Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

In this review, we will compare You Need a Budget (YNAB) with EveryDollar, two popular budgeting tools. Both can help you achieve the same goal, but their features and usability are different.

In a Nutshell

YNAB is for those who want a comprehensive tool to categorize spending as they go and better understand financial habits.

EveryDollar is for budgeters and beginners who want a simple, affordable, or free budgeting app.

Did you know?

Empower is a budgeting, investment tracking, and retirement planning tool all in one, and it’s free.

About YNAB

You Need A Budget, or YNAB, has loyal fans who claim it has changed their financial lives. This budgeting style looks at each dollar coming in and out and makes sure you keep track of every single penny. It even works with variable income and expenses.

YNAB is based on four rules to help you get total control of your finances:

- Give every dollar a job: This means taking all the money coming into your bank account and allocating every penny to an expense category.

- Embrace true expenses: Set goals for variable expenses or short-term savings like a holiday gifts fund, an upcoming vacation, or paying for a subscription. This means setting aside an amount each month to go towards a future goal.

- Roll with the punches: Budgeting is meant to be flexible, so it’s okay to allocate more or less money to certain categories as long as you’re not spending more than you make. Did you have an unexpected car repair? That’s okay, but you might have to cut back on your restaurant spending this month to cover your car repair expenses.

- Age your money: The goal is not to spend all your money the second it hits your account. It’s okay to have some breathing room, especially for those who want to get out of the paycheck-to-paycheck cycle.

Learn More: 4 Reasons YNAB Beats Mint Hands Down

About EveryDollar

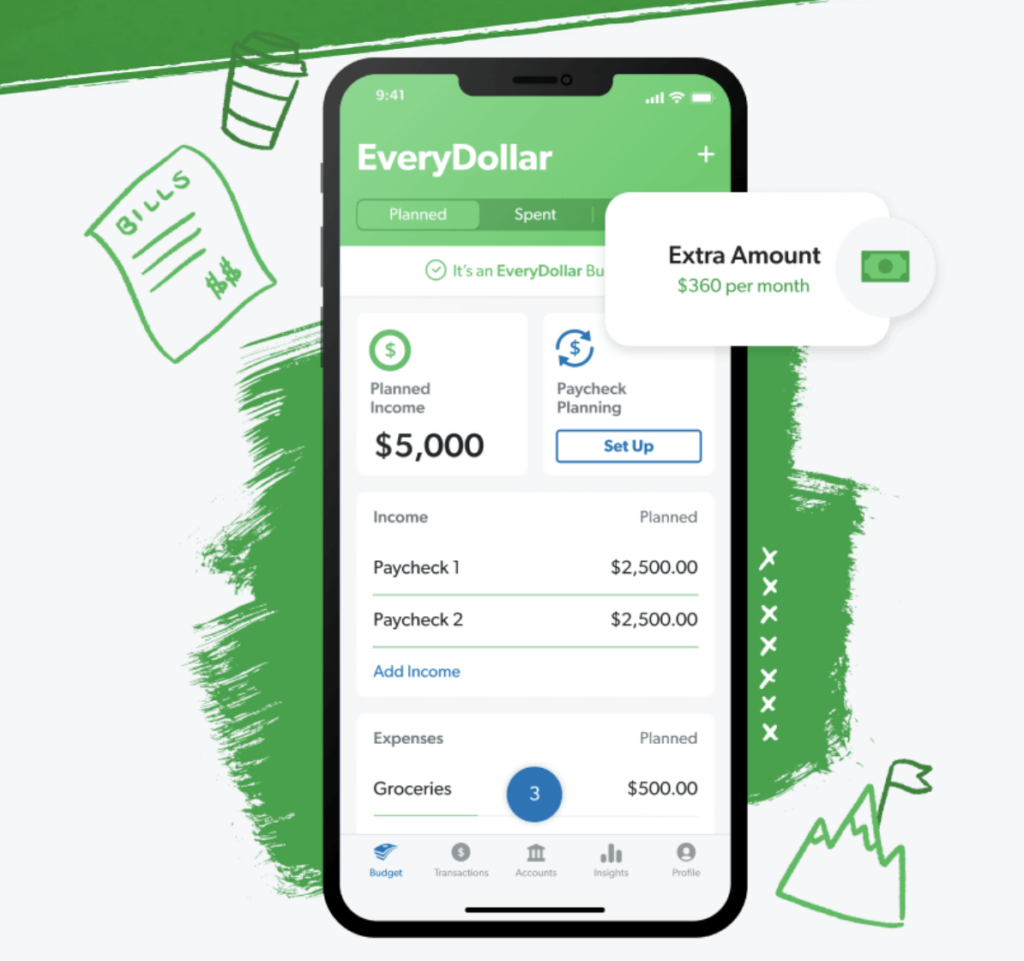

EveryDollar, founded by finance expert Dave Ramsey, is most known for helping folks get better with their finances using baby steps. This budgeting app claims you can create a budget in 10 minutes.

There are both free and paid versions. With the paid version, you can get additional features, including the ability to sync with your bank to automatically populate transactions.

The type of budgeting EveryDollar uses is called zero-based budgeting (similar to YNAB). With EveryDollar, you take your income and divide it into spending, saving, and debt payoff categories. You have to allocate every dollar (hence the app’s name) until there’s nothing left, or it reaches zero.

YNAB vs EveryDollar: Features

Features of YNAB

YNAB works for beginners or advanced budgeters and it also offers features to help you look toward the long term.

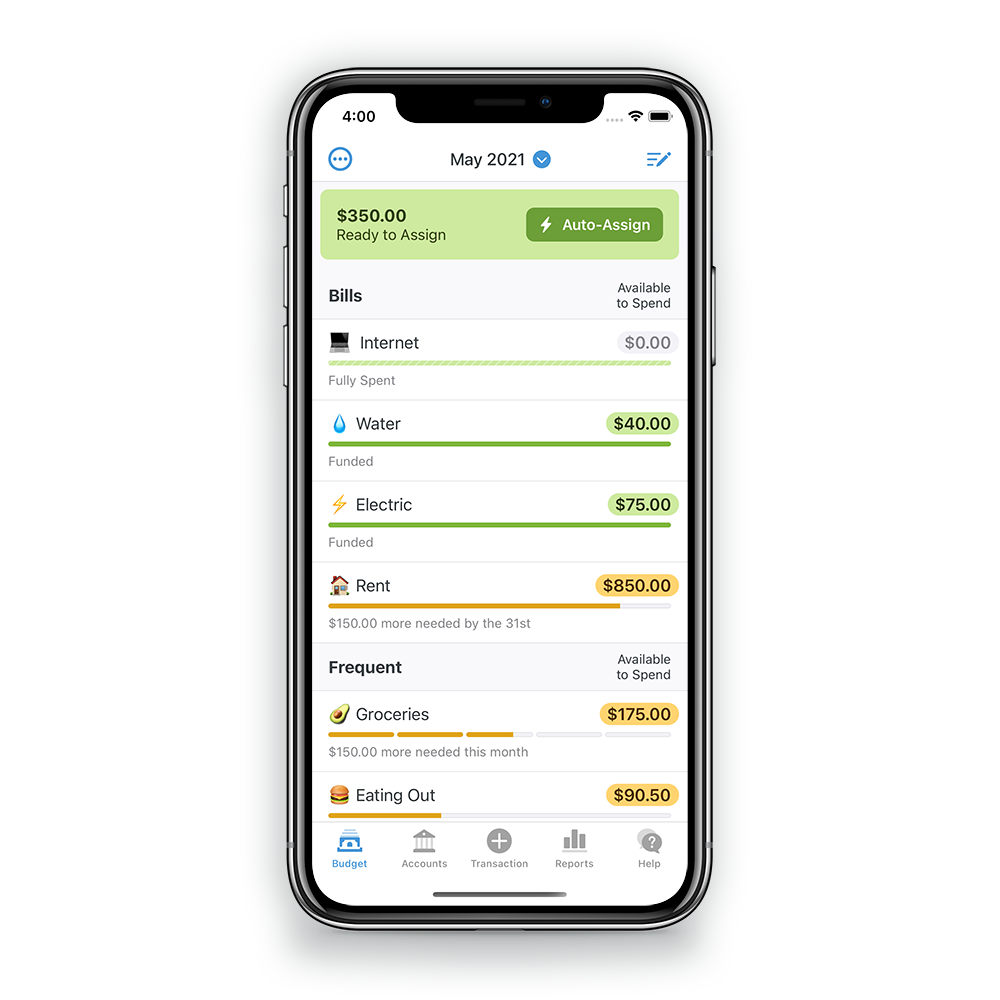

Intuitive Interface

When you sign up, you’ll need to add spending categories (you can eliminate or adjust them later). Then you assign money to each category until all your income is accounted for.

The interface is a standout feature, making it easy to see your entire budget in one place. At the top of the dashboard, you can see your total cash flow. On the right, you can see how much you’ve budgeted for the month, the total amount that’s available in your budget.

You can then look closer at your budget and see what happens to it in real time when you adjust your spending categories. It shows you what’s left in each category, allowing you to shift your spending as needed.

Automatically Import Transactions

YNAB users have the option to manually enter their transactions or import them automatically. For the automatic option, you link your financial accounts. If you’re concerned about security, YNAB cannot make changes to your account, only import transactions.

To import your transactions, click on the import button, and any transactions that are at least 24 hours old will populate. This works with some financial institutions better than others. Whether you enter them manually or sync them automatically, you’ll need to assign those transactions into categories.

When you link your credit card accounts, YNAB will also track your cash and credit spending separately.

Age of Money

The Age of Money is a unique feature. YNAB believes the longer your cash stays in your checking account before spending, the better off you are financially. The goal is to be more mindful by spending less or making smarter spending decisions. YNAB encourages you to get to the point where your money is 30 days old. In their own words, “When you are spending money you earned last month, you will have nothing to stress about money-wise.”

The Age of Money indicator will show up at the top right corner of your budget and will keep you updated as you go. It’s meant to motivate you, so shoot for a higher age!

Goals

This feature is exactly as it sounds: create financial goals. It’s a helpful way to clarify what you want and find a way to track the metrics. Ideally, seeing your goals will motivate you to stick to them.

To use, create a goal and select a spending category. This goal will indicate how much money you need to save each month in that category to reach it by your specified date.

You can even set goals for an amount you want to pay towards your debt within a certain timeframe. All you need to do is link your credit or debit accounts though not all accounts can be linked.

Features of EveryDollar

EveryDollar is a simple budgeting app that doesn’t have snazzy features compared to others. Still, it’s a useful tool to help your budgeting game.

Customize Categories

You get to customize the spending categories. You’ll be asked how much you spend in common or major categories like housing, food, and transportation when you sign up. You then add and name additional categories as needed.

Examples include debts, household items, and even your annual HOA fee. You’ll have to make sure you allocate all your money.

Easily Adjust Budgets

Just because you allocate a certain amount of money for each category doesn’t mean you’ll stick to it. That’s why EveryDollar has two columns: the budgeted amount and the amount you’ve spent so far. This allows you to see how much you have left to spend by the end of the month and review your spending habits to see where you may need to make adjustments.

Sinking Funds

You can turn any spending category into a fund, where the money you didn’t spend rolls over to the next month. This feature is useful if you have variable expenses like holiday spending or when paying your property tax bill.

Learn More:

Automated Syncing of Bank Accounts

The paid version allows you to sync your bank accounts, so your transactions populate automatically.

YNAB vs EveryDollar: Price

How Much Does it Cost to Use YNAB?

YNAB offers a 34-day trial (check it out to see if you like it). After that, it costs $14.99 a month or $99 a year.

How Much Does it Cost to Use EveryDollar?

The good news is there’s a free basic version of EveryDollar. However, you have to input all your transactions manually. This might be an upside if you want to be more hands-on or are new to budgeting.

The Premium or paid version allows you to import transactions directly from your financial accounts. EveryDollar Premium costs $79.99 per year. You can get a 14-day trial to see if you like it, but you must enter a debit card (Dave doesn’t take credit cards!).

YNAB vs EveryDollar: Pros and Cons

YNAB Pros

- Offers tools to motivate you: Sure, you can budget better with YNAB, but the goals function and the dashboard are designed to push you to reach other financial goals, like aging your money.

- Intuitive dashboard: From seeing all your cash flow at a glance, to more detailed spending reports, YNAB has you covered.

- Free trial: you can check out YNAB free for 34 days to see if this app works for you. Paying the membership fee might be worth it if you can save more than $14.99 per month (or $99 per year) by using this tool.

- Continual updates: With each update, YNAB continues to improve, making it more user-friendly for its customers.

YNAB Cons

- No investing features: This might not be a downside if you’d rather just have budgeting software, but those who want more need to look elsewhere to actively track their investments.

- Takes a while to get used to: YNAB is great once you get the hang of it, but you might encounter some challenges when getting started. Not a dealbreaker, but keep this in mind when you start using the app.

- Not many ways to contact customer service: You can’t call or email YNAB to answer any questions. Only live chat is available.

EveryDollar Pros

- Simple to use: You can get everything set up with EveryDollar within a few minutes, assuming you know how much you want to allocate to each category. Plus, the interface is user-friendly.

- Focuses on budgeting only: No need to worry about all the other shiny features if you don’t want to, since EveryDollar does what it does best: helps you create a budget.

- Syncs with Dave Ramsey’s Baby Steps: The app has a section where you can learn the additional baby steps, such as saving for an emergency fund. That way, you can continue to get better with your money.

- Ad-free: you don’t have to worry about being bombarded with ads like other types of free budgeting software.

EveryDollar Cons

- Paid version doesn’t offer much more: Sure, you can sync your transactions, automatically, but to pay $79.99 a year for the privilege might not seem worth it.

- The free version is limited: You’ll need to manually enter transactions which could be a turnoff for many budgeters, and you must enter a debit card.

Related: Best Online Budgeting Tools

Why Choose YNAB

If you’re someone who is detail-oriented and wants to improve your financial well-being with a better budgeting tool, YNAB is for you. The dashboard allows you to see how each dollar is accounted for and whether you’re reaching the financial goals you set.

Why Choose EveryDollar

EveryDollar is best for those who are beginners and want something simple to get started with. Plus, if you’re a Dave Ramsey fan, this budgeting app is a great choice because you can learn about the Baby Steps all in one place.

YNAB vs EveryDollar Which One is Best?

| Features | YNAB | EveryDollar |

|---|---|---|

| Fees | $99 per year | Free (basic version) or Premium for $79.99 per year |

| Investment monitoring | (limited) | |

| Bill management | x | |

| Manually enter transactions | x | x |

| Mobile App | x | x |

| Rollover budget from the previous month | x | (limited) |

| Create savings goals | x | x (with Premium) |

The best budgeting app ultimately depends on what features you want, how you work best, and the price tag. For instance, EveryDollar is a simple budgeting app that focuses on making sure you’re following the amount you give it for the month. It’s also the less expensive choice.

YNAB, on the other hand, is a more complex budgeting app that doesn’t offer a free version, but you’ll get to allocate all money coming (in detail), and you get more snazzy charts and tables.

The best budgeting app is one you will use. So start with one, see if you like it and if you need to change your mind, do so.