Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Has setting up a budget and getting better control of your finances already gone the way of other New Year’s resolutions? If so, you may need a little bit of help to make it a reality. Simplifi can provide that help for a very low monthly fee. It will help you not only to create a budget but also to develop plans to get out of debt and build savings to create a stronger financial future.

Simplifi offers four different plan levels so you can choose the one that best fits your financial profile. Each is available at a surprisingly low monthly fee.

What is Simplifi?

Simplifi is designed to do exactly what the name implies, to simplify your financial life. It does this by aggregating all your financial accounts – savings and checking accounts, credit cards, loans, and investment accounts – on the same platform. This will give you a high-altitude view of your finances, as well as the ability to track income and spending, reduce expenses, and increase funds flowing into savings.

The service also provides real-time alerts, projected cash flows, and insightful reports to help you make better decisions with your money. While Simplifi offers only the above services, Quicken also offers their Deluxe, Premier, and Business & Personal plans to provide more assistance with investments, retirement, running your small business, and even managing rental properties.

With all the services provided by Simplifi and the Quicken family, the company charges surprisingly low monthly fees for the four plans they offer. Each also comes with a 30-day money-back guarantee, allowing you to test out the app before making it a permanent part of your financial repertoire.

Simplifi, which is included in the Quicken profile, has a Better Business Bureau rating of F on a scale of A+ to F. It also has 4.0 out of five stars from more than 2,100 iOS users on The App Store, and 2.8 out of five stars from more than 1,300 Android users on Google Play.

Simplifi Features & Benefits

Simplifi offers financial capabilities that are as comprehensive as you need them to be, though the number of features you’ll have access to will depend on the specific plan you select.

Simplifi Spending Plan

Simplifi enables you to choose different budget plans. It starts by analyzing your income and expenses, then it generates a personalized spending plan. You can choose the budgeting plan that will be used – 50-30-20, zero-based budgeting, envelope budgeting, and more.

The Spending Plan will automatically calculate how much you have left to spend each day of the month. You’ll have the ability to add any planned spending, such as holidays and vacations. You can even exclude spending categories you don’t want included in your budget. Finally, you can add savings goals to your budget.

You can use the app to reduce or pay off your debts. This can be done by determining which debts you want to pay off, setting a timeline, and making the necessary adjustments to your budget.

The app can be used to reach savings goals, including building a safety net, by setting automatic transfers into savings after finding areas in your budget where you can reduce expenses.

Investment management

This capability is available only with Quicken Premier and Quicken Business & Personal. You’ll be able to assemble all your investment accounts on the app, find new investment opportunities, track your progress, and more. Either plan comes with access to Morningstar’s Portfolio X-ray tool, helping you to analyze mutual funds and exchange-traded funds (ETFs). Armed with that information, you’ll be able to make better and more informed investment choices.

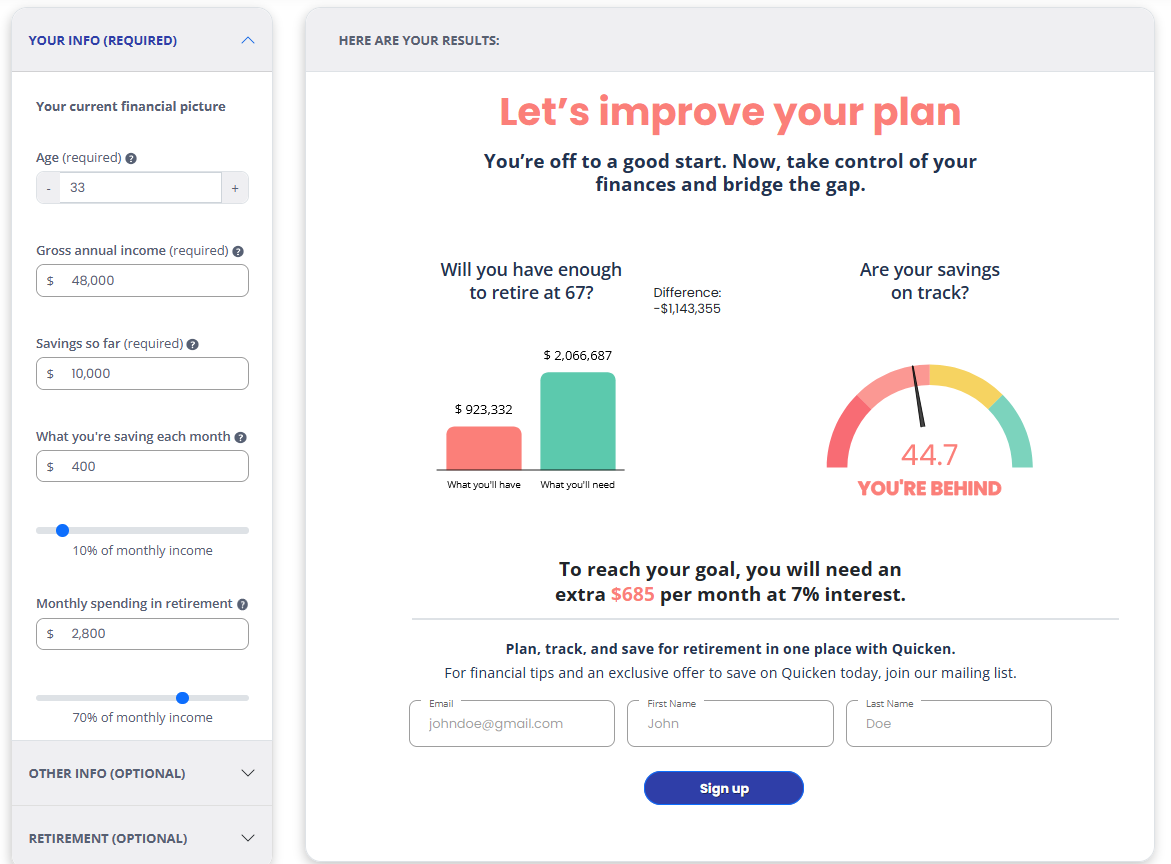

Calculators

Along with your subscription to Simplifi you’ll also have access to valuable calculators. They include a budget calculator, 401(k) calculator, retirement calculator, and even a vacation calculator.

The Simplifi Retirement Calculator.

Other Quicken Plans

If you’re looking for a more comprehensive financial app, Quicken offers Quicken Deluxe, Quicken Premier, and Quicken Business & Personal.

- Quicken Deluxe provides more detailed financial tools than you can get with Simplifi. It’s designed to help you manage and reduce debt, build a secure retirement, create multiple budgets, and make tax filing easier.

- Quicken Premier offers the same features and benefits of Quicken Deluxe but also includes best-in-class investing tools, built-in tax reports, reconciliation tools, and the ability to track and pay bills through Quicken. However, be aware that Premier is designed for personal finances, not for rental properties or your business. In addition, your year-end tax information can be exported either to TurboTax or to your accountant.

For retirement purposes, Premier offers its Lifetime Planner, as well as a comprehensive view of your entire investment portfolio. You’ll also have access to Morningstar’s Portfolio X-ray tool, enabling you to better evaluate holdings in ETFs and mutual funds.

- Quicken Business & Personal is Quicken’s most comprehensive plan, featuring all benefits available in both the Deluxe and Premier plans, plus business and rental activities. It’s designed to help you manage your business, as well as rental properties, alongside your finances. It will help you keep your financial documents organized, prepare financial statements for your business, and optimize your situation for income tax preparation.

On the business side, it can provide profit and loss and cash flow statements, balance sheets, and even reports for Schedules C and E for your income tax return. If you have rental properties it can help you to manage tenants, process payments, pay expenses, maintain lease terms, and keep track of tenant deposits.

Perhaps best of all, Quicken Business & Personal automatically separates your finances from your business finances.

Other Simplifi Features

Availability: Can be downloaded free of charge at The App Store for iOS devices (13.4 and higher), and at Google Play for Android devices.

Account security: Quicken protects user information by using 256-bit encryption to securely transmit data from your financial institutions into the app. Other security measures include integrity checks, firewall-protected servers, the option to password-protect your data files, and passwords issued by your financial institutions that must be entered each time the app accesses those accounts.

Customer service: Available by chat and community support, seven days per week, 5:00 AM to 5:00 PM, Pacific time. Indirect phone support is available. You will need to enter your phone number and choose “Call Me” from the Help Center widget. If a representative is unavailable, or if it’s outside business hours, you can leave a voicemail and a representative will get back to you as soon as possible.

Simplifi Pricing

Quicken has the following price levels for each of the four plans it offers:

- Simplifi: per month (was $3.99 per month).

- Quicken Deluxe: $4.97 per month (was $5.99 per month).

- Quicken Premier: $5.99 per month (was $7.99 a month).

- Quicken Business & Personal: $6.59 per month (was $10.99 per month)

All plans are available with a risk-free 30-day trial.

Simplifi Pros & Cons

Pros

- Comprehensive financial dashboard where you can aggregate all your savings, investment, spending, and debt-related accounts in one place.

- Offers four different plans, each designed for a specific financial profile, and at reasonable monthly payments.

- Because all plans offered charge monthly fees, there are no ads to distract the user experience.

- Simplifi is provided by Quicken, which is one of the best-known and well-established financial product providers in the industry.

- 30-day money-back guarantee on all four plans.

Cons

- Does not offer a free version as some of its competitors do.

- Phone contact is based on a call-back arrangement; there is no direct phone access to customer service.

- Better Business Bureau rating of F.

Simplifi Alternatives

If Simplifi isn’t the right financial app for you, consider one of the following alternatives:

Rocket Money

Rocket Money is one of the most comprehensive financial apps available. Part of the Rocket family that includes Rocket Mortgage, Rocket Money offers a Visa credit card with unique cash-back rewards. If you are looking to purchase a home, you can earn 5% rewards which can be applied toward the down payment – up to $10,000 – as long as the mortgage will be taken through Rocket Mortgage.

If you already have a loan with Rocket Mortgage, you can earn 2% cash back, which will be applied toward the payoff of your mortgage. Rocket Money also offers budgeting, bill negotiation, subscription cancellation, and other services.

YNAB

YNAB is an excellent choice if you are primarily concerned with budgeting. The company claims the average user saves $600 in just the first two months, and $6,000 in the first year. YNAB accomplishes this by changing your attitude toward money.

That includes a four-step process, in which you become highly intentional about how you spend money. It emphasizes preparation, flexibility, and moving your finances to where you are one month ahead of your budget. YNAB is offered at $14.99 per month, or $99 if paid annually. Either payment plan comes with a 34-day free trial.

Empower

Empower is a better choice if you’re looking for a financial app that also adds investing to the mix. At the core, Empower is a free financial aggregator where you can link all your financial accounts in one place.

They offer investment-related tools, such as their Retirement Planner and Investment Checkups. With various fee structures, they also offer self-directed investment accounts, managed portfolios, IRAs, and wealth management. You can also take advantage of the Empower Personal Cash account currently paying 4.70% APY on FDIC-insured balances up to $5 million, with no fees and unlimited transfers.

Frequently Asked Questions (FAQ)

Is Simplifi worth the money?

Given the low monthly fees, ranging from to $6.59, Simplifi packs a lot of value for the money. Even at the low end, you’ll be able to aggregate all your financial accounts on the platform, create a workable budget, pay off debt, and reach your savings goals.

Is Simplifi better than Mint?

Since Mint is disappearing, the answer to this question is no longer relevant. But based on our reviews of the two platforms, we believe Simplifi is easily the better of the two.

The main advantage Mint provided was that it was a free service. But as the years passed, and the program wasn’t updated, it became increasingly quirky. Simplifi is an actively managed program by Quicken and offers four different plan levels so you can choose exactly what you want the app to do for you.

Is Simplifi better than Rocket Money?

It’s an apples-and-oranges comparison. While Simplifi is more of a general financial management app, Rocket Money offers benefits not available on other financial apps.

For example, while Rocket Money does offer some level of budgeting, it has specializations in bill negotiations and subscription cancellations. It also provides credit monitoring and a Visa credit card that can help you to either purchase a new home or pay off an existing mortgage (assuming both involve a Rocket Mortgage loan).

Should You Sign Up for Simplifi?

If you’re looking to improve your finances, whether that’s simply implementing a budget or paying off debt, and/or building savings, Simplifi can be the best you’ll spend in any given month. If you’re also looking to get help with managing your investments, you can take advantage of Quicken Premier. And if you have a small business or rental property, Quicken Business & Personal can handle every corner of your financial world.

If you’ve been struggling to get your finances under control and to create a better future for you and your family, Simplifi offers an excellent program. It may not be free to use, but at per month, it comes attractively close.

Simplifi

Summary

Simplifi is a low-cost budgeting app that offers consumers everything they need to create a budget, receive alerts, track spending, and improve their finances.