Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Today’s budgeting tools make managing your money easy. While some are free, others have so much more to offer if you’re willing to pay a small fee. Quicken and Mint are great examples. Let’s look at which one is best for your budget.

Today, there are many choices for personal finance software.

Quicken and Mint are two of the most popular budgeting software systems available. While they’re similar apps, each has its own specializations. And perhaps the biggest difference between the two is that while Quicken is a paid service, Mint is completely free.

Does that make Mint the better of the two systems? Not necessarily. Quicken offers more services than Mint, which may more than justify the fee you’re paying for the service.

Or not.

Let’s look at the two side-by-side–Quicken vs. Mint–and see how they stack up against each other.

What Quicken & Mint Both Offer

The basic features of both platforms are very similar. Each provides budgeting, enabling you to know how and where your money is being spent. They do this by enabling you to link your various financial accounts–bank accounts, loans, credit cards, investment accounts, etc.–and automatically import transactions. This enables you to synchronize your entire financial life on one platform.

Each works on multi-devices. You can set up either account on your laptop but also access it from your smartphone or other device.

Both also provide you with access to your credit score, as well as regular email or text updates, keeping you informed of the latest developments and trends in your finances.

Quicken Features

Quicken’s main strength is that it’s one of the most comprehensive personal financial apps available. In fact, it covers the gamut of personal financial activities, minimizing dependence on other apps to provide supplemental services.

One of the major advantages Quicken provides is that your information is stored on your own computer, rather than on Quicken itself, or the cloud. Yes, storing data on the cloud is becoming more common. But being able to store the information on your own computer eliminates the security risks associated with cloud storage.

Quicken has four separate packages available, each with its own services. Some of the major services offered include:

Quicken Bill Pay

Pay any bill directly from any checking account included on the platform. The service is available only on the Premier and Home & Business plans.

Track the Market Value of Your Home

Enter your home address, and Quicken will continually update the estimated market value of your home. Once again, this feature is available only on the Premier and Home & Business plans.

Quicken Investment Features

On the Premier and Home & Business plans you can:

- Track loans, investments, and retirement accounts

- Evaluate your investments with Morningstars Portfolio X-ray tool

- Compare buy-and-hold options with improved portfolio analysis

- See how your returns compare to market averages

- Track investment cost basis and create Schedule D tax reports

- Make better buy/sell decisions with market comparisons

Business & Property Management Features

These are available only with the Home & Business edition, and include:

- Categorize and separate personal and business expenses

- Track your business profit loss and tax deductions

- Run Schedules C and E reports to simplify tax time

- Create and email custom invoices and estimates

- Manage lease terms, rental rates and security deposits

- Track outstanding and paid rents

- Add payment links directly to invoices

- Save rental documents directly to the app

Credit Score

Your credit score is provided by Equifax. The score provided is the VantageScore, and is not your actual FICO score (this is a common practice with free credit score providers). The negative to the service is that your score is only updated quarterly (most credit score services report on at least a monthly basis).

TurboTax Tie-in

You can export your Quicken data directly into TurboTax for tax preparation.

Mint Features

Mint is an online personal finance app that brings all your financial information together on one platform. You link your various financial accounts to Mint, and each time you visit the site the information is automatically updated. It provides a snapshot of your financial information, including graphs and charts that offer visual presentations.

Features offered by Mint include:

Track Bills

Mint enables you to keep all your bills organized on the platform. That includes regular payments, like rent, utilities and loan payments, as well as variable expenses like paying the babysitter. The app will indicate both the due date and the payment amount. You can also get bill reminders, to let you know what’s due, how much and when. Bill reminders can be sent to your mobile phone.

The service also provides alerts letting you know when your funds are getting low, or if there is any unusual or suspicious activity in your accounts. The app will even let you know how much money you’re spending on fees, such as ATM fees.

Investment Tracking

Mint enables you to include taxable brokerage accounts, mutual funds, IRAs and 401(k) accounts. You can even compare your own account performances to various market benchmarks to see how well you’re doing. They also have a fee analyzer service, that displays fees being paid to investment advisors, brokerages, and even 401(k) providers. They’ll identify the ones considered unnecessary, to maximize the return on your investment.

Credit Score Access

Mint provides your credit score from TransUnion. They will also provide you with information telling you how your score is calculated, and how you can improve it. You’ll get credit alerts whenever TransUnion receives new credit information from creditors.

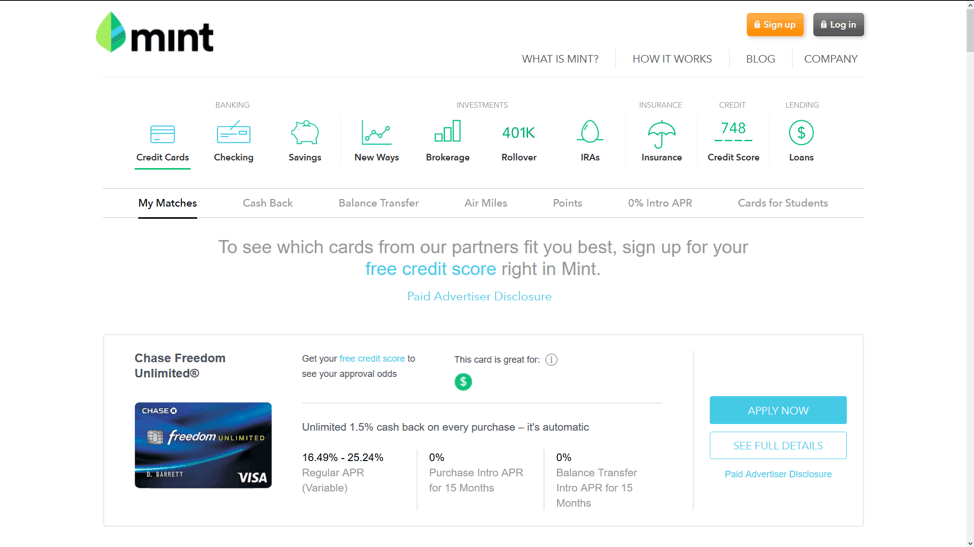

Mint Find Savings

Through this feature, Mint enables you to find better deals on a wide variety of service providers. They can help you find better deals with bank accounts, credit cards, brokerages, retirement plans, insurance, and loans.

Based on your financial situation, they’ll make recommendations of specific providers under each category. This enables you to compare the various offers available to you, allowing you to select the one that works best. The offers are quite extensive, giving you the widest possible choice of provider options.

Budgeting

Quicken

Quicken offers budgeting on all four plans. You can create a budget to track your spending, categorize your expenses automatically, and easily export your data directly to Excel. All your bank and credit card accounts are available on the same platform.

The app sets up a realistic household budget, which is based on your spending history. You can customize spending goals, making it easier to pay bills and plan for the future. The platform forecasts your balances, provides you with reminders to pay bills, and keeps you informed of how much money you have available in your accounts.

Mint

Mint bases budgeting on your average spending per category. This enables you to create a budget based on spending patterns. You can track your spending from month-to-month, or from year-to-year. They will automatically suggest a budget, based on your spending, but you can make adjustments along the way.

Mint provides default categories for your spending accounts, but you can rename them, or even recategorize them in ways that work best for you.

The platform allows you to plan for one-time expenses, as well as recurring monthly expenses. You can also do projections to see how much money you’ll save by cutting back on a particular spending category.

Budget Winner: Quicken for having more features like the ability to export data, bill pay reminders and balance forecasting.

Synchronization

Quicken

Quicken synchronizes with more than 14,500 participating financial institutions. Account information automatically populates, but can also be entered manually.

Mint

Mint allows synchronization with linked financial accounts, but you can also enter the information manually. As a free service, its automatic synchronization is not always entirely effective.

Synchronization Winner: Quicken

Pricing

Quicken

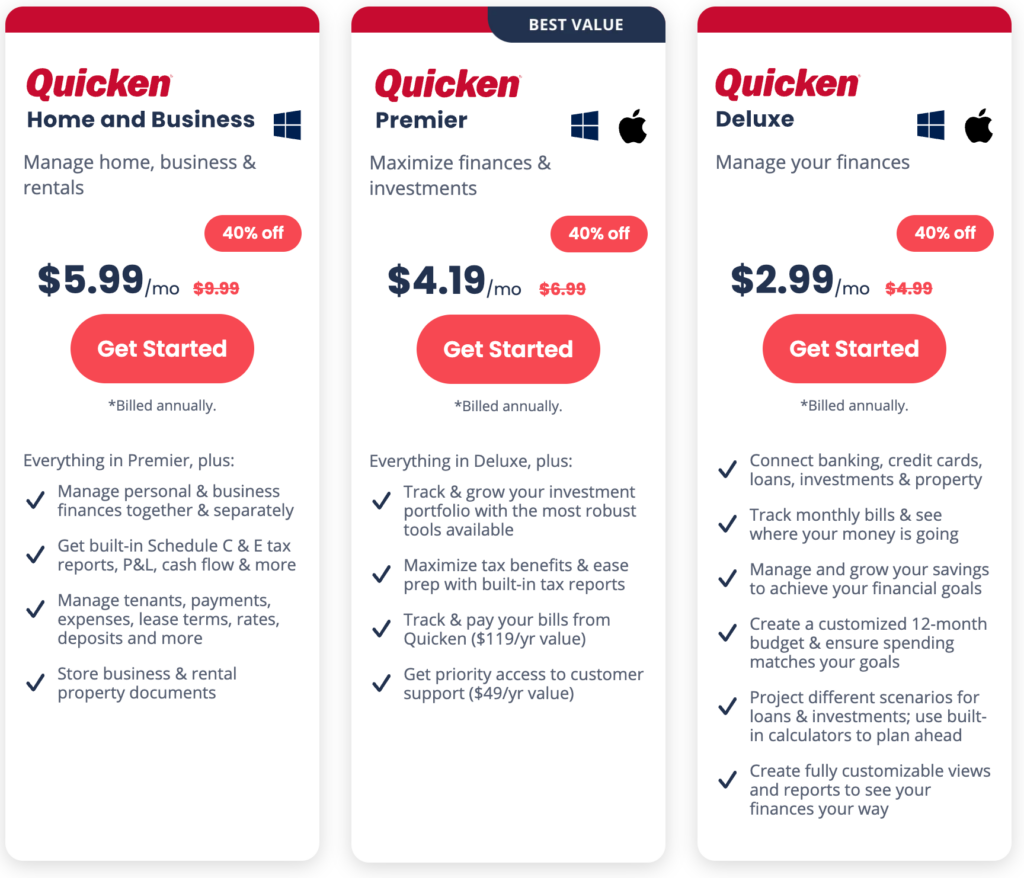

Quicken offers four different packages, each with its own pricing structure. The packages and pricing, as well as the specific features they offer, are as follows:

Quicken also provides a 30-day money-back guarantee if you are not satisfied with the product. You also have the option to change your plan at any time.

Mint

Mint is free to use, and it doesn’t offer various tiered plan levels. But in case you’re wondering how the site has gotten so popular without charging fees, there is an explanation. Much like Credit Karma, Mint makes its income from third-party vendor advertising on the site.

This takes place through the Find Savings service. If you sign up for one of the products or services offered on the site, Mint will receive a small fee for connecting you with the service provider. There is no additional charge to you by the service provider, so the entire Mint income process is completely invisible and even irrelevant to the user.

Pricing Winner: Mint, because it’s hard to beat free!

Customer Service & Education

Quicken

Quicken offers live chat through an app called My Pure Cloud. They do not offer phone support.

They provide a FAQ page, a Common Help Topics page (under the Learn & Support tab), as well as the Quicken Community, where users come to talk about app-related issues. These pages can help you learn to optimize your use of the Quicken platform.

They also offer a Money Management Tips page, with personal finance-related topics, including how to save money, how to stop living from paycheck to paycheck, teaching your children how to save and spend wisely, and much more.

Mint

Mint offers customer service through either email or live chat, which is available seven days a week, from 5:00 AM to 9:00 PM, Pacific time. Mint Help is also available with a limited number of topics, generally related to the operation of the platform.

Mint doesn’t offer the variety of educational resources that you can find on Quicken, but then it’s a completely free app to use.

Customer Service Winner: Mint

Security

Quicken

Quicken protects your information with the following processes:

- 256-bit encryption

- Integrity checks to ensure that a message received has not been altered after it leaves the sender

- Firewall-protected servers in the Quicken data center

- Password issued by your financial institution that you must enter each time you connect to the Internet

- Option to password protect your data files

- Information is transmitted using encrypted, secure socket layer (SSL) technology

Mint

Mint uses the following security measures to protect your information:

- Multi-factor authentication, requiring special security questions or a code supplied either by email or text

- Four-digit code to view your information

- Security screenings with VeriSign to ensure security for the transfer of sensitive data

- Information in read-only fashion (Mint has no control over any of the accounts displayed in your app.)

- Option to set up your account with TouchID

Security Winner: It’s a tie. It’s clear both Quicken and Mint value your security.

Mobile Access

Quicken

Quickens mobile app is available for iPhone, iPad or Android devices. It is available at the App Store and Google Play. The mobile app offers all the features of the desktop version. You can use your mobile device to snap a picture of your receipts. The app provides alerts and notifications for account changes.

Mint

Mint Mobile is available for iPhone, iPad, Android mobile devices, and Android tablets. The app can be downloaded at the App Store and Google Play. Mint is also available for Apple Watch.

Mobile Access Winner: It’s a tie, though Mint has better reviews. However, that could also be because Mint is a free platform.

Summary

At the core, both Quicken and Mint are budgeting apps. But it really comes down to the specific features each offers, and which you as a consumer are interested in having.

Quicken certainly offers more services, but you also have to pay an annual service charge in order to have them. Mint works well as a basic budgeting software plan, but it does lack certain basic features you might expect in that type of platform. Perhaps the most glaring absence is the bill pay feature, which ended in June 2018.

Bottom Line Mint or Quicken?

If you’re looking for a free, no-frills budgeting app, Mint is the better of the two platforms. In fact, if it comes down between Mint and the Quicken Starter version–at $34.99–you’ll probably be better off going with Mint. Both are basic budgeting packages, and neither offers bill-paying services.

If you’re looking for a personal financial platform that includes your investing activities, Mint is very limited in this regard and will provide no more than basic services. Quicken Premier or Home & Business provides the Morningstar Portfolio X-ray tool, as well as improved portfolio analysis, and the ability to track cost basis and create Schedule D tax reports.

If you need a platform for investment management and tracking, we suggest Empower. The free version analyzes your financial situation and includes helpful tools like an investment check-up and a mobile app. You’ll even get a free consultation from a licensed financial advisor. Find out more in our Empower review.

Quicken Premiers’ home market value tracking feature is interesting, but the information comes from Zillow, which you can easily access without the app.

The business and property management features, available on Quicken’s Home & Business version are highly specialized for those who are self-employed, and particularly for investment property owners. If either applies to you, the $89.99 annual fee for the service is an excellent investment.

Quicken also has the advantage of deeper educational resources, as well as the ability to export financial information to TurboTax at tax time.

On balance, Quicken is the better of the two services by a wide margin, particularly on the premium versions. But if all you’re looking for is basic budgeting, and the other Quicken features don’t interest you, Mint will certainly get the job done for you and will do it completely free.