Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Looking for a way to get quick cash or a personal loan? You’re not alone. More than half of Americans report having taken out a personal loan in their lifetime. But it can be hard for those with little credit history or not great credit scores to get an unsecured loan.

Enter Upstart. Founded by ex-Google employees, Upstart offers fast personal loans to those with low credit scores or a limited credit history. Read on to learn about Upstart, what it offers, and if it’s the right choice for you.

What is Upstart?

Upstart is an online lending platform that helps borrowers with thin credit, no credit, or bad credit get an unsecured loan. But Upstart doesn’t provide the funds themselves. Rather, using artificial intelligence, Upstart connects borrowers with banks and other financial institutions that fund the loans.

In addition to the use of AI, what’s interesting about Upstart’s qualification process is that it uses nontraditional data to determine a borrower’s loan status. These include your residence, college education, and job history, while traditional lenders focus on the hard numbers, like credit score and income, instead.

Upstart is ideal for borrowers who are relatively new to credit, or those those with average credit.

Upstart Loan Options

Upstart offers unsecured loans between $1,000 and $50,000, available in 3 or 5-year terms. One of their most-touted features is that it’s fast funding, meaning that the loan funds can be in your account in as little as one business day.

Personal loans from Upstart can be used for several purposes, including:

- Credit card payoff

- Starting a business

- Medical bills

- Larger purchases

- Moving

- Travel

- Weddings

- Home improvements

Upstart’s APR ranges from 5.4% – 35.99%, though Upstart borrowers average at about a 25% APR. You’ll also pay up to 12% of your loan amount in origination fees, or the flat amount you agree to pay in exchange for receiving the loan.

Upstart Personal Loan Features

Here are some of Upstart’s best features:

- Fast funding: For personal loans, Upstart can provide funding as soon as one business day.

- Fixed-rate loans: You’ll pay a set APR between 5.2% and 35.99%. While the APR on the low end is competitive, the maximum is high by industry standards.

- Nontraditional approval process: your loan approval isn’t just based on your credit score; Upstart takes into account non-traditional aspects of your financial life, like work history, education, and residence.

- Automated loan process: The loan process with Upstart is largely automated, with 88% of loans being fully automated.

- Easy application: Upstart’s application process is quick and easy, with the ability to check your rate with a soft credit pull within five minutes.

- No prepayment penalty: You can pay off your Upstart loan faster without having to worry about prepayment penalties.

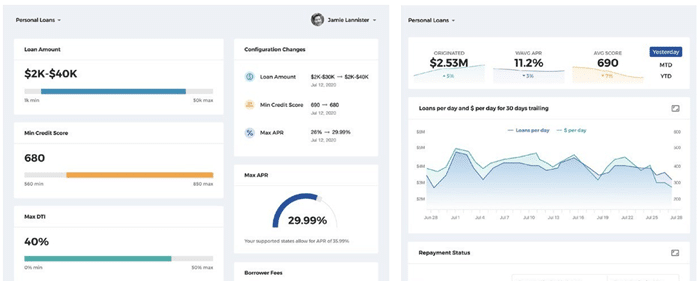

- Simple dashboard: Upstart’s dashboard is easy to use, making it simple to track your progress and stay on top of your loan.

Fees

Like many lenders, you won’t get out without getting stuck with a few fees. Upstart doesn’t charge a prepayment penalty, but you may pay an origination fee of up to 12% of your loan amount. (Remember, origination fees are the flat amount you agree to pay in exchange for receiving the loan.) So before you agree to the terms of an Upstart loan, make sure you check to see if you’ll be charged an origination fee.

Late fees are another thing to consider. Upstart charges late fees of 5% of the late payment amount or $15, whichever is greater.

Finally, interest rates on Upstart loans range from a competitive 5.2% to a staggering 35.99% APR. Keep in mind that your interest rate takes a variety of factors related to your financial history in mind, like credit score, income, and employment.

Signing Up

Filling out an application for Upstart is fairly quick and easy. You provide information about the amount you want to borrow, the purpose of the loan, your personal identifying information, education level, income, and what you have in savings.

You also need to share how you prefer to make payments and whether you’ve applied for a loan in the last three months.

To qualify for a loan with Upstart, you need to meet the following eligibility requirements:

- U.S. citizen or permanent resident

- At least 18 (in most states)

- Have a valid email address and Social Security number

- Have a U.S. bank account

- No bankruptcies

- Have a job or be starting one within 6 months

- Less than six hard inquiries on your credit report in the last six months, with some exceptions.

Security

Like most other lenders, Upstart uses bank-level encryption on its website and claims to use best practices when keeping your personal information private.

You can access a secure website to monitor your loan account progress and see where you stand. Keep in mind that Upstart does not have a mobile app. More on that below.

Mobile Support

Oddly enough for the fintech industry today, Upstart doesn’t offer a mobile app where you can view your loan, make payments, or see their payment history.

However, the website is accessible from your mobile device, and it’s fairly easy to use, though if you prefer to bank solely from your phone, it might make more sense to choose a loan servicer that offers a robust mobile app.

Customer Service

Upstart’s customer service support is fairly standard. Get help with your loan or application process seven days a week, from 9 a.m. to 8 p.m. EST. You can also reach out via email.

- Phone: (855) 438-8778

- Email: [email protected]

Upstart Pros & Cons

Pros

- Low minimum APR: Upstart minimum APR is competitive, starting at 5.2%.

- No minimum credit score to qualify: Unlike many lenders, Upstart does not have a minimum required credit score. (In most states)

- Quick access to funds: Once approved, get your funds from Upstart in as little as one day.

- Nontraditional approval process: Credit score isn’t the only thing considered when you apply for an Upstart loan. Your employment history, education level, and residence also play into things.

- Soft credit pull: Upstart initially does a soft credit pull during the application process and doesn’t do a hard pull, which will decrease your credit score slightly, until you’re ready to finalize your loan.

- Option to change payment date: With Upstart, you can change your payment date once every 12 months, as long as it’s within 15 days of the original due date.

- No penalty for early payoff: Unlike many similar lenders, Upstart doesn’t charge a penalty for early payoff.

Cons

- Potential fees: While you may get away with not paying an origination fee, some borrows will pay an origination fee of up to 12% of their loan amount

- Late fees: Late fees are 5% of the late payment amount or $15, whichever is greater.

- Limited repayment options: The only two choices for repayment terms are three years or five years.

- High maximum APR: Pay up to a 35.99% APR, high by any standard.

Upstart Alternatives

While Upstart can be a good choice for some borrowers, its high maximum APR and potential origination fee may lead borrowers to explore other options.

SoFi

With SoFi Personal Loans, you can borrow up to $100k and the funds can be received the same business day you sign your loan. When you apply for a credit card consolidation loan and set up direct payment to your lenders, SoFi will give you an extra rate discount.

Rates start at 8.99% with all discounts and SoFi offers unemployment protection. If you lose your job, SoFi will temporarily pause your payments and help you find a new job.

Best Egg

Best Egg offers personal loans in amounts ranging from $2,000 to $35,00 and if you have a special offer or code, you can apply for a personal loan up to $50,000. Loan interest rates fall between 8.99% – 35.99% and after you complete a short screener, personal loan offers will appear within seconds.

The one-time loan origination fee is between 0.99% and 8.99% with Best Egg and loan terms have a minimum of 3 years with a maximum of 5 years.

Related: The Best Online Personal Loan Rates and Offers

Who is Upstart For?

Upstart is designed to help those with fair to average credit, and those who are relatively new to credit get personal loans. If you’re looking for an unsecured loan and haven’t been able to qualify with other lenders, Upstart might be able to help you get the funding you’re looking for.

Bottom Line

Upstart can help those who may not qualify for traditional personal loans get the cash they need. But it comes with a cost, as Upstart can charge origination fees and has an interest rate of up to 35.99% APR.

Upstart is a solid offering for borrowers who need quick funding and who are willing to pay a potentially higher interest rate if they wouldn’t otherwise qualify for some of the other personal loan offerings.

Upstart

Summary

Upstart offers personal loans for every situation with a quick application process. Rates are a bit more expensive than most but funds are much more accessible than most.