Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

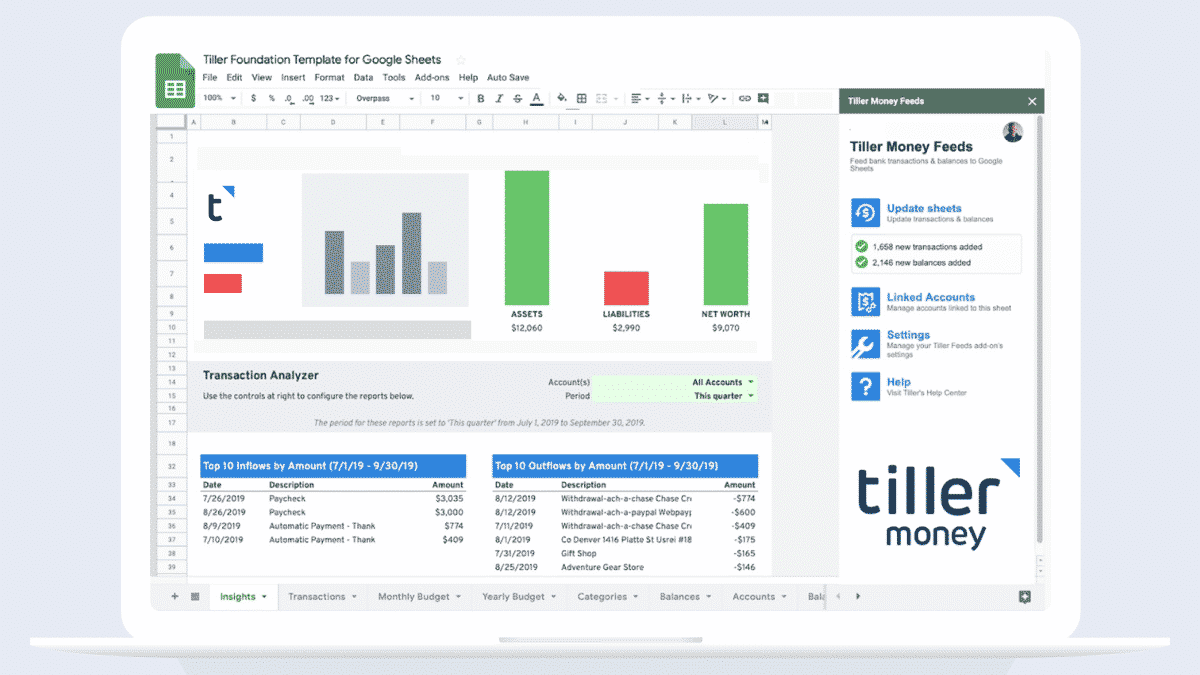

Tiller provides powerful tools to help you manage your finances. Through the simplicity of spreadsheets, it enables you to automatically download transactions from all of your financial accounts into Google Sheets or Microsoft Excel. It then provides spreadsheet templates and powerful tools to manage everything from your monthly budget to tracking your net worth. We dive into the details in this Tiller review and rating.

Tiller Snapshot

What is Tiller?

Tiller enables you to manage your daily finances automatically via spreadsheets. It does this in several ways. First, it enables you to connect your financial accounts to a Google spreadsheet. You can connect checking and savings accounts, credit cards, and even investment accounts. Once connected, Tiller automatically downloads all of your transactions and balances into Google Sheets.

Second, Tiller provides powerful templates to help you manage your money. A key template, called the Tiller Foundation Template, includes tools to help you track your monthly budget, net worth, and account balances.

Finally, Tiller offers various tools that enable you to view your financial data and analyze it in numerous ways. For example, these tools can help you automatically categorize your expenses, split a transaction across multiple categories, and even plan for your retirement.

How Does Tiller Work

Tiller Feeds

Tiller automatically downloads your transactions through a Google Sheet add-on called Tiller Feeds. This add-on enables you to select which accounts you want to connect to a spreadsheet. Tiller gives you the option of connecting one or more of your financial accounts with up to five Google Sheets.

In this way, you can manage your personal finances with one spreadsheet, your small business finances with another spreadsheet, and all of your investments in a third spreadsheet. Alternatively, you can manage all of those things in a single spreadsheet. Tiller gives you the flexibility through its Tiller Feeds to decide for yourself.

This add-on also enables you to create automatic expense categories. With this feature, you can have Tiller automatically categorize expenses based on the downloaded description. For example, you could set all transactions that have Starbucks in the description to a category of your choosing, such as coffee or restaurants.

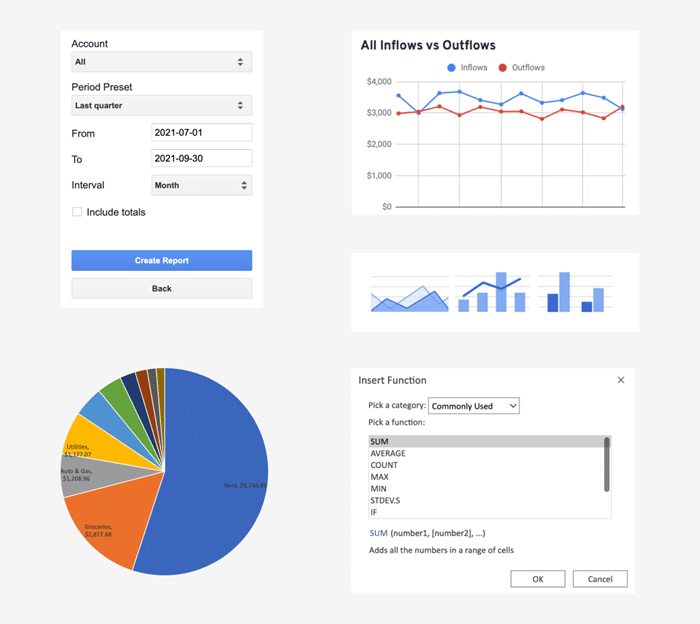

Tiller Labs

The second Google Sheets add-on that Tiller offers is called Labs. Through this add-on, you gain access to dozens of tools that help you analyze, modify, and view your financial data. For example, one tool allows you to view your transactions by category. You could easily see your restaurant category and all of the transactions that have been categorized as restaurant expenses. This helps you understand where your money has gone within each category.

Other tools include dashboards to manage business expenses, as well as projecting cash flows through retirement based on your investments.

Tiller Features

Tiller offers a host of features including the following:

- Split Transactions

- Monthly Budgeting

- Access (Web, iOS, and Android via Google Sheets App)

- Bill Management

- Net Worth Tracking

- Retirement Planning

- Reconcile Transactions

- Automatic Expense Categorization

- Two-Factor Authentication

- Automatic Downloading of Transactions

- Manual Entries

How to Get Started with Tiller

The first step is to sign up for a 30-day free trial. All that’s required is a Gmail account. Once you’ve created the account, you then connect the financial institutions that you want Tiller to track. This can include checking and savings accounts, credit card accounts, and even investment accounts.

Once you’ve linked your financial accounts, you can then use the Tiller spreadsheet template to create up to five different spreadsheets. For each spreadsheet that you create, you can indicate which of your financial accounts Tiller should download transaction and balance information.

From here you can set your expense categories. Tiller provides a list of pre-populated expense categories. You can, however, change these, delete them, or add additional categories.

Once you’ve finished creating your list of expense categories you can then categorize the transactions that Tiller has downloaded to the spreadsheet. In the first download, Tiller includes transactions going back. 90 days.

Finally, you can set up automatic categorization of expenses through the Tiller Feed. This will enable Tiller to automatically categorize future expenses.

Pros & Cons of Tiller

Pros

- Automatic downloading of transactions

- Complete control over the spreadsheet

- Auto categorization of expenses

- Excellent reporting

- Excellent tools to analyze and report on financial data

Cons

- It does take some time to learn how to use Tiller.

- It’s not ideal for those who are intimidated by spreadsheets.

Is Tiller Safe?

The short answer is yes. Tiller supports two-factor authentication via Google Sign-In, as well as all of your financial accounts data is protected with bank-grade 256-bit AES encryption. Tiller securely connects to financial accounts using Yodlee. Yodlee is used by nine out of the 15 largest U.S. banks. Just as important Tiller does not see or store your bank sign-on credentials. And no person at Tiller will see your data unless you specifically choose to share it with a Tiller analyst, or support team member.

Tiller Video Review

Tiller Alternatives

There are several options in the world of budgeting software. Some that quickly come to mind are Quicken or Mint, You Need A Budget (YNAB), CountAbout, and Empower. Each of these has its pluses and minuses. For those focused primarily on budgeting, Tiller is arguably the best option because it uses spreadsheets. You never lose control of the data, and you can modify the data in any way you wish.

That being said, for those who want to track investments, Empower is probably an option that should be considered. In addition, if you want to migrate data from Quicken or Mint, Tiller is not the solution. In that case, CountAbout is an ideal alternative.

Empower.

Empower is a one-stop shop for tracking all of your personal finance activity. You can use it for budgeting, tracking your credit card spending, or keeping tabs on your investments. The wealth management tool is best used for individuals with moderate to high net wealth and who have a lot of accounts that need monitoring.

Empower is free to use and if you like what they have to offer, you can always upgrade your service to their wealth management service where Empower will manage your investment portfolio (0.49% – 0.89% annual fee).

CountAbout

CountAbout is a perfect budgeting solution for anyone in need of importing data from Quicken or Mint. CountAbout is about half the price of Tiller per year ($39.99) and the brand offers widgets that allow you to see your budget in different ways (think graphs, charts, etc.).

This is an ad-free platform but the one downside to CountAbout is that it’s not great at syncing with investments. Empower is the better option if you are more focused on investing and less on budgeting.

Should You Give Tiller a Try?

Tiller is ideal for those who like working with spreadsheets and want to take control of their finances. Once the basic concepts are mastered, Tiller is extremely easy to use. And because it uses spreadsheets, you always have complete control of the data and how it’s presented. In fact, you could create your own custom spreadsheet, rather than use Tiller’s templates if you prefer.

For those who want to track investments, Tiller can help but it is probably not a complete solution. If you have significant investments to track, Empower is probably a better option. Many, including myself, however, use both tools.

Final Thoughts

Tiller is quickly becoming my favorite budgeting tool. It does take some time to learn and understand Tiller. Once you do however it’s extremely easy to use, at a cost of $79, a year. The price is reasonable. In addition, Tiller gives you a 30-day free trial to give Tiller a try.

Tiller

Summary

Tiller is excellent for those wanting to budget their money. It can work well with the 50/30/20 budget or even an envelope budgeting system.