Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

You’re probably already familiar with Rocket Money’s well-advertised corporate cousin, Rocket Mortgage. While Rocket Mortgage focuses on providing home financing, Rocket Money zeroes in on your finances on a personal level. However, certain services offered by Rocket Money will help you purchase a home through Rocket Mortgage – after all, the two organizations are related.

If you’re looking for a financial app that will help you to better manage your money, Rocket Money rates a close look. Not only do they offer expense tracking and budgeting, but also bill negotiation, subscription canceling, and credit score monitoring. They also offer one of the most interesting credit card rewards programs in the industry. It’s worth looking at Rocket Money just for the credit card.

What is Rocket Money?

It would be easy to categorize Rocket Money as a financial aggregator, budgeting software, bill negotiating service, or even savings plan. However, the problem with any of these labels is that they all apply to Rocket Money. Simply put, Rocket Money is one of the most unique financial apps available, just based on the sheer number of services it provides.

In addition to the services provided by Rocket Money itself, consumers will also have access to Rocket Mortgage for home financing, and personal loans through Rocket Loans. The tie-in with those additional services alone makes Rocket Money stand out from the competition.

Rocket Money claims to have saved its customers over $1 billion in bill negotiations and canceled subscriptions. Rocket Money also offers an automatic savings option and a credit card that will help you purchase a home or pay off your mortgage. More than 5 million people are Rocket Money members.

Rocket Money has a Better Business Bureau rating of B on a scale of A+ to F. It also has 4.3 out of five stars by more than 60,000 iOS users on The App Store, and 4.3 out of five stars by more than 51,000 Android users on Google Play.

Rocket Money Features & Benefits

Rocket Money offers the following features and benefits, though exactly which will be available to you will depend on the plan type you choose, Free or Premium.

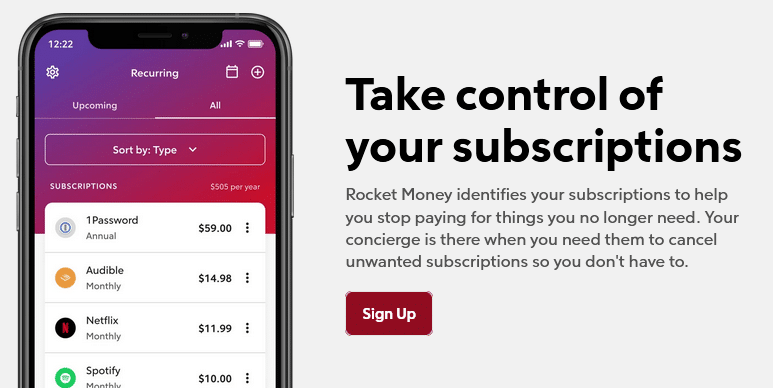

Manage Subscriptions

Rocket Money identifies subscriptions in your budget so you can choose to cancel them if they are no longer necessary. A concierge can help you cancel subscriptions. This feature also provides a recurring view of when bills are due, so you can pay them on time and avoid late fees. The concierge service is available with the Premium version only.

Budgeting

You can set up a budget that automatically monitors your spending and allows you to create trackers to help you reach your savings goals. Rocket Money will let you know how much you have available each month. It will also provide alerts to let you know when you are close to reaching a savings goal. Available with the Premium version only.

Bill Negotiation

Upload your bills and they will be scanned to find potential savings. From there, Rocket Money negotiators will help you to get better rates. That includes better rates on cell phones, cable services, and auto insurance policies. This is available with Free and Premium plans, at a cost of 30% to 60% of the amount saved on each bill.

Spending Insights

Rocket Money will analyze your finances so you can see where your money is going, and help to improve your cash flow. The service connects to your bank accounts to identify spending categories, particularly those where you can reduce your spending. It also provides real-time alerts to help you avoid inadequate balances and the overdrafts and late fees they bring.

Smart Savings

Rocket Money analyzes your savings accounts to determine the best time to save for spending goals and to avoid overdraft fees. You can set your savings goals and even the savings frequency. From there, Rocket Money will transfer deposits into a designated account with their FDIC-insured banking partner. The current banking partner is NBKC Bank and partner of Synapse. Available with the Premium version only.

Net Worth

By some measures, this is the most important metric in your financial life because it provides the most accurate measure of your financial well-being. By linking all your financial accounts with Rocket Money you’ll receive regular updates on the value of your assets and liabilities balances. Available with the Premium version only.

Credit Scores

Rocket Money provides access to your complete credit report and enables you to track your credit score. The service also alerts you of important changes that may have an impact on your score. The credit score is the VantageScore from Experian.

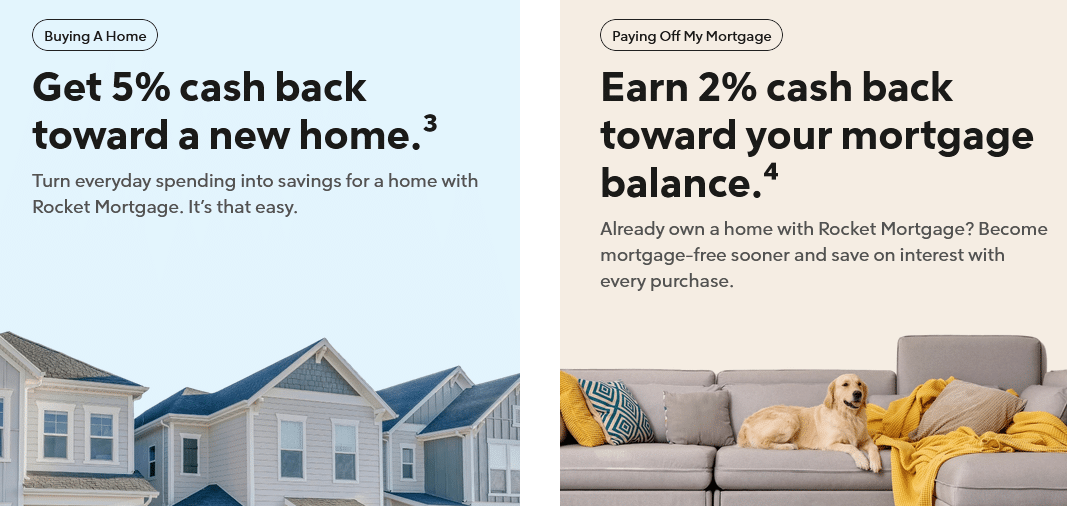

Rocket Visa Signature® Card

Rocket Money offers its Rocket Visa Signature® Card to qualified applicants. The card comes with cash-back rewards of up to 5%. You will earn unlimited five Rocket Rewards Points for every dollar spent using the card.

Rewards have three redemption options:

- 5% cash back toward the purchase of a new home, or

- 2% cash back toward your existing mortgage balance, or

- A statement credit of 1.25%.

To qualify for either offer, you must either be planning to purchase a home with a new Rocket Mortgage, or already have an existing Rocket Mortgage. If you already have a mortgage, the cashback can be applied toward your mortgage balance to help you pay off the loan faster.

If you are qualified to purchase a new home, the 5% cashback offer can accumulate up to $8,000 in points, which can be redeemed toward a new Rocket Mortgage transaction, offsetting the required funds to close. You may also be able to earn an additional $2,000 in points, which can be used as a lender credit for closing costs.

The credit card comes with the following terms:

- APR for purchases: 20.49% to 30.99% variable APR, based on creditworthiness (balance transfers and cash advances are not available).

- Annual fee: $95, waived for customers who have an existing, serviced mortgage with Rocket Mortgage.

- Foreign transaction fee: None.

- Late fee: Up to $25.

- Over-limit fee: None.

- Return payment fee: Up to $37.

The card also provides extended warranty protection for one year, Porch Piracy Protection for up to $10,000 on eligible stolen items, and cell phone protection for theft and damage up to $750 when you pay your wireless bill each month using the card.

Anyone can apply for a credit card, but the rewards points will be enhanced if used in conjunction with a pending or existing Rocket Mortgage.

Other Rocket Money Features

Availability: Can be downloaded free of charge at The App Store for iOS devices (14.0 and higher), and at Google Play for Android devices.

Account security: Rocket Money uses Plaid to provide secure financial transfers with more than 15,000 financial institutions. It also uses the most up-to-date industry protocols for storing data, including bank-level 256-bit encryption. Servers are hosted securely using Amazon Web Services (AWS). Funds held in a Smart Savings Account are covered by FDIC insurance for up to $250,000 per depositor.

Customer service: Available by email and live chat, Monday through Friday, 9:00 AM to 8:00 PM, Eastern time.

Rocket Money Pricing

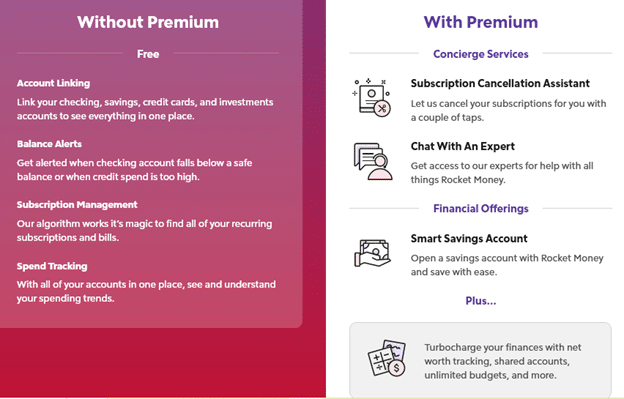

Rocket Money offers two versions, Free and Premium. The features provided by each plan are as follows:

As a standalone service, Rocket Money charges a fee equal to 30% to 60% of bill negotiation savings (on both the Free and Premium versions), or $4 to $12 per month for the Premium plan. Rocket Money sets a wide range of fee structures to allow customers to choose a level that is comfortable for them.

Rocket Money Pros & Cons

Pros

- Offers a free version.

- The Rocket Visa Signature® Card can be used to accumulate up to $10,000 toward the purchase of a new home, or toward paying off your existing Rocket Mortgage.

- Flexible fee structure range to make the cost a comfortable fit for customers.

Cons

- Does not offer investment assistance.

- No phone support is offered.

Rocket Money Alternatives

If Rocket Money isn’t the right finance app for you, one of the following may prove to be a better choice. However, because of the many financial services Rocket Money provides, there is no direct competitor.

YNAB is one of the very best budgeting apps available. That’s the main thing YNAB does. YNAB claims its average user saves $600 in the first two months, and $6,000 in their first year. It uses a simple four-part money management system that virtually changes your relationship with money.

It does this by instructing you on how to be more intentional about how you manage your finances, to be prepared for the unexpected, to incorporate flexibility, and – ultimately – to get yourself into a position where you can use last month’s pay for this month’s expenses. YNAB is offered at $14.99 per month, or $99 if paid annually. Either payment plan comes with a 34-day free trial.

Empower acts as a financial aggregator where you can link all your financial accounts on the platform, to track and budget from the free Empower Personal Dashboard. It comes with valuable tools, like the Retirement Planner and Investment Checkups to help you better prepare for the future.

You can also open an Empower Personal Cash account currently paying APY on FDIC-insured balances up to $5 million, with no fees and unlimited transfers. Empower also offers investment accounts, managed portfolios, IRAs, and wealth management, each with its fee structure.

Simplifi is an excellent choice if your primary interest is in getting control of your spending, with the ultimate goal of enabling you to save more money. It does this by helping you to set up savings goals which you can monitor the progress of continuously. It even provides real-time alerts and reports to keep you updated on your progress. Offered by Quicken, it’s available for $2.99 per month.

Frequently Asked Questions (FAQ)

Is the Rocket Money app legit?

Absolutely! It’s part of the Rocket Mortgage organization, which is the largest retail mortgage lender in America. The company also gets high ratings from both the Better Business Bureau and its mobile app users. Funds held on deposit with Rocket Money are FDIC-insured through partner banks.

How much does Rocket Money cost?

There is no simple answer to this question. They do offer the Free version, but if you use it to negotiate bills, they will charge between 30% and 60% of the amount saved on each bill. The Premium version uses a sliding scale of between $4 and $12 per month. What’s nice about this arrangement is that Rocket Money allows you to choose the fee you will pay.

Does Rocket Money cancel subscriptions?

Subscription management is part of the Rocket Money program, whether you choose the Free or Premium plan. The company claims to have canceled nearly 2.5 million subscriptions on behalf of its members. The favorable ratings the app receives from its mobile users seem to confirm that claim.

Should You Sign Up for Rocket Money?

Because of the many financial benefits Rocket Money provides, this app is a good choice for many consumers. The app can enable you to get better control of your finances through a combination of budgeting and expense management in the form of bill negotiation and subscription cancellations.

The credit card offer is unique since it enables you to accumulate rewards toward either the purchase of a new house or the paydown of an existing Rocket Mortgage.

If you are looking for investment guidance to go along with your financial management, you may be better suited to an alternative, like Empower. If you’re ready to take complete control of your budget, YNAB will be the better choice. For just about everyone else, Rocket Money should fit the bill.

Rocket Money

Summary

Rocket Money is a terrific budgeting app that offers a free and premium plan and the ability to reduce the cost of your subscriptions with the click of a button.