Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

When I first began really taking my personal finances seriously, I can remember setting a random dollar amount in my head as my monthly savings target. I also committed to myself that I would raise my savings amount by $50 per month each calendar year.

There’s nothing terribly wrong with this savings plan. It did help me to form the habit of putting a little money away each month. And it helped me improve with budgeting and expense-cutting. But a few years ago, I learned how to calculate my savings rate and it was a game-changer.

As you will see, your savings rate is the key factor in determining how soon you can retire or reach financial independence. Here’s how to calculate your savings rate and how to increase it so that you can reach your financial goals faster.

What Is a Savings Rate?

Your savings rate is simply the percentage of your income that is left over after you cover your expenses. For example, let’s say that you bring in $5,000 per month and spend $4,000 on your bills and stash the other $1,000 in your savings account, retirement account, or other investments.

To find your savings rate, you’d begin by dividing $1,000 by $5,000.

$1,000 / $5,000 = 0.20

Then simply convert the number you’re left with into a percentage by moving the decimal point two places to the right. In the example above, you’d find your savings rate to be 20%, right in line with the rate that most experts recommend.

Why Your Savings Rate Matters

Increasing your savings rate can speed up the rate at which you meet your financial independence or retirement savings goals for two reasons:

- It means you can live comfortably with a lower income, which decreases the amount of money you need to have saved to retire.

- It means you’re putting more money away each month which will help you hit that retirement number faster.

So, you essentially get a double benefit for every extra dollar you save. And this is why your savings rate can dramatically reduce your required number of working years.

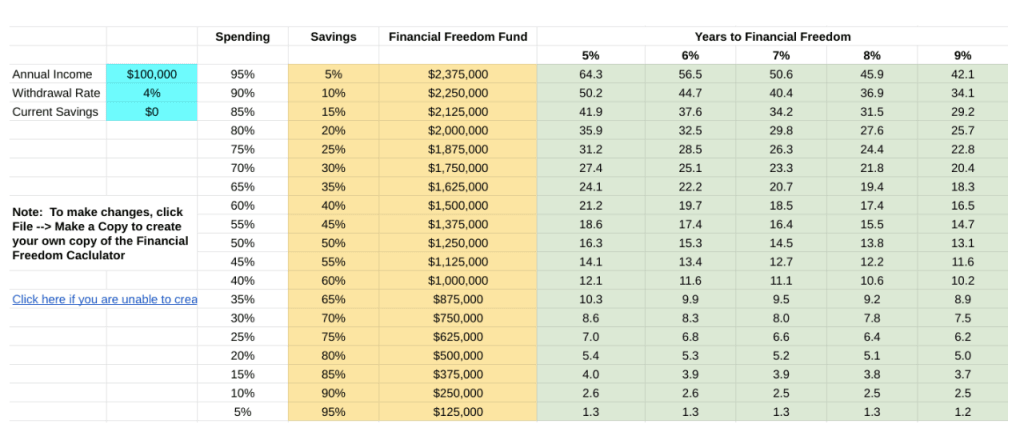

For example, using the Financial Freedom Calculator, you can see it would take approximately 50 years to reach financial independence with a 5% savings rate (assuming a 4% withdrawal rate and 7% return on investments).

But bump up your savings rate to 20% and you cut your work time down to just under 30 years. And with a 50% savings rate, you could retire in less than 15 years!

How to Calculate Your Savings Rate

Above, we simply described your savings rate as your amount saved divided by your income. But what is considered income?

Some experts recommend using gross income when calculating your savings rate while others prefer to use net income. Below we explain how to find your savings rate with either method and the pros and cons of each.

Using your gross income

Using gross income when calculating your savings rate is definitely the simpler of the two methods. Most of us won’t know for sure what our final tax liability will be until we file our tax returns, which makes it hard to accurately calculate our true savings rate until then.

Additionally, some experts suggest that basing your savings rate on your take-home pay could cause those in higher tax brackets to feel like their savings rate is higher than it really is.

For example, let’s say that you make $175,000 per year, placing you in the 32% income tax bracket. After taxes, you may only be left with around $120,000 of take-home income. So what would your savings rate be if you saved $24,000 per year?

If you used $120,000 as your income number, your savings rate would equal 20%. But you actually earned $175,000 in income. And when you use that number, your savings rate drops to around 14%.

Using your net income

Despite the points discussed above, many financial gurus still recommend using your net income when calculating your savings rate. For example, this is the recommendation of Mr. Money Mustache, who has inspired many FIRE (financial independence retire early) enthusiasts to start calculating their savings rates.

One of the biggest reasons for using net income is you cant spend OR save your income tax money even if you wanted to. It’s not truly disposable income. So why should you be penalized for income that you have no real control over?

If you do decide to use net income for your savings rate, however, you’ll need to add your 401(k) or Traditional IRA contributions, and any employer matches, back to your income even though they’ll be deducted from your taxable income.

For example, let’s say that you contributed $10,500 to your company 401(k) and your annual take-home pay was $59,500. In this case, you’d add those two numbers together to calculate an annual net income of $70,000. Then you’d divide $10,500 by $70,000 to find a 15% savings rate ($10,500 / $70,000 = .15).

How to Improve Your Savings Rate

Don’t pressure yourself to increase your savings rate by 25% or 50% overnight. Even bumping up your rate by just 1% or 2% can make a big difference over the long haul. Here are a few strategies to help you squeeze more savings out of your income.

1. Start budgeting

It’s hard to increase your savings rate without a plan. That’s why budgeting is such an important skill to master if you’re looking to take control of your finances.

Once you create a budget and start tracking your costs, you may quickly identify expenses that could be trimmed. Just dining out less per month or canceling subscriptions you no longer use could help you increase your savings rate by a few percentage points.

Building a budget doesn’t have to be difficult or time-consuming. There are many online budgeting tools and apps available today that make it easy to build and manage a budget with minimal effort. Check out our full list of favorites.

2. Pay off or refinance high-interest debt

The average credit card today carries an interest rate of around 14.58% APR (annual percentage rate). And it’s not unusual for cards to charge APR rates of well over 20%. If you have a lot of credit card debt (or other high-interest debt), you significantly improve your savings rate by just eliminating all of those expensive interest charges from your life.

If you can pay your debts off quickly, then you should probably just knock them out. But for payoff timetables longer than a few months, you may want to consider applying for a 0% balance transfer card or a debt consolidation loan if you can qualify for a lower interest rate.

3. Maximize your employer match

If your employer is willing to match a percentage of your 410(k) contributions, you need to do whatever you can to maximize that available match. By doing so, you could get an extra 50% to 100% of savings out of every dollar you put away.

For example, let’s say that you make $60,000 and your employer is willing to match your dollar-for-dollar contributions up to $5,000. Without the match, hitting that $5,000 mark would equal a savings rate of around 8% ($5,000 / $60,000 = 0.083).

But with the match, you’d actually be saving $10,000 per year. For the most accurate savings rate calculation, you’d need to add that $5,000 of employer contributions to your income as well. But even after doing so, your savings rate would nearly double to just over 15% ($10,000 / $65,000 = 0.153).

4. Increase your income

When I first married my wife, she wasn’t working and we learned to live off my income alone. When she got a job about a year into our marriage, we resisted the urge to raise our standard of living and saved 100% of her income instead. Just like that, our savings rate skyrocketed overnight.

Our story illustrates an important point. One of the best ways to increase your savings rate is to add an extra income stream or two while keeping your expenses the same.

Starting a side hustle could be a great way to boost your monthly income. From food delivery to tutoring to freelance writing, there are all kinds of flexible ways to make money on the side. Check out our 75 top side hustle ideas.

5. Use automatic savings tools

Sometimes the best savings plan is one that you don’t have to think about. There are lots of great tools out there that can help you save money automatically.

The simplest option would be to set up regular automatic transfers from your checking account to your savings account inside your bank’s online portal. But there are more sophisticated options as well. For example, Empower can analyze your income and spending habits and can automatically move the perfect amount of left-over funds into savings.

Other tools like Stash and Acorns can automatically round up all your credit card transactions to the nearest dollar. And you can choose to deposit these round-ups in cash accounts or invest them in stocks and funds.

With the right tools, you may be able to increase your savings rate by 2% to 5% with very minimal effort.

Learn More: