Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

How much should you be saving? It’s a question that we ask a lot, and there are a number of rules of thumb. One answer is based on the 50/20/30 budgeting system. Popularized by Senator Elizabeth Warren, this rule of thumb suggests we should be saving 20% of our income.

How much should you be saving? It’s a question that we ask a lot, and there are a number of rules of thumb. One answer is based on the 50/20/30 budgeting system. Popularized by Senator Elizabeth Warren, this rule of thumb suggests we should be saving 20% of our income.

Any general guideline, however, has shortcomings. For starters, how much we should save will vary based on our age, years to retirement, and overall goals. A 20-year-old may not need to save the same amount as somebody in their 50′s who’s just starting to save for retirement. Yet if a general rule of thumb only gets us so far, how do we decide just how much to sock away each month?

Financial Freedom Calculator

To answer this question, I’ve created what I call the Financial Freedom Calculator. This simple spreadsheet can quickly estimate how long it will take you to achieve financial freedom based on the percentage of your income that you save. Below is a quick view of the calculator. We’ll walk through the underlying assumptions, and you can use this link to access the calculator(you’ll be prompted to make a copy of the spreadsheet so that you can edit it).

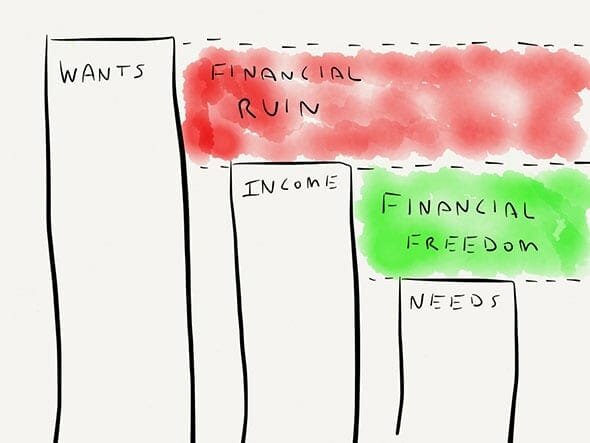

We achieve financial freedom when our investments can generate sufficient income to meet our living expenses. For most people, this occurs at the traditional retirement age, if at all. Others, like Mr. Money Mustache, achieve financial freedom at a very young age. The idea behind the Financial Freedom spreadsheet is to estimate how many years it will take you to achieve financial freedom. The spreadsheet uses the following assumptions and inputs:

- The Number: The spreadsheet assumes that financial freedom occurs when we’ve saved 25 times our annual spending. For example, for a family spending $75,000 a year, they would need to save 25 times this amount or $1,875,000 to achieve financial freedom. This is based on the well-known 4% withdrawal rate in retirement. You can change this assumption in the spreadsheet. Raising the withdrawal rate reduces the number you’ll need to save while lowering the withdrawal rate raises it.

- Rate of Return: The spreadsheet provides results based on annual returns ranging from 5% to 9% in 1%increments. As you’ll see, the rate of return significantly affects the time it will take to achieve financial freedom. In the section of the spreadsheet labeled “Have Fun With Your Own Numbers,” you can enter any rate of return you’d like.

- Inflation: The calculator does not adjust for inflation. However, you can factor in inflation based on the rate of return you choose.

- Income: The assumed annual income is $100,000. It was chosen as a nice round number. You can of course change this input once you create and save a copy of the spreadsheet. Note, however, that changing the annual income does not change the time it takes to achieve financial freedom. This may seem counter-intuitive at first, but remember that saving and spending are based on a percentage of income. Saving 10% of your income, regardless of whether you make $50,000 a year or $5,000,000, means that you are spending 90% of your income. Given an assumed annual return on investments, the time to save 25 times 90% of your income is the same.

- Saving/Spending: The spreadsheet assumes that your saving and spending added together equal 100% of your income. In retirement, however, you may spend significantly less than you spend during your working years. This could be the case for several reasons, including having a paid-off mortgage, moving to a less expensive area of the country or providing for fewer family members (at least one hopes the children eventually move out!). For this reason, the “Have Fun With Your Own Numbers” section enables you to set specific dollar amounts for your savings and income, which together may not equal your current income. For example, a family making $100,000 and saving 20% today is spending 80% or $80,000. But in retirement, they may plan to spend only $50,000.

- Current Savings: You can enter your current savings. Of course, the more you already have saved, the closer you are to financial freedom.

Maintain an emergency fund

One of the most important ways to measure your financial freedom is whether or not you have debt. If you owe money to someone else, especially if it’s at a high-interest rate, can you really consider yourself financially free?

A common rule of thumb is to maintain an emergency fund equal to 3 to 6 months’ expenses. So, if you spend $3,000 per month, you’d want to have an emergency fund of $9,000 – $18,000. This should be enough to let you weather a significant financial catastrophe, such as an injury or losing your job.

A great place to keep your emergency fund is in a savings account, such as Chime®. Chime is a financial technology company whose mission is to provide basic financial services that are “helpful, easy, and free”. Through its award-winning financial app and debit card, Chime provides a broad range of services including a Spending Account, a Credit Builder Account, and a Savings Account. This lets you keep easy access to the money while earning some interest. Chime’s savings has no minimum balance or monthly fee, making it a good choice whether you have a strong emergency fund or want to get started building one.

A great place to keep your emergency fund is in a savings account, such as Chime®. Chime is a financial technology company whose mission is to provide basic financial services that are “helpful, easy, and free”. Through its award-winning financial app and debit card, Chime provides a broad range of services including a Spending Account, a Credit Builder Account, and a Savings Account. This lets you keep easy access to the money while earning some interest. Chime’s savings has no minimum balance or monthly fee, making it a good choice whether you have a strong emergency fund or want to get started building one.

To learn more about Chime, check out our full review.

I hope you find the calculator useful. And if you have suggestions for ways to improve it, please leave a comment below.