Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

American Express Bank Rates

Established in 1989, American Express Bank has its main office at 115 W Towne Ridge Pkwy, Sandy, UT 84070. The OCC provides primary supervision over the institution.

Snapshot

| Bank Details | |

|---|---|

| Website | www.americanexpress.com |

| Founded | 03/20/1989 |

| Branches | 1 |

| FDIC Cert # | 27471 |

| Total Assets | $192.15 billion |

| Total Deposits | $146.51 billion |

Rates

Here are the rates for the accounts we track for American Express Bank. While we work hard to keep rates and other information current, you should confirm rates and terms with the bank or credit union before opening an account.

Certificates of Deposit

Savings Accounts

Checking Accounts

American Express Bank Overview

American Express National Bank is a member of the American Express family of companies and provides a range of financial services to its customers. The bank is headquartered in Salt Lake City, Utah, and is FDIC-insured up to the maximum allowed by law.

The bank offers a savings account, checking account, and multiple CD terms. These accounts offer a competitive interest rate. The bank does not charge any monthly maintenance fees and accounts can be opened online or over the phone. There is no minimum deposit required to open an account. American Express National Bank also offers personal loans and business checking accounts.

Overall, American Express National Bank offers a range of financial products and services that can be useful for customers who are looking to save money, earn rewards, or manage their finances more effectively. The bank’s high-yield savings accounts and CDs offer competitive interest rates and FDIC-insured protection, while its credit cards provide a excellent rewards and benefits. The bank’s personal loans offer fixed interest rates and flexible repayment terms, while its online and mobile banking features provide customers with easy access to their accounts and a range of tools to help them manage their finances.

Compare American Express Bank Rates

Featured Savings Accounts from Our Partners

Bank/Credit Union

Min. Deposit

APY

Learn More

4.57%

%

4.55%

American Express Bank Review

Amex entered banking years ago. Today, they offer great rates with low fees. Check out our take in this American Express savings account review.

Amex offers a solid interest rate on its savings account, although you can do better. You’ll find our database of savings accounts ordered by APY here.

I opened an account to find out.

First of all, if the bulk of your savings is earning less than 0.5% Annual Percentage Yield (APY), it’s time to change. There is usually no excuse for settling for interest rates that low. It’s simple and easy to double or triple the interest you receive in your account every month. Granted, this might not add up to a lot of money. But high-yield savings accounts help to ensure your cash will at least hold its value when up against inflation. Your money loses value over time when sitting in a low-interest or no-interest account.

Application process

After visiting the American Express website, I was impressed with the application process. The first step is entering your personal information. If you have an American Express savings account currently, you can easily link your current account to the application.

As I do not have a savings account with AMEX, I entered my personal information. Following this, I entered the amount I intended to deposit from my external bank account. There is no minimum deposit required to open, and I decided to start with $500. While there is an option to send a check, I chose to pull the funds from an existing bank account via an electronic transfer (ACH). After confirming my personal information and deposit amount, I agreed to the standard terms of service and entered my external banking information (routing number and account number). I chose to link this account to my personal Wells Fargo brick-and-mortar checking account.

The strength of American Express, in this first impression, is the bank’s professional appearance. Each step through this process, the bank’s website was very helpful in letting me know what to expect and when to expect it. When I confirmed my external banking information, it was clear that I would need to verify two test deposits into my newly-linked Wells Fargo account. I immediately received an email with instructions for verifying the test deposits, and I received a welcome kit in the mail in days. It took three days, from Friday to Monday, for the deposits to hit my Wells Fargo account.

Verifying deposits

After the weekend, I checked my Wells Fargo account and saw two small test deposits from American Express. Once again, AmEx outlined the process clearly, as you can see from the image here. To finalize the link between my new American Express account and my existing checking account at Wells Fargo, the bank required me to enter my email address, a verification code that was sent to me via email, and the amounts of the two test deposits.

After the confirmation, American Express allowed me to create an online user identity for viewing statements and otherwise operating my new bank account. User names for the American Express Personal Savings Account require at least two numerals, so I was unfortunately forced to use a non-standard user ID. For the first time, I chose to receive online statements in lieu of paper statements. This is a trend I want to continue; I receive too much paper in the mail, and electronic states — when chosen without paper statements — will help reduce my clutter, as well as on a small scale, help the environment.

Using my American Express Personal Savings Account

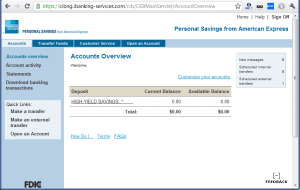

As of today, I am waiting for my initial deposit to reach my new American Express savings account. Although there is not much I can do, I am able to look at all the features contained in the website and get a feel for its operation. My first order of business was customizing the account names. I also looked at the options for downloading activity into applications like Quicken. American Express supports Quicken through the “Web Connect” service as well as Microsoft Money. There are options for QIF and CSV downloads, too.

There are not many different things you can do with this savings account. Although the bank recently lowered the interest rate offered on these accounts, the rates are still comparatively high. The deposits at American Express are fully insured by FDIC, which means there is no risk in depositing your money up to the FDIC maximum, currently $250,000 for an individual savings account. American Express does not currently offer a checking, bill-payment, or other “transactional” account, so this type of service is fine for letting the cash you need to sit and grow, losing as little value to inflation as possible in a savings account.