Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

If you’ve been struggling to implement a workable budget, it can help to use a budgeting app to make it happen. One of the very best in the industry is YNAB (You Need a Budget). It’s one of the best because it takes a commonsense approach to budgeting, and employs a highly user-friendly strategy in the process.

YNAB was started in 2004 by Jesse and Julie Mecham to help with their budgeting efforts. It has since become one of the most popular budgeting apps available.

How does YNAB work, and how can it help you to create a budget you can thrive with? We’ll discuss this in our YNAB Review.

How Does YNAB Work?

You’ll start by linking your checking account to the YNAB app so that transactions can automatically be imported. (You will also have the option to enter your expenses manually if you prefer not to link your checking account.).

You’ll then need to create your plan. YNAB provides their DIY Money Planner workbook if you need help with this process. Essentially, you’ll need to make a list of all your expenses and non-monthly costs – like holiday and vacation expenses, or quarterly, semiannual, or annual insurance premiums – plus a little bit extra for fun stuff. That can include coffee on the way to work, an occasional dinner out, a trip to the movies, and similar expenses.

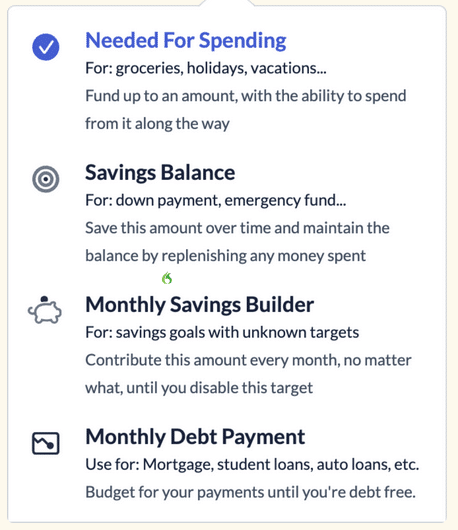

From there, you’ll set up spending targets:

YNAB provides you with the ability to add additional accounts, like savings accounts, loan accounts, and credit cards. As you do, YNAB will be able to import those transactions automatically as well. The app can even add cash-paid expenses to make the budgeting process truly comprehensive.

YNAB is a budgeting app that works based on the zero-based budget method. That means you’ll take all the money you have available, and divide it up across expenses, debt payments, and savings until every dollar in your budget has been allocated.

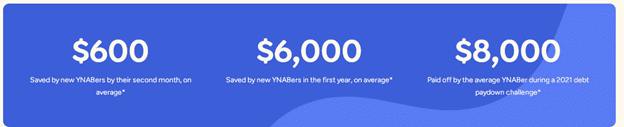

The full name of the app is You Need A Budget, but YNAB for short. It claims to save users $600 within the first two months, and $6,000 within the first year.

How does YNAB accomplish that goal?

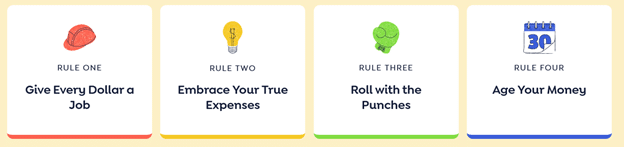

The Four Rules of YNAB

The entire concept is based on four rules and each of the four rules describes a very specific strategy:

RULE 1: Give Every Dollar a Job – This rule starts by asking the question, “What do I need this money to do before my next paycheck?” With that in mind, you’ll assign each dollar you earn to an expense category so that every dollar is “employed” somewhere in your budget.

RULE 2: Embrace Your True Expenses – This rule is designed so that you will anticipate large, occasional expenses. These can include expenses for holidays and birthdays, vacations, and large insurance payments. You’ll break each expense down into monthly increments, and transfer the funds into a dedicated account to be prepared when these expenses arise.

RULE 3: Roll With the Punches – This rule is designed to incorporate flexibility into your budget. If you overspend in one category, you can simply move funds from another to cover. The idea is to learn to reallocate your spending priorities as needed, rather than to have your budget go off the rails when you overspend in a certain category.

RULE 4: Age Your Money – You can think of this rule as the ultimate goal of YNAB. It’s designed to end the paycheck-to-paycheck trap so many people are stuck in. As you get better control of your budget and spend less money, you’ll eventually move into a place where you are paying this month’s bills with last month’s money. In that way, you’ll always be at least one month ahead of your budget.

To help you understand the YNAB process, and to better understand budgeting in general, YNAB offers multiple guides as part of the program:

YNAB Features & Benefits

Free Workshops

YNAB offers free workshops to help users better master their budgeting process. Some are live, while others enable you to watch a recording.

Workshop topics are very specific, and include:

- Get Started with YNAB

- Customize Your Categories

- Manage Credit Cards and Eliminate Your Debt

- Transitioning from Mint to YNAB

- Using YNAB as a Couple

- Level Up Your Savings

- Working with Variable Income

- And more

YNAB for College Students

Understanding that proper money management begins before entering the workforce, YNAB encourages college students to sign up for the service by providing a 365-day free trial. The offer applies to undergraduates, graduate students, medical residents, international students, and even part-time students.

You must be a college student to take advantage of the plan, and that will require providing proof of enrollment. That can be done with a college ID card, a school transcript, or a tuition statement.

YNAB is willing to give college students the service free for one year to help generate word-of-mouth referrals for the service. They see college students as a primary source of referrals.

Other YNAB Features

Availability: Can be downloaded free of charge at The App Store for iOS devices (15.0 or later), and at Google Play for Android devices. YNAB is also available for computers. Updates take place across all connected devices.

Shared service: You can share your subscription with up to six people, all for the price of a single subscription. That will enable you to include your spouse, family members, and other trusted parties in your budgeting venture.

Account security: YNAB uses data encryption, two-factor authentication, and data centers that are accredited multiple times over to protect your information.

Customer service: YNAB can only be contacted by in-app email. No phone contact is offered.

Third-party and user ratings: YNAB has a Better Business Bureau rating of B- (on a scale of A+ to F), and 4.6 out of five stars (“Excellent”) by nearly 1,500 reviewers on Trustpilot . It also has 4.8 out of five stars from more than 48,000 iOS users on The App Store, and 4.6 out of five stars from nearly 17,000 Android users on Google Play.

YNAB Pricing and Plans

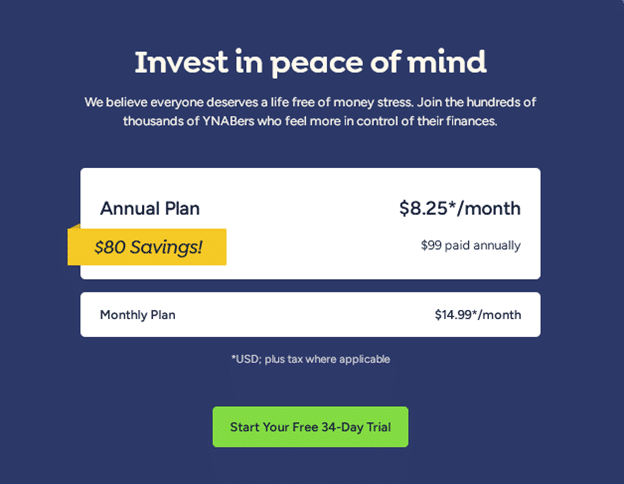

YNAB offers two different fee plans. You can choose to pay monthly, at $14.99 per month, or make a single annual payment of $99, which works out to be $8.25 per month. Either option starts with a 34-day money-back guarantee.

Because the service is offered for a fee, users can enjoy it without interference from ads. Once again, college students can enjoy one free year of the service.

Referral bonus: YNAB will give existing customers one free month of the service when they refer others who sign up for the app and complete the 34-day free trial. Your referrals must sign up through your personal referral link. Not only will you get a free month of the service, but so will the person who you refer. Since there is no limit on how many free months you can earn on referrals, you can enjoy the service free of charge as long as you keep those referrals coming in.

YNAB Pros & Cons

Pros

- Highly user-friendly budgeting app designed to change your attitude about money, rather than adhering to a rigid spending plan.

- 34-day money-back guarantee.

- Since you pay a fee for the service, you won’t be bothered by third-party ads.

- College students can take advantage of YNAB free of charge for 365 days.

- One free month of the service as a referral bonus. Applies to both you and the person you refer and allows for unlimited referrals.

Cons

- No free plan is offered, as some competitors do.

- Contact by email only, no phone contact is offered.

- YNAB is not investment-specific, so you may need to sign up for a different app once you begin investing the money you’ve saved with the app.

- Does not offer bill payments through the service.

YNAB Alternatives

If YNAB isn’t the right budgeting app for you, consider one of the following alternatives:

Rocket Money

Rocket Money is part of the Rocket Family, which includes Rocket Mortgage. That’s an important connection. In addition to comprehensive financial tools, Rocket Money also offers its Visa credit card with a cash-back rewards arrangement that enables you to accumulate up to $10,000 toward the purchase of a home (to be financed by Rocket Mortgage), or 2% cash back that can be applied toward repayment of an existing Rocket Mortgage.

Rocket Money also offers budgeting, bill negotiation, subscription cancellation, and other services. The budgeting app is FREE and its premium features incur a $4 to $12 monthly charge (you pay what you want within that range)

Simplifi

Part of the Quicken family, Simplifi provides a budgeting app that lets you choose the budgeting method you like. From there, it will organize all your financial accounts on the platform, enabling you to cut expenses and redirect funds into savings goals. Simplifi offers four different plan levels, ranging from basic budgeting to investments and management of small business finances and investment real estate.

Fees for the service range are per month.

Empower

Empower offers a free financial aggregator for all your financial accounts on their Financial Dashboard. Though it doesn’t offer detailed budgeting capabilities (coming soon!), it does provide valuable planning tools, such as its Retirement Planner and Investment Checkups. However, one of the big advantages of Empower is that it enables you to go to the next step in the budget and savings process, which is investing.

To start, they offer the Empower Personal Cash account currently paying 4.70% APY on FDIC-insured balances up to $5 million, with no fees and unlimited transfers. But you can also take advantage of multiple investment options, including self-directed investment accounts, managed portfolios, IRAs, and wealth management.

Frequently Asked Questions (FAQ)

Is YNAB that good?

YNAB is one of the most popular budgeting apps available and is highly rated by mobile users on Google Play and The App Store. It gets high marks because it is a user-friendly system that helps customers better understand how money works. Using a simple four-step strategy, users can go from living paycheck to paycheck to being debt-free and cash-rich.

Is YNAB better than Mint?

Since Mint will be discontinued, the question no longer matters. But even before it was announced Mint would shut down, YNAB was the clear winner between the two budgeting apps. YNAB enables users to be intentional about budgeting and to make it work to improve their financial lives. Mint, while free, worked mostly as a financial aggregating platform where you can keep an eye on your expenses.

How safe is YNAB?

YNAB is a secure application, using two-factor authentication, and encrypting the transmission of all data. While no financial app is secure, YNAB takes reasonable steps to protect your information and data.

Should You Sign Up for YNAB?

If you’re serious about getting control over your finances, YNAB is one of the very best budgeting apps you can use. At just $14.99 per month – or $99 per year – you can implement a workable budget, then get out of debt and build savings in just a few short months. YNAB provides everything you need to make that happen, which is why you should sign up today so you can begin reaping the financial benefits as soon as possible.

YNAB

Summary

YNAB offers a 34-day free trial of its budget app that allows you to take control of your finances and start saving more and spending less. The monthly cost of the app is $8.25.