Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Acorns saves your money consistently, and completely out of sight then lets you invest that savings in a diversified portfolio of stocks and bonds. If you’ve never been able to save and invest in the past, this app can get you moving in the right direction.

Acorns has been steadily upgrading the app to present a complete financial wellness system, offering banking, investments, retirement, and even setting up investment accounts for your minor children.

What Is Acorns?

Acorns is one of the most diverse investment apps currently available. It’s part micro-savings app, part micro-investing app, and a full on robo-advisor platform. The app was only launched in 2014, but it already has more than 8.2 million users, and over $1 billion invested. That kind of participation speaks volumes about the value of the Acorns app.

Using your smartphone, you connect the app to multiple bank accounts and/or credit cards. As you spend money the way you ordinarily do, Acorns will allocate a small amount to savings. They refer to this process as Invest your spare change‚ and we’ll get into that process in some detail in the next section.

As your savings collects, the money is automatically moved into an investment account. Since this requires just $5, Acorns is also a micro-investing platform. That’s when the Acorns robo-advisor enters the picture. With that small amount of money, a fully diversified portfolio is created for you, then fully managed going forward. But they also offer the capability to link a primary checking account to make either one-time or recurring transfers, as well as to set up regular payroll deposits to fund your account.

They’ve expanded their menu to include four primary account types Acorns Invest, Acorns Later, Acorns Checking and Acorns Early. The combination will enable you to bank, invest, and save and invest for retirement and for your children’s futures, all in the same app.

Simply put, since Acorns came into existence, there’s no reason not to save and invest money. The app thus far has primarily attracted Millennials, who are comfortable with using technology for ordinary activity, like spending. But it can really benefit anyone who has had difficulty saving and investing money in the past.

How Acorns Works

Acorns Invest

This is Acorns basic taxable investment account. It’s a micro-investing account that lets you build your portfolio by investing spare change from your spending activity, as well as through regular or one-time contributions.

A portfolio of exchange traded funds (ETFs) will be created for you based on your investor profile and risk tolerance. That is determined by the answers you provide to seven questions when you open your account which you can do in as little as five minutes. The ETFs will give you a well-diversified portfolio of stocks and bonds.

(See Acorns Investment Methodology below for more complete investment information.)

Acorns Later

This is Acorns retirement account. You can open an IRA, right alongside your Acorns Invest account, and maintain both taxable and tax-deferred investments with the same company. You can set up a traditional, Roth, or even a SEP IRA using Acorns Later.

Acorns Later can be funded by linking a source bank account, then making contributions to your IRA account through direct transfers, either one-time or on a recurring basis. You’ll be able to contribute up to $6,000 per year – or $7,000 if you are 50 or older – for a traditional or Roth IRA, and up to $57,000 for a SEP plan. Funds in your retirement account will be invested using the same investment methodology used for Acorns Invest.

You can also feel secure knowing as you move closer to retirement age, Acorns will gradually rebalance your portfolio into more conservative investments. This will be done so that you will have access to your retirement funds when retirement comes around.

Acorns Checking

This is the Acorns checking account that comes with a heavy metal Visa debit card that invests for you. You can use the debit card to get real-time Round Ups. With the debit card you will have access to more than 55,000 fee-free in-network ATMs across the U.S. Acorns Checking gives you the ability to bank with the same app you invest through.

Acorns Early

With Acorns Early you can begin investing for your minor children. You can set up a UTMA/UGMA account in less than two minutes. By investing just $5 per day for your child beginning at birth, and assuming a 7% average annual investment return, the account may be worth more than $60,000 by the time the child reaches his or her 18th birthday. You can set up recurring investments in the account, which can also be done automatically using spare change.

UTMA/UGMA accounts are not like dedicated education accounts, like 529 plans, that can only be used for education. You can set up and fund the account, then use the money for any purpose that benefits your child. You can even easily transfer the funds to your children when they reach age of majority. And there’s no limit to how many children you can set up an Early account for.

Features and Benefits

Though it’s only been around since 2014, Acorns has been steadily expanding the menu of features and benefits the app offers. Some of the more noteworthy ones include:

Real-Time Round Ups: With regular Round Ups you round up your purchases to the nearest dollar. Then with a Multiplier, you can multiply the amount that goes into savings and investments. For example, if you choose to triple your Round Up, a 75 cent Round Up becomes $2.25. Acorns now allows you to link multiple cards and accounts so you can take advantage of Round Ups from several spending accounts.

Recurring Investments and One-Time Investments: By linking a primary checking account, you’ll be able to make either one-time or recurring transfers into your Acorns accounts.

Acorns Mobile App: The Acorns app is available at The App Store for iOS devices 11.0 or later, and is compatible with iPhone, iPad, an iPod touch devices. The Android version is available on Google Play for devices 5.0 and up.

Money Basics: This is the Acorns knowledgebase. Even if you know absolutely nothing about investing whether that involves index funds, expense ratios, fractional shares, or dollar cost averaging Money Basics is the resource to turn to get all the information you need so you can becoming a more knowledgeable investor. Money Basics has more than 80 instructional articles providing complete details on every investment topic.

Smart Deposit: Acorns offers this feature so you can automatically transfer funds to your various Acorns accounts with regular payroll deposits.

Acorns Grow: This feature connects you with knowledge on the go with custom news, advice, and interviews, powered by CNBC, and delivered to your app each day.

Acorns Earn: Acorns partners with over 400 brands, like Apple, Blue Apron, Airbnb, Walgreens, Walmart and Macy’s. When you shop with these merchants, extra money will be added to your Acorns account. It’s an opportunity to earn up to 10% in bonus investments on select categories, like gas, groceries, retail, and restaurants you’re already using.

You can simply link a debit or credit card to the Acorns app and check out the Earn page to find participating brands. You can even earn money by searching for a new job, by tapping Earn from a new job on your Earn screen. And if you invite a friend through the app, both you and the referral will receive $5 in your investment account. New referral bonuses are offered each month as a way to earn even more money.

Acorns Investment Methodology

Acorns is a robo-advisor, and like other robo-advisors it invests based on Modern Portfolio Theory (MPT), which emphasizes asset allocation to both maximize returns and minimize losses.

The basic taxable investment account is Acorns Invest, while the IRA account is Acorns Later.

Your portfolio is invested in exchange traded funds (ETFs) that are invested in broad market indexes. By using ETFs, your portfolio can be spread across over 7,000 individual stocks and bonds through fractional share ownership in Acorns portfolio ETFs.

The current Investment indexes, as well as the corresponding ETFs are as follows (though not all funds and asset classes are currently in use in all portfolios):

- iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares Core S&P Mid-Cap ETF | IJH

- iShares Core S&P Small-Cap ETF | IJR

- iShares Core MSCI Total International Stock | IXUS

- iShares Core 1-5 Year USD Bond | (ISTB)

- iShares Core U.S. Aggregate Bond | (AGG)

- Vanguard Small-Cap Index Fund ETF Shares | VB

- Vanguard REIT Index Fund ETF Shares | VNQ

- Vanguard 500 Index Fund ETF Shares | VOO

- Vanguard Emerging Markets Stock Index Fund ETF Shares | VWO

- Vanguard FTSE Developed Markets Index Fund ETF Shares | VEA

Acorns will invest your money according to five different portfolio allocations, based on your personal investment risk tolerance. The five portfolios are Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive.

The specific asset allocations in each portfolio are as follows:

| Asset Class/Portfolio | Conservative | Moderately Conservative | Moderate | Moderately Aggressive | Aggressive |

|---|---|---|---|---|---|

| Large Company Stocks | N/A | 24% | 35% | 47% | 55% |

| Small Company Stocks | N/A | N/A | 2% | 3% | 5% |

| Short Term Government Bonds | 40% | N/A | N/A | N/A | N/A |

| Ultra Short Term Corporate Bonds | 40% | N/A | N/A | N/A | N/A |

| International Company Stocks | N/A | 12% | 18% | 24% | 30% |

| Ultra Short Term Government Bonds | 20% | N/A | N/A | N/A | N/A |

| Medium Company Stocks | N/A | 4% | 5% | 6% | 10% |

| Government and Corporate Bonds | N/A | 60% | 40% | 20% | N/A |

Once your portfolio has been created, it will be rebalanced periodically to maintain the targeted asset allocations. You also have the benefit of automatic dividend reinvestments, so your money will remain fully invested at all times.

Acorns Fees

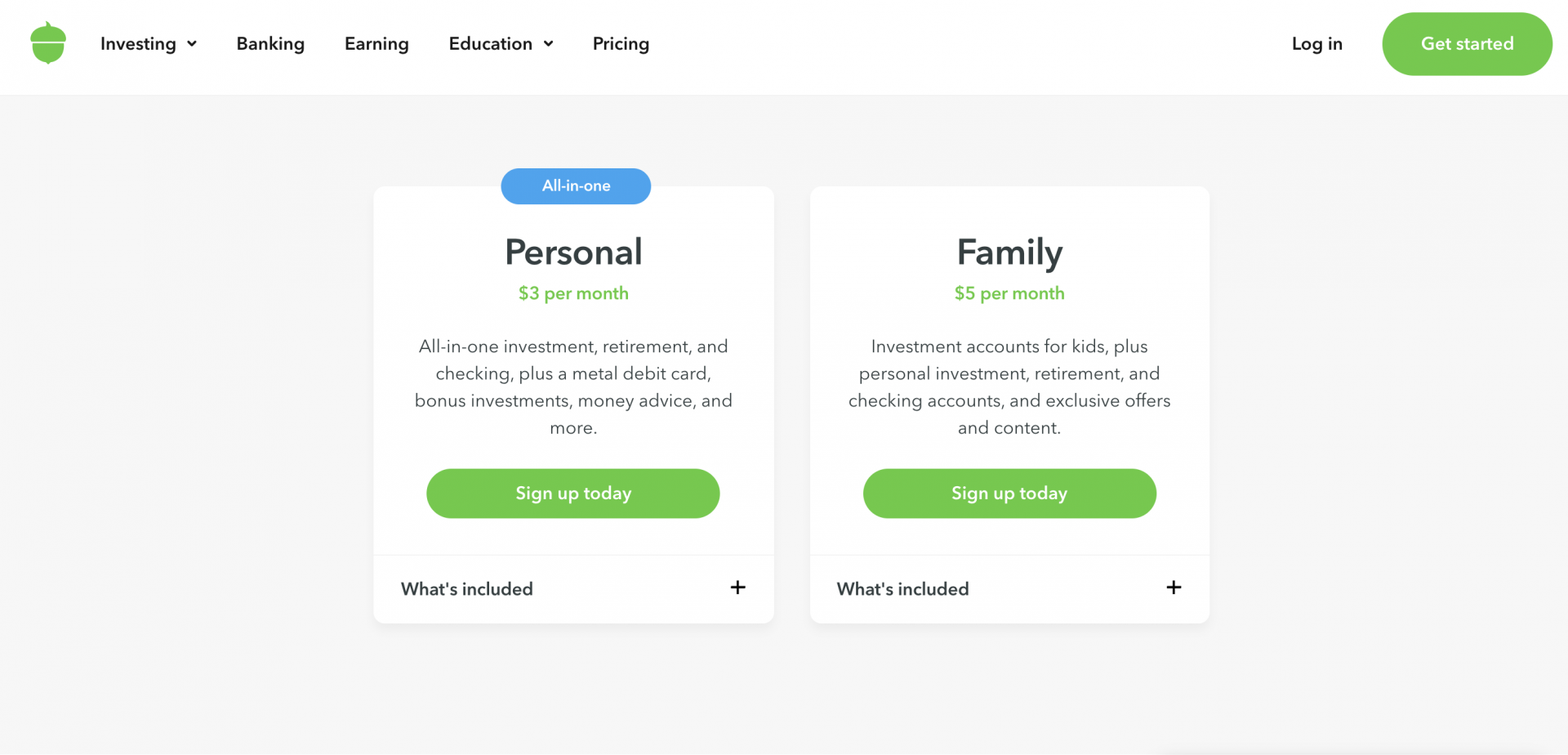

Acorns has two pricing structures, based on two plan combinations:

Acorns has two pricing structures, based on two plan combinations:

- Acorns Personal: This plan is the combination of Acorns Invest, Acorns Later and Acorns Checking. The fee for this plan is $3 per month.

- Acorns Family: This Plan combines all the basic account types offered under Acorns Personal and adds Acorns Early. The fee for this combination is just $5 per month.

There’s both good news and bad news with the Acorns fee structure. The bad news is that the fee is prohibitive on small accounts. For example, if your account has $100, and you’re paying $1 per month for the fee, that’s $12 per year. That’s a 12% fee, which is completely off the charts when compared to other robo-advisors.

But the good news is the fee is ridiculously low on larger account balances. Since you’re paying the same $12 per year for a $10,000 account, your annual management fee is just 0.12%. That’s well below the average among robo-advisors.

But that imbalance shouldn’t be seen as a negative. Instead, it should provide an incentive to build up your investment account as quickly as possible. After all, the purpose of investing isn’t to accumulate $100, or even $1,000. It’s to move well above those amounts.

And on higher balances, Acorns become incredibly competitive.

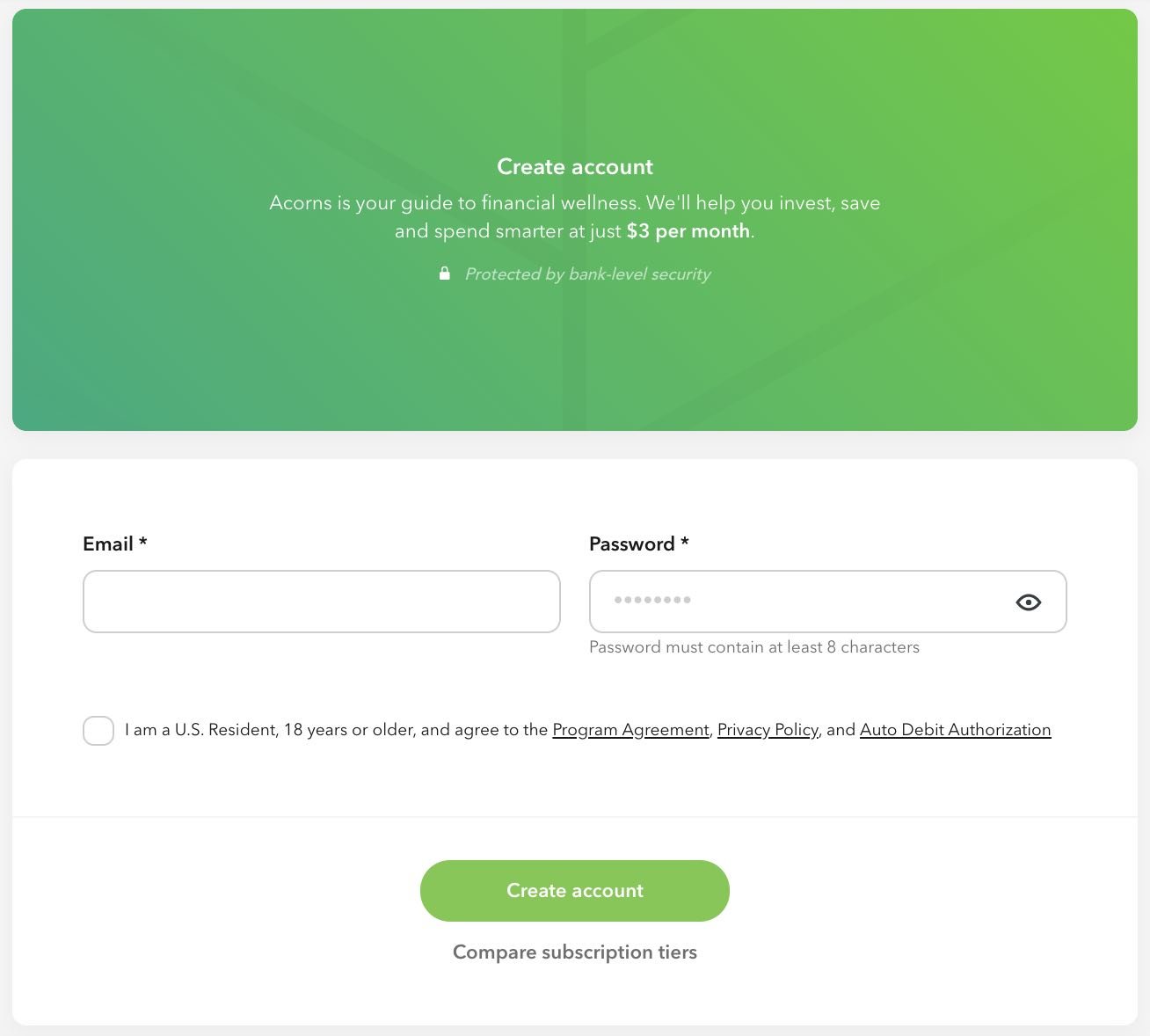

How to Sign Up with Acorns

To sign up with Acorns you need to be a U.S. resident, and at least 18 years old. You’ll apply through your mobile device, either iOS or Android. You’ll start by entering your email, then creating a password. You’ll then need to agree to the Acorns Program Agreement and the Auto Debit Authorization.

Next, you’ll select your plan level, Personal or Family. You’ll determine your Round Up setting. You can either round up to the next dollar, or use the Round Up Multiplier to multiply the round up–all the way up to 10 times the regular Round Up amount.

You’ll then be required to provide the standard information needed to open a financial account, including your full name, physical address, and Social Security number. Finally, you’ll complete a series of seven questions that will be used to determine your investment profile and risk tolerance. The answers to your question will determine if your portfolio will be conservative, moderately conservative, moderate, moderately aggressive, or aggressive.

Security

Acorns Securities is an SEC-registered broker-dealer, and a member of both FINRA and SIPC. That means your account is protected for up to $500,000 in securities and cash, including up to $250,000 in cash. Meanwhile, Acorns Checking accounts are protected by FDIC insurance for up to $250,000 per depositor.

Platform security includes 256-bit Secure Socket Layer (SSL) encryption, bank level security, account alerts of unusual activity, and account safeguards, like multi-factor authentication, automatic logouts, and ID verification to prevent unauthorized access to your account.

Customer Service

This is a limitation with the Acorns app. No phone contact is available. You can only connect with customer service via email, which is done directly through the website. They disclose that the response time is one to two days, due to high demand.

If you’ve been having difficulty saving money, and just haven’t been able to get into the investing habit, Acorns may be the solution to your problem. The app will also take you beyond basic savings and beginning investments, by helping you to save and invest for retirement and even for your children’s financial futures.

Pros and Cons

-

The fee of $1 per month is a real bargain as your account balance grows. On a balance of $20,000, the fee is just 0.06% per year, which is very close to free!

-

You can save money by spending money, which is probably the very easiest way to save money in any form.

-

Acorns Checking gives you a free checking account to go with your investment account.

-

You can start investing with just $5, which makes the app perfect for new and small investors.

-

Acorns may be the best app on the market to turn a non-saver/non-investor into a committed saver/investor–and without doing anything different to get there.

-

Acorns Later requires opening an Acorns Personal or Family account.

-

On lower account balances, the $12 annual fee can take a big chunk out of your portfolio. $12 is a lot of money to pay for the management of a $100 portfolio.

-

Customer Service is limited to email. They even disclose the response time is one to two days. And there was no phone contact available.

FAQs

[faqs-content id=”Q525WETXRJAYPH3YCBGYX5S53Q” /]

Acorns Alternatives

Overall, probably the best feature of Acorns is the ability to accumulate savings passively, through Round Ups. But if you’re able to save small amounts of money, and don’t have a need for an app that saves money through spending activity, there are other choices.

Stash Invest is a micro-investment app, similar to Acorns. They don’t have anything like spending round ups, but you can invest in increments of $5. They have a similar advisory fee to Acorns, at $1 per month, but at $5,000 that drops to 0.25%. From that point forward, the advisory fee will be lower than what Acorns charges.

Betterment is a full on robo-advisor. But they have no minimum initial investment requirement, and you can fund your account with regular contributions. They have a fee of 0.25%, which will also be more cost effective than Acorns at any portfolio amount.

For more advanced investing, check out M1. Not only is it a robo-adviser, with no minimum initial investment, and no annual fee, but you can also choose the investments held in your portfolio. In fact, you can even create multiple portfolios.

Also read: Best Automated Savings Apps

Should You Sign Up for Acorns?

Originally designed for younger investors – primarily Millennials, which is still the primary user base – Acorns has expanded its platform to offer financial wellness to users of all ages. Since they now offer banking, complete with a debit card, as well as investing, retirement, and saving for your children’s future, Acorns will work for all age groups.

They’re offering a comprehensive financial wellness package, that will not only enable you to invest and spend your money more wisely, but also educate you about the investment process. But you’ll also get the benefit of complete automated investment management at a very low monthly fee. They’ll create a portfolio for you, based on your own investment temperament and goals, then handle all the management details for you. Your only job will be to fund your account, much of which will happen automatically through the Round Up process.

But Acorns remains a perfect app for new and aspiring investors. Even if you’ve never been able save and invest money in the past, the entire Acorns app is designed to change that outcome, by directing the flow of at least some of your money into investment accounts. And since Acorns now offers banking through Acorns Checking, you can handle many of your banking functions on the same app where you invest.

If you’d like more information, or if you’d like to sign up for the app, visit Acorns here.