Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

I recently took a new job in another state, which caused me to sell my home and find a place to rent. I’ve now been renting for over a year and must say that I love it. I like not having to worry about repairs or paying property taxes.

But one of the things I was reminded of for this upcoming tax season that I really do miss is the tax deductions for homeowners.

Seriously, owning a home can not only give you a cheaper monthly payment than renting but in many cases, the tax benefits make the decision a no-brainer.

We’re going to cover the main tax benefits you’ll see when you own a home. From there, you can decide on what’s right for you.

Tax Deductions for Homeowners

1. Mortgage Interest is Tax Deductible

If you own a home and don’t have a mortgage greater than $750,000, you can deduct the interest you pay on the loan. This is one of the biggest benefits to owning a home versus renting—as you could get massive deductions at tax time.

The limit used to be $1 million, but the Tax Cuts and Jobs Act of 2017 (TCJA) reduced the limit and made some clarifications on deducting interest from a home equity line of credit.

Prior to the TCJA, you could deduct interest on a mortgage up to $1 million, plus a HELOC up to $100,000. And it didn’t matter what your HELOC was used for (i.e., student loans, credit card debt). The TCJA clarifies that you can deduct HELOC interest but must still stay under the total limit of $750,000 and be used to improve the home.

As you can also see, TCJA is in effect until 2026 and the law applies to mortgages and HELOCs that were taken out after December 15, 2017. If you’ve taken a mortgage out before that date, the $1 million limit will still apply.

You can also include interest that you may have paid as part of your home closing—you can find this on the settlement sheet. For more information, TurboTax has put together a nice set of frequently asked questions on this topic.

2. Property Taxes are Tax Deductible

Another awesome benefit to owning a home is the ability to deduct your property taxes. Before TCJA, the rules were a little more flexible and you were able to deduct the entirety of your property taxes. Now things have changed a bit.

Under the new law, you can deduct up to $10,000. The deduction for state and local income taxes was combined with the deduction for state and local property taxes, too. You also can no longer deduct foreign property taxes as you could pre-TCJA.

As we showed you above, TCJA is in place until 2026 (through 2025). If the law is extended or modified, we could see more of this. If nothing is done, the rules will go back to the way they were before this law was enacted. But for at least the next several years, I’d anticipate a cap of $10,000 in deductions on property taxes.

If your taxes are paid through an escrow account with your lender (i.e., they’re added to your monthly mortgage payment and paid by the lender) you will see the amount you paid in taxes on your IRS Form 1098—so you can apply that deduction directly to your taxes.

If you pay your taxes directly to the municipality you live in, you’ll need to make sure you have a record of the money you paid (i.e., a copy of the check you used). You can also deduct any taxes that you reimbursed to the seller if they prepaid it while owning the home (find these on the settlement sheet).

3. Mortgage Points are Tax Deductible

If you paid points to your lender when you got your mortgage or refinanced an existing one, you can take advantage of a tax deduction. The only caveat is that you have to have actually given money to the lender for these points.

We’ve talked about mortgage points before, but to refresh your memory, they’re almost always expressed as a percentage of the loan. So if each point is 1.5% and your home is $300,000, each point would cost you $4,500.

Where this benefit really kicks in is if you have a home equity line of credit or you’ve refinanced your loan.

Assuming you do meet the qualifications, you can deduct the amount you pay toward points each month you make payments. When you make a mortgage payment, a fractional percentage is built into the loan for points—that’s the amount you can deduct. So, for example, if $10 of your payment each month is for points, you could deduct $120 at the end of the year (12 x $10), given you’ve made payments every month of the year.

I would definitely recommend talking to a tax professional before you take deductions on points. It can be a bit tricky if you’re not familiar with the process.

4. Private Mortgage Insurance – Sometimes

Private Mortgage Insurance (or PMI) is a fee you have to pay when you put less than 20% down on your home. Lenders do this to protect themselves from losses in the event you default on your loan.

If you took out your mortgage after 2007, it’s possible you can claim a tax deduction on your PMI payments. The current tax law states that you can claim the deduction if your adjusted gross income is $109,000 or less if you’re married or $54,500 if you’re single.

This hasn’t always been an option, though. According to House Loan Blog, the mortgage insurance premium deduction extension was one of 30 tax provisions President Trump agreed to extend on February 9, 2018, when he signed H.R. 1892, the Bipartisan Budget Act of 2018.

As of right now, you can take advantage of this, but be mindful that it gets reviewed annually. We always recommend trying to put 20% down on your home loan so you can avoid this, but we know it’s not always realistic. This tax deduction provides a silver lining to having to pay PMI.

5. Home Sale Exclusion Tax Deduction

As our lives change, so do our housing situations. It’s not common for people to take out a 30-year loan and live in their home for all 30 years anymore. The way we look at housing has changed.

With that said, it’s safe to assume we’ll sell our homes at some point. That’s where the next benefit comes in—the home sale exclusion. If you’ve lived in your primary residence for two out of the five years before you sell it, you’re excluded from paying taxes on any profits you make for up to $500,000 if you’re married and up to $250,000 if you’re single.

Let’s say you’re single and you buy a home for $200,000 and live in the home for seven years. Say over time you put $50,000 of improvements into it—making your total investment $250,000.

Then say in the seventh year you sell the home for $400,000, as values in your market have increased significantly. You just made a profit of $150,000. According to the home sale exclusion, none of that $150,000 is counted as taxable income. This could save you thousands of dollars at tax time.

If for any reason you didn’t meet the requirement of living in the home two out of the five years before the sale, you can still take advantage of the home sale exclusion—but your deduction will be prorated.

6. Take Advantage of Energy Efficient Upgrades

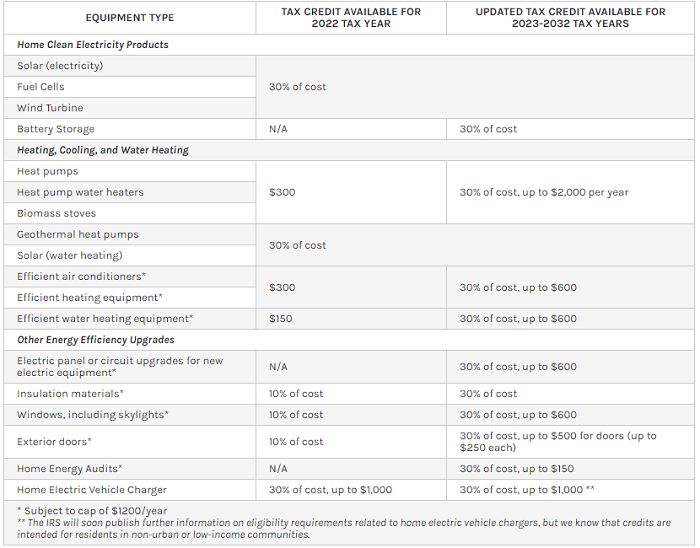

Beginning Jan. 1, 2023, the credit for energy-efficient upgrades equals 30% of certain qualified expenses, including:

- Qualified energy efficiency improvements installed during the year

- Residential energy property expenses

- Home energy audits

The most common of these upgrades continues to be the installation of solar and that’s covered under the Residential Clean Energy Credit. The amount of that credit gets a touch lower over time, but you still have a lot of time before it begins to fade.

- 2022 to 2032: 30%, no annual maximum or lifetime limit

- 2033: 26%, no annual maximum or lifetime limit

- 2034: 22%, no annual maximum or lifetime limit

7. Getting Older Can Mean Saving More

According to Senior Living, aging in place means a person making a conscious decision to stay in the inhabitation of their choice for as long as they can with the comforts that are important to them. As they age these may include adding supplementary services to facilitate their living conditions and maintain their quality of life.

If you plan to live in your home for a long time, you can deduct expenditures that assist you with aging. Some common examples are wheelchair ramps that you’d install to enter your home or grip bars in a bathtub to avoid slipping.

You may also be able to get deductions on things like lowering electrical figures or cabinets, among other home adjustments.

8. Work From Home Tax Deductions

Whether it’s a side hustle or a full-time work-from-home position, you can deduct your home office expenses and the space that is used. The current tax law allows you to take a tax deduction of $5 per square foot, for up to 300 square feet of office space.

You can get a maximum deduction of $1,500 but know that there are extremely tight guidelines on expensing your home office. I would always suggest talking to a tax professional, but if you want to read more about it first, TurboTax did a really in-depth piece about this topic.

Frequently Asked Questions (FAQ)

What Property Can I Consider My Home?

According to the IRS, there are three primary rules you need to follow in order to consider something your home. Does it have cooking, sleeping, and toilet capabilities? If so, you can use the deductions above and classify it as your home. This includes your boat, RV, condo, mobile home, or anything else that qualifies.

Can I Deduct Interest From a Refinance?

Yes, you can. The IRS considers a refinance just like it does a first mortgage; as acquisition debt.

What Qualifies as a Home Office?

If you’re looking to receive a tax deduction for a home office, you have to answer yes to these three questions.

1. Is this area used exclusively for your business?

2. Is it regularly used?

3. Is it used for YOUR business?

Bottom Line

While it won’t completely squash the rent versus buy debate, understanding the tax benefits of buying and owning a home can help you make a more educated decision. In fact, you may have not known about some of these, or known the degree to which they can benefit you at tax time.

As I’ve stated numerous times throughout the article, make sure you’re consulting with a tax professional before making any serious deductions on your taxes. At the very least, use a premium product like TurboTax, which offers a ton of live help and walks you through all of this stuff, step-by-step.