Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Personal Capital (now called Empower) first introduced what is by far the best financial dashboard I’ve used. It’s a free online tool that tracks everything from your bank accounts to your investments. It comes with great graphs and charts that show your asset allocation, investing costs, and cash flow. One of its best features, however, is the Empower Retirement Planner.

I started using the tool when Personal Capital first launched in 2011. I’ve tracked my retirement plan with Empower for years. It’s not the only tool I use, but it’s one that I think everybody who is planning for retirement should at least try.

Here’s why.

Empower’s Ultimate Retirement Calculator

Automation

Unlike many retirement calculators, there’s very little information to enter. Once you’ve linked your investment accounts to Empower’s Financial Dashboard, it has most of the data it needs to run its retirement simulations.

Monte Carlo Analysis

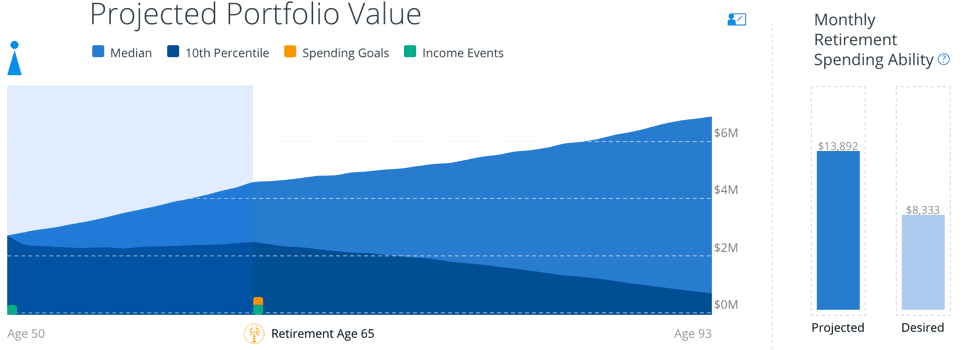

It doesn’t just assume a set return on investments. Instead, it takes your investments, calculates the average return and beta (variability of the return), and then runs 5,000 hypothetical return scenarios. The result is a probability calculation of the likelihood that you’ll have enough money in retirement. Mine was 93%.

Customization

You can customize the calculator in several ways. For example, while it assumes a 4% rate of inflation, you can change that assumption. You can also enter spending goals, such as the cost of a trip around the world in retirement.

Social Security

The calculator takes into account social security payments and enables you to set the payments to specific amounts if you want.

Beautiful Graphs

Like the financial dashboard, the retirement calculator comes with beautiful graphs that easily communicate a lot of data.

Customizing the Retirement Planner for Best Results

There are several important ways you can customize the planner to fit your specific situation. First, you can change the assumed tax rate on retirement withdrawals, the inflation rate, and your life expectancy. If nothing else, changing these assumptions is important to understand just how sensitive the outcomes are to these three assumptions. Changing the inflation rate assumption from 4% to 3% made a huge difference in my projected retirement account balances and increased my odds of having enough money in retirement to 97%.

Second, you can customize the assumptions about social security. You can change the timing of when you and your spouse will start taking social security and the estimated amount of the benefit.

Finally, you can change the assumptions about how much you’ll save each year. You can set your savings rate to automatically increase by a set percentage each year. And you can set spending goals in retirement.

Related: Are You Saving Enough for Retirement? Here’s One Rule of Thumb to Know

How To Use the Empower Retirement Savings Calculator

The Empower retirement savings calculator is an excellent tool to help you understand whether you’re on track for retirement. It’s straightforward and easy to use, you just have to plug in a few variables and the calculator will do the rest.

Let’s walk through how to use it so you get the most accurate number. Youll enter the following parameters:

- The year you were born – The calculator will consider your age and investment horizon to help determine where you should be.

- Current investable assets – This is how much money you have to invest, including money you’ve already invested. Think 401(k), IRA, cash, and any other assets you have that you can invest today if necessary.

- Annual savings – Project how much you save on an annual basis. This can include 401(k), IRA, and other retirement savings (as well as any cash you set aside).

- Risk tolerance – Empower lets you choose from five different levels of risk tolerance. This is a critical part of the calculator since it determines the types of investments you should be holding. My general recommendation is, the younger you are, the higher your risk tolerance should be (since you have a longer window of time before you retire). The opposite is true for someone close to retirement – your risk tolerance should be lower since you need to be thinking about capital preservation.

- Retirement age – The age you plan on retiring. Remember that there are nuances to the FIRE method – like having to worry about how to deal with taxes before you’re technically of retirement age. Either way, pick an age you think you’d like to retire by.

- Annual retirement spending – This could fluctuate widely depending on if you have a mortgage, where you retire, what your health is, etc. The best thing to do for now is estimate what you think you’ll need to live comfortably in retirement.

- Social Security start age – Assuming Social Security is still funded by the time you retire, pick the age you expect to start taking it. It defaults to 67, but you can take it earlier if you’re willing to pay a penalty.

- Annual Social Security – This is how much (in dollars) you expect to earn from Social Security. You can estimate this value using the Social Security retirement tool.

- Other retirement income – If you anticipate getting any additional income in retirement (such as a business or side income), put that here.

After that, Empower will project the likelihood of meeting your retirement goals so you know whether you need to pick up the pace and invest more or perhaps take on a more aggressive investment strategy.

Related: What Is a Good Retirement Income?

FAQs

How do I calculate what I need to retire?

The easiest way to calculate what you’ll need to retire is by using the rule of 25. The rule states that you should take how much you spend in a year and multiply it by 25. This should give you a dollar figure that, when using the 4% rule (withdrawing 4% per year), you can live comfortably while maintaining your principle investment balance.

Do retirement calculators account for inflation?

The Empower Retirement Calculator will factor in inflation to a degree. But you should assume that this is just an estimate. We don’t know what inflation will look like in the future, much like we won’t know what the economy will look like, so it’s best to take this estimate with a grain of salt.

What is the average 401(k) balance for a 65-year-old?

According to Empower, the average 401(k) balance for a 65-year-old is $422,960, while the median 401(k) balance for a 65-year-old is $165,740.

Related: Best Retirement Planning and Tracking Apps

How much do I need to retire comfortably at 65?

How much you’ll need in retirement depends entirely on your current spending and saving behaviors. That being said, a good range to shoot for is between $600,000 and $2 million, depending on a variety of factors.

How long will a million dollars last in retirement?

Research done by SmartAsset shows that, on average, a one million dollar retirement balance should last just over 23 years for most people.