Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Good credit is essential to your financial health. However, building credit can be challenging. Luckily, there are some excellent credit-building apps out there to help you do just that.

We researched to find the best apps to build your credit score in 2024. This guide will provide insight into what each of these credit builder apps offers and how they work.

We’ll also explain what your credit history is, why it matters, and other ways to build or repair your credit score without necessarily having to rely on one of these apps. With our tips and advice, you’ll soon have all the information needed to make informed decisions about using one of these best credit-building apps.

The 8 Best Apps to Build Your Credit Score

The number of credit-building apps available has grown significantly in recent years, with more and more people looking for ways to build their credit scores. With so many options to choose from, though, knowing which one is best for you can be difficult. So below, we’ll look at our picks for the top eight apps to build your credit score.

| Credit Building App | Best Feature |

| Experian Boost | Speed |

| Self | Largest Potential |

| Mint | Budgeting |

| Kikoff | Multiple Account Types |

| Chime | No Fees |

| Extra | Rewards |

| Brigit | Cash Advance |

| myFICO | Credit Reports |

1. Experian Boost™

With Experian Boost, you’re going straight to one of the sources. Experian is one of the three credit bureaus. It offers a product called Experian Boost™, designed to give you a little nudge in the right direction, including helping your Experian credit score by looking at some of your recurring bills, such as rent and your gym membership.*

Experian’s score is based on information in your Experian credit report and uses FICO 8 to determine your score. In addition to offering insight into your credit, you can get a dark web scan to see if and where your personal information has been compromised online.

You use Experian Boost™ by connecting a bank account or credit card. Then the app will review your spending patterns to identify rent, insurance payments, and gym memberships. Making your regular monthly payment, on time, to these accounts can help improve your Experian credit score significantly.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost™.

Read our Experian Boost Review

2. Self

One of the more active ways to boost your credit score is with Self. The idea here is that you can build a credit history while setting aside money in savings.

With the Self Credit Builder loan, you basically set up a situation where you make monthly payments that are reported to the credit bureaus. At the end of your term, you are given back your initial loan amount (minus interest and fees).

Plans with Self begin with a $25 per month commitment. There is a $9 admin fee to start the loan plus regular interest. Terms are two years in length the larger the loan you take, the greater the potential improvement to your credit.

3. Mint

One of the original budgeting apps, Mint offers users the ability to track all of their financial accounts in one location. Connect your savings accounts, credit cards, loans, and investments, and have a single place to see your financial health and wealth. Mint also offers users access to their credit score (TransUnion) and an abbreviated version of their credit report.

The Mint app is free to use and it’s the only app I’ve checked regularly over the past few years. One of the best ways to build your credit score is to pay down your debt so your debt-to-income ratio improves. Knowing what you spend and how you might be able to budget better can really help.

4. Kikoff

Kikoff has a few different products available, the most popular is the Kikoff Credit Account. For a flat $5 monthly fee, you’ll be given a $750 credit line that can only be used to purchase items from Kickoff (not for everyday purchases like gas and groceries). Each month, you make payments to cover the cost of the things you buy and it’s reported to Equifax and Experian.

The KikOff Credit+ Cash Card is another credit-building option and this one does not have a monthly fee attached. Connect your bank account and use your Kikoff cash card to make everyday purchases. The money in your bank account pays off the purchases and the payments are reported to the credit bureaus.

With this product, you’ll have access to 55,000 fee-free ATM’s and when you connect your direct deposit, you’ll receive payment up to 2 days faster.

5. Chime

The Chime Credit Builder is a little different than others on our list because it acts more like a secured card than it does a debit card or loan. After opening an account and connecting your bank account, you’ll have access to a Visa credit card. When you make purchases using your credit card, the funds deposited into your secured account will be used to pay your monthly balance in full.

Chime reports to all three credit bureaus and boasts that members see an average credit score increase of about 30 points. Chime also has a savings account that offers direct deposit payment up to two days early from your employer and currently yields a 2.00% APY.

There are no fees or interest payments associated with the Chime Credit Builder account.

Read our Chime Credit Builder Review

6. Extra Debit Card

Extra is one of the more expensive options for building credit but it also comes with a few unique perks. The Extra Debit Card builds credit by connecting with your bank account and using the money in your bank as collateral for your debit card purchases. Every day, your savings are used to cover all the purchases made (the previous day), and the payment history is reported to two of the credit bureaus (Experian and Equifax).

The cost for this service is $149 per year. For an extra $50 per year, you’ll have the ability to earn rewards points on every purchase. The rewards rate is only up to 1%, so in order to make the extra $50 worth it, you’d need to spend at least $5,000 per year on your Extra Debit Card.

Extra writes that members increased their credit score by an average of 48 points by regularly swiping with the Extra Debit Card.

The Extra Debit Card is issued by Evolve Bank & Trust or Patriot Bank N.A. (Member FDIC), pursuant to a license by Mastercard International. Loans provided by Lead Bank. Extra is responsible for credit reporting and reports on time and late payments, which may impact a credit bureau’s determination of your credit score. Rewards points only available with rewards plan.

7. Brigit

The Brigit Credit Builder is similar to the Self Credit Builder in that you loan yourself money, pay it back on time and hopefully watch your credit improve after a history of on-time payments. After signing up, you connect your bank account, select a loan amount each month and Brigit will make auto payments into an FDIC-insured account.

After the term has been completed, the money is returned to you (in full). During the payment phase of the loan, you will not have access to the funds so make sure you can afford to set aside hundreds of dollars across the span of two years. You’ll also have access to up to a $250 cash advance, without fees or interest (not all users will qualify).

There is no credit check when signing up, so your credit will not be impacted negatively. Brigit reports to all three credit bureaus and you can cancel your loan at any time and receive back the loan amounts you’ve already paid.

8. myFICO

The Fair Isaac Company is often considered the premier credit scoring provider. When you go to myFICO, you get access to your FICO scores. However, there is no free version of myFICO. The cheapest access costs $19.95 per month and only includes your Experian credit report.

If you want access to all three of your credit bureau reports and scores, you need to pay $29.95 per month, and your scores only update every three months. For monthly score updates from all three bureaus, you need to pay $39.95 per month.

However, this comes with the advantage of seeing different types of scores, including those that might be considered for car loans or mortgages. You can also get identity monitoring, credit monitoring, and identity theft insurance.

With myFICO, you get detailed information about your score and what’s dragging it down. You can use that information to make tweaks and improve your credit score.

What Is Credit History and Why It Matters

Credit history is a record of your credit activity over time. It includes information such as the types of accounts you have, how much debt you owe, and whether or not you make payments on time. Lenders can use your credit history to determine if they want to lend money to you and what interest rate they will charge.

Why Does Credit History Matter?

Your credit history matters because it can affect your ability to get loans, lines of credit, mortgages, and other forms of financing in the future. A good credit score means lenders are more likely to approve your loan applications and offer better terms than someone with a bad or no credit history. Having a good credit score also makes it easier for landlords and employers to trust that you’ll pay your rent on time each month.

How Is Credit History Calculated?

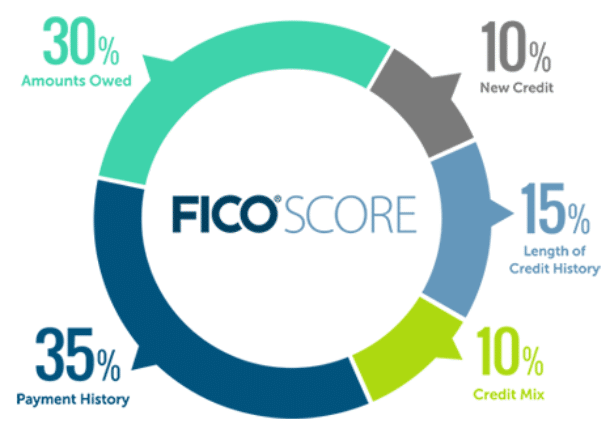

Your FICO Score (also known as a “credit score”)” is calculated based on five factors: payment history (35%), amounts owed (30%), length of credit history (15%), new accounts opened (10%) and types of accounts held (10%).

- Payment history – Includes late payments, collections accounts, bankruptcies, etc., while the amount owed looks at how much debt you currently carry compared with the total available limits across all your open lines of credit.

- Amount Owed – Your debt-to-credit ratio is crucially important. Maxing out credit cards is a sign that you’re not ready to take on new credit, so keeping the ratio as low as possible is important to have an excellent credit score.

- Length of credit history – Considers how long ago certain items were reported; newer items may weigh more heavily than older ones depending on their type/severity level.

- New accounts – Look at recent inquiries when applying for new lines of credit; too many inquiries in a short period could negatively impact this factor. Having an established mix between revolving debts like cards and installment loans helps improve this one.

- Types of accounts held – Examines which kind(s) of debts are being managed responsibly – from student loans and auto loans through home equity products and personal finance companies, etc.

All these elements together help create an overall picture of financial responsibility that lenders use when deciding whether or not someone should qualify for their services. Good credit history is essential to your financial health and should be taken seriously. A great way to build credit is using a credit-building app, which we’ll discuss in the next section.

What is a Credit Builder App?

Credit builder apps are designed to help people in their 20s build and improve their credit scores. They provide an easy way for users to manage their finances, pay bills on time, and keep track of spending habits.

How Do Credit Building Apps Work?

A credit builder app works by allowing users to set up automatic payments for recurring bills such as rent or utilities. This helps ensure that the user bills user’s on time each month, which is a critical factor in building good credit. The credit-building app also tracks spending habits so users can better understand where their money is going and make more informed decisions about how they spend it.

Benefits Of Using A Credit Builder App

- Using a credit builder app has several benefits, including:

- Improved financial literacy

- Increased control over budgeting

- Easier tracking of expenses

- A better understanding of personal finance concepts like debt-to-income ratio

- Improved access to financial products such as loans or mortgages with lower interest rates due to higher credit scores

Using a credit builder app may even lead to rewards from certain lenders who offer incentives for having a good payment history.

Advantages Over Traditional Banking Methods

Compared to traditional banking methods, such as opening up a savings account at a bank or applying for a loan through an online lender, using a credit builder app offers several advantages:

- It’s free (most don’t charge)

- It’s fast (users usually get started within minutes)

- It’s secure (encryption technology similar to what banks use)

- It provides real-time feedback on progress (credit reports only look backward)

Methodology: How We Select the Best Credit Builder Apps

At the start of any research project, it must use a transparent methodology for selecting the best credit builder apps. We understand that everyone has different needs and preferences regarding personal finance tools, so we’ve taken an in-depth look at each app on our list to ensure they meet specific criteria.

First and foremost, we looked at App Store and Google Play user reviews. This is one of the most reliable ways to gauge how an app works. We also considered customer service ratings and features like budgeting tools, debt-tracking capabilities, and rewards programs.

We also ensured that our list’s apps are artists and compliant with industry standards such as GDPR or PCI DSS. Security is always a top priority when dealing with sensitive financial information, so we paid close attention to this during our selection process.

In addition to security considerations, we wanted to ensure that all of these apps were easy for beginners who may not yet be familiar with personal finance concepts or terminology. That’s why we have several tutorials within each app description and helpful tips about using them effectively over time.

Finally, the cost was another factor that weighed heavily into our decision-making process. No one wants their budget blown by unnecessary fees, so all the apps featured here offer competitive pricing plans (or they’re free) without sacrificing quality or features. You can rest assured knowing you’re getting your money’s worth on every purchase.

We’ve researched the best apps to build your credit score to help you make intelligent financial decisions.

What Are Some Other Ways to Build Your Credit Score?

Secured Credit Cards

Secured credit cards are an excellent way to build credit. They require a cash deposit that acts as collateral for the card, and they report your payment activity to the three major credit bureaus. This means you can use them just like any other credit card type without worrying about high interest rates or fees. When used responsibly, secured cards can help you establish a positive payment history and build your credit score over time.

Personal Loans

Personal loans are another great option for building credit. These loans come with fixed payments that must be made on time each month to maintain good standing with lenders and creditors. If you make all your payments on time, this loan will show up positively on your credit report and help boost your credit score over time. Examples of installment loans include car loans, student loans, personal loans, etc.

Rent Reporting Services

Rent reporting services allow landlords to report their tenants’ rental tenants directly to the three major credit bureaus (Experian, Equifax & TransUnion). By using these services, renters can take advantage of their rent payments being reported every month, which helps them build a positive payment history and improve their overall scores over time – even if they don’t have any type of debt or accounts open. Not all landlords participate in rent reporting services, so you must check before signing a lease agreement if this is something you want access to.

Becoming An Authorized User On Someone Else’s Card

Being an authorized user on someone else’s account. Another way people can build their individual credit histories is by helping out family members or friends who already have established accounts in good standing with creditors and lenders. Being added as an authorized user allows one person access to another person’s credit line, meaning both parties benefit from responsible spending habits and timely payments made by either party.

What Builds Credit the Fastest?

Credit is important, from getting a loan to renting an apartment. Knowing what builds credit the fastest can help you make intelligent financial decisions and improve your credit score quickly.

Paying Your Bills On Time

Paying your bills on time is one of the most effective ways to build credit fast. Making payments for all accounts—credit cards, loans, rent—on or before their due dates will show creditors that you’re responsible with money. This will have a positive impact on your credit score over time.

Keeping Balances Low

Keeping balances low is another way to build up your credit quickly. When it comes to revolving debt like credit cards, try not to exceed 30% of the total available balance at any given time; if you have a $1,000 limit on a card, don’t let it go above $300 at any point during the month. Doing so shows lenders that you manage debt responsibly and won’t overextend yourself financially.

Applying for New Credit Sparingly

Applying for new lines of credit too often can be detrimental to your overall credit score. Each inquiry takes points off temporarily until they are removed after two years or more, depending on how long ago it was done.

It’s the best practice to only apply for new credit when necessary, such as when making large purchases like cars or homes where having good terms may save thousands in interest rates over the lifetime of repayment. So be sure to weigh whether applying for new lines of credit makes sense based on current needs versus future goals.

Staying With The Same Creditors for Longer

Sticking with creditors longer also helps build trust, which increases chances for better terms down the road should additional borrowing become necessary later in life. If possible, try not to close accounts unless necessary, as doing so could lower scores due to the shorter average account age, which affects scoring models used by lenders today.

Checking Reports Regularly

Finally, checking reports regularly ensures accuracy and allows individuals to avoid potential issues that may arise, such as identity theft or incorrect reporting from creditors themselves. Everyone has access to a free annual report through the AnnualCreditReport website, but other services are available for those who wish to monitor activity more frequently than once a year.

Frequently Asked Questions (FAQ)

What is the best way to build credit?

Building credit is a process that takes time and dedication. The best way to build credit quickly is to make sure all bills are paid on time, keep balances low on any existing credit cards, apply for a secured credit card, or become an authorized user on someone else’s account. Else’s bills on time will help you establish a positive payment history which accounts for 35% of your overall credit score.

Keeping the balance low will also improve your utilization rate, which makes up 30% of your score. Finally, applying for a secured card or becoming an authorized user can give you access to more available lines of credit and help increase your total amount of available revolving debt – both factors that contribute to 15% of your overall score.

How do I build my credit ASAP?

Building credit is an essential part of financial health. To get started, make sure you have a bank account and use it regularly to pay bills on time. Next, consider applying for a secured credit card or store card with low limits that reports to the major credit bureaus. Make sure to keep your balance low and pay off your bill in full each month. Finally, stay away from payday loans, which can damage your credit score in the long run. With patience and discipline, you can build good credit quickly.

Bottom Line

The best credit-building apps can help you build your credit score quickly and easily. Credit history is essential for various reasons, so it must understand what it is and how to improve it.

Credit builder apps make it easy to start building your credit without taking on additional debt or spending money. It’s also worth saying that there are other ways to build your credit, such as making payments on time and using secured cards responsibly.

Finally, the fastest way to build your credit is by ensuring all accounts are paid in full each month and keeping balances low on revolving accounts like credit cards. With these tips in mind, you’ll be well on your way toward improving your financial future.