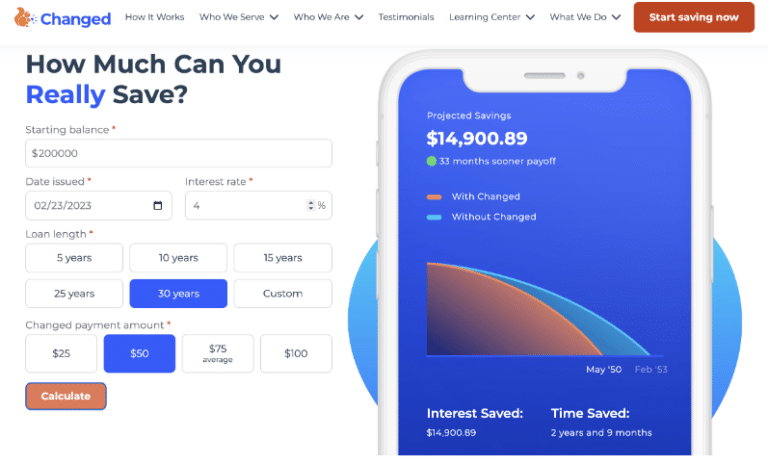

The Changed App Review – Paying Off Debt with Spare Change

Round-up apps are everywhere in the fintech space. Think, Acorns, Chime, and Stash. The Changed app does things a bit differently. Instead of earmarking your round-ups to save or invest, this micro-saving app uses round-ups from everyday purchases to help you pay off debt. Learn more about this round-up tool, how it can help you…