically, it’s a much more personalized offering that also gives you priority access to many services on offer.

Additional Features and Benefits

Customer service. You can reach Empower by either phone or email, 24 hours a day, 7 days a week. This applies to both the free version and the Wealth Management service, but the Wealth Management service also comes with access to two live financial advisors. However, direct phone support is available Monday through Friday from 8:00 AM to 6:00 PM, Pacific time.

Mobile App. The mobile app is available for iOS and Android devices, as well as Apple Watch, and can be downloaded at the App Store or on Google Play.

Data export features. There is currently no capability to print reports from the Empower application. They promise the capability is in the pipeline, but cannot provide an estimated time of arrival.

However, you can export transactions. To do so, you need to log into the website or mobile app (iOS only) using either Chrome or Firefox. You then navigate to Transactions/All Transactions, then click on CSV to export the transactions.

Security. Empower uses the following security measures:

- The platform is read-only, so no withdrawals or transfers can be made

- Two-factor authentication

- Requires you to register any devices you use to access the platform

- Military-grade encryption (256-bit AES) to keep your data secure

- Firewalls and perimeter security

- Continuous monitoring

- Fingerprint scanning is available for iOS devices (but not Android)

Empower Cash™

Like many companies offering robo advisor services, Empower is getting into the banking game. Empower Cash™ pays 4.70% APY.

The account has no minimum balance, unlimited withdrawals, and sleek access through your phone. It also offers FDIC insurance of up to $1.5 million in deposits. But be aware that this account does not offer either debit cards or a bill payment capability.

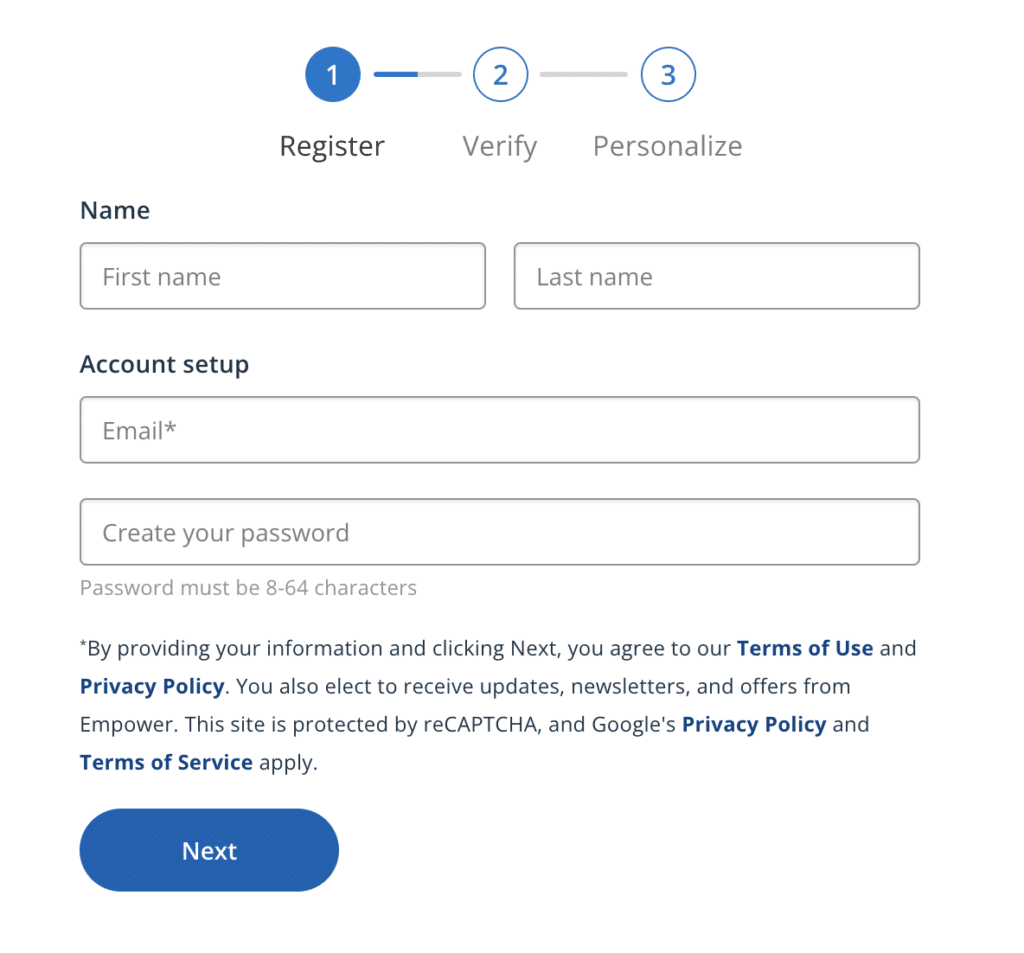

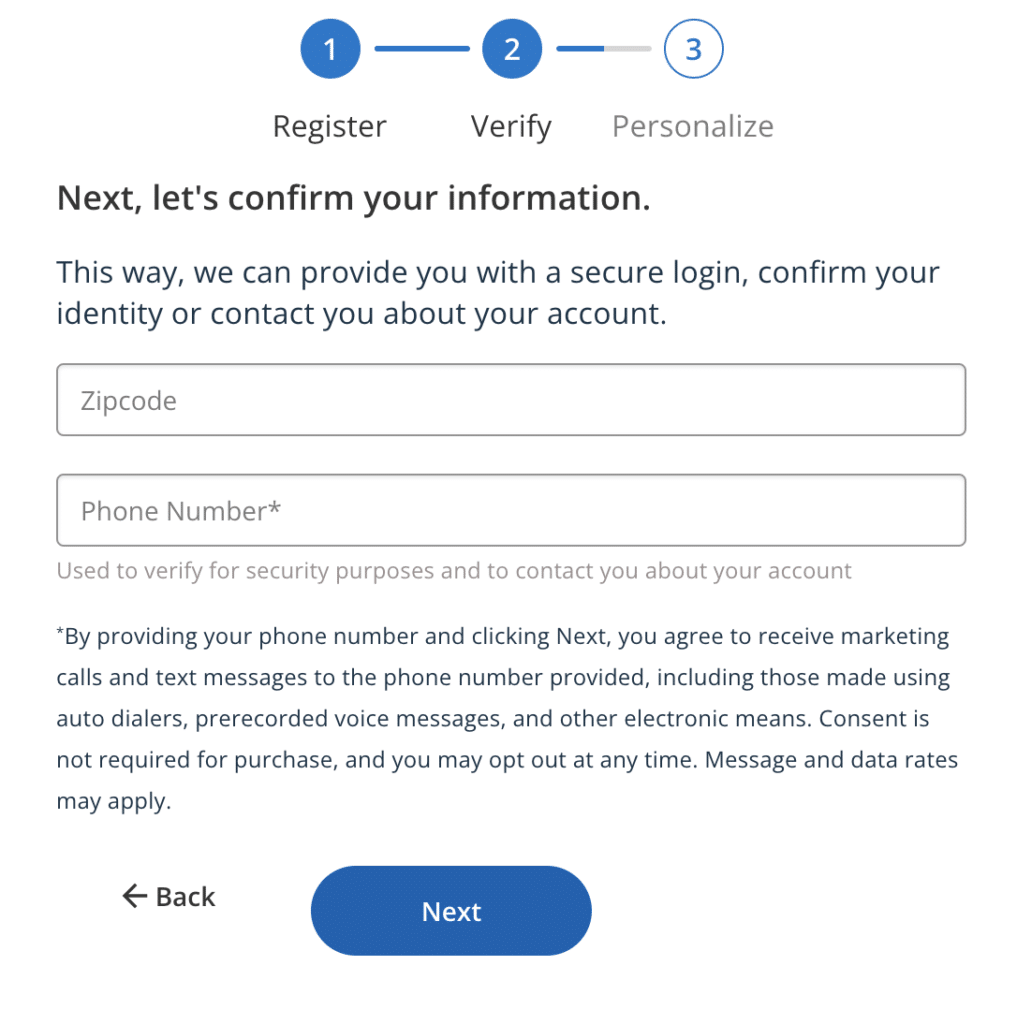

How to Sign Up with Empower

It’s easy to sign up for Empower and link your accounts. Here’s a quick overview of the signup process:

- Click Sign up/Register at the top of the website

- Enter your information, including your email, and phone number, and create a password

- Answer the questions about your personal finances

- Link your accounts

You’ll be asked the age at which you plan to retire, and the amount of money you have saved toward retirement. (As indicated throughout this review, Empower has a strong orientation toward retirement.)

Once you’ve completed that information, you’ll begin linking your accounts. Empower syncs with more than 12,000 financial institutions, or you can simply enter your institution’s name and web address. Start typing the first few letters of the financial institution’s name, and it should come up. Next, you’ll enter the account’s credentials to link your account. It takes a few minutes to link each account.

You can include almost any account that affects your net worth, including bank, investment, credit card, and mortgage accounts. Empower will analyze your financial accounts going back from one to three months. Based on the analysis, you’ll have access to all the tools on the Personal Dashboard, as well as Empower’s recommendations for your investment accounts.

When you sign up, even if you’re signing up for the free account, you’re required to set up a call with a personal advisor. This is just a chance to answer any questions you may have and to get you familiar with the app. This call can be as quick as a couple of minutes or longer, depending on your questions and familiarity with the app. The advisor will review your answers to the questionnaire, including your risk tolerance, timeline, and financial goals.

If you want to sign up for the Wealth Management service, you can contact a financial advisor to get the process going (or wait a short while, and one will contact you). You’ll be required to provide additional information, including documentation verifying your identity. You will then need to link one or more financial accounts to transfer funds into your Pershing account, which will hold your investments. Empower also allows you to transfer securities from other investment platforms.

You’ll complete a questionnaire that will determine your risk tolerance, investment goals, and time horizon. But you’ll also have a web conference with a financial advisor, where more specific information will be gathered. Your portfolio will be created based on your answers to the questionnaire, as well as the information provided to the financial advisor.

Empower Pros and Cons

Pros

- Budgeting and investment management on one platform — Empower offers both personal financial management/budgeting, plus investment management on the same platform.

- Free Personal Dashboard — The Personal Dashboard includes a large number of investment tools as well as budgeting capabilities and is free to use. It will also provide investment advice for accounts beyond your Empower Wealth Management account.

- Tax optimization — The Wealth Management service uses extensive tax optimization strategies to minimize the income taxes generated by your investments.

- Financial Advisors — The Wealth Management service provides two financial advisors for each client, who can help you manage your entire financial life.

- Socially responsible investing — If you consider yourself socially responsible and you want to make sure your investments align with your values, you can do that with Empower.

- High interest rate on Empower Cash — Though the current yield is lower than what is available through Betterment or Wealthfront, the rate is competitive with local banks and credit unions.

Cons

- High minimum for Wealth Management — The minimum initial investment required for the Investment Service is $100,000, and the Wealth Management service is $250,000, which will eliminate small and most medium-sized investors.

- Empower Cash lacks basic banking functions — The account does not offer a debit card or a bill payment capability, which makes it a weaker product offering than the competition.

- Solicitation — If you sign up for the free version you will be solicited to upgrade to the Wealth Management service. Some users and readers have described this as “annoying”.

- High fees — The fee of 0.89% most investors will pay for the Wealth Management service is much higher than robo advisors, like Betterment and Wealthfront, who charge from 0.25% to 0.40%. But it does need to be pointed out that Empower provides investment management services closer to traditional human investment managers, rather than robo advisors.

Is Empower Safe?

Safety is the most important feature of any personal finance app. I understand most people are afraid to connect their accounts to any tool that automatically tracks them. We were taught never to share our personal information, and now they’re asking you to link your accounts to the Empower app.

Empower uses AES-256 encryption. This is the same level of security the military uses for a frame of reference. They also use multi-factor and biometric identification, making it much harder to hack into someone’s account.

Behind the scenes, Empower does a lot to keep your information safe. First, they have you create a trusted device list. If you try to log on from a device that’s not on the list, you won’t be able to access your account. You can also deactivate devices at any time.

Empower also never sells your data to third parties. They operate as fiduciaries, meaning their decisions are in your best interest. Empower is also constantly testing and re-testing the app’s security, using a crowdsourced bounty program to get input from professionals to ensure there’s little to no risk of accounts getting hacked.

Empower Alternatives

One of the qualities that make Empower stand out from the competition is its combination of both budgeting capabilities and investment management. But is Empower really the best choice to provide investment management, and what can you do if you don’t have the minimum $100,000 required to take advantage of the wealth management service?

Fortunately, there are alternatives that, while they don’t offer budgeting capabilities, they do provide investment management services comparable to Empower, but at a much lower fee.

Betterment

Betterment offers similar investment services to Empower, but they do it for a much lower annual fee. You can open an account with no money at all, and then begin investing as you fund your account. You can have your portfolio managed for 0.25% with an Investing account, which means a $10,000 portfolio can be professionally managed for just $25 per year.

And though Betterment doesn’t provide a personal advisor with its Investing account the way Empower does on its Wealth Management plan, you have unlimited access to certified financial planners if you select the Premium plan. That plan has a minimum balance requirement of $100,000, and an annual fee of 0.40%. But that is less than half the annual fee charged by Empower. And on all plans, you’ll get the benefit of tax-loss harvesting on taxable investment accounts.

Betterment has seriously expanded its product menu in recent years. They now offer socially responsible investing, a smart beta portfolio, and even a target income portfolio. And if that’s not enough, Betterment Cash Reserve and Checking provide you with a linked checking account, complete with a Visa debit card, a current interest yield of 5.00% APY, and FDIC insurance on your deposits for up to $1 million.

Wealthfront

Very similar to Betterment, Wealthfront is a robo advisor providing automated investment management at a much lower annual fee than Empower. The fee is identical to the Betterment Digital plan at 0.25% per year. And you only need $500 to open an account. Wealthfront builds your portfolio with a mix of funds invested in stocks and bonds, but they also include real estate and natural resources for broader diversification.

Wealthfront also offers specialized investment portfolios, like smart beta, a risk parity fund (loosely based on hedge fund investing), and socially responsible investing.

Banking features include the Wealthfront Cash Account, currently paying 5.00% APY on all balances with complete FDIC insurance up to $5 million. It also comes with checking account features, which allow direct depositing of paychecks, as well as the ability to pay bills and transfer funds to family and friends. You’ll also get a debit card to make purchases and access cash from ATMs. Meanwhile, Wealthfront’s Portfolio Line of Credit allows you to borrow up to 30% of the value of your account which must be a minimum of $25,000 at interest rates well below 4%.

Vanguard Personal Advisor

Vanguard Personal Advisory Services is a financial services platform that competes directly with Empower’s Wealth Management platform. Vanguard PAS is another example of a hybrid robo advisor/personal financial advisory service. In other words, you’ll have access to human advisors (most of whom are CFAs) to help you personalize your management plan and create an investment strategy that meets your goals.

Vanguard offers portfolios geared toward many different types of investors. Some of the most common include retirement, saving to buy property, college funds, and more. Clients aren’t limited to these selections and can work with an advisor to customize to their specifications.

Vanguard boasts impressively low rates compared to its direct competitors in this space. The minimum to open an account is $50,000, and Vanguard charges a 0.3% asset management fee on balances under $5 million (which gets progressively lower as balances increase past certain thresholds). There are no other account fees, making Vanguard’s transparency impressive.

Vanguard customers receive unlimited phone, email, or video appointments with their advisor, and are free to adjust their financial strategy at any time. One major difference is that low account balances ($50,000 to $500,000) work with a team of advisors, while high account balances ($500,000+) are assigned a personal advisor.

All things considered, it’s an impressive offering and is priced competitively within the hybrid robo space. It’s an attractive service offering that stacks up well against Empower.

Schwab Intelligent Portfolios

Intelligent Portfolios is Schwab’s hybrid robo/personal advisor offering, although it leans heavier toward the robo advisor side than most competitors on our list. Schwab bills their service as automated investing with human help when you need it.

Customers provide details on their investment goals upon signing up and the robo advisor builds a diversified portfolio that automatically rebalances when needed. You can talk to a human when needed, but they will not give you personalized investing advice (opting for more general advice).

Because of the lower levels of personalized service, Schwab is able to keep costs a lot lower for Intelligent Portfolios. There is zero management fee, but customers do pay the expense ratios on ETFs in their portfolio. The account minimum is $5000 to get started.

The portfolios draw from 51 ETFs, and Schwab customizes a portfolio based on the details you provide initially. This includes your risk tolerance, investing goals, timeline, etc. Once the portfolio is set, investors are free to make changes as they see fit or adjust their goals at any time.

Overall, if you’re looking for a hybrid advisor that leans heavier to the automation side, then Intelligent Portfolios is more what you’re looking for. Due to the lower reliance on human advisors, the fees are also much lower than most competitors we examined above.

Read More:

Should You Sign Up with Empower?

One of the factors that makes Empower unique as a financial platform is that it operates as both a financial management service and an investment management service. We’ve provided the table below comparing Empower with popular budgeting and robo advisor apps to give you a side-by-side view of what each offers:

| Category | Empower | YNAB | Quicken | Mint | Betterment | Wealthfront |

|---|---|---|---|---|---|---|

| Budgeting | Yes | Yes | Yes | Yes | N/A | N/A |

| Bill payment | No | No | Yes | No | N/A | N/A |

| Online synchronization | Yes | Yes | Yes | Yes | N/A | N/A |

| Reconcile transactions | No | Yes | Yes | No | N/A | N/A |

| Investment tracking | Yes | Yes | Yes | Yes | N/A | N/A |

| Credit score monitoring | No | No | Yes | Yes | N/A | N/A |

| Fee for budgeting | $0 | $6.99/month | $34.99 to $99.99/year | $0 | N/A | N/A |

| Minimum investment | $100,000 | N/A | N/A | N/A | $0 | $500 |

| Advisory fees | 0.89% up to $1 million (lower on higher balances) | N/A | N/A | N/A | 0.25% up to $100,000, then 0.40% | 0.25% on all balances |

| Financial advice | Yes | N/A | N/A | N/A | Limited | No |

| Accounts available | Joint and taxable investment accounts; traditional, Roth, SEP and rollover IRAs; trusts | N/A | N/A | N/A | Joint and taxable investment accounts; traditional, Roth, SEP and rollover IRAs; trusts | Joint and taxable investment accounts; traditional, Roth, SEP and rollover IRAs; trusts |

| Mobile app | Android & iOS devices | Android & iOS devices | Android & iOS devices | Android & iOS devices | Android & iOS devices | Android & iOS devices |

| Invest in individual stocks | Yes | N/A | N/a | N/A | No | Yes |

Who Is Empower For?

Empower works for high net worth investors, who are looking for comprehensive personal financial management. They offer investment services comparable to robo advisors but also provide direct big-picture advice.

If you’re looking only for a budgeting service, Empower may not be the best choice. You’ll be better served by YNAB, Quicken, or Mint. Mint is also a free service, but it includes credit score monitoring. YNAB and Quicken are paid services, and both reconcile transactions, while Quicken provides bill payment and credit score monitoring.

Related: YNAB vs. Quicken

If you don’t have at least $100,000 to invest, you won’t be able to use the Empower Wealth Management service. You will also need a minimum of $250,000 to gain unlimited access to personal financial advisors. But if you do meet the minimum investment requirement, but just want automated investment management, and not overall financial advice, you may be better off working with a true robo advisor.

What Others Are Saying

So you don’t rely entirely on my opinion of Empower, I have looked into what third-party sources are saying about the service.

The Better Business Bureau gives Empower high marks. Not only do they award it the highest-ranking A+ available (on a scale of A+ to F), but only six complaints have been filed against the company in the past three years.

TrustPilot gives Empower 4.3 stars out of five, based on 618 reviews. However, 73% of those reviews give Empower an excellent rating.

Meanwhile, Empower has garnered 4.5 out of five stars from nearly 14,000 Android users on Google Play, and 4.7 out of five stars from more than 28,000 iOS users on The App Store.

Honest Recommendation

As highly rated as Empower is, it is my feeling that this is a service designed primarily for people who are floating somewhere in the middle of the financial spectrum.

I say that because while the platform offers valuable free financial tools, which are certainly a benefit to small investors, you’ll need at least $100,000 to take advantage of the wealth management service, and $250,000 to have unlimited access to financial advisors. If you have investable assets in this amount, Empower can work well. It will give you services comparable to traditional, human-guided investment services, but at a much lower annual fee.

But if you have less than $100,000, you’ll be better served by using one of the robo advisor services, like Betterment or Wealthfront, which require little or no money to invest, and charge an annual management fee that’s only a fraction of what Empower charges.

However, Empower’s free dashboard is unlike other apps that separate your accounts, you see everything in one place. As a visual learner, the charts and graphs on the dashboard help me understand my financial picture. I can see my total net worth (which is especially motivating), all my account balances, and my monthly cash flow.

It tells me how I’m doing with my budget this month, which allows me to make quick changes if I’m way off my target. It also lets me see immediately where my emergency fund balance is and even how much I’ve saved for retirement.

Having these numbers ‘in my face’ helps me make smarter financial decisions. Before, saving for retirement or even for emergencies was a back-burner goal for me because I didn’t see the true value of it. Now that I see all my financial metrics upfront, I know what to do to reach my financial goals.

If you’re looking primarily for a robust budgeting app, Empower offers limited capabilities. The better option will be to use a dedicated budgeting service, like YNAB, Quicken, or Mint.

Pro Tip

I use Empower to track my net worth automatically (which I love) and pair it with Mint’s free budgeting tools for the perfect pairing. I’m not spending any money and have the best of both worlds with both apps. I don’t feel overwhelmed using both apps and I’m more on top of my finances than ever before. Check out our full list of Best Budgeting Apps here.

How We Tested the Product

We tested Empower by doing a thorough review not only of the company website but also of third-party sources, like the Better Business Bureau and TrustPilot. We also considered reviews conducted by competing websites to make sure our evaluation of Empower’s capabilities is accurate and comprehensive.

Naturally, we’ve compared Empower with competing products, such as the robo advisors and budgeting apps listed in this review. After all, any product or service can only reliably be evaluated against its competition.

We determined that, when compared to traditional, human-guided investment management services, Empower comes up strong. However, we feel that for the majority of consumers and investors, the better choice will be to use a combination of lower-cost robo advisors and one of the dedicated budgeting apps.

Bottom Line

If you’re looking for a way to track your bank accounts and credit cards, look no further than Empower. It’s a one-stop shop to track your income, expenses, cash flow, net worth, and what changes you should make to reach your financial goals.

Empower Wealth Management has a real advantage over traditional human investment advisors, who charge anywhere from 1% to 1.5% to manage your portfolio. If you’re looking for a similar service level, but you don’t want to pay those high fees, Empower is definitely the way to go.

Considering all that Empower has to offer, this is an investment platform that is well worth checking out.