Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Keeping a functioning budget is critically important to financial health and a lot of apps have been created to help you automate the process. CountAbout is a relatively new all-around personal finance tool that imports data directly from both Quicken and Mint.

It has some interesting features that make it helpful for personal budgeting, investment management, and even simple business or group budgeting. Here’s what you can find with CountAbout and what sets it apart from the crowd.

Countabout Features

CountAbout offers some interesting features. Some of them are pretty standard for online money management software. Others are unique.

Standard features include the ability to automatically download your transactions from many financial institutions, budgeting features, custom income and spending categories and tags, financial reports, and apps for both Android and iOS.

Some of the software’s unique features include:

- Data imports directly from Quicken and Mint

- Widgets that let you customize your view and get at-a-glance data on your finances

- Running balances that include uncleared transactions

- An ad-free interface

- Recurring transactions

Simple User Interface

I personally am a fan of Mint’s user interface. However, it has gotten more cluttered recently with ads. The CountAbout interface is much cleaner but also less fancy. It’s fairly intuitive, though, The interface includes several tabs across the top–Transactions, Budgets, Reports, Recurring, and Invoices.

Under Transactions, you’ll find any transactions automatically imported from your bank. Or you can add transactions on your own manually. If you prefer to do things this way, you don’t have to import your transactions at all. You’ll add transactions that you can then categorize, which will also let you track your budgets for various categories.

Under Budgets, you can set up budgets for various categories. This section is interesting, as you can view your budget annually.

Under Reports, you can find some standard reports, including reports on your accounts, categories, and tags. You can export these reports into a CSV if you need to store the data elsewhere.

The Recurring section allows you to add transactions that take place each month. If you’re manually tracking your transactions, this can be a simple way to save some time rather than inputting these transactions each month.

Investments

The Investment page is available to Premium subscribers only. There you can maintain a list of all investment holdings at institutions that provide holdings data through CountAbout’s data provider. (Note: the feature does not include the ability to manually add investment transactions, nor is there a plan to include it.)

The Investments page provides a ready list of the securities held in your portfolio, as well as the market symbol, cost basis, market value, and gain/loss percentage. If you have multiple investment accounts, it’s a convenient way to keep all your investment holdings in one place.

CountAbout added an Invoice feature that can help small businesses, contractors, and freelancers better manage their billing of clients and customers. What makes the Invoice feature even more attractive is that you can transfer data to and from Quicken, Freshbooks, and Wave. That will help you to better integrate your business activity with your accounting software.

CountAbout Plan Pricing

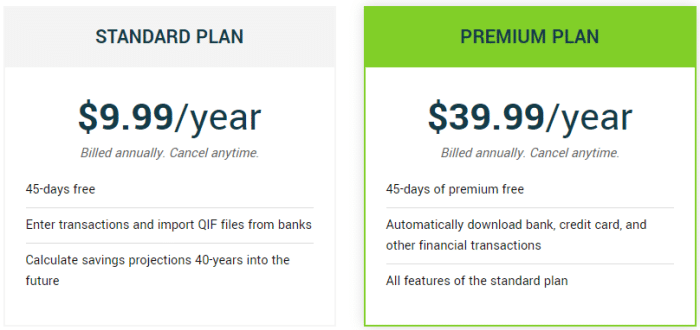

CountAbout offers two plans, both include a 45-day free trial to make sure you’re happy with the app. The standard plan does little; it will allow you to set up a budget the entries must come manually. This is a good place to start if you want to see what CountAbout can do for you but long-term, spending the extra $30 a year is a no-brainer.

The Premium Plan is what the vast majority of subscribers use and it will automatically download your bank data to place in your budgets and projections. When you compare the cost vs. other budget apps, just over $3 a month is on the low end. Very reasonable.

Inputting Budgets and Transactions in CountAbout

Before you start inputting a budget, you’ll want to mess with your category list. You can customize all of your category names, and you can use more or less than what CountAbout comes with.

It comes with a huge list of categories, including a large number of income options, and tons of different expenses categories. You can also click the edit button in this section to change the available categories.

Add more detail to your transactions with tags. So, for instance, you could have a transaction that falls into your Food & Dining category, but then include Fast Food, Fine Dining, and Grocery tags. Then at the end of the month, you could see how much you spent in each of these smaller categories without your budget having too many overarching categories.

Alternatively, you can also add transaction images. Simply snap a photo of your receipt or other documentation using your mobile device, then upload the image to the related transaction in CountAbout.

Once you get the categories settled, then you can create budgets. You create budgets each month for the whole year. So you could budget to spend $500 on groceries every month, but maybe you bump it up to $600 in November when you host Thanksgiving festivities.

It’s helpful to look at your budget on an annual basis, and many budgeting software doesn’t account for this type of budgeting. You can also budget for the expenses based on the year. So if you want to spend $2,000 on entertainment for the whole year, just put that into the Yearly box. Then it’ll automatically split out the amount evenly across all twelve months.

If you start with a history of categorized transactions in CountAbout, you can base your budgets on your historical transactions. That’s what the “Use History” button means. Of course, you need to have some data in the system for that to work! But once you do, it can be an interesting way to get a base for your budget, but then you can tweak the budget from there.

Each time you add a transaction, you’ll have to add it to a category. This ensures that it comes out of the right budget. If your transactions are automatically added, you can add a category to them as you approve them.

The transaction will ask you which account it comes from, what category it goes into, and what tags apply. And, of course, you’ll have to input the amount.

Once you input transactions, you can clear them by clicking into the account the transactions came out of. This interface will also let you see your balance, adjusted balance, and uncleared transactions. You can reconcile your accounts from this interface, as well.

Widgets

As I said, one of the interesting things CountAbout offers is widgets. These let you add some graphical or text-based elements to your interface. But instead of guessing what you care about, they let you completely customize the interface to reflect what’s most important to you.

So you can, for instance, put a chart of your account balance on your Transactions page. This will give you a historical representation of your account’s balance. If you sync your transactions, the balance will be up to date with what your bank account shows.

Pros and Cons of Countabout

Pros

- Simple user interface — If you’re overwhelmed by a lot of graphics and ads on your current budgeting software, this one might be the best option for your needs. It is very simple and streamlined

- Automatic downloading of transactions — Some people may be uncomfortable with this from a security perspective. But I much prefer it for my budgeting software, as it saves time versus entering every transaction manually. (Note that if your bank has multi-factor authentication, the sync may not work. I had trouble getting it to sync with Huntington National Bank, but I also have this issue with other personal finance software.)

- Customizability — The ability to customize your user interface, budgeting categories, and more means you can use this software exactly how you need to. This means it is applicable for both personal and business spending, which could be helpful.

- Ease of use — Because it’s pretty straightforward, CountAbout is also easy to figure out. You don’t have to jump through a lot of hoops to set up your accounts and budgets.

- Transferability — If you’re transferring from another popular budgeting software, especially Quicken or Mint, you can move your historical data over to CountAbout. This is a helpful option if you want to pull in your last few years’ worth of data.

Cons

- Simple user interface — If you like the bells and whistles that other personal finance software offers, you might not prefer the interface of CountAbout. This is really more of a personal preference than anything.

- Accounting focus — Being able to reconcile your accounts and clear transactions is helpful, especially if you’re a business. But if you’re looking for more of a streamlined “about what I spend each month” software, this one may not be the best option for your needs.

- Cost — CountAbout isn’t free, which is one of the reasons that it doesn’t include pesky ads all over the interface. The premium version, which includes the auto-sync option, is $39.99 per year. You can also get a basic version for $9.99 per year. You can try the software free for 45 days, though, so you can get a feel for it before you spend money.

- Lack of investing functions — CountAbout can sync with investing accounts. But it doesn’t have a lot of functions for this. There are definitely more robust options out there for tracking your investments.

Alternatives to CountAbout

Simplifi

Simplifi is a great alternative to CountAbout that allows you to input custom savings goals, see your future cash flow position, and provide a personalized budget based on your expenses and income. You can share your finances with a partner if you wish and set up financial alerts so you’re always aware of the money coming in and going out.

Pricing for Simplifi is comparable to CountAbout. The cost is just a month.

PocketSmith

PocketSmith is another personal finance software app that offers users an excellent set of features to help them prepare a monthly budget. PocketSmith focuses more on your future, providing annual projections to help guide you through your financial future.

Three plans are available and the higher up you go, the longer PocketSmith will offer projections. All three plans offer automatic bank fees and all offer email customer support with unlimited budgets. You can find the differences here:

| Plan Name | Monthly Cost | Projection Length | Dashboards |

| Foundation | $9.99 | 10 Years | 6 |

| Flourish | $16.66 | 30 Years | 18 |

| Fortune | $26.66 | 60 Years | Unlimited |

Who Is CountAbout For?

If you’re a detail-oriented person who likes keeping an annual budget with very detailed categories, CountAbout might be a good option for you. At $39 per year, the cost definitely isn’t prohibitive. If you prefer to enter your transactions manually, you can pay just under $10 a year for the basic version.

This software is also a viable option for small businesses or even organizations like your school’s PTA organization. If you’re responsible for managing money for organizations besides your own household, CountAbout includes some basic accounting and reporting functions that you could find very helpful.

Those who are less detail-oriented or need more basic functions can probably get by with free personal finance software. Or if your goal is more about tracking your investments versus tracking a detailed budget, you might try investing-centric software like PocketSmith instead.

CountAbout

Summary

CountAbout offers a simple user dashboard with excellent features and an easy-to-integrate budget. With a low monthly fee, CountAbout is a great financial tool to use.