Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

YNAB and Quicken are two of the most popular budgeting platforms available. There are numerous similarities between the two platforms. Both provide budgeting, and give you the ability to take greater control of your finances.

YNAB focuses additional efforts on helping you to get out of debt, as well as saving money. It’s an excellent budgeting platform if you’re looking to build a basic foundation for your finances.

Quicken goes a step further. They provide several different plans, two of which provide greater support for more advanced financial functions, like investing or running a small business.

Each can work well for you, depending on what your situation is, and the financial goals you hope to achieve going forward.

Review: YNAB vs. Quicken

YNAB

Short for You Need a Budget, YNAB is one of the better established budgeting tools. It was launched in 2003, mainly as an app for the owner and his wife to maintain their own budget. When they saw how effective it was, they launched it to the general public.

It provides all necessary budgeting tools, plus abundant support and educational resources. The app attempts to be a full-service budgeting and financial management platform, that helps you to become gradually better at handling your finances.

YNAB has steadily grown to be one of the most popular budgeting platforms there is. They claim new users can save an average of $600 in just the first two months, and over $6,000 in the first year.

The YNAB program is built on a foundation of four basic rules:

Rule #1: Give Every Dollar a Job

The basic idea is that you establish from the beginning specifically what you want your money to do for you. In the process, each available dollar is assigned a spending category. This rule gives you a chance to determine beforehand how and where your money will be spent. The purpose is to put you in full control of your spending activity.

Rule #2: Embrace Your True Expenses

This rule requires that you budget for large expenses. These aren’t unexpected emergencies either, but rather large and may be irregular. It requires that you budget for this expense in advance. An example can be a large annual insurance premium, or an upcoming vacation.

The purpose of the rule is to take those expected large outlays, and blend them more efficiently into your regular budget. That prevents them from becoming budget-busters once they hit.

Rule #3: Roll With the Punches

This rule is one of the basic principles that sets YNAB apart from other budgeting apps. It requires that you build flexibility into your budget.

For example, it’s very common to go over budget in any single spending category. But this rule requires that you make adjustments in other spending areas to offset the higher-than-expected category. If for example you spend more on car repairs than you budgeted for the month, you move money out of other categories, like groceries, entertainment, and gifts. The specific expense categories vary, but the overall budget remains intact.

Rule #4: Age Your Money

This rule is highly unconventional. YNAB wants you to work toward being able to spend last month’s income this month. Put another way, it keeps your income one month ahead of your spending.

This makes total sense. The most basic purpose of a budget is to create extra room in your finances. By getting to the point where you’re always at least one month ahead of your expenses, your entire financial situation begins to open up.

The philosophy behind this rule is to move you steadily away from living on the financial edge. It will force you to build savings, and to get away from the usual paycheck-to-paycheck existence that causes so much financial stress.

In this way, YNAB fully recognizes the intimate connection between emotions and finances. Brilliant!

YNAB Features and Tools

With the four basic rules firmly in place, YNAB offers the following features and tools to help you work within those roles:

Goal Tracking: YNAB directs you to set monthly funding goals, which will enable you to break your long-term goals into smaller, more manageable ones. In this way, they attempt to make seemingly far-off and difficult goals more achievable through short-term action steps.

Real-time Information: YNAB makes it easy to use for couples. You can access real-time data online or on the app at any time so you always know where you’re at with your budget.

YNAB Workshops: YNAB provides daily online classes to help you manage your finances. Some of the topics include:

- Set Up Your Budget

- Master Credit Cards with your Budget

- Credit Card Overspending

- Create a Debt Paydown Plan

- Reach Your Savings Goals

- Pay for Big Expenses without Borrowing

- Break the Paycheck to Paycheck Cycle

YNAB Investment Features: This is one of the weak spots in an otherwise strong financial management platform. YNAB helps you to get control of your finances, get out of debt, and begin saving money. But they don’t offer any resources or tools to move you to the next level, which is investing.

Read More: 4 Reasons YNAB Beats Mint Hands Down

Quicken Features

One of the primary benefits of working with an app like Quicken is that your information is stored on your own computer. That means there’s less likelihood of a data breach through Quicken itself, or some form of cloud storage capability.

Unlike YNAB, which offers a single program for all users, Quicken has four separate plans. Each is designed to meet a user’s specific financial profile, providing tools and resources that will meet those needs.

The four plans are as follows:

- Starter This is the basic plan that synchronizes all your accounts, and establishes basic budgeting.

- Deluxe Has all the features of the Starter plan, but also allows you to create a customized budget, manage and track your debt, and increase savings goals.

- Premier Includes all the features of the Deluxe plan, but also adds free online bill payment, priority access to customer service, and simplifies your taxes and investments.

- Home & Business Comes with everything in the Premier plan, plus the ability to separate and categorize business and personal expenses, email custom invoices from Quicken with payment links, and simplify tracking your business tax deductions, and your profit and loss. This plan is perfect for the self-employed and those who own investment real estate.

A description of the features in the above plans is discussed below. Just be aware that the tools and features you will have will depend on the plan you select.

Quicken Features and Tools

The budgeting function is available on all four plans. It allows you to create a budget and then track your spending. Expenses are categorized automatically, and all data can be directly exported to an Excel spreadsheet. And as is typically the case for budgeting software, all your financial accounts are synchronized on the Quicken platform.

Your budget is based on your actual spending history. From there, you can customize your spending categories, which will help you to establish goals.

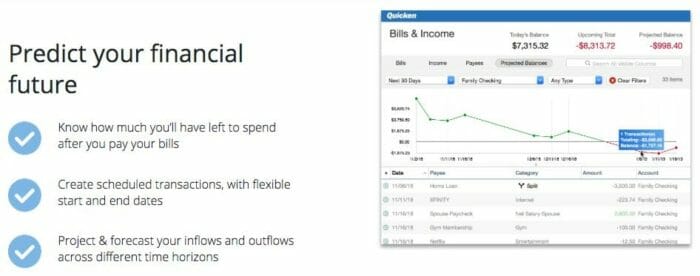

The platform can even forecast future balances. As well, you’ll be provided reminders to pay bills and given the ability to know exactly how much money you have available in each account.

Quicken Bill Pay: Pay bills from any checking account included on the platform. Bill Pay is available only on the Premier and Home & Business plans.

Quicken Bill Pay: Pay bills from any checking account included on the platform. Bill Pay is available only on the Premier and Home & Business plans.

Track the market value of your home: Enter your home address, and Quicken will continually update the estimated market value of your home. Once again, this feature is available only on the Premier and Home & Business plans.

Related:

Quicken Investment Features: These are available only on the Premier and Home & Business plans. With them, you’ll have the ability to:

- Track loans, investments and retirement accounts

- Evaluate your investments with Morningstar’s Portfolio X-ray tool,

- Compare buy-and-hold options with improved portfolio analysis

- See how your returns compare to market averages

- Track investment cost basis and create Schedule D tax reports

- Make better buy/sell decisions with market comparisons

Business & property management features: Available only with the Home & Business edition, and include:

- Categorize and separate personal and business expenses

- Track your business profit loss and tax deductions

- Run Schedules C and E reports to simplify tax time

- Create and email custom invoices and estimates

- Manage lease terms, rental rates and security deposits

- Track outstanding and paid rents

- Add payment links directly to invoices

- Save rental documents directly to the app

Free credit score: You will have access to your quarterly Equifax VantageScore. (Not available on Quicken for Mac.)

TurboTax export capability: You can export your Quicken data directly into TurboTax for tax preparation.

Read More: Quicken Full Review

Pricing: YNAB vs. Quicken

YNAB

YNAB is available at a single price, of $7 per month. And if you prefer, you can instead pay $84 for the entire year. That will remove one more item from your monthly budget.

Quicken

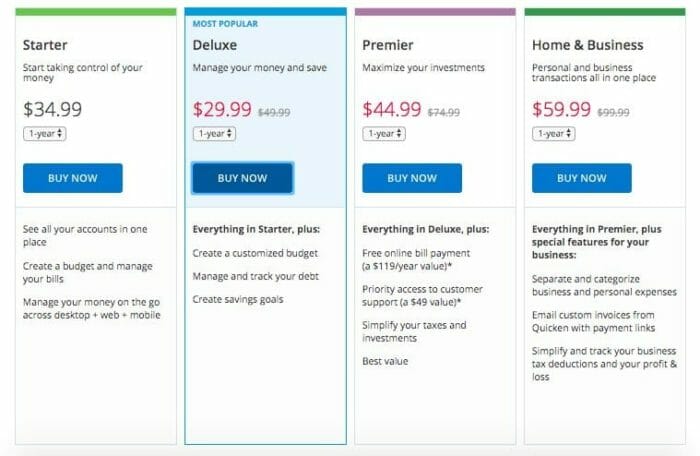

Each of Quicken’s four different plans has its own pricing structure. The packages and pricing, as well as the specific features they offer are as follows:

Quicken also provides a 30-day money-back guarantee if you’re not satisfied with the product. You also have the option to change from one plan to another at any time.

YNAB vs. Quicken: Customer Service

YNAB

Unfortunately, customer service is another weak spot with YNAB. There is no direct phone or email contact available, though they do offer live chat. However, live chat responses are delayed up to 24 hours (which really negates the live part).

Alternatively, they do offer FAQ pages and Help Docs, as well as a community forum, that will help to answer the most basic questions.

Quicken

Quicken provides live chat through the My Pure Cloud app and phone support. Like YNAB, Quicken has a FAQ page, Common Help Topics, and the Quicken Community, to help you answer basic questions, as well as share problems and solutions with other users.

YNAB vs. Quicken: Synchronization

YNAB

With YNAB you can direct import your account information from more than 12,000 financial institutions, using the YNAB Direct Import tool. As is typically the case with financial management platforms, you’ll need to enter your login credentials for each account you add.

One of the downsides of the YNAB synchronization process is that it will only import the most recent balance from an account. Your previous account activity will not be imported. Activity will only begin recording as it occurs, and then within 24 hours of clearing your account.

If you cant locate your financial institution, you can use File-Based Import instead. This feature will be particularly useful if you live outside the U.S. or Canada. QFX, OFX, QIF and CSV files can be imported.

You can select the account you want the transactions imported into, and even include or exclude transactions before your account start date.

Quicken

With Quicken, your account information either populates automatically or you can enter it manually. The platform is synced with more than 14,500 financial institutions. Chances are the ones you deal with are already synced on the platform.

Related: Quicken vs. Mint

YNAB vs. Quicken: Accessibility

YNAB

The YNAB app is available for both Android and iPhone mobile devices. Its also available for iPad, Apple Watch, and Alexa. Each can be downloaded at either Google Play or iTunes.

Quicken

The Quicken mobile app can be downloaded on your iPhone, iPad or Android devices, from either the App Store or Google Play. The mobile app provides alerts and notifications of changes in individual accounts. It also gives you the ability to make mobile check deposits, simply by taking a picture of the check.

YNAB vs. Quicken: Promotions

YNAB

YNAB is currently offering users the ability to try the service free for 34 days.

And that’s not all. In addition to the 34-day free trial, YNAB is offering one year free for students. It applies to both high school and college students, whether you’re full-time or part-time.

Quicken

Quicken is currently offering a 40% discount on their Deluxe, Premier and Home & Business plans, which is reflected in the current basic pricing. (Discount accurate as of June 13, 2019.)

The discount applies only for the first year, and does come with a 30-day money-back guarantee.

Bottom Line YNAB vs. Quicken

YNAB and Quicken are two excellent platforms, and you can’t go wrong with either. It really depends on what you hope the service will do for you.

If you haven’t set up a budget, feel like you’re carrying too much debt, or are unable to save money, YNAB can help. Their four Rules will help you gain proper perspective on your relationship with money. But they’ll also help you get better control of what you do with your money, and enable you to focus on paying off debt and saving money for specific goals.

We really like the Age Your Money concept, and feel this makes YNAB a service well worth having. The idea of moving your income at least one month ahead of your expenses is a financial game changer. Properly executed, it will move you out of the depressing world of paycheck-to-paycheck financial existence, and on to a place where good things start to happen.

Quicken is the better platform for people with more advanced financial situations. It’s easily the better service for someone with investments. For example, the Premier or Home & Business plans provide advanced services to help you manage your investments and provide accurate tax reporting–especially if you use TurboTax to prepare your taxes.

The Home & Business version is even more specialized. It’s designed specifically for those who are either self-employed or own investment property. This moves Quicken well beyond the realm of budgeting software. And the low, flat annual fee is highly cost-effective for people with more complex financial situations.

Need More? Quicken Alternatives

If you’re looking for basic budgeting, and getting out of debt, you’ll be better served with YNAB. But if you’ve already moved beyond that point, and you’re into managing investments, Quicken will be the better choice.