Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Quicken has been a big name in the personal finance industry for many years. While many people continue to use the software, others are looking for Quicken alternatives.

In some cases, people want to consider Quicken options that are free. Others want a more modern interface and a better app experience. Luckily, the personal finance space has evolved over the last several years, and there are plenty of new players ready to swoop in to provide you with the guidance you need. Here are a few alternatives to Quicken that are worth checking out.

Our Top Alternative to Quicken

1. Empower

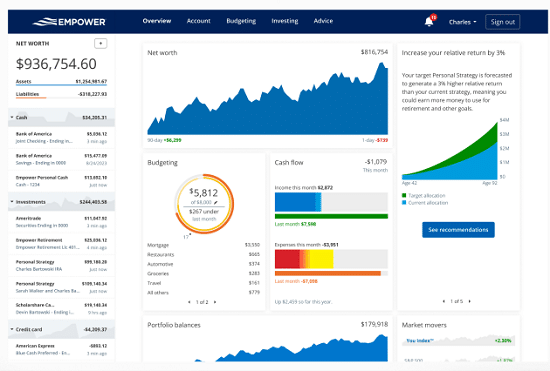

Empower may have the best all-around money tools available, and they are completely free. Like Quicken, Empower users can link all of their accounts and track them all in one place. This includes tracking your investment accounts and your net worth. Also like Quicken, Empower tracks your spending and categorizes it for you allowing you to get a clear picture of where your money is going each month.

The Dough Roller team has used dozens of money apps, and Empower stands out as one of the best user interfaces available today. You can see that here in a snapshot of the Empower dashboard.

Empower also features a retirement planning tool and a retirement savings fee analyzer. It can be used either on a desktop or through a mobile device. One thing Quicken users might miss is the ability to track and pay their bills from within the software itself. Even lacking this feature, Empower is certainly one app that you should try.

- Cost: Free

- Features: Financial budgeting dashboard, investment fee checkup, cash flow analyzer, 401(k) analyzer, net worth tracker, and retirement planner.

The Rest of the Best Alternatives to Quicken

| Quicken Alternative | Best Feature | Monthly Cost |

| Empower | Tracking Net Worth | FREE |

| Simplifi | Awesome App | $2.99 |

| YNAB | Complete Budget | $14.99 |

| PocketSmith | Forecasting | $9.99 |

| Mint | Free Budgeting App | FREE |

| GoodBudget | Envelope Budgeting | FREE |

| HomeBudget | Percentage Budgeting | FREE ($5.99 App Cost) |

| Dollarbird | Tracking Expenses | FREE |

2. Simplifi

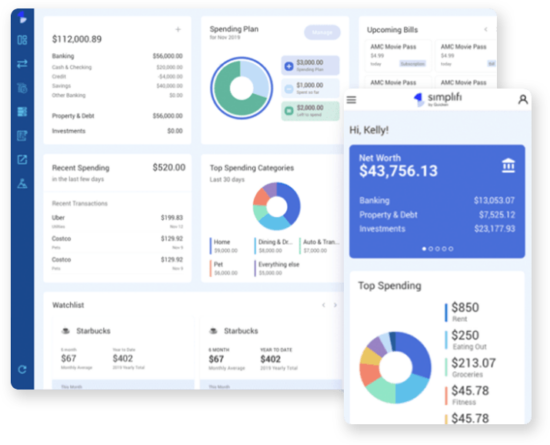

For those who manage their budgets on a smartphone, Simplifi offers one of the cleanest interfaces we’ve seen. Connect your accounts and you’ll see all your finances in one place. It alerts you to your upcoming bills, and recent spending (if you want to look), and even tracks your investments.

Simplifi is one of our favorite budgeting apps designed for a smartphone. The design is beautiful and very easy to use. You can see all of your finances in one place. Features include goal setting and tracking, budgeting, and investment tracking. Simplifi also includes excellent reporting.

- Fees: $2.99/month

- Features: Budgeting, goal tracking, investment tracking

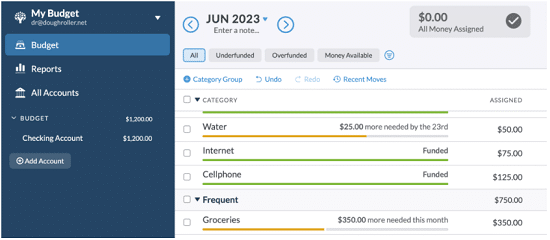

3. YNAB (You Need a Budget)

If you’re looking for great budgeting software, YNAB is it. YNAB takes the guesswork out of budgeting by providing you with a flexible living budget that will save you money and help you stay positive. The app enables users to set financial goals and track their progress. It also comes with a loan calculator and can generate spending and net worth reports.

YNAB does not offer the investment tracking and analysis features Empower offers. But if budgeting is your priority, YNAB is an excellent option.

- Fees: $14.99 per month or $99 annually; free 34-day trial

- Features: Budgeting, investment monitoring, bill management, add-in manual entries

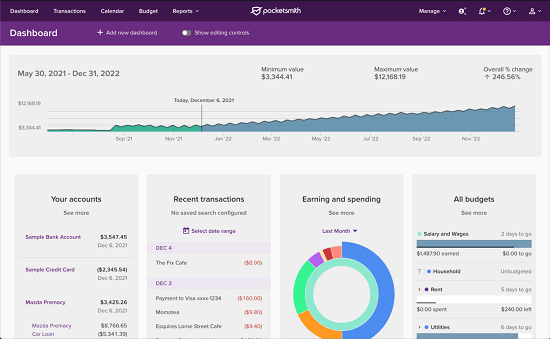

4. PocketSmith

PocketSmith is a personal finance software app that allows you to connect your bank accounts, investment accounts, loans, and credit cards to see a big-picture view of your finances and find out your net worth. A great feature you’ll find here is the ability to forecast your money and run what-if scenarios to project future balances.

Other features include creating budgets, setting up alerts if your money is running low, and reminders to pay bills, though an actual bill-paying function isn’t available.

There is a free version but it’s very basic and you’ll have to input your bank info manually. The Foundation version is $9.99 a month and gives you access to connect 6 accounts, automatically imports your bank feeds, and comes with 10-year budget projections. The Flourish package is $16.66 per month and gives you 30-year budget projections and the ability to connect to 18 banks from all countries.

Finally, the Fortune package is $26.66 per month, offers a 60-year budget projection, allows you to connect to unlimited bank accounts, and has unlimited dashboards.

- Fees: Free; $9.99, $16.66 or $26.66

- Features: Creating budgets, alerts, reminders for bills, projecting scenarios in the future

- Promotions: Try the Premium monthly subscription at a special price. Get 50% off the first two months.

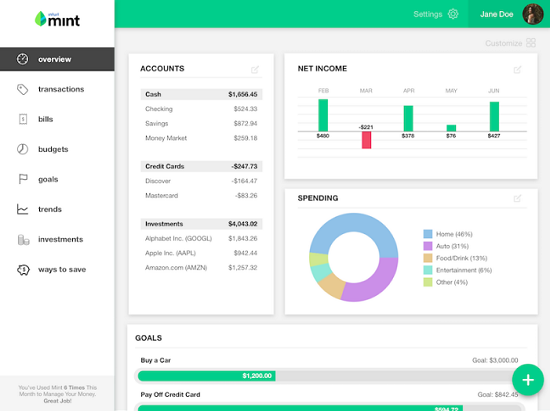

5. Mint

For long-time Quicken users, Mint is probably the app that is the most similar. Like Quicken, the Mint app allows you to view all of your accounts in one place. Simply link your accounts, and the Mint software tracks your entire financial life. Through their desktop or mobile app, you can use Mint’s budgeting software, track your investments, and view your categorized expenses.

They also offer users alerts and advice, as well as the ability to get a free credit score. In addition to Mint, Quicken users should check out Mint Bills. This is a fun feature that helps you monitor your bills and pay them directly through the app. Best of all, both Mint and Mint Bills are free.

- Fees: Free

- Features: Customizable budgets, download transactions easily, track investments, use via desktop or mobile app

6. GoodBudget

GoodBudget is a free mobile app that can be used to help you create a budget based on an envelope system. It is a pretty basic setup, but it gets the job done.

Just sync your bank accounts with GoodBudget, and it will help you track both your income and your spending. Simply set an amount for each category, and you can easily see how close you are to reaching your spending allowance for the month. You can also sync your budget across multiple phones, so everyone in your household has access to the information. This app is available on iOS and Android devices.

- Fees: Free

- Features: Multiple users, set limits on each spending category, tracks income and spending

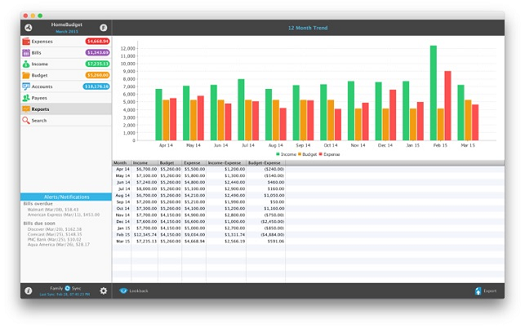

7. HomeBudget

If you’re looking for a detailed mobile app to help replace Quicken, HomeBudget could be a great choice. This app may have the best interface of all the mobile apps on this list. It is clean, color-coded, and easy to read. Once you link your accounts, you’ll be able to see your expenses, income, budget, accounts, and bills. There is also a chart that shows you how much you are spending as a percentage of your income.

This app also offers you the ability to search for past transactions, so you can easily pull up any information you may need. HomeBudget is available on iOS for $4.99 (free for the lite version) or on Android devices for $5.99.

- Fees: Free (iOS lite version only); $4.99 (iOS) or $5.99 (Android)

- Features: Search for past transactions, budgeting, charts to see your spending

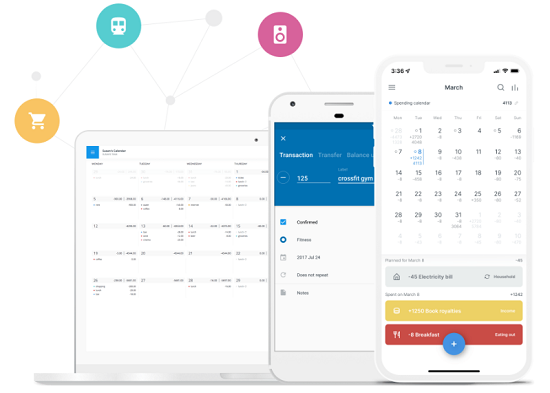

8. Dollarbird

Dollarbird is a mobile app that uses a monthly calendar as the basis for its design. This makes it easy for you to see when and where you may have expenses coming up. After you sync your accounts with Dollarbird, the app helps you track your spending and income.

Unique to Dollarbird is the 5-year financial plan, which allows you to set (and hopefully meet) your financial goals. Dollarbird also alerts you to any upcoming bills that need to be paid. The app is available for free on iOS and Android devices.

- Fees: Free

- Features: Upcoming bill alerts, budgeting, financial forecasting

What Is a Budgeting App?

A budgeting app is a piece of software you can use on your computer or mobile device. Its purpose is to help you track your finances such as your expenses, income, investments, savings, and debt payoff status.

In many cases, these types of apps will sync with your financial accounts such as your credit card and bank accounts to monitor your finances in real-time. The point is so that you can track things like your spending automatically, saving you time from having to do so manually. Depending on the app, you can also access features such as forecasting future scenarios, planning for retirement, and getting insights into your financial habits.

Is It Worth Paying for a Budgeting App?

It’s up to you and whether you think the features will be worth it to help you thrive in your financial future. Both free and paid apps have their advantages and disadvantages so it’s best to look at what features you want when making your comparison.

It seems strange to pay for an app to help you save money, but it could be worth it if you end up saving more than what you paid or learn about your habits that can positively impact your future. In many cases, paid apps offer a free trial so you can test it out to see if it’s worth the investment and one that you’ll use over time.

What Features Should You Look for in a Budgeting App?

At the very least, you want an app that will sync with your financial accounts (though most, if not all will do this). There are also plenty that will automatically categorize your spending into different categories and even provide charts or tables to show you what your financial habits are like.

If you want more guidance there are apps that offer educational components and ones that forecast certain scenarios. If you want to go with an app that offers a savings feature, make sure that the bank account is FDIC-insured

Our Methodology for Choosing Alternatives to Quicken

We understand that budgeting can be challenging for you it’s easy to throw in the towel when it feels like so much work to track expenses and figure out where your money went. The good news is that we did all the legwork of researching the ones where you don’t need to do so much manually.

The tools we tested out are some of the most popular ones on the market. We compared how each app functions, its security features, pricing, and how they access your financial data. Our picks are the ones that offer free trials or have a free version, are secure, and are user-friendly.

Bottom Line

Whether you are a Quicken user looking for alternatives or someone who is just ready to get their finances in order, know that you have many options. These are several of our favorite financial tools, available to help you automatically track your saving and spending habits.

Since many of them are free, there is no risk in trying them out. The best alternative is Empower, which will track your investments and your net worth. It will track all of your spending and categorize it for you — allowing you to get a clear picture of where your money is going each month.

Sign up for a few of them, and see which you like best (and which you’re likely to stick with!). It doesn’t matter how you track your money, as long as you do it.