Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

There are few things more annoying in my life than recurring, nominal bank fees. I find it amazing that few things can rile us up more than looking over a bank statement and finding a $9.99 monthly charge.

Good thing then, that Chime®–a new platform that is backed by Bancorp Bank or Stride Bank, N/A/, Members FDIC–offers checking, savings, and debit card accounts.

Before you decide to start an account with Chime, look over the fine print. In this article, I’ll review Chime in detail, so you can determine if it’s right for you or not. Let’s start with learning more about Chime itself.

What Is Chime?

Many of us are getting fed up with traditional banks. Banking is something that we need to have access to, but the associated fees and other nuisances that go along with it are less than desirable.

So, we’ve been seeking banking alternatives that do things in a more customer-friendly fashion. One such financial app is Chime.

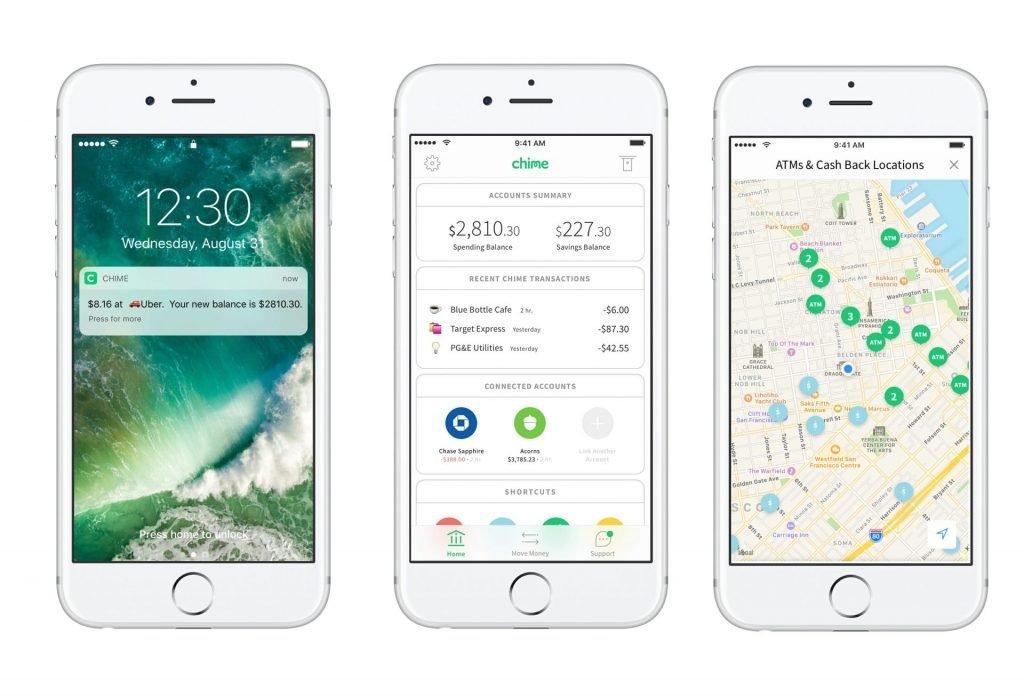

Chime is an online or “mobile-only” app that offers you an alternative to traditional financial managing methods. If you are sick of having to pay high fees or if you don’t want to deal with overdrafts, then you might be interested in this financial app.

It makes things convenient and offers you a streamlined service that’s easy to understand.

How Chime Works

The layout of Chime is simple: every one that signs up will have access to a checking account (Chime calls this a “Spending Account”), a savings account, and a debit card.

All the money that you deposit into your Chime account will initially go to your checking account. You can use that money to make everyday purchases with your debit card, use it online like a standard checking account (to send money), or write paper checks using the Chime Checkbook app.

Money from your checking account can be transferred to your savings account. Then, you can choose to keep it there or set up external transfer accounts (there is no charge to transfer cash).

Chime Key Features

SpotMe®

SpotMe lets you make debit card purchases that may overdraw your account free of any overdraft fees. Chime will “spot” you whenever you want that little extra cushion to cover the cost of a purchase.

There isn’t any fee to use SpotMe, but you’ll have the ability to leave Chime an optional tip (note that whether you tip or not will not affect your eligibility for SpotMe) as soon as you repay your negative balance. Chime says this tipping helps them offer this service to its members at no strict cost.

To be eligible for SpotMe, Chime members who receive a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. Limits are determined by Chime based on factors such as account activity and history. It’s important to know that any purchase you make that would overdraw your account over your SpotMe limit will be declined. It’s also important to know Chime Member Services can’t manually boost your SpotMe limit.

Compared to other banks, SpotMe is pretty unique. Most banks offering overdraft protection require you to open a savings account to cover the overdraft or you’ll get bank fees for those overdrafts. But as you’ll see in the rest of the review, Chime is different. That’s why they’ll allow you to overdraft up to $200 with SpotMe without even charging a fee. In addition, they don’t ask that you link your savings account to your Chime Checking Account or charge you a fee for SpotMe.

Finally, know that SpotMe only covers debit card purchases. If you choose “credit” when you’re buying something, you won’t be covered with SpotMe. To begin using SpotMe, according to Chime:

Open the Settings tab in your Chime app to find out if you’re eligible for the SpotMe feature (make sure you have the latest version of the app).

Once you agree to the SpotMe Terms and Conditions, you are officially enrolled in SpotMe!

When you’re enrolled in SpotMe, you will be able to make debit card purchases that overdraft your account up to $200*.

When we receive your next deposit, we will automatically apply it to your negative balance. No overdraft fees are applied. Ever.

Chime Savings Round-Ups

Every time you use your debit card to make a purchase, Chime will automatically round the change up (to the nearest $1). Then, it will deposit that change into your Chime savings account.

For example, if you make a purchase at the grocery store for $44.26, Chime will charge your debit card $45. The additional $0.74 will be transferred into your savings account automatically. This is done for every single purchase you make.

On the surface, this may not sound all too different from other money-rounding apps, like Acorns or Qoins.

Savings round up bonuses will be deposited every Friday, and the max amount of bonus money you can earn as a result of these round ups is $500 annually. When you consider the example above, I would venture to say that hitting the $500 figure in a single year would require many thousands of annual purchases. It would be very difficult to do (meaning the cap should not be considered a negative factor).

Also read: Best Round-Up Apps

High Yield Interest Rate

Chime is now paying an APY right in line with the best online savings accounts available. So not only can you score with their top-notch features, but you’ll also earn a top-notch interest rate.

Related: Best Online Savings Accounts with High Interest

Automatic Savings Feature + Checkbook

Chime allows all of its members to have direct deposits placed into their checking accounts. From there, users can choose to set up an automatic savings feature, which allows 10% of your direct deposit to automatically be placed in your savings account for direct deposits over $500. You’ll find this in your Chime account.

Chime Checkbook allows you to send a paper check free of charge, to anyone you need. The app can be found on any mobile device or in your Chime online account. Plus, there is no limit to the number of checks you can send each month. However, there is a limit of $5,000 per check sent and $10,000 per month in the total amount of checks sent.

ATM Access

You can enjoy many free ATMs to withdraw money from your account when you sign up for Chime. The ATM network is robust with more than 60,000+ fee-free ATMs through the MoneyPass and Visa Plus Alliance ATM networks. If you use an out-of-network ATM, then the fee will only be $2.50, which is better than most traditional banks. *Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

Automatic Deposits and No Foreign Transaction Fees

You can make use of features such as an automatic deposit for your paycheck. This makes it possible to get your paycheck early and is one convenience that draws people to the app.

You also won’t have to put up with any annoying foreign transaction fees so those who travel abroad can rest easy.

Chime Pricing & Fees

The reasons why you would generally incur a fee on your checking account are somewhat universal. They are:

- Your average daily balance dropped below the required amount to keep the account fee-free.

- You did not make enough debits from the account in a month.

- The account you had signed up for was discontinued, and you were automatically enrolled in a different program… one that now incurs fees.

However, Chime does not charge for any of these things.

In fact, the only fee you will ever find from using your Chime savings, checking, or debit card account is if you make a withdrawal from an ATM that is not on their network.

No minimum fees, no monthly fees, and no membership fees. Ever. But that’s not the only reason to consider using Chime for your everyday money management needs.

Also, the fact that there are no foreign transaction fees to worry about is a real upside for people who travel out of the country regularly. If you travel out of the country on business or if you have family in another country, then you will not have to worry about fees hampering your experience. The fees are kept to a minimum here, and that is the most positive aspect of this app.

Signing Up for Chime

Signing up for Chime shouldn’t be overly complicated, but it is not always instantaneous. Some users have reported not getting their debit card for up to two weeks after signing up.

This can be quite an inconvenience for some and is something you will want to consider before moving forward. The actual application process is simple enough, but you may wind up waiting longer to take advantage of the account than you would like.

You will only need to provide the standard forms of identification to get things started. Getting an account is easy enough to make this a practical option for most people. As long as you have a smartphone, it should be simple to sign up and then manage your account as necessary.

Just remember that there are no traditional bank branches for you to rely on so you will be doing everything using your smartphone.

Chime Security

The security of your money is very important, and you want to make sure that you can trust any bank before doing business with them. Thankfully, Chime has the fundamental security credentials you would expect from a bank.

They are partnered with the FDIC so you can feel confident that your money will be in good hands if you use Chime. You can set up both a checking (again, called a spending account) and a savings account with no problems.

Being this is a mobile-only app, you may not get the same help you would at a traditional bank. If you do encounter security problems, it will likely be more difficult to resolve these issues. They do not have the same robust support structure that most traditional banks do, so remember this before you sign up.

Chime Mobile Support & Accessibility

Chime’s mobile support and accessibility is its best feature, aside from the lack of fees. You will be managing your Chime account entirely from your mobile phone.

Chime’s mobile support and accessibility is its best feature, aside from the lack of fees. You will be managing your Chime account entirely from your mobile phone.

You can access your account at any time and can make whatever moves are necessary on the fly.

Keeping track of how much money is in your account will always feel effortless. You won’t be left guessing and should be able to keep your money moving smoothly. This is a straightforward experience that allows you to do what you need to do without making it a hassle.

Chime Customer Service & Support

Customer service and support staff might be lacking when you use Chime. Being a mobile-only app puts it at a disadvantage in several ways.

For example, you’ll never have the option to talk with someone about any problems you are experiencing face-to-face. If there is an unresolved issue with your account, then you must try to solve it over the phone.

The level of their customer support staff is not up to the same standard as many traditional banking options. This could wind up harming your overall experience and will make some people shy away from signing up.

If you are worried about having a tough time with the customer service situation, then go with a traditional bank. Using Chime won’t be as easy if you’re expecting a robust customer service platform.

The customer service agents are there and will work to assist you. Just understand that customer service is not an area where Chime shines.

Pros & Cons

-

Avoid fees — The most apparent positive benefit of signing up Chime is the ability to avoid fees. You will not be charged monthly fees for your account, and you can make use of the standard banking features you need.

-

FDIC-insured — It’s safe to open an account with Chime due to being insured by the FDIC, so you know that you can count on them from the standpoint of basic safety.

-

No foreign transaction fees — The lack of foreign transaction fees will be beneficial, too.

-

Lots of ATMs — The only fee you’ll see with Chime is the $2.50 out of network ATM charge you’ll be forced to pay sometimes. But there are thousands of ATM’s that are free, so you probably won’t have to pay that fee too often (if ever).

-

Simple direct deposit — Getting a direct deposit of your paycheck into your Chime account is convenient. Setting everything up for this will be simple, too.

-

Depositing cash — One of the big negatives is that it will be challenging for you to deposit cash. As you might expect, the lack of a physical banking location makes this tough. You must deposit cash in a very roundabout way, making it more of an annoyance than it is worth.

-

Customer service — The customer service options for Chime are not as good as most people would hope for.

-

No physical branches — The big negative comes when you consider the inconvenience of not having a physical location to go to. Aside from making it difficult to put cash into your account, it also makes it impossible to speak to someone face-to-face. This takes the human element out of the equation when trying to solve a dispute and will make certain things more frustrating.

Alternatives

One of the alternatives to using Chime will be signing up with a traditional bank. Choosing one of the big branches in your area might be more beneficial to you.

These large banks can also act as lenders when you need loans, so it’s helpful to build a relationship with a renowned bank. There are other options closer to what Chime offers as a mobile-only option, too.

You could consider signing up at Simple. This is another fee-free checking account you can take advantage of. It has no monthly fees and a 0.01% APY. It might be worth it to consider going this route instead, so take your time to consider your options before moving forward. It is another all-digital option, but it might be better than Chime in a few key ways. This option will still have some downsides that Chime does.

If none of these options work for you, check out our list of free checking accounts you can open right now.

Learn More: Best Mobile Banking Apps

Bottom Line – Is Chime Right for You?

When you consider what Chime has to offer, this is a terrific offer for anyone in need of a fee-free debit card and a fee-free checking account.

To anyone that cannot use a cash back credit card to make routine purchases, this is a fantastic alternative. For this reason alone, I would highly recommend Chime.

I’d also recommend Chime to anyone in need of an online checking account. The ability to send paper checks without cost is a huge plus, and it would be nice not to have to worry about unnecessary banking fees.

Utilize the Chime savings account and take advantage of their automated savings tools, but also be smart and set up external savings accounts. Interest rates are on the rise and it would be foolish to miss out.