Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

When it comes to investing, one of the most critical factors is cost. That’s why it is essential to invest in low-cost mutual funds and ETFs and to use a low-cost broker if you buy individual stocks and bonds. And that brings me to this review of Betterment, an online investment service that makes investing in stocks and bonds simple and easy.

In this Betterment review, I’ll review the original robo-advisor, Betterment, and its key features. I’ll also cover how it works and its pros and cons. From there, you can make an educated decision on whether Betterment is a fit for your financial life or not.

What is Betterment?

Founded by Jon Stein in 2008 as the first widely available robo-advisor, Betterment is a website that enables investors to invest in stock and bond exchange-traded funds (ETFs). Stein’s goal was to develop an investment platform that had the customer as its top priority and focus.

Rather than picking the individual ETFs, though, Betterment picks them for you based on an asset allocation you select. There are no options to build a portfolio yourself unless you have $100,000 or more in your account–otherwise, you can only select from pre-built, professionally assembled portfolios. As an investor, all you have to do is decide how much of your investment you want in stocks and how much in bonds.

One of the intriguing things about Betterment is that you’ll have a unique portfolio from everyone else–no two investment portfolios are precisely alike. And if you need some help with deciding how to allocate your investments, Betterment has several tools that can offer you some guidance.

How Betterment Works

When you sign up for the service, you’ll complete a brief questionnaire that will be used to determine your risk tolerance, investment goals, and time horizon. Your portfolio will be built around the results of the answers you provide.

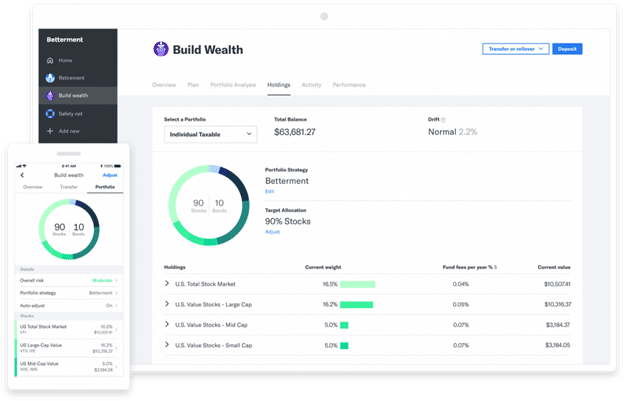

Here’s an example of the Betterment layout.

What Betterment will then do is keep this portfolio balanced for automatically invest new deposits where needed to maintain that balance. They decide when to buy and sell shares and which holdings to keep in the portfolio. It’s all done for you.

Account types

Betterment offers IRAs (Traditional, Roth, and SEP), individual and joint taxable accounts, trusts, and 529 college accounts. Business 401(k) accounts are available through Betterment for Business, but not Solo 401(k) plans.

Funding your account

You can open an account with Betterment with no money at all, and begin investing with as little as $10.

After you sign up, you will link your checking account to Betterment. Doing this enables you to make online contributions and withdrawals from your account. You can then either make individual contributions whenever you’d like or set up a recurring contribution. This makes monthly investments and dollar-cost averaging very easy.

Betterment Features and Benefits

Professionally-optimized portfolios

Betterment is a robo-advisor, which means they use their proprietary algorithm to determine risk levels and investments that should be a part of that corresponding portfolio. It also means your portfolio will stay optimized to the best possible asset allocation for your goals and risk tolerance. Betterment uses global investments, so you’ll be diversified across all types of asset classes, big and small, across the world.

Betterment investment portfolio

Betterment portfolios are constructed of low-cost, index-based exchange-traded funds (ETFs). For the Core Portfolio, they use a mix of six equity funds and six bond funds. In addition to being low-cost, a single ETF can provide exposure to hundreds of securities within each asset class.

Current ETFs used include the following:

Equities

| Asset Class | ETF | ETF Ticker Symbol |

| US Total Stock Market | Vanguard Total Stock Market Index Fund ETF | VTI |

| US Value Stocks – Large Cap | Vanguard Value Index Fund ETF | VTV |

| US Value Stocks – Mid-Cap | Vanguard Value Mid-Cap Index Fund ETF | VOE |

| US Value Stocks – Small Cap | Vanguard Small-Cap Value Index Fund ETF | VBR |

| International Developed Markets Stocks | Vanguard FTSE Developed Markets ETF | VEA |

| International Emerging Markets Stocks | Vanguard FTSE Emerging Markets ETF | VWO |

Bonds

| Asset Class | ETF | ETF Ticker Symbol |

| US High-Quality Bonds | iShares Core US Aggregate Bond ETF | AGG |

| International Developed Market Bonds | Vanguard Total International Bond Index ETF | BNDX |

| International Emerging Market Bonds | iShares JPMorgan USD Emerging Markets Bond ETF | EMB |

| US Short-Term Treasuries | Goldman Sachs Access Treasury 0-1 Year ETF | GBIL |

| US Short-Term High-Quality Bonds | JPMorgan Ultra-Short Income ETF | JPST |

| US Inflation-Protected Bonds | iShares 0-5 Year TIPS Bond ETF | STIP |

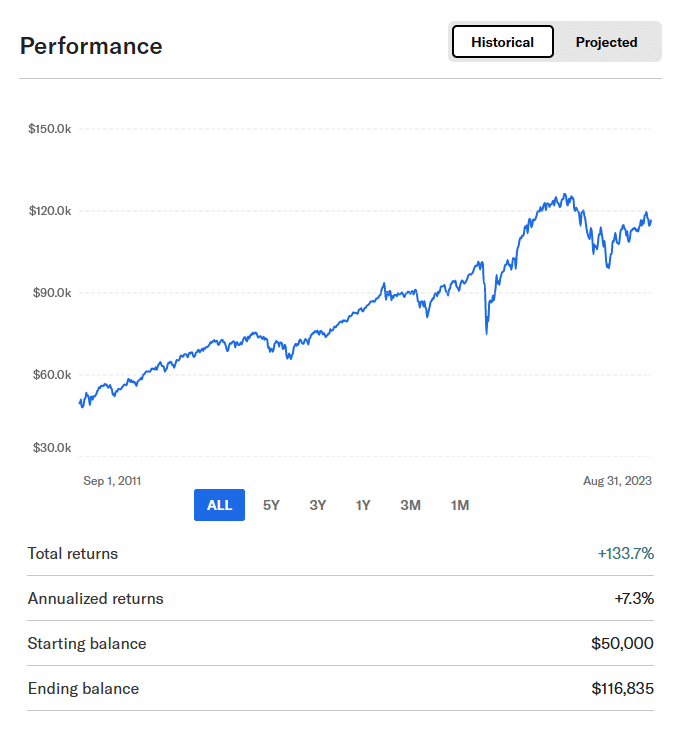

Betterment investment performance

Betterment offers multiple portfolio types, but the Core Portfolio is the base plan. The performance of this portfolio, from September 1, 2011, through August 31, 2023, has provided an average annual return of 7.3%.

The portfolio below is based on an allocation of 70% stocks and 30% bonds:

Automatic rebalancing

Betterment handles rebalancing for you, automatically. All you do is establish a goal and your risk tolerance, and they do the rest. You’ll get emails from them telling you they’ve either rebalanced your portfolio or reinvested your dividends and rebalanced your portfolio.

Tax-loss harvesting

Rob just did an excellent podcast on tax-loss harvesting to explain the more in-depth details, but in short, tax-loss harvesting is when you sell investments at a loss, strategically, to offset the taxes you’ll pay on the gains you make from selling shares that have increased in value.

Tax-loss harvesting is very tricky, and if done incorrectly can result in tax penalties. Betterment does this automatically for you, though. They’ll buy and sell assets at the best times, so you are reducing your tax impact as much as possible. This feature is available on all taxable investment accounts, as it is not necessary for tax-sheltered retirement accounts.

Retirement Planning

Betterment features a robust retirement planning section where you can add as much information as you want (the more, the better). This allows the algorithm to help you decide how aggressive you need to be with your investing, how often and how much you need to deposit, and what your future financial outlook will be in retirement, based on those factors.

You can link external accounts. Many people have multiple retirement savings avenues, and they may not all be with Betterment. By connecting your outside 401(k), IRA, and other retirement accounts, Betterment can offer a more complete assessment of retirement readiness. The result is an analysis of whether you are on track to retire, and how much more if any you should be saving.

Betterment continuously stays synced with your Betterment and non-Betterment accounts and uses over 20 pieces of information to create and maintain a retirement plan for you.

What makes this different, too, is that Betterment considers taxes. According to Betterment, a key differentiator “is that we account for taxes based on the accounts you invest in by adjusting the expected returns while saving and the withdrawals while in retirement.

You can then change your allocation anytime you want (limited to one change per day). Using your age and income range, you can compare your asset allocation to others similarly situated. Betterment also shows you the potential upside and downside of your distribution over one and ten years.

Portfolio options

Betterment offers no fewer than 10 portfolio options, in addition to the basic Core Portfolio. Those portfolio options are as follows:

- Goldman Sachs Smart Beta Portfolio – this portfolio uses smart beta (a hybrid between value investing and market hypothesis) to choose investments in hopes of getting you a more significant return while minimizing risk.

- BlackRock Target Income Portfolio – if you want low-risk, this is for you. It invests solely in bond funds, so the risk is small, but the expected return will be as well. This is an excellent option for those close to retirement.

- Innovative Technology – focuses on high-growth potential companies in clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology.

- Broad Impact – invests in companies that rank high for environmental, social, and corporate governance (ESG).

- Climate Impact – invests in companies with lower carbon emissions, as well as funding “green projects”.

- Social Impact – focuses specifically on companies actively working toward minority empowerment and gender diversity.

- Cash Reserve – see description below.

- Universe – invests in the crypto landscape, including decentralized finance, payments, and the metaverse.

- Sustainable – focuses on crypto assets that are on the path to sustainable energy usage, or that utilize less energy to validate transactions.

- Bitcoin/Ethereum – a portfolio with a 70% allocation in Bitcoin and 30% in Ethereum, the two largest cryptocurrencies.

Financial advice packages

In addition to robo-advising, Betterment offers the ability to connect with a certified financial planner to get advice on significant life events, including changing jobs, having a baby, buying a home, or planning for retirement. Those who want to talk to a real person and get practical advice will appreciate this as a supplement to everything else Betterment offers. There is a cost to these packages, however:

- Getting Started – $299

- Financial Checkup – $399

- College Planning – $399

- Marriage Planning – $399

- Retirement Planning – $399

- Crypto Planning – $399

By purchasing one of these planning packages, you’ll receive a 45-minute session with a certified financial planner.

Customer service

Customer service is available by phone, Monday through Friday, 9:00 AM to 6:00 PM, Eastern time. Betterment also offers a virtual assistant through the platform, which is available on a 24/7 basis for basic questions.

Mobile app

The Betterment mobile app is available for iOS devices on The App Store and for Android devices on Google Play. The mobile app provides all the capabilities of the web version.

Betterment Cash Reserve and Checking

Betterment promises easy account set-up for this feature and access to financial advice. Below is a list of the key features:

Cash Reserve

- FDIC-insured up to $2,000,000 ($4 million for joint accounts)

- The current yield of 4.25%, but Betterment is offering 5.50% on new accounts

- No minimum balance ($10 to invest)

- No fees on balances

- Create multiple savings goals

- Unlimited withdrawals (compared to a limit of six withdrawals per month with most savings accounts)

- Ability to transfer money between savings and a linked checking account within 1 -2 business days

The Cash Reserve feature also offers the option to have Betterment take available cash that would otherwise be sitting there and invest it into a bond portfolio. Betterment claims this portfolio can earn more than 10 times more than a traditional cash savings account while saving on taxes.

According to Senior Quantitative Researcher Adam Grealish, since the underlying funds are mostly U.S. government bonds, they are not subject to state income taxes, which means you can take home more of the yield you earn, compared to a bank account offering a comparable interest rate.

Checking

- ATM fees are reimbursed worldwide

- No account fees

- No overdraft fees

- No minimum balance

- FDIC-insured up to $250,000

- Visa debit card

- Can be used with Apple Pay, Google Pay, or paper checks

- Mobile check deposit

- Earn cashback rewards on select brands, like Costco, Adidas and Aeropostale (rewards vary by brand)

The Betterment Checking account is a game-changer. It’s Betterments mobile-first checking account and debit card for your daily spending. And there are no fees — in fact, Betterment reimburses ATM fees and foreign transaction fees around the globe. There are also no minimum balance requirements or overdraft fees.

Related: Betterment Checking Review

Charitable giving

If you want to donate shares to charity directly from your account, you can. Not only is this a great thing to do to help organizations in need of financial support, but it also eliminates any capital gains taxes you’d pay on donated shares (check with a tax advisor before making a move like this, however).

Betterment Premium

If you have at least $100,000 to invest, you can choose Betterment Premium. This service comes at a slightly higher annual advisory fee than Betterment Digital, but it will give you access to a team of certified financial planners (CFPs) to help you manage your entire financial life. That will include help saving for the down payment on a house, retirement planning, and more. You can contact an adviser at any time by email or by phone.

Flexible Portfolios

With at least $100,000, you’ll be eligible to participate in the Flexible Portfolio option. That will give you the ability to adjust asset allocations within your portfolio. It starts with the Core Portfolio but gives you options to raise or lower individual asset allocations, as well as to participate in additional asset classes. Those classes include commodities, high-yield bonds, and real estate investment trusts (REITs).

Betterment Pricing and Fees

There are two plans with Betterment, each with different account minimums and pricing structures:

Digital

- Account minimum: $0, but $10 to begin investing.

- Annual fee: $4 per month, switching to 0.25% per year with either an account balance of $20,000 or recurring monthly deposits of $250 or more in all Betterment accounts.

Premium

- Account minimum: $100,000

- Annual fee: 0.40%

Crypto

- Account minimum: $0

- Annual fee: 1% plus trading expenses

The main difference between Digital and Premium is the amount of attention you’ll get. With Premium, you’ll get unlimited access to Betterments Certified Financial Planners who can give you advice on your portfolios, both inside and outside of Betterment. This means assistance with things like your 401(k), which is awesome. You can also talk with them about advice on life events and other financial planning situations.

Betterment Pros and Cons

Pros

- Easy to use: Very easy to get started with investing.

- Unique features: Multiple goal options and corresponding asset allocations.

- RetireGuide: Long-term retirement planning and advice.

- Great portfolio options: Optimized portfolios with simple asset allocation.

- Reasonably priced: Inexpensive for what you get.

- No minimum upfront investment.

- The use of fractional shares enables full account diversification even with small balances.

Cons

- Restrictive: Investors who want complete control may not appreciate the automated features.

- Unable to manage external accounts: Can view other external accounts, but you can’t align your investment strategy easily since they’re managed elsewhere.

- Certain ETFs only: You can’t invest in individual stocks

- Can be pricey: Guided advice is expensive.

- The $4 monthly fee can raise the effective rate of the advisory fee to an uncompetitive level on accounts with just a few hundred or even a few thousand dollars.

- Cash back rewards on the Visa debit card are not specified.

Frequently Asked Questions (FAQ)

How trustworthy is Betterment?

Funds held with Betterment are fully insured by government-sponsored agencies. Investment accounts are insured with SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. Checking account balances are covered by FDIC insurance for up to $250,000 per depositor, while Cash Reserve balances are FDIC insured for up to $2 million per depositor.

However, you should be aware that Betterment has a Better Business Bureau rating of “F” and a Trustpilot rating of “Poor”, though both ratings are based on a relatively small number of reviews for such a popular investment platform.

What are the downsides of Betterment?

The two main downsides of Betterment are 1) investors will be unable to choose their investments, and 2) the performance of your portfolio may not match that of the S&P 500. Point #2 owes to the fact that your portfolio will be diversified into bonds, as well as different stock sectors. That portfolio will likely underperform the S&P 500, especially during years in which the index does especially well.

Which is better, Fidelity or Betterment?

Fidelity is a full-service investment broker also offering self-directed investing. It also offers a robo-advisor option with Fidelity Go. If you prefer self-directed investing or even a mix that includes a managed option, Fidelity will likely be the better choice. But if you’re interested solely in the automated investment management provided by a robo-advisor, Betterment is likely the better choice.

Most investors will pay an annual advisory fee of 0.25% with Betterment, compared with 0.35% with Fidelity Go. And while Betterment does offer tax-loss harvesting on taxable investment accounts, Fidelity Go does not.

Can you make money from Betterment?

Betterment enables you to make money, either through interest earned on your cash deposits or from capital gains and dividends earned on investment securities.

Should You Sign Up with Betterment?

The answer to that question depends on the type of investor you are. Betterment is an excellent choice if you are a new or inexperienced investor or a seasoned investor who lacks the time and incentive to manage your investments. It’s also an excellent choice if you are looking for a low-cost way to access financial advice from certified financial planners.

But Betterment is not recommended if you are an experienced or self-directed investor who prefers to choose your investments and manage your portfolio. If you are, your needs will be better served using one of the popular investment brokerage firms.

Betterment

Summary

Betterment started the robo-advisor revolution and still does it better than just about everyone else. Low fees, excellent options, and top-notch customer service make this a great place to start for beginners and advanced investors.