Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Health Savings Accounts (HSAs) are tax-advantaged accounts that can be used to pay for medical care if you have an HSA-eligible plan, or a high-deductible healthcare plan (HDHP).

You’ve probably heard more and more about HSAs in recent years, as HDHPs have increased in popularity. In fact, more than half of workers in the private sector are now enrolled in HDHPs.

As with other types of tax-deferred accounts, however, an HSA comes with a lot of rules that must be followed. We’ll cover the requirements, rules, and regulations, plus how to get the most out of this tax-advantaged account in this detailed guide to HSAs.

What is a Health Savings Account (HSA)?

An HSA is a savings account that allows you to save money on a pre-tax basis for qualified medical expenses. In addition to pre-tax contributions, HSAs offer tax-free growth and tax-free distributions when they’re used for qualifying expenses.

HSA-qualifying expenses include deductibles, copays, coinsurance, and medical items, such as prescription drugs, flu shots, hearing aids, and more. In order to be eligible for an HSA, you must be enrolled in an HSA-eligible plan or an HDHP. HSAs are also triple tax-advantaged, which means contributions are tax-deductible, growth is tax-free and distributions are tax-free when used for qualified medical expenses

HSA vs FSA

While similar to FSAs, there are a few key differences to note. Both HSAs and FSAs are tax-advantaged accounts used to pay for qualifying medical expenses. But an FSA can only be established with your employer, and generally have lower contribution limits. FSA funds also do not roll over from year to year.

An HSA is member-owned, which means you can open one even if your employer doesn’t offer it, as long as you have an eligible healthcare plan. Contribution limits for HSAs are usually higher, and unused funds roll over year-to-year, making them ideal for an additional retirement savings vehicle. More on that later.

HSA Limits

Like other tax-preferred accounts, HSAs come with both withdrawal and contribution limits. For 2024, the contribution limit for an individual is $4,150 and $8,300 for families.

The withdrawal limits are fairly straightforward. Money in the account can be used for healthcare-related expenses, including vision and dental care expenses. T the IRS imposes a hefty 20% penalty for withdrawals not used for qualifying medical expenses.

HSAs are only available for certain types of health plans, and there are as many contribution and withdrawal rules governing these accounts as there are with tax-advantaged retirement savings plans. Despite their complex nature, though, HSAs can be a great savings vehicle attached to your consumer-driven healthcare plan.

How to Qualify for an HSA

To qualify for an HSA, you must first be signed up for a qualifying health plan, also called an HDHP. To qualify for an HSA in 2023, your plan must have a minimum individual deductible of $1,500 and a minimum family deductible of $3,000, according to the IRS. (These limits will increase to $1,600 and $3,200 in 2024.) This means that this year, you’ll pay $1,500 out of pocket for individuals (or $3,000 for a family) before your insurance will kick in to cover additional expenses.

There’s also a cap on out-of-pocket spending. The maximum annual deductible and other out-of-pocket expenses for an HDHP in 2023 is $7,500 for an individual and $15,000 for family coverage.

One other qualification: You can’t be covered by other health plans except what’s allowed in the federal guidelines. Acceptable coverage includes liability coverage like workers’ compensation, coverage for a specific illness or disease, disability insurance, dental care, vision care, or long-term care insurance.

You cannot use HSA funds if you also have access to a full-fledged flexible spending account (FSA). You can, however, use an HSA in tandem with a Limited Healthcare FSA (LEX HCFSA).

Many employers now offer sponsored HSAs, which makes signing up and administering the account particularly simple. Also, many of the plans on today’s health insurance marketplace include HSAs that are attached to your healthcare plan. But you don’t need to have a healthcare plan with an attached HSA in order to open one.

As long as your existing healthcare plan meets the requirements, you can open an HSA independently. Many banks and credit unions now offer and administer HSAs. To sign up, you’ll just have to prove that your healthcare plan qualifies.

How to Choose a Health Savings Account

Even if you’re in an employer-sponsored healthcare plan that comes with an HSA option, you are still free to shop around for an account, just as long as your healthcare plan otherwise qualifies. Worth noting: since your HSA funds roll over year-to-year, many use their HSA as an additional investment savings vehicle. So if your employer’s plan doesn’t offer good HSA investment options, consider taking your funds elsewhere.

While shopping around for an HSA is a wise option, there are a couple of potential caveats to consider:

- Employer contributions: Your employer may or may not choose to contribute to an alternative personal HSA. If this is part of your potential benefits package, be sure you don’t lose out on this free money. You can, in fact, open up multiple HSAs. You can own as many HSAs as you like, so long as the total annual contribution to all accounts is less than or equal to that year’s IRS-mandated contribution limit.

- Pre-tax versus post-tax: With an employer-sponsored HSA, contributions are usually taken from your paycheck pre-tax, so you’ll see immediate savings. With an independent HSA, you’ll likely make post-tax contributions, so you won’t see the savings until you file your taxes.

Where to Open a Health Savings Account

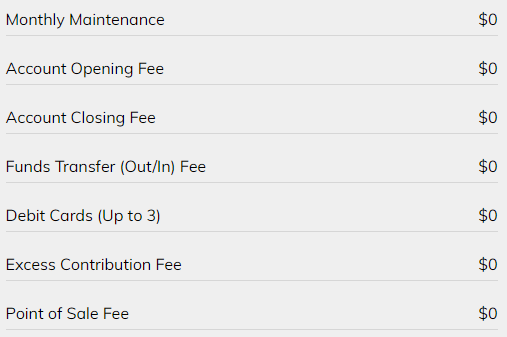

If you plan to open an independent HSA, there are countless options. Look for HSAs that offer varied investment options, low or no fees, no cash minimum for investments, an HSA-linked debit card, and perhaps even an HSA app for the more tech-savvy.

The Lively HSA is a great place to begin looking into an HSA. Lively allows you to save or invest with your HSA and there’s no cost to open an account or any monthly fees.

When opening a Lively Health Savings Account, you’ll have two options to choose from for your investments. You can open either a Schwab Health Savings Brokerage Account ($24 annual access fee) and/or an HSA Guided Portfolio from Devenir (0.50% annual management fee).

How to contribute to an HSA

So you have an HSA. Now how can you fund it? If you’re on an employer-sponsored healthcare plan with an attached HSA, you can have contributions automatically deducted from your paycheck, pre-tax. This will save you money by reducing your taxable income.

If your employer adds to your HSA as part of your benefits, this should be made clear in healthcare enrollment paperwork. Some employers will even front-load the account with the full year’s worth of their promised contribution. Others contribute a certain dollar amount per paycheck or per month until they hit the promised contribution. It’s not unusual for employers to use a combination of these approaches, contributing 50% of the total on January 1, and then adding the rest in on a per-paycheck basis. Know your employer’s strategy before you start contributing.

What if you’re opening an independent HSA or using an independent healthcare plan with an attached HSA? In this case, you’ll have to add after-tax contributions to your account. You can talk with your account administrator about how to do this. Typically, it’s simple to set up recurring transfers to the account. The main difference here is that your contributions aren’t deducted pre-tax. That means you’ll claim the deduction when you file your taxes.

HSA Contribution Limits

As with many tax-advantaged retirement accounts, HSAs have federally set limits on annual contributions. These limits typically increase year over year. For 2023, the contribution limit for an individual is $3,850; for family coverage, the limit is $7,750. Plus, those who are 55 and older can contribute an additional $1,000 annually.

Keep in mind that if you’re using an employer-sponsored HSA, this limit is the combined contributions from both you and your employer. In other words, if your employer’s benefits package includes a $2,000 annual contribution to your HSA, you can only contribute $1,850 if you’re on an individual plan and $5,750 if you’re on a family plan.

Speaking of individual versus family plans, there’s one interesting caveat to HSA contributions. The contribution limit applies based on the people covered by your qualifying HDHP, but the funds can be distributed to any of your dependents.

How to Use Your HSA

Since HSAs can only be used for qualifying medical expenses, you’ll want to be sure the items qualify before you dip into your HSA. What does that include?

- Medical equipment and supplies

- Home care

- Imaging (Think MRI, X-Ray, etc.)

- Payments to doctors & dentists

- Prescription drugs

While the qualifying expenses are fairly broad, it’s worth contacting your healthcare administrator if you have questions about a specific expense, since non-qualifying HSA spends can result in a 20% penalty.

Many HSAs come with specialized debit cards that deduct funds directly from your HSA. Often, these limited-use debit cards will reject any transactions that are clearly non-medical. But you still may be required to provide receipts to the account administrator and, later, the IRS, proving that any HSA distributions were for qualifying medical expenses.

Other HSAs work on a reimbursement model. So, you’ll pay for the expense out of pocket and then send your receipts to the HSA administrator. The administrator will verify the expense and send you a reimbursement via your HSA.

The first option is typically easier on your budget. With the reimbursement model, you’re paying into the HSA, ideally, month by month. So your taxable income is already reduced. Then, you have to pay out of pocket for the medical expenses and wait for your reimbursement to come in. You’ll still reap the tax benefits, but this model can be tough if you’re on a tight budget.

How to Invest with an HSA

Investing with your HSA isn’t a given. In fact, one study found that just 9% of HSAs were invested in 2022. That could be because many HSAs require a high minimum cash balance before you can begin investing.

You may choose to invest your HSA in a money market fund, in stocks or index funds, or even with a short-term bond fund, depending on your risk tolerance and medical costs. If you’re a relatively healthy individual with no family or dependents, you may want to take a riskier approach to investing. If you have a family and young children, it might make more sense to keep your HSA more liquid or take a more conservative approach to investing it.

In many cases, an HSA can be a great additional savings vehicle for retirement. If you find yourself with extra money to save and generally low healthcare expenses, add your HSA to your overall savings strategy. Roll funds over from year to year, and make wise investing decisions.

By the time you get to retirement, and likely to the point in your life where your medical care costs are rising, you could have a nice nest egg earmarked for medical expenses. Or you could use that money for other retirement-related costs since after age 65 you can use the money for anything, penalty-free (but you will still pay income tax on the money taken out).

Frequently Asked Questions (FAQ)

Do I Need Health Insurance to Own an HSA?

Yes. In order to open or maintain a Health Savings Account, you must be enrolled in an HDHP with a minimum annual deductible of $1,350 for individuals (or $2,750 for family coverage).

Who Can Contribute to my HSA?

Anyone. It does not matter who makes the contributions, only the account holder (and employer if there is one) will receive the tax deductions.

Is My HSA FDIC Insured?

Yes. When opening an HSA, your savings will be FDIC-insured and if it’s a high-quality HSA, you should also be earning interest.

Final Thoughts

Health Savings Accounts aren’t for everyone, and they don’t fit with every healthcare plan. But if your healthcare plan offers an HSA, it’s a great option for saving money on taxes, or even as an additional retirement savings vehicle.

Talk with your employer to see if they have a specific HSA plan already in use. And if they don’t start shopping around to find a Health Savings Account that works best for you and your family.