Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

For many, budgeting is about as appealing as a root canal. Yet, failing to budget can result in overspending. One budget that enables you to control spending without feeling you have to watch every dime is the 50/30/20 budget rule. The 50/30/20 budget rule gives grace for spending while keeping savings and investing a priority.

Here’s how the 50/30/20 budget can improve your spending, savings, and financial stability.

What Is the 50/30/20 Budget?

The 50/30/20 budget gives every dollar in your bank account a purpose. This budgeting idea comes from the 2005 book All Your Worth: The Ultimate Lifetime Money Plan by Massachusetts Senator Elizabeth Warren and her daughter Amelia Warren Tyagi.

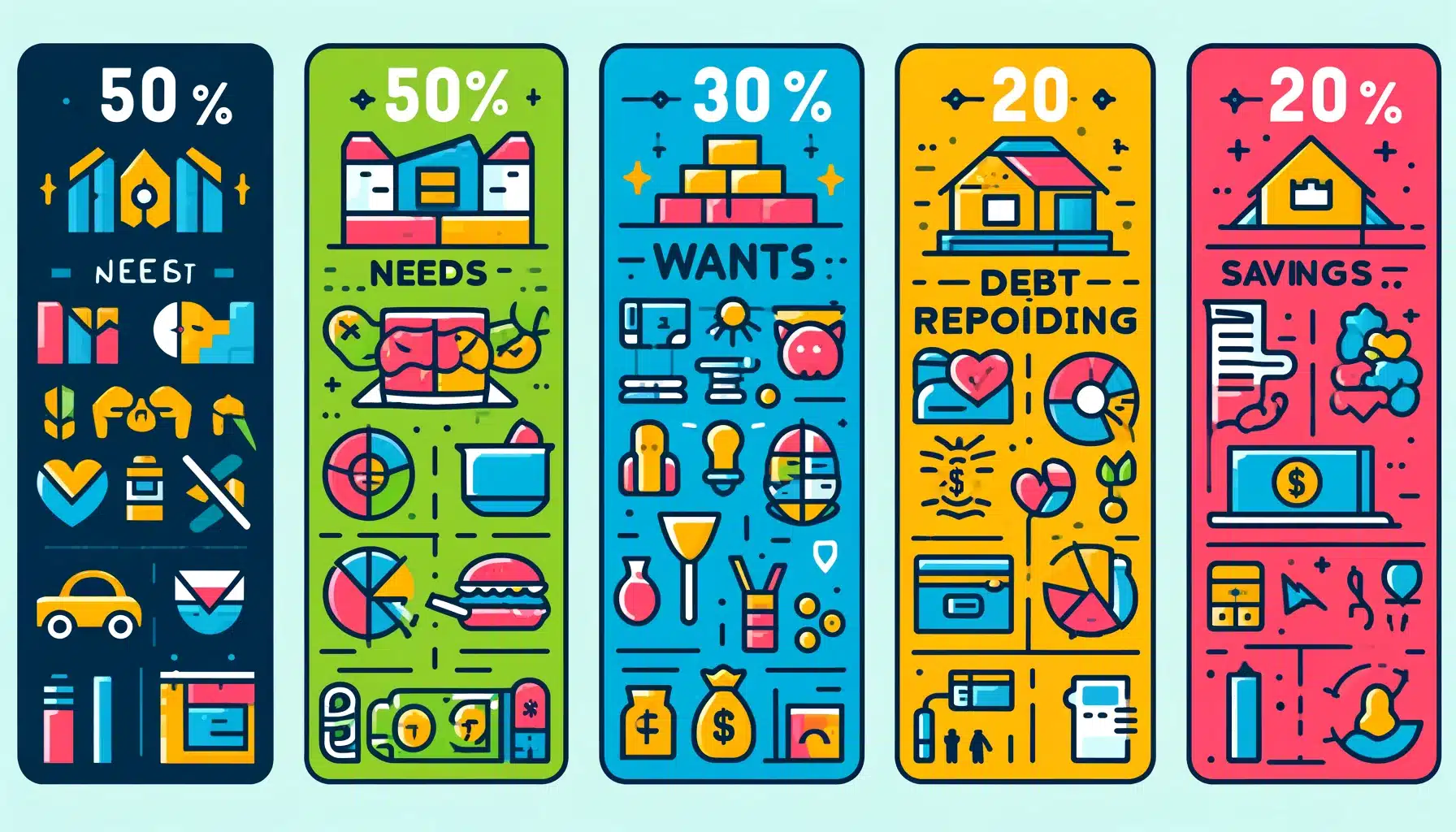

The 50/30/20 budget organizes your money into needs, wants, and savings.

Half of your paycheck, or 50%, goes toward non-negotiable needs. 30% goes to the fun stuff. And the remaining 20% goes toward savings, investing, and paying down debt.

Too often, budgeting guidance can be unrealistically restrictive and shames frivolous spending. Or some financial advice can lean too heavily on simple platitudes. For example, stop buying a $5 fancy coffee daily and put that amount in a savings account instead.

While this advice isn’t wrong, a more realistic approach may yield better results. A budget should include some indulgence and fun. The 50/30/20 budget leaves room for buying what you want while prioritizing saving and investing. So you won’t feel like you’re on a restrictive financial diet.

How the 50/30/20 Budget Works

Budgets are easily broken. But when you leave room for typical spending, you’re more likely to stick to the plan.

The 50/30/20 Budget creates an organization template for your monthly income. You’ll know exactly where every dollar needs to go.

Budget 50% of Your Money for Needs

We might think we “need” modern amenities like updated smartphones, Wi-Fi, and a fresh haircut.

But needs will come down to what keeps you alive, employed, and out of jail. Needs can include:

- Groceries

- Utilities

- Mortgage

- Rent

- Car loan

- Gas money

- Car maintenance

- Work clothes

- Childcare costs

- Healthcare insurance

- Copayments

- Credit card minimum payments

If you work from home or are self-employed, having the latest smartphone and the fastest internet may fall under work necessities. In certain work-contingent situations, expenses that seem like “wants” can be classified as “needs.”

Budget 30% of Your Money for Wants

This “wants” section is the special feature of the 50/30/20 budget. It’s a built-in buffer. A significant 30% of your monthly budget goes to non-necessities.

This extra expense may be a new outfit for the next holiday party or sushi when you don’t like cooking. It can also be for a spontaneous movie date or a Starbucks commute ritual. You can indulge without getting off track if you stick to your 30% limit.

Other “want” purchases might include:

- Vacations

- Tech accessories

- Donations

- Gifts

- Streaming services

- Plants

- Home Decor

- Gym/club memberships

- App subscriptions

Any expense that isn’t necessary for survival or paying off debt is likely a candidate for the “wants” category.

Budget 20% of Your Money for Savings

The smallest chunk of your money is set aside for savings. We’re generally using the term “savings” here. This money can also be used for retirement investing and paying off debts faster.

How you divide your savings budget is up to you. You can begin by building your emergency fund. Put three to six months’ monthly expenses in your emergency fund and keep them there.

Your excess savings can pay off any high-interest debt, like credit cards. Check out our list of best savings accounts for ideas on where to stash your emergency fund.

If you’re not already sending a portion of your paycheck to a retirement fund, consider getting a 401k or IRA. Then, you can send 10% to your emergency fund and 10% to your retirement account. You can also send a higher percentage to your savings to build your emergency fund faster. The choice is yours.

Helpful 50/30/20 Budgeting Tools

Using a budgeting app increases the chances of sticking to it. Research shows that the instant feedback consumers receive from their budgeting apps helps them manage their financial goals.

We’ll highlight some of the best budgeting apps below.

YNAB

YNAB, or You Need a Budget, can streamline your finances into an easy-to-follow budget. Even if you have multiple income streams spread out among different bank accounts. The app can support a 50/30/20 budget with its smart categorization feature to divide expenses into wants, needs, and savings categories.

As the app learns your expenses and budgeting goals, it can automatically recognize and categorize your spending. You’ll receive a free trial of YNAB for 34 days to see if this is the budgeting platform for you. After the trial, a subscription costs $14.99 per month or $98.99 per year.

Tiller

For those who truly appreciate the unmatched orderliness of a spreadsheet, Tiller is the budgeting app for you. It offers a simple spreadsheet design. You can fully customize your budget and easily set up a 50/30/20 budget system. Use a community template if you don’t feel like tinkering with the spreadsheet.

You can link all your financial accounts so your Tiller spreadsheet updates automatically and gives you feedback on your total financial picture. Tiller Money is free for 30 days, then $79 per year.

Simplifi

Backed by fintech giant Intuit, Simplifi connects all your bank, investment, and retirement accounts. Your dashboard is your control center, so you can quickly assess your finances and stay on your budget. Their customizable categories can be personalized to match a 50/30/20 budget setup.

The app also offers helpful insights to highlight how small changes can help you realize financial goals in the future. Simplifi costs $35.88 annually or $2.99 per month.

What if I Can’t Afford To Follow the 50/30/20 Budget?

The beauty of the 50/30/20 budget is that it’s percentage-based instead of relying on static numbers. This allows people in any income bracket to start a budget plan.

However, you may find that you can’t follow a 50/30/20 budget if most of your income goes toward absolute necessities.

To calculate if the 50/30/20 budget works for your financial situation, comb through your last full bank statement. Add up the total amount of deposits or your standard monthly income.

Then, find the total expenses that are absolute necessities. Figure the percentage you spend on necessities by dividing your necessary expenses by your monthly income. Multiply this number by 100.

For example, if you make $5,000 per month, and your needs total $3,000:

3,000/5,000 = 0.6

0.6×100 = 60% of your income goes toward the “needs” category.

How to Lower Your Needs Percentage

Don’t give up if your necessary expenses total more than 50%. But you will need to get creative. Two ways to get your absolute necessary expense percentage down are to:

- Find a way to increase your income through a side hustle or a new job.

- Find cheaper options for your absolute necessities. This might include buying generic groceries instead of name brands, trading in your vehicle for a vehicle with a lower monthly payment, or refinancing your mortgage for a lower APR.

Using a budgeting app can also help you evaluate your spending habits in the “wants” category. Then, you can make more informed spending choices from now on.

50/30/20 Budget Alternatives

If the 50/30/20 setup is unrealistic for your budget right now, you could view it as an attainable goal while you increase your income or decrease your necessary expenses.

In the meantime, you can still take charge of your budget with one of the following proportional budget systems.

80/20 Budget

The 80/20 budget is the simplest way to practice proportional budgeting. It removes the need to track your expenses throughout the month. You also won’t need to put any thought into which purchases are necessities and which are wanted. The 80/20 budget breaks down like this:

- 80% of your monthly income goes toward all expenses, necessary and superfluous

- 20% of income goes into savings

If you immediately move 20% of your paycheck into savings when you get paid, you’ve done all the legwork this budgeting method requires. Of course, you should check your bank account often enough to make sure you don’t overdraw.

70/20/10 Budget

The 70/20/10 stands out from other percentage-based budget types for its aggressive approach to paying down debt. The 50/30/20 and 80/20 leave an open suggestion to pay down debt if you have room in the 20% savings section. But the 70/20/10 dedicates a separate category to it.

The 70/20/10 works the following way:

- 70% of income goes to living expenses and wants

- 20% of income goes to savings

- 10% of income goes to paying down debt

This is the ideal budget plan for people who are burdened by high-interest-rate revolving credit. Hacking away at debt every month puts you in a position to be debt-free. Once that happens, you might transition to the 80/20 or 50/30/20 budget.

Frequently Asked Questions (FAQ)

Is the 50/30/20 budget realistic?

The 50/30/20 budget rule is attainable, especially if you already only spend 50% of your income on necessary living expenses. But you’ll have to live differently than many Americans. As of April 2023, the percentage of disposable income that Americans put toward savings is only 4.1%.

Proportional budgets are just one way to approach your finances. Depending on your financial focus and how involved you want to be with your budgeting, you could opt for zero-based budgeting, an envelope system, or a pay-yourself-first method.

Does the 50/30/20 budget use gross or net income?

The 50/30/20 budget is based on net income, meaning after taxes have been taken out. If you’re a W-2 employee, the amount that hits your bank account should already have taxes withheld. If you’re a W-9 contractor or self-employed, it’s important to figure out your estimated quarterly tax payments before setting up your budget plan.

How much money should you keep in your emergency fund?

Conventional wisdom recommends three to six months’ living expenses in the emergency fund. Treat this as a guide. Depending on your job security, you may be motivated to strive for more.

Final Thoughts

When left unsupervised, dollars tend to dwindle without notice. But a budget gives your money a mission to improve your financial standing.

The 50/30/20 budget is one money management route to get there. With the help of budgeting apps, you can easily start tracking and organizing your money as soon as your next paycheck drops.

With this proportional budget plan, you can secure your financial future without sacrificing fun spending. The bottom line is that the 50/30/20 budget has some advantages as a starting point, but like most financial rules of thumb, it can also lead you astray.