Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

It seems like a simple question at first. What is a good credit score?

But what seems simple on the surface is often more complicated underneath. That’s true when it comes to your credit score, too.

Trying to define a good credit score is like trying to define beauty. It’s in the eye of the beholder. But in the case of your credit score, what’s “good” depends on the opinion of the lender.

The bottom line is that different lenders have different criteria for what they consider a “good” score. If you applied for a loan today, one lender might turn you down while another offers you credit. This is, in part, because they’ll look at your credit score slightly differently. But that’s not to say that there isn’t some consensus among lenders.

What Is A Good Credit Score – A High Altitude View

Generally, lenders will consider anything above 700 to be a good credit score. Between 650 and 700, and you might get loans with some lenders but not others. But if you’re going for the best possible interest rate, you’ll want to aim even higher than 700.

But the truth is that there’s no single authority that defines what a “good” credit score is versus an average score versus a bad score. So we’ll have to do some detective work to figure out those ranges.

First, we’ll look at why there are so many differences of opinion on this seemingly simple question. Then, we’ll dive into common credit score range breakdowns. Finally, we’ll talk about what does and does not go into your credit score, and we’ll direct you to some resources to help you improve yours.

Resource: Check your credit score for free at Credit Karma.

Why Is it So Complicated?

First, let’s talk about why determining the answer to this question is so complicated. There are a few different reasons, including:

You have more than one credit report

For one thing, it’s important to understand that you have three different credit reports. Three bureaus–Experian, Equifax, and TransUnion–each collect credit data separately. Sometimes smaller lenders will report to one or two of the bureaus, but not all three. This could mean that some of your data doesn’t appear on all three reports.

Plus, if there are mistakes on your credit report, a mistake could appear on only one bureau’s report. This can affect your credit score from that bureau, but not the others.

You never know which bureau’s score a potential lender will pull. For larger loans, like mortgages, lenders will often pull your latest score from two or all three bureaus. But credit card companies, for instance, will typically only look at one bureau’s report.

This means that even if your credit score with one company looks excellent, your score with another company could look good or average.

What it means for you: If you’re aiming to get a baseline for your credit score, you’ll want to look at scores based on all three credit reports, if possible.

There are two major scoring models

Another major wrench in this conversation is the fact that there are two major scoring models. There are several different types of scoring models. However, the two major models are the FICO Score and the VantageScore.

In general, these scoring models will look at similar data. How many late payments have you had? How much debt do you have relative to your available credit? But they’re still not the same. This means you could have a good score with one model and an average score with the other.

Plus, both of these major models have multiple iterations, as well. Right now, lenders can choose from more than a dozen FICO scoring models. There are models specific for car loans and models specific for home loans, for instance. The algorithm tweaks will make your numerical score appear slightly different, even if the raw data is the same.

And, again, you don’t typically know ahead of time which scoring model a potential lender will use. So this makes it even harder to know if your credit score is objectively “good.”

What it means for you: When possible, check out both your VantageScore and your FICO score. Our list of free credit score sites offers both FICO Score and VantageScore estimates.

Your score may fluctuate from day to day

Perhaps you think you have a great credit score today. But if you’re right on the line between good and great, that could change tomorrow. Unless you take a big credit hit, your score isn’t likely to change dramatically from one day to the next. But it could.

If you’re getting ready to apply for major credit, it’s especially important to pay attention to this issue. This is why you shouldn’t apply for new credit while you’re also trying to get a mortgage, for instance.

What it means for you: Don’t get too hung up on the specific number you see at any given time. Remember that your score can fluctuate, and do your best to keep those fluctuations trending upwards.

Different lenders have different criteria

We can try all day to pin down the specific point at which your average score becomes a good one. But the fact is that different lenders have different criteria. One lender might give you decent rates with a score of 650, while another will require a score of 675.

Criteria will also vary depending on what type of loan you’re getting and on other financial factors. It’s always important to remember that lenders look at more than just your numerical credit score. They’ll also look at factors that don’t appear on your credit report, including:

- Whether you have a full-time job

- How long you’ve worked at your job

- How much money do you make versus your monthly financial obligations

These items don’t appear anywhere in your credit report. But they’ll appear elsewhere in your loan application.

So if you have a 750 credit score but a low income, you probably won’t qualify for a $500,000 mortgage. But if you have a 650 credit score and make $250,000 a year, you might qualify for that mortgage. (Though you probably won’t get an excellent rate!)

What it means for you: Take our assessment of what makes a “good” credit score with a grain of salt. We’ll give you a general idea of what the industry says, but different lenders will interpret those numbers differently. And never forget that non-credit factors also play into whether or not you’ll qualify for the loan you want at a good rate.

Why Should I Care, Anyway?

Is all of this making your head spin? You’re not alone! At this point, maybe you’re wondering why you should even care.

Well, for one thing, having a good credit score can seriously affect your ability to get credit. A higher score will also result in lower rates. This means you can save tons of money just by improving your credit score.

Don’t believe me? Here’s one way to see how the differences play out.

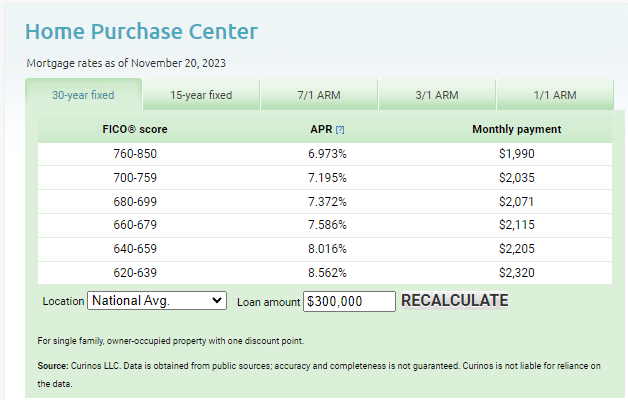

Looking at current mortgage rates, let’s see how the varying FICO credit scores stack up when applying for a 30-year fixed mortgage of $300,000. (Note: These rates are based on FICO’s national average)

But your credit score doesn’t just affect how big your mortgage payment will be. It also impacts things like:

- How much do you pay for auto and homeowner’s insurance?

- How much you’ll pay for private mortgage insurance (PMI) on a home mortgage

- What you pay in credit card interest.

- Whether you qualify for a 0% introductory APR credit card.

- Whether you qualify for the best rewards credit cards.

- How employable you are, in certain states.

- Whether or not you qualify for a lease agreement or utilities.

Bottom line: Your credit score is central to everything you do in your financial life. So having a good one is important.

Self is a unique company that offers to help you build your credit score. Instead of applying for a credit card that has high fees or a high interest rate, Self has created a way for you to increase your credit score through a self-funded loan.

After you’ve applied for your loan and selected a payment option, you’ll be on the path to building your credit. Once you’ve completed your payments, the entire principal is returned to you minus the interest rate.

So What Is A Good Credit Score?

But we still haven’t answered the basic question of this article: What is a good credit score?

With all the above information in mind, we’ll try to break down credit score ranges. Again, though, remember two things:

- Take this with a grain of salt. Different lenders may give you a different breakdown.

- A higher score is always better, even if you’re near the top of the range.

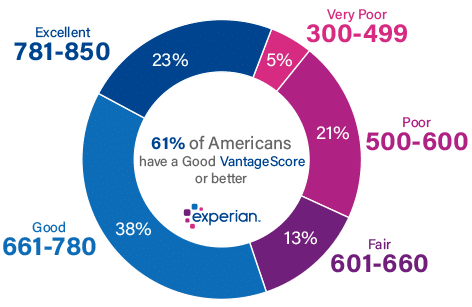

The VantageScore credit score range classifications are as follows:

- Excellent: 781 – 850

- Good: 661 – 780

- Fair: 601 – 660

- Poor: 500 – 600

- Very poor: 300 – 499

According to this information, we might consider a “good” VantageScore to be anything above 660. But you won’t get the absolute best rates from lenders until you hit the 781 mark. For the FICO score, “good” is any score above 670. But you won’t unlock the lowest rates until your score is near or at 800. (See data in the FAQ section below under the question, “What is a good credit score?”)

What Goes Into My Score?

Remember how we said that the FICO score and VantageScore look at different data? They do, but we won’t worry too much about that here. Their specific formulas are top-secret. But they do release information on basically what they’re looking for in a good score.

As an overview, Experian reports the following factors and the impact they have on your credit score:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- Types of credit used: 10%

- New credit: 10%

Here is what you should worry about, in order of importance, when it comes to your credit score:

Payment History (35%)

Do you consistently make all your payments on time? Lenders are concerned about this aspect of your credit history. So it’s the most heavily weighted factor in your history. Problems in this area include late payments and negative filings like bankruptcy. But you can improve your score over time by making your minimum payments on time every month.

Amounts Owed (30%)

This isn’t primarily about your total amount of debt, though account balances do appear on your credit report. Instead, it’s about the total amount that you owe on revolving debt accounts, like credit cards, versus the amount of credit you have available.

Running up big balances on your credit cards is the easiest way to tank this part of your credit score. Paying those balances back down may be one of the quickest ways to improve your score.

In the lending business, “amounts owed” is commonly referred to as credit utilization ratio. Based on the credit scoring models, a credit utilization ratio below 30% is considered to be a good range. But the lower the percentage, the better. A credit utilization ratio of 80% or higher can have a major negative effect on your credit score – even if you have an excellent payment history – because it indicates an increased potential for credit default.

Length of Credit History (15%)

The longer you’ve had credit, the higher this portion of your score will be. This is why it’s important to think twice before closing old credit accounts, even if you don’t use them often.

Types of Credit Used (10%)

Having a mix of credit types–revolving and installment–helps improve this portion of your credit score.

New Credit (10%)

Taking out new credit isn’t necessarily a bad thing. Applying for a lot of new credit at once can cause your credit score to decrease.

How Do I Get a Good Credit Score?

We have loads of content here on Dough Roller about how to improve your credit score. I’ll break down the first steps you need to take, and then link you to more in-depth resources for further reading.

1. Make all your payments on time, every month. This will ensure that your payment history stays in good shape. If you already have late payments on your report, catch those accounts up as quickly as you can.

Once you’re in the habit of paying your bills on time, you’ll want to sign up for Experian Boost™. It’s free and will take note of the utility bills and mobile phone bills that you pay on time and use that information to give your FICO Score a boost.

Read our Experian Boost Review

2. Pay down revolving credit balances. Carrying a high balance on a credit card or HELOC can cause your score to drop precipitously. Pay these balances down as quickly as you can, and you’ll find your score increases.

3. Be careful about applying for new credit. Generally, you should only apply for the credit you need. Don’t apply for new credit just to get a different credit score mix. It’s okay to shop around for credit, especially for accounts like a mortgage. But do this within two weeks to keep from dinging your score too much.

4. Consider leaving older accounts open. This can increase your average length of credit history, which is helpful for your score.

Frequently Asked Questions (FAQ)

What is a good credit score by age?

Age isn’t one of the criteria that determines your credit score. However, there is an age correlation with credit scores, because with age comes a deeper credit history.

Younger consumers tend to have fewer credit lines and more outstanding credit per line, while older consumers tend to have more credit lines and lower balances on each. The net result is that credit scores tend to rise with age.

Credit Karma has reported the average FICO score by age as follows:

18 to 25: 679

26 to 41: 687

42 to 57: 706

58 to 76: 742

77 and up: 760

Can you get a 900 credit score?

There may be less commonly used credit scoring models that have a maximum score of 900, but that level is not possible with FICO and VantageScore, which are the two most commonly used credit scoring models. Each has a maximum credit score of 850.

Is 700 an OK credit score?

Both FICO and VantageScore consider 700 to be in the “good credit” score range. But exactly what constitutes good credit varies by lender. One lender may consider 720 to be a good credit score, while another may see 680 in that category. You will likely qualify for most types of financing with a credit score of at least 700.

Should You Always be on the Lookout for Ways to Improve Your Credit Score?

You should never become obsessive about your credit score, especially considering that it fluctuates over time, and often for reasons that aren’t entirely clear.

But at the same time, it is important to monitor your credit score regularly. This will enable you to know where your score is at all times, but more importantly, to take action if you see a sudden decline. A significant decline can indicate that a derogatory entry has been added to your report. If it has been, you’ll need to take action as quickly as possible to remedy the situation.

Otherwise, you should have as a loose goal a strategy to gradually improve your credit score over time. Once again, you shouldn’t want to obsess over this, but the higher your credit score is, the more types of financing you’ll be eligible for, and the lower the interest rate you’ll pay for each.