Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Boosting your credit score often requires months or even years of near-perfect financial behavior and decisions. This proves to be difficult for most people, and they remain stuck in the lower range of credit scores.

But a new tool from Experian (one of the three major credit bureaus) called Experian Boost™ provides another way of increasing the creditworthiness of millions of Americans, especially those that have little or no previous history of borrowing. That itself is a dilemma, as lenders are reluctant to lend to people who have no prior borrowing history.

Below, we’ll explore Experian Boost to give you a better understanding of what it is and how it could help you.

How Experian Boost Works

The concept behind Boost is to help consumers by recognizing timely payments of rent, utility bills, and cell phone bills in calculating their FICO® Score. These financial activities are often ignored by credit bureaus, but including them can help boost the scores of millions of Americans.

To start off, Experian Boost users won’t have to pay anything. This service caters to people struggling to achieve better credit or build credit from scratch.

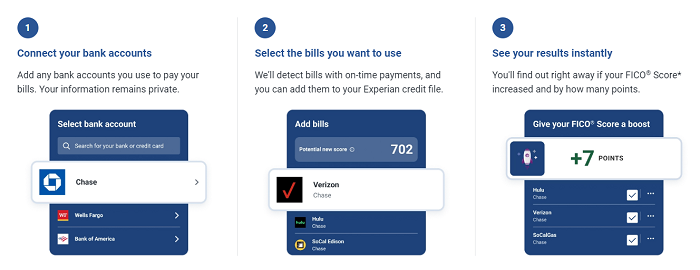

Experian Boost works using a simple, three-step process:

Individuals looking to boost their FICO® Score through Boost must authorize Experian Boost to access their bank account statements to identify rent, cell phone, and utility bill payments. Experian takes this information and uses it to adjust your Experian credit report and FICO Score.

Experian will review two years of payment history. To qualify for inclusion, the bill must have at least three payments in the last six months, including at least one payment within the past three months.

Experian Boost will consider any of the following payment types:

- Mobile and landline phone

- Internet

- Cable and satellite

- Gas and electricity

- Residential rent with online payments

- Video streaming services (think Netflix, Hulu, and Disney+)

- Water

- Power and Solar

- Trash

There’s an important caveat regarding rent payments. Experian Boost only considers rent payments made to select property management companies or rent payment platforms, all of which must be made online. They will not consider payments made with cash, money orders, personal checks, or mobile payment transfer apps.

Also, rent payments will not be included if you have an active mortgage account open. They will also exclude any other rent payment arrangement that already appears on your Experian credit report.

Late payments are not included. One thing to note is that Boost will only count your positive payment history and will not consider any defaulted or missed payments on your rent, cell phone, or utility bills. In fact, as you’ll notice from Step 2 in the screenshot above, you can choose the bills you want to include for the service. This makes the concept different from conventional methods of calculating credit scores where defaulted or missed payments hurt your score.

As stated, to take advantage of Boost, you have to authorize Experian to access your bank accounts via their website. Upon verification and confirmation to include the data in your credit file, a new FICO® Score is delivered to you within a few minutes. The entire process takes about 5 minutes, and it results in an increased FICO Score almost immediately.

Can Experian Boost Help Your Credit Score?

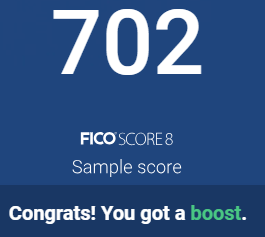

When you apply for a loan or a line of credit, lenders utilize the scores from either all or any of the three credit bureaus. Each bureau issues different versions of your scores. Boost only affects your Experian Credit report and FICO® 8 score

The following are the groups best positioned to take advantage of Experian Boost.

- Consumers with subprime credit scores: These individuals can boost their FICO Score when applying for loans or mortgages and get better deals than they would have obtained otherwise.

- Young adults: Experian Boost can be a significant advantage for people without much credit history and lenders are reluctant to lend to such people as they have no track record.

- Responsible customers: There are many people with tremendous financial discipline whose timely payments are not reflected in their credit reports. Boost can help bridge the gap and make such individuals eligible for better loans and various credit.

Experian Boost may not help individuals who have no credit file at all. According to the Experian Boost website, you must meet the following minimum credit file requirements to be eligible for the service:

- You have at least one account on your credit report that has been active for at least six months.

- You have at least one account on your credit report that has been reported to a credit bureau within the last six months.

- You are not listed as “deceased” on your credit report.

Experian reports that users with non-rental data only improve their FICO Score 8 by an average of 13 points.

More Access to Credit

The Experian Boost tool comes at a time when consumer advocates, lenders, and even the government (Consumer Financial Protection Bureau, to be precise) are looking for new avenues to ease access to credit. This holds especially true for people on the verge of qualifying. It is also helpful for those individuals who have no previous credit history but have displayed financial responsibility through timely payments of their bills.

The company plans to broaden the net of Experian Boost beyond telecom and utility bill payments, considering other types of timely transactions.

Other Benefits of Experian Boost

When you sign up for Experian Boost to get more than just a potential increase in your credit score.

Experian also gives you access to your Experian credit report and your FICO Score 8, which will be updated every 30 days. FICO Score 8 is especially relevant because it is the most commonly used credit score by creditors.

By monitoring your credit score on a regular basis, you will be in a better position to improve your credit score. That will include being able to dispute negative information reported in error. In addition, regular monitoring of your credit will also help you to spot fraudulent activity quickly. That’s important, because the sooner you take action on fraudulent activity, the better your chance of heading it off.

Experian Boost can also run a free identity scan. That will enable you to see if your personal information appears anywhere on the dark web and on people finder sites.

Just as important, Experian will provide you with your credit score based on your actual FICO 8 Score. That’s a score commonly used by banks, insurance companies, and other parties likely to pull your credit. This is unlike the so-called “FAKO” credit scores provided by most free credit score providers.

Meanwhile, Experian claims that you will get credit card and loan offers, as well as an opportunity to save on car insurance, by subscribing to the service.

Pros and Cons

Pros

- Experian Boost works best for consumers with bad or thin credit histories.

- Gives you access to your FICO Score and credit report, which are updated every 30 days.

- Increase your score through bills you’ve already paid – that includes common expenses, like rent, utilities, and cell phone service.

- Only counts on-time payments, and disregards late payments.

- Comes with secure bank-level SSL encryption.

- Credit score increases occur instantaneously.

- They’ll let you know if and when your FICO Score increases or decreases, for no additional cost to you.

- Not all types of rent payments are included in the service.

- Experian Boost is free to use.

- You can exit the program at any time.

Cons

- No boost in your score with other credit bureaus – your credit score may improve on your Experian credit report, but that will not change your credit scores from Equifax or TransUnion.

- Possible privacy and security concerns from connecting your bank account.

- Your FICO® Score is not guaranteed to improve.

- The odds are actually low — only 5% to 10% of people moved up one credit tier. For some, this might be significant; but for others, you may be better off getting a secured card and doing it the old-fashioned way.

- Experian Boost only works with FICO Score 8 – different industries use variations of the FICO score, so the score accessed by a mortgage or auto lender may not reflect the improvements.

- Won’t provide help to consumers with good or excellent credit. Since the credit score increases only a few points.

Alternatives to Experian Boost

UltraFICO

Experian is testing another tool to assist with boosting credit scores in partnership with FICO®. The tool, called UltraFICO, is also being developed to aid thin-file consumers.

By analyzing cash balances, UltraFICO® is positioning itself to help customers without any credit or insufficient credit history. The tool aims to help them by proving they are viable for credit through the management of their cash accounts.

Like Experian Boost, UltraFICO® also needs to access your bank account to assess your financial behavior. But unlike Boost, UltraFICO will not be looking at your telecom and utility bill payments. Instead, it will look at your savings account and whether any of your accounts (for example, checking) have any overdrafts.

Related: Experian Boost™ vs. UltraFico

StellarFi

StellarFi is another alternative to Experian Boost. In fact, the service is very similar. It also relies on connecting your bank account to the system and reporting your payment history on select recurring expense payments.

However, one area where StellarFi departs from Experian Boost is that they do charge for the service – $4.99 per month. But that may be a small price to pay for one big advantage StellarFi does have – they report to all three major credit bureaus.

Other Strategies to Improve Your Credit Score

There are also other ways to improve your credit score. The steps below can lead to a higher score by all three credit bureaus.

Rent reporting service

By utilizing a rent reporting service, you could improve your credit score given you make timely payments. Some companies offer to do this service and report your rent payments to the credit bureaus.

Open a secured credit card

Applying for a secured credit card is like a safety net, so you miss no payments due to negligence. The card is meant for starters and is backed by a certain amount that acts as both your deposit and your credit limit. The deposit means you are not drawing on too much credit and an automatic payment is a shield against missed or forgotten due dates. Both of these actions can have adverse effects on your credit score.

Becoming an authorized user

Becoming an authorized user of someone else’s credit card leads to the advantage of reaping the benefit of their excellent score. This happens when someone with an established line of credit, includes you as an authorized user.

Take out a credit builder loan

These are loans commonly offered by banks and credit unions specifically for the purpose of enabling consumers to improve their credit. You’ll take out an installment loan in which the proceeds are deposited into a savings account, which acts as collateral for the loan.

You’ll then make monthly payments – either from your paycheck or automatically debited from the savings account – that will be reported to all three credit bureaus. As on-time payments are made, your credit score will improve. And when the loan is finally paid off, you’ll have a paid installment loan on your credit report. Your credit score generally doesn’t matter when applying for these loans, since they are fully secured.

Should You Sign Up with Experian Boost

Your credit score is an essential contributor to your financial health. It is the ultimate factor in determining whether you qualify for a loan, a mortgage, or a line of credit and the interest rate you pay. A low score means higher interest rate payments and might ultimately lead you to be disqualified.

Experian Boost can help increase your FICO® Score particularly if you do not have a history of loans or a credit card in your own name. Permission granted to Boost to access your banking transactions can be withdrawn at any time, and you can opt-out of the service. With no cost and hassle-free signup, Experian Boost looks to be promising and exciting.

Experian Boost™

Summary

Experian Boost offers a quick and easy way to help improve your credit score. Free to use, anyone who currently rents and is looking for a boost should try it out.