Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

As you grow in your career, make more money and invest more, your net worth grows (usually). For many people, net worth is a good barometer of how well you’re doing based on the money you have saved, your age, and how much you make.

So, in this article, we’ll explore how much net worth you should have. Let’s get started by understanding net worth in a bit more detail.

What Is Net Worth?

Net worth is the value of any assets you own minus any liabilities you owe. Your net worth shows you your overall financial position and how well you’re doing against peers of the same age and income range. Your net worth can be positive or negative.

Your net worth is positive if your assets exceed your liabilities. It’s negative if your liabilities exceed your assets. Net worth can be applied to individuals, countries, companies, or entire sectors.

For example, for a business, net worth might also be looked at as the book value or the shareholders’ equity. Individuals with a high net worth are known as high-net-worth individuals or HNWI.

Assets and Liabilities

Assets could be both liquid and illiquid. Illiquid assets are difficult to convert into cash quickly, and they might be things like real estate property or a business you own. Liquid assets are investments or possessions that can be sold for cash relatively quickly and lose little value. A good example of a liquid asset is something like a bank account.

Other examples of liquid assets include CDs, mutual funds, stocks, bonds, or any possessions with real value, like antiques, artwork, or jewelry.

Liabilities are any debts you owe. Liabilities include things like auto loans, home mortgages, your student loan debt, credit card balances, personal loans, any taxes you haven’t paid, liens and judgments, medical debt, business loans, and more.

Ways to Calculate What Your Net Worth Should Be

There are a few simple ways to calculate what your net worth should be. For simplicity, I will give you two examples.

The first comes from the book The Millionaire Next Door and authors Thomas Stanley and William Danko. Their book uses the following formula for calculating your net worth as a rule of thumb. It says:

Net Worth = (Your Age x Your Pre-Tax Income) / 10

This is a good starting point for calculating what your net worth should be.

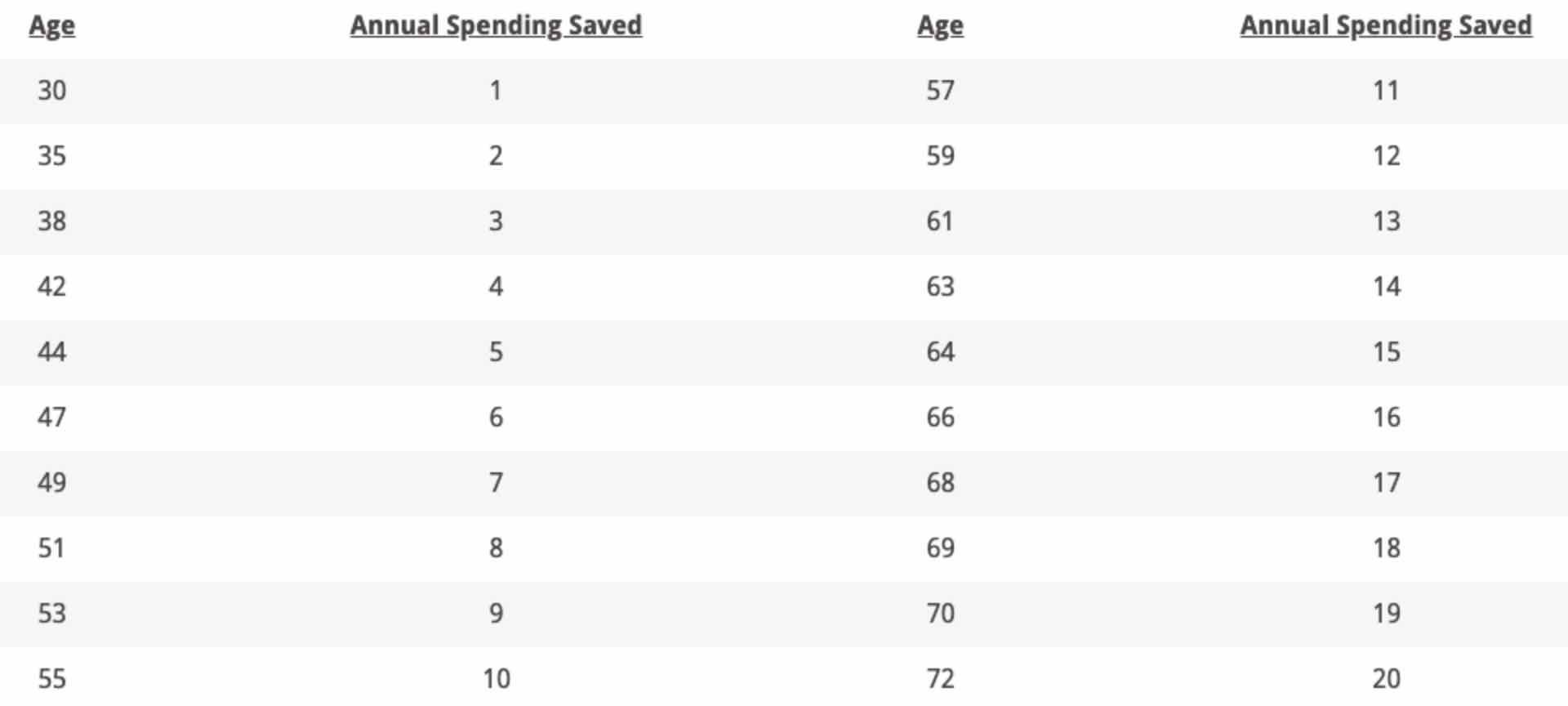

The next method for calculating your net worth comes from financial advisor David John Marotta, and he uses a formula where it looks at how much you have saved based on your age and determines what your net worth should be. So as you get older, you should have a higher multiplier of whatever your annual spending is.

For example, he has a couple of variations of this article and his formula out there, but the one I have just looked at shows a 1x multiplier for age 30. That means whatever you spend a year, at age 30, you should have equal savings. Here’s the full chart from his website:

As you get older, that multiplier increases. So, for example, by age 45, you might have a 7x multiplier, meaning you should have seven times whatever you spend every year put away in savings. And that should determine what your net worth should be.

As you get older, that multiplier increases. So, for example, by age 45, you might have a 7x multiplier, meaning you should have seven times whatever you spend every year put away in savings. And that should determine what your net worth should be.

Using the example above of a 30-year-old person who makes $100,000 per year, let’s assume that they spend $60,000 per year. So, using this formula, your net worth should be equal to whatever your annual spending is, so $60,000. This is a little bit more of a realistic number than the ones that the authors of The Millionaire Next Door came up with.

Now, let’s jump ahead to age 45. Let’s say this person has increased their income to $150,000 per year. According to this formula, you would then use a 7x multiplier to determine your net worth. So, if you make $150,000, let’s say by this point, you spend $80,000 per year. So let me take $80,000 and multiply that by seven, which gives you $560,000.

So, this formula says that by age 45, if you’re spending $80,000 a year, you should have a net worth of around $560,000. This number is more realistic when you’re younger in your career, but I think it’s a little bit unrealistic as you get older.

By age 45, to have a net worth of $560,000 is great, but the bigger concern is, should you be spending $80,000 a year? So there’s more due diligence to be had with this formula. However, it should be a good quick pulse check for you.

Learn More: Tools to Track Your Net Worth

Net Worth Targets by Age and Median Household Net Worths

Below, we will talk about some net worth targets combined from several sources. First, looking at the two formulas mentioned above, and considering other research that’s available online, these are some general guidelines as a starting point for what your net worth should be.

Remember, a lot of this will depend on your financial situation, where you live, what you do for a living, and what your investment horizon looks like. So this is just a starting point.

General Net Worth Targets by Age

- The 20s – When you’re in your 20s, it’s generally accepted that you will be focusing on getting out of any debt like student loans or credit card debt you may have accumulated in college. You’ll also get started with your first job and get set up with a retirement plan so you can build your net worth. Anything in your 20s in terms of positive net worth is generally okay.

- The 30s – By the time you reach your 30s, you might have at least half of your salary from your 20s saved. For example, if your salary in your 20s was $60,000, you may have a net worth of about $30,000 by the time you’re 30. Again, this is just a general guideline and may differ based on your situation.

- The 40s – By age 40, aim for two times your annual salary as your net worth. So, if at age 40 you are now making $100,000, your net worth should be at least $200,000. You can see the stark differences in the formula used above, where the person at age 45 spending $80,000 per year should have had a net worth of around $560,000. As you can see, it depends a lot on what you make and how much you spend when calculating your net worth.

- The 50s – At age 50, your net worth should be roughly about four times your salary. So, if your salary at age 50 is $150,000, your net worth should be right around $600,000. Usually, around this time is when you’re making the most money in your career.

- The 60s – By age 60, your net worth should be around six times your annual salary. So if at 60 years old, you’re making $175,000 a year, your net worth should be about $1,050,000.

These are just general guidelines. So much depends on how much you make and how much you spend. How much you spend can be more critical for net worth than how much you make.

I have a relative who made no more than $50,000 running his own business for his entire career, and he retired by the time he was in his early 50s because he saved so much of his income. So, it doesn’t matter how much you make. I would focus more on how much you save.

Real Estate and Retirement Accounts

Another common way to grow your net worth without tying money up into retirement accounts is real estate. As real estate typically appreciates over time (again, this will vary greatly depending on where you live), it can help grow your net worth exponentially.

Remember, the calculation of net worth includes your assets. It doesn’t have to be liquid assets or cash. If you own a home that’s worth $500,000, that gets added to your net worth total. Now, remember that if you have a mortgage on that home, that’ll be considered a liability and lowers your net worth.

In this example, if you have a $500,000 home, but you owe $400,000 on it, you’re positive $100,000 in your net worth.

Retirement accounts are also a great way to build your net worth. It’s probably the most common asset involved in your net worth as well. And this includes things like a 401k or a 403(b) if you’re at a nonprofit organization, but you can also have your retirement savings in something like a Roth IRA or a Traditional IRA.

Another thing to remember is that an HSA is a great way to boost your retirement savings, as it can be converted into an asset much like an IRA after a certain age.

Read More: Is Your Net Worth Below or Above Average?

Ways to Improve Your Net Worth

Now that you have a better understanding of what net worth is, how it’s calculated, and some of the general guidelines, let’s consider some ways to improve your net worth.

Reduce Your Spending and Pay off Debt

To increase your net worth, you have to have a positive cash flow. The best thing you can do is track your spending. See if you’re living below your means, so you’re spending less than you make.

If you’re spending more than you make, you have to cut your spending to avoid going into debt or cover expenses with more debt like credit cards. Also, to set money aside for savings and to increase your net worth, you have to spend less than you make.

I always recommend creating a budget as a starting point. There are a couple of options.

If you’re someone who likes to watch where every dollar comes and goes, I would look at You Need a Budget, but if you’re someone who wants something simple, check out Empower.

(Personal Capital is now Empower)

Related: Empower vs. YNAB – Which Will Best Benefit Your Financial Life?

Snowball Method

Along with creating a positive cash flow is paying off your debt. Reducing your debt will reduce your liabilities, allowing your net worth to increase. You could pay off your debt in many, many ways.

I would advocate for two methods, the avalanche method and the snowball method. The snowball method became popular with Dave Ramsey, and it includes listing out your debts from the smallest dollar amount to the highest dollar amount.

And you start by paying off the balance with the lowest dollar amount. Once that debt has been paid off, you move on to the next smallest dollar amount, adding the money from the payment you made with the first debt to the second one.

Math doesn’t get factored into this because it does not include interest rates. So common sense and math would tell you to pay off the highest interest rate debt first. However, psychology shows that paying off small balances creates smaller wins and keeps you motivated to keep going. Plus, it reduces the total number of debts you have.

One thing to know is that the snowball method does require a lot of discipline because after you pay off a debt, you’re supposed to take that payment and apply it to the next smallest payment. One risk you run is taking that extra payment you no longer have to pay and spending it.

Avalanche Method

The next method is the avalanche method, also called the stacking method, and this involves listing your debts from highest to lowest interest rate, and you pay off your debt in that order.

Mathematically, this makes a lot more sense, but it does not count how much debt there is. Even if you have a $1,000 balance at 20% interest, and that’s your highest interest rate, it will be paid off before any larger balances at a lower interest rate. Much like the snowball method, once the first debt is paid off, you move to the second-highest interest rate debt. You can even take the same payment application method as a snowball method and apply that payment to the next highest interest rate.

Put More Money in Savings or Increase Your Salary

Try to put more money in savings. The first way to do this without making more money is to take a long, hard look at your budget and see what kind of cuts you can make to free up more income.

Maybe this means cutting out a gym membership or cutting out subscriptions you don’t use anymore. You also may be able to negotiate better interest rates on loans you have or debt you have and utilities, things like your phone bill or your cable bill.

After you have gone through your budget to find things to cut out, try making more money either at your current job or through a side hustle.

At your current place of employment, depending on the job and the job level and the company, consider trying to get a pay increase every two years, if not every year. Some companies will give an annual pay increase to keep up with inflation, but not all companies do this.

If you haven’t received a pay increase in two years, I would recommend finding a way to talk to your boss about that.

The other option is to pick up a side hustle, whether it means delivering groceries through Instacart, starting a blog, or selling stuff online through Etsy. Picking up a side hustle is far more commonplace than it was several years ago, and it’s a great way to make extra money. You can then use that extra money to either pay off your debt or put it in savings.

Some Other Financial Markers to Look At

Hopefully, by this point, you have a better understanding of net worth, how to calculate it, and how to improve it. We will finish the article by giving you other milestones or financial markers to look at as you’re growing your net worth. And these aren’t necessarily hard and fast rules, but they’re just different things for you to consider as you’re growing your net worth.

Positive Net Worth 10 Years After Your Graduation

After you graduate, you’ll usually be entering the workforce. One measuring stick is to look at ten years out from your full earning potential, which doesn’t include residencies or internships. You are considering ten years into your career.

So, if at age 23 you get a full-time job and get a paycheck, by age 33 is when you would use this measuring stick. And the measuring stick is that your net worth should be positive.

If your net worth is positive ten years after you graduate and start in the workforce, this is a good indicator you have upward-trending financial health. If you have a positive net worth earlier in your career, that’s better.

For some people, five to seven years is a better measuring stick, but considering the environment today, having a positive net worth ten years after graduation is a good milestone.

Average Rate of Savings

According to research by the Federal Reserve Bank of St. Louis, Americans’ average savings rate as of early 2020 is around 7%. However, the median is a lot lower. For example, 31% of people are saving nothing, 27% of people are saving between 1 and 5%, and 41% save 6% or more.

The study also found that more income didn’t correlate to more savings. The income percentages for the most common savings rate were similar across all income levels.

People always compare savings rates to countries like China, which might be extreme because the economy and lifestyle are so different. However, just as a point of reference, the latest data shows that the average savings rate is around 40 to 45% for people living in China.

According to the study we just referenced, if 7% is good, aiming for somewhere between 10 and 20% of our savings rate, if not more, is better.

Determining When to Retire

You may have heard of the FIRE movement before. But I want to talk about the FTI ratio, and this was created by a guy named Doug Massey in the early 2000s.

It’s not something that you’re going to find on many blogs or in a lot of videos. It’s pretty well-hidden throughout the forums on places like Quora and Reddit. However, it’s an interesting way of looking at retirement.

So the FTI ratio (I’ll let you look up what FTI stands for) is your age times your net worth, divided by your yearly expenses. So:

FTI = Age x Net Worth / Annual Expenses

If you’re 50 years old and your yearly expenses are $50,000, then you would take 50 times your net worth and divide it by $50,000.

Massey says that if your FTI number is greater than 1,000, it’s safe to retire, and you have enough net worth to cover your expenses for the rest of your expected lifetime. It also applies to quitting your job to find something else.

So by following this formula, you should have enough net worth to last while you’re looking for another job.

Other metrics to use, such as the Barista FIRE, Fat FIRE, and other variations of FIRE, determine when to retire. But I thought this one was interesting because it’s less known, and it’s a unique way of looking at when you can retire.

Final Thoughts

Well, there you have it. This hopefully showed you how much net worth you should have based on your age and other varying factors. I have to reiterate that this information will differ depending on your current financial situation, your job, where you live, and many other factors.

However, if you use this as a starting point, it could be helpful because you could compare where you stand versus where other people might stand, and it might allow you to set financial goals.

Regardless of your net worth, the key things you should remember are to spend less than you earn, save as much money as you can, and pay down your debts. Following just those three simple rules will have you well on your way to creating a positive and high net worth in time.