Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Creating a budget is a critical step in building a healthy financial profile. Gone are the days of taking out your pencil and calculator and instead, pulling out your phone and searching fo the best budgeting apps.

If you’re trying to follow the Dave Ramsey style of zero-based budgeting, EveryDollar may be the budgeting app you need. This tool says you can create a budget in less than 10 minutes, and it’s free to use. Here’s the scoop on what EveryDollar offers and why it might be the budgeting tool you’ve been looking for.

How Does EveryDollar Work?

If you’ve ever heard the basics of Dave Ramsey’s Financial Peace University plan, you know that budgeting is about giving “every dollar a job.” That’s what this app, which Ramsey’s company designed, aims to do.

With EveryDollar, you’ll start by entering your monthly income. Then EveryDollar gives you a customizable template for budgeting your monthly expenses, and you can add the categories that make sense for your spending plan. You’ll enter your expenses as you spend, categorize them, and make sure you stay under budget or see where you go above budget.

EveryDollar also features some dashboard-style views so you can get an at-a-glance look at your overall spending and each budget category.

EveryDollar Pricing

The basic version of this app is free. That said, it requires you to input your transactions manually which can be an extreme hassle if you’re someone who spends a lot of money on everyday purchases.

Sometimes, though, this can be a good thing if you’re getting started with budgeting. Something is empowering and awakening about entering all of your spending as you do it. It can help you see how much money you’re spending before you overspend.

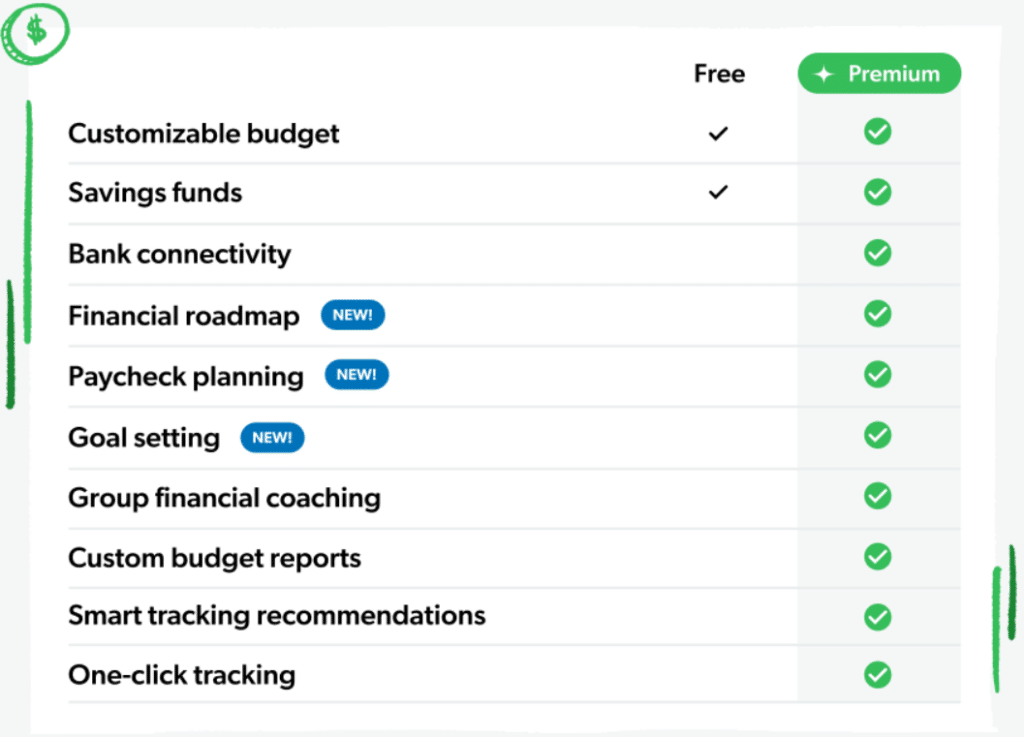

If you want to import transactions directly from your bank account, you’ll have to pay for EveryDollar Premium. You can sign up for a 14-day free trial, but after that, the service costs $79 per year or $17.99 per month if you want to pay month to month (Ramsey is banking on you seeing the value in an annual subscription).

EveryDollar Features and Benefits

EveryDollar features a simple-to-use interface and a budget you can customize. It also has apps available for Apple and Android, so you can enter expenses from everywhere. That makes it a good option for a combined budgeting app with your spouse or partner, too. You can each use the app to enter expenses as you spend money.

EveryDollar can also sync to your bank account and automatically import your transactions from your bank or credit card statements. This additional option also comes with priority support.

Signing Up

Getting started with EveryDollar is as easy as giving them your email address and password to create an account. Then you can start creating your budget.

However, if you want to sync to your bank account, you’ll need to sign up for the free trial and then connect the app to your bank account. You log into your bank account through the app so that EveryDollar can pull in your transactions.

Getting started with your actual budget could take a bit longer. EveryDollar says you can create a budget in ten minutes. And you probably can if you have a pretty simple, streamlined budget. But if you have a more complex budget, it could take longer to create your budget. But that’s really about how well you know your income and expenses and how many budget categories you’re likely to set up.

Synchronization

If you sign up for EveryDollar Plus, your app will sync with your bank account and pull transactions in real time. Then you can log in to categorize your transactions as you go.

Regardless of which version you use, though, your budget and inputs will always be synced across your laptop/desktop and your phone or multiple phones. Again, it’s a great option to use if you want to budget along with someone else since you can both install the apps and enter your spending in real time.

Security

As with many budgeting apps, EveryDollar uses data encryption techniques and has a multi-factor authentication system in place. It also has a data center where individuals are on site all the time to ensure the physical security of the data stored on EveryDollar’s servers.

Mobile Accessibility

EveryDollar has an app available for both Android and Apple. These apps are intuitive and easy to use, and you can do everything on the app that you can do on your laptop or desktop. The apps sync to the desktop/laptop version, as well, so you have access to your spending data from anywhere.

Customer Support

EveryDollar has online customer support available and an FAQ section that tackles everyday questions. During normal business hours, you can ask a chatbot your question and if you’re not satisfied with the response, you can request an agent.

You also can submit a ticket at any time and the typical response time is 48 business hours. Unfortunately, EveryDollar does not offer phone support.

EveryDollar Pros and Cons

Pros

- Zero-based budgeting — If you’ve been out of control of your money, a true zero-based budget that gives every dollar in your budget a job is a great way to get back on track. Since it operates off of this principle, EveryDollar is a great way to go.

- Flexible budget — Some budgeting apps come with preset categories that may or may not make sense to you. With EveryDollar, you can create the exact categories that make sense to you.

- Mobile app — These days, having a mobile app on your budgeting tool is almost essential. You can manage your entire budget from your phone.

- Good interface — EveryDollar is easy to use and intuitive, and it has a nice-looking interface. I love having a snapshot of my budgets and overall spending, as well, and theirs is very nice.

Cons

- Pay for syncing to bank — To sync the app to your bank account, you have to pay $99 per year, which is fairly expensive.

- No investment tracking — EveryDollar is specifically for budgeting and doesn’t include access to investment tracking or other advanced tools that some other budgeting apps offer.

- Zero-based budgeting — This is both a pro and a con. Zero-based budgeting is great if you have a steady paycheck each month. But it’s a tougher model if you have a variable income, and EveryDollar isn’t set up well to deal with that.

EveryDollar Alternatives

There are a lot of high-quality budget apps that you may want to try other than EveryDollar. My personal two favorites are Rocket Money and YNAB.

Rocket Money

Rocket Money is a budgeting app that does everything extremely well. From setting up your budgets and receiving automated alerts to intuitive suggestions on how to improve and lower your everyday bills, Rockey Money is the budgeting app I’m currently using.

The cost for Rocket money is FREE if you use a limited set of features. If however, you’d like to know where you can reduce your subscription costs and have Rocket Money help do that for you, the monthly fee is between $4 and $12. Rocket Money offers the “pay what you want” model for your monthly charge but unlike some other brands that offer this model, they’ve set the floor at $4 (not $0).

YNAB

YNAB is similar to EveryDollar in that it uses the zero-based budgeting method to keep your finances in check. YNAB has created a system that follows “four rules” and if your budget can comply, chances are you’ll come out of using YNAB with a much healthier financial profile.

- Give Every Dollar a Job

- Embrace Your True Expenses

- Roll With the Punches

- Age Your Money

YNAB offers a 34-day free trial so creating an account and setting up your initial budget is risk-free. After the trial expires, the ongoing cost is $99 annually or $8.25 per month.

EveryDollar Frequently Asked Questions (FAQ)

Does EveryDollar include a free credit score?

Unfortunately, both EveryDollar free and paid plans do not include a credit score. Many budget apps include a credit score from at least one major credit bureau and you can usually get a free credit score from your credit card provider as well.

Is EveryDollar available outside of the U.S.?

Another no I’m afraid. EveryDollar is for U.S. consumers only and when signing up, you will be required to input a stateside mailing address.

Can I create multiple budgets under the same account?

I’m getting pretty good at saying no, so here comes another one. An EveryDollar account can only create a single budget and if you want to add another, you must set up an additional Dave Ramsey account.

Should You Sign Up for EveryDollar?

If you’re relatively new to the world of budgeting and want a simple, straightforward budgeting tool, EveryDollar is a great option. If you’re brand new to tracking your spending at all, it can be a great way to start with the free app where you have to manually enter your transactions. That takes more time, but it also puts you in closer touch with what you’re spending regularly.

EveryDollar is a basic, un-flashy budgeting tool, but it gives you the ability to budget flexibly and is very simple and easy to use. If you want a tool without extra bells and whistles but that gives you nice dashboards and mobile access, this is a great option to try.

EveryDollar

Summary

EveryDollar is perfect for beginners who aren’t looking to spend money each month to create a simple budget that can help them improve their finances.