Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Mint.com has been a good budgeting tool. I have used it myself from time to time. Unfortunately, however, Mint.com has closed for good, and the transition for users to CreditKarma shows that the new platform doesn’t have the budgeting capabilities Mint.com once had.

These are the best Mint alternatives to get you exactly what you want. I’ve used four options below, and they’re all very good apps.

Editor’s Choice of the Best Mint Alternatives

Each of the ten best Mint alternatives below is an excellent choice, but three stand out and offer users something extra.

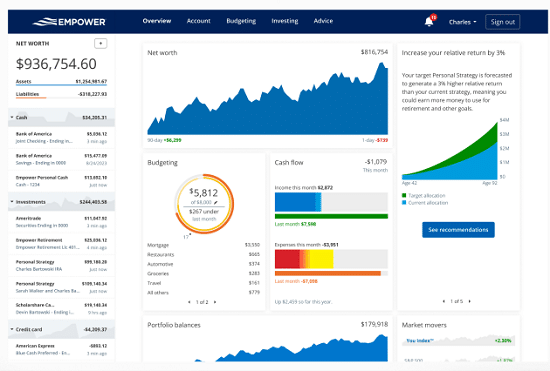

1. Empower – When you compare Mint to others, the best comparison has to be with Empower. Like Mint, Empower is free to use, which is something you cannot say about any other brand on our list of Mint alternatives.

Second, Empower goes the extra mile and does budgeting, showing you a detailed look at your investment portfolio. Mint users’ biggest complaint was the inability to track investments, which was solved with Empower.

2. Simplifi – Apples to apples, Simplifi is likely the best comparison to Mint. The layout, user interface, and budgeting capabilities are similar to Mint, plus Simplifi is a sister brand of Quicken, the OG of personal finance software.

The Simplifi app is extremely easy to use and descriptive, showing you how your budget works and how you can improve. Simplifi is the least expensive “paid” option of all the best Mint alternatives on our list, charging just $2.99 monthly when billed annually.

3. Tiller – For someone like me (spreadsheets are exciting!), Tiller is amazing because I’m allowed to create and design my budget however I want to, and Tiller’s job is to feed me my transactions in a Google Sheet or Excel file. Mint was excellent at creating a solution for everyone, but with Tiller, I’m convinced my budget template is best for ME.

If you’re hesitant about Tiller, that’s OK because you’ll start with a 30-day free trial. You can choose from many different budget templates or create your own, and if you don’t get the hang of it or it doesn’t happen, you won’t owe anything. Should you decide to stick around, the cost is a flat fee of $79 annually.

Best Mint Alternatives for Budgeting and Investment Tracking

1. Empower: Best Free All-Around Financial App

Empower is arguably the closest alternative to Mint. Like Mint, it’s free, enables users to link their accounts, and offers budgeting, investment tracking, and retirement planning. If your goal is a free app to manage all of your finances in one place, Empower is the answer.

I like that the interface is as visual as Mint’s. It also includes budgeting capabilities, but it has a much more robust investment tracking option.

I don’t like budgeting with Empower as easily as I do with Mint. Still, Empower tracks your budget, automatically categorizes your spending and bills, and monitors your cash flow. In addition, its investment tracking and retirement planning features are much better than those of Mint.

Empower is also the only free option available now that Mint is shutting down.

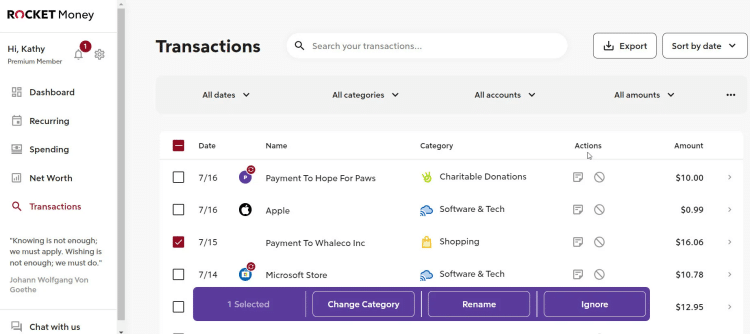

2. Rocket Money

With Rocket Money, you can connect all your financial accounts in one place and receive balance alerts for products and transactions you deem important. Rocket Money has a free option that includes creating a budget, monitoring your spending, and tracking all transactions so your wallet and investments are under one roof.

For a fee between $4 per month and $12 per month billed annually, Rocket Money will provide enhanced customer support, help canceling unwanted subscriptions from your budget, and personalized advice to help you spend less and save more.

The difference in prices does not change the features you receive; Rocket Money employs the “pay what you think is fair” model, giving you the choice to pay more or less for their services.

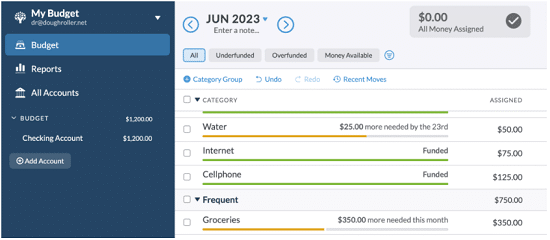

3. YNAB: Best for Budgeting

There’s a lot to love about the You Need a Budget (YNAB) budgeting software. However, one of the key features that sets it apart from Mint.com is that it allows for longer-term planning. With Mint, you can’t change a budget for that month until the first of the month. That gets frustrating if your budget varies by month and you want to plan for that.

With YNAB, though, you can set up budgets for several months in the future. Another key feature is easy goal setting, which I prefer over Mint’s financial goals options. Plus, the point of YNAB is to learn to live on last month’s income. It takes time to get to this point. But it’s a worthy goal that can make your financial life much more stable.

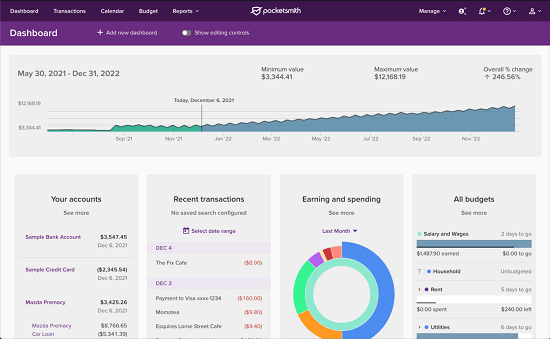

4. PocketSmith: Best for Financial Planning

PocketSmith has many of the same features as Mint, including the ability to view all of your accounts in one place. But it also lets you plan ahead better with projected daily balances. Another bonus—it gives you the option to track your net worth! You can run income and expense statements at any time.

The most attractive part of PocketSmith is its ability to forecast accurately. But it also has a great backward-looking feature in the form of an excellent search engine. This lets you quickly find and pull up any past transaction, which can be handy if you want something specific. Overall, this is a great option.

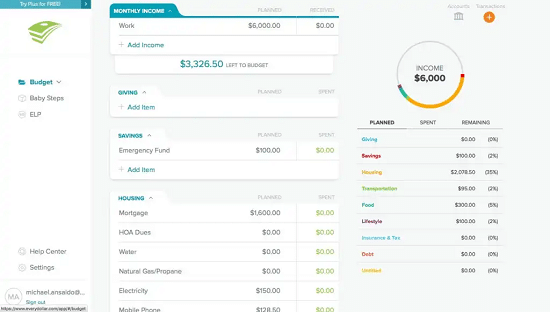

5. EveryDollar: Best for Dave Ramsey Followers

If you’re a fan of Dave Ramsey, his budgeting software may help you stay on top of the Baby Steps. Ramsey’s parent company created the EveryDollar budgeting software. It operates similarly to Mvelopes since Ramsey advocates for the envelope budgeting method. But it also builds in the Baby Steps, so you can always see where you are on the plan.

EveryDollar also has a helpful app for tracking your spending on the go. It has nice visuals that can help you see where you are at any given time.

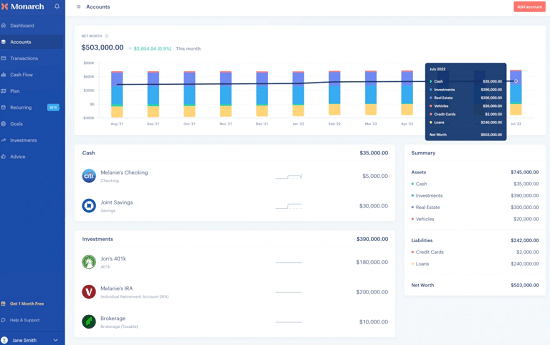

6. Monarch: Best for Couples

Monarch is one of the more intuitive budget and tracking apps, and I can personally attest to its ability to figure out pretty quickly what I’m looking for. They currently boast of having more than 11,000 different banks and financial institutions under their watch, so you shouldn’t have trouble linking the accounts you need.

Two of my favorite features of Monarch are:

- Users are allowed to invite a partner to budget with them. A second login is created for the same account, and both users can budget together (which is perfect for a married couple who share finances).

- Your portfolio analysis tool provides detailed historical performance data, offering insight into your investments’ peaks and valleys.

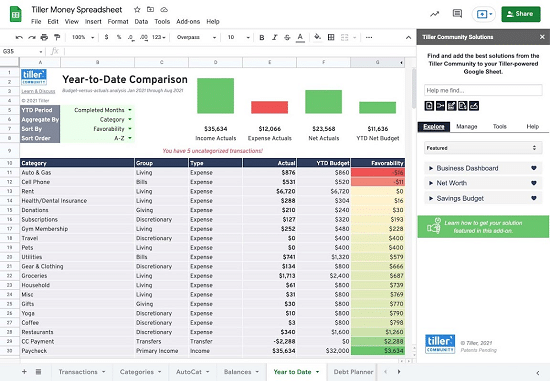

7. Tiller: Best for Experienced Spreadsheet Users

Tiller is slightly different from most of the apps on our list. It takes all of the data you would normally see in the app’s interface and publishes it straight to an Excel file or Google Sheet. This allows you to control how you view your budget and finances and gives you more control over what you think is important.

The catch with Tiller is that to maximize its potential, you really need some experience in Excel or Google Sheets. The installation is pretty simple, and there are a lot of different templates and styles for you to choose from. All users can create up to five different spreadsheets at once, and Tiller will feed the data you choose into the sheet you choose.

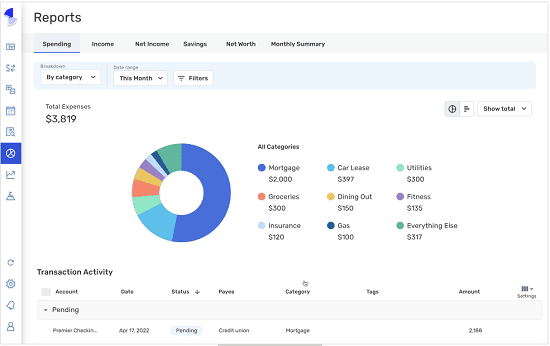

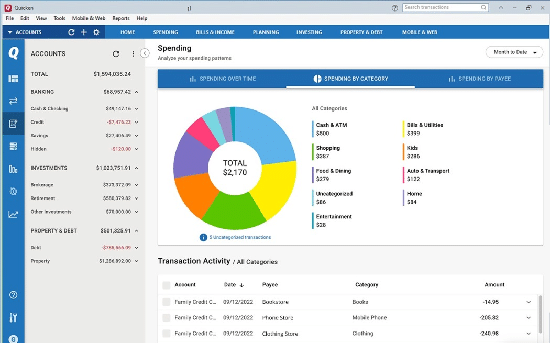

8. Simplifi: Best for Overspenders

Simplifi is true to its name, focused only on the spending and saving part of your personal finance journey. The app has a terrific dashboard that filters out your chosen categories; its top priority is showing you how much you are spending and how to reduce it.

While Simplifi is one of the least expensive options on our list, it lacks the ability to track your investments meaningfully. I think this app would be a perfect introduction to using a budgeting tool, but more experienced users are likely to find better options elsewhere.

9. Quicken: Best for Desktop Users

The OG of budget software, Quicken, is still one of the best tracking tools an individual or small business can use to manage their finances. Desktop users have more functionality, and of all the best mint alternatives on our list, Quicken does the best job of tracking your investments.

The pricing structure is also more favorable than others on our list. Quicken has price plans that range from $3/mo to $6/mo, and users on the high end have a greater ability to parse, split, and categorize transactions.

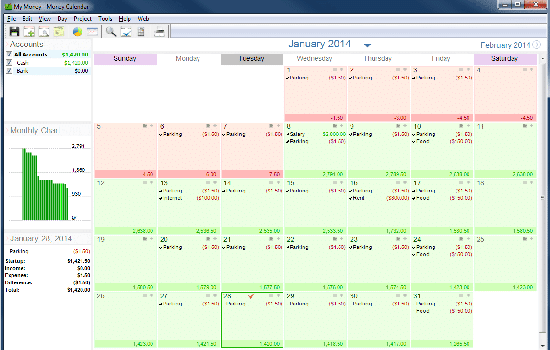

10. Money Calendar: Best for Calendar-Based Budgeting

Budgeting for all your bills for the month is great. However, figuring out your actual cash flow can be difficult unless you get all your money on the first of the month. Enter Money Calendar. This personal finance tool offers calendar-based budgeting. So you’ll know how much cash you should have at any time.

Money Calendar is a great option if you have enough money to pay all your bills, but not all of them simultaneously. It lets you schedule upcoming bills and expenses in a calendar and creates cash projections and daily bank balances for the future.

Frequently Asked Questions (FAQ)

Can I Add Transactions Manually?

Yes. Every app listed above allows you to add transactions (and accounts if needed) manually. Be careful if you go this route because tracking things with individual entries can get pretty tedious. Hence, the whole budget app phenomenon.

What can I do if my financial account Isn’t Linked?

If your account will not properly link, you have a couple of options. The first thing to do is double-check your login details. Open a request with your financial tracking app of choice to have your account added; most of the time, it will be added. If that does not work, the best solution is to track the account manually.

Is There a Limit to the Number of Accounts I Can Link?

There is no limit so long as you’re being “reasonable.” Some of the apps allow a true unlimited number, while others will allow up to one thousand. I’ve never met someone with even a quarter of that number, so you should be OK.

Final Thought on the Best Mint Alternatives

I’ve been using Mint for many years and the app for the last few. The addition of accounts, tracking of spending, and overall ability to keep my financial health in check are just three reasons I loved it.

But I had also grown frustrated with a few things. One of those things was that I could not reset my budget in the middle of the month. It’s a bit of a headache to wait until the month closes before assessing my monthly spending properly (sometimes), and it’s been that way for a while.

The other pain point I encountered using Mint is that as my investment portfolio has grown, other apps offer better intuitive advice. Mint could track them, but it focused more on day-to-day spending and less on growing wealth. The best Mint alternatives can do a lot more to enhance your investment strategy.