Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Capital One Bank Review (2023)

Established in 1933, Capital One Bank has its main office at 1680 Capital One Dr, Mclean, VA 22102. The OCC provides primary supervision over the institution.

Snapshot

| Bank Details | |

|---|---|

| Website | www.capitalone.com |

| Founded | 05/22/1933 |

| Branches | 272 |

| FDIC Cert # | 4297 |

| Total Assets | $475.63 billion |

| Total Deposits | $374.16 billion |

Rates

Here are the rates for the accounts we track for Capital One Bank. While we work hard to keep rates and other information current, you should confirm rates and terms with the bank or credit union before opening an account.

Savings Accounts

Certificates of Deposit

Capital One Bank, formerly ING Direct and Capital One 360, offers a range of banking products. These deposit accounts generally offer competitive interest rates with no monthly fees. In this Capital One Bank review, we’ll cover these accounts and the current yields. We’ll also look at account minimums and features, and see how CapOne compares to other online banks.

Capital One Savings Accounts

Capital One offers several different types of savings accounts. In addition to a standard account, called 360 Performance Savings, the bank also offers savings accounts for kids and for retirement savings in an IRA.

360 Performance Savings

Let’s first look at the terms of the 360 Performance Savings account:

- Interest Rate: 2.00%

- Monthly Fee: $0

- Minimum Deposit: $0

- FDIC Insured: Yes

It’s important to keep in mind that 360 Performance Savings accounts do not come with debit cards, ATM cards or checks.

Kids Savings Account

I’m always skeptical about financial products aimed at children. That’s particularly true for a savings account. What makes it any different than any other savings account. And in the case of Capital One, its Kids Savings Account pays just 0.50% APY, much lower than the 360 Performance Savings. Why and what makes this account unique for children?

Frankly, not much. Yes, it doesn’t come with fees or minimums, but neither does the 360 Performance Savings account. It does allow parents to link their child’s account to their account. This makes transfers for allowance easy. And you can set up savings goals, which is a useful feature. But is it worth a rate that’s a full 100 basis points lower?

For small amounts of money where the interest rate won’t make much difference, this account works well for a child. It’s not, however, the place to park larger amounts of cash for a child.

Note that when a child turns 18, their account is automatically converted into a 360 Savings account.

360 IRA Savings

Capital One offers both a traditional and Roth IRA Savings Account. Like the Kids Savings Account, however, it pays significantly less than the 360 Performance Savings Account.

It doesn’t charge fees or require minimums. And if you have other accounts and Capital One, it’s convenient to have IRA accounts at the same financial institution. Yet the rate is well below what you can get at other banks.

Related: See our list of the best online savings accounts.

Capital One Checking Accounts

Capital One offers one of the best checking accounts available today–360 Checking. It also offers an excellent account for children. We’ve used both for years.

Capital One 360 Checking

We’ve had a 360 Checking account for years. While we don’t use it as our primary checking account, it’s been an easy way to transfer money back and forth with our daughter (see the Money account below).

Here are the details:

- Interest Rate: 0.10% (all tiers)

- Fees: No hidden fees or minimums as you earn interest on your everyday money

- ATMs: 39,000 fee-free Allpoint® ATMAutomatic Teller Machines and 2,000 Capital One® ATMs

- Debit Card: Free MasterCard® Debit Card for all purchases

- Credit Pull: According to Capital One 360, they do a “soft” pull (won’t affect your credit score) when you apply for a checking account. However, they do a “hard” pull (may affect your credit score) if you apply for an overdraft line of credit.

- Direct Deposit: Yes

- Minimum Deposit Requirement: There are no minimum balance requirements

- Availability: All 50 states

- Mobile Deposit: Yes

- Online Bill Pay: Yes

I’ve found both the website and mobile app to be extremely easy to use. And while they have bank branches near our home, I’ve never had to go into one.

MONEY Teen Checking

We opened MONEY accounts for both of our children in high school. The account proved to be a convenient way to give them an allowance. And our daughter used it to get her direct deposit paycheck when she worked at a Hallmark store.

The account earns the same 0.20% interest rate as the 360 Checking. It has no minimum deposit requirement or monthly fees. And it’s linked to the parents’ account for easy access and control. It also comes with a free debit card for both ATM withdraws and as a purchase option online or in stores.

Children as young as 8 years old can have an account. Once they turn 18, they can convert it to a 360 Checking account if they want to. Bot of our children, now in their mid-20s, still have the MONEY account!

Capital One 360 CDs

Capital One offers certificates of deposit with terms ranging from 6 to 60 months. Given the crazy interest rate environment we are in, however, it makes no sense to invest in a CD unless you think rates will go down even further. Here’s why.

They highest current rate at Capital One is 1.50% for 12 and 18 month CDs. The rate goes down for longer-term CDs, which is not normally the case. In a “normal” rate environment, CD yields rise as the term lengthens.

Unless you think rates will fall even lower, there’s no reason to lock in your money for a rate you can earn on a savings account.

Capital One does charge a penalty for early withdrawal of a CD. For CDs of 12 months or less, the penalty for early withdrawal is 3 months of interest. The penalty rises to 6 months of interest for longer CDs. Also, keep in mind that you cannot make a partial withdrawal of CD funds–it’s all or nothing.

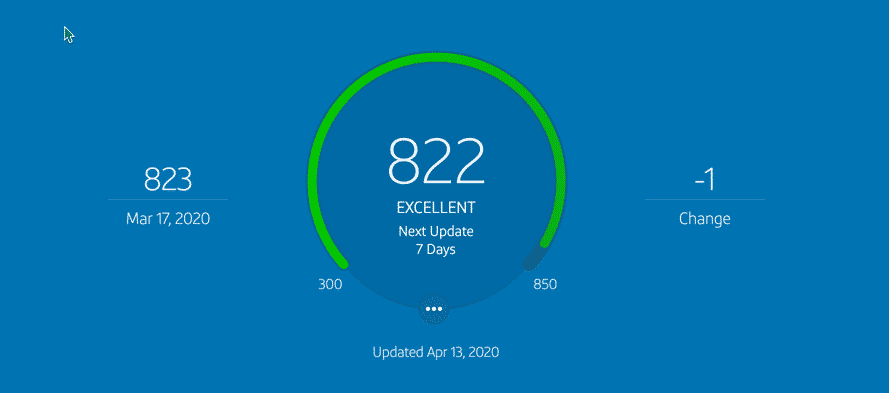

Capital One CreditWise

With Capital One you also get free access to your VantageScore 3.0 credit score. Called CreditWise, you’ll see the factors that are both helping and hurting your score. Capital One also gives you personalized suggestions on how to improve your credit score.

CreditWise also comes with a simulator. You can, for example, see how making 6 months of on-time payments or increasing your credit limit, for example, affect your score. You get access to your TransUnion credit report, identity alerts and a list of activities that could affect your credit score.

Refer-a-Friend

360 Performance Savings account: Capital One pays you when you refer a friend or family member. The current payout is $20 per referral, up to a total of $1,000. In addition, the friend you refer can get up to $100 in bonuses from CapOne.

360 Checking Account: In addition to the $20 referral fee you can earn, the friend you refer can get a bonus of $25 if qualifying transactions are met.

Capital One FAQs

Is Capital One Bank an online bank?

Yes and no. It is an online bank available throughout the U.S. Unlike most online banks, however, it does have physical branches in multiple states.

Where does Capital One Bank have branches

It currently has physical branches in Washington DC, Connecticut, Delaware, Louisiana, Maryland, New Jersey, New York, Texas and Virginia

Is Capital One Bank safe?

Yes. It’s bank accounts are insured by the FDIC. And it offers online fraud reporting, locking of debit cards, real-time alerts, and secure log in.

Is Capital One Bank FDIC insured?

Yes. Capital One was established in 1933. It’s headquartered in McLean, VA and is an active member of the FDIC (#4297)

Capital One Bank

Summary

Capital One combines both a traditional brink and mortar bank and the online Capital One 360. It offers competitive rates with low fees, and it’s website and mobile apps are easy to use.