Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

There are plenty of budgeting services and apps to choose from. One well worth considering is PocketGuard. It’s an app that tracks your spending, helps you budget for expenses, and allocates money for savings.

It doesn’t promise to make you rich but can give you greater control over your finances. And that’s the first step forward with all things financial.

What is PocketGuard?

PocketGuard is a personal finance information management service designed to help you track your spending, create a budget, and lower expenses. It can also monitor for potentially unwanted and unauthorized charges, such as hidden fees, billing errors, forgotten subscriptions, scams, and fraud.

PocketGuard is an app available for download at the App Store and Google Play. It is available only in the U.S. and Canada, though they plan to expand internationally.

PocketGuard works in five steps:

- See the big picture. You link your bank accounts, credit cards, investments, and loan accounts to assemble your entire financial life on the app.

- Be aware of your spending. Transactions are updated and characterized in real-time, allowing you to see where your money goes and how you can save.

- Know what’s safe to spend. This is the “pocket” part of PocketGuard. It lets you know how much money is left over after you’ve paid all your bills and set some aside for savings.

- Put your budget on autopilot. The app automatically builds a personalized budget based on your income, expenses, and the goals you create.

- Discover simple ways to save. The app helps you save money by negotiating lower bills and finding high-interest savings accounts.

PocketGuard has the following third-party and user ratings:

- Better Business Bureau: Not rated

- Trustpilot: 4.3 out of 5 stars (“Excellent”) based on nine reviews

- The App Store: 4.6 out of 5 stars based on 6,900 reviews

- Google Play: 3.6 out of 5 stars based on 2,030 reviews

PocketGuard Features and Benefits

Budgeting

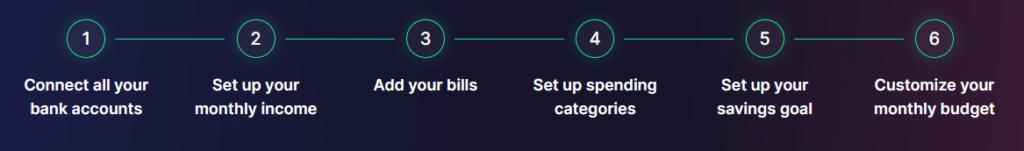

PocketGuard starts the budgeting process by enabling you to connect all your bank accounts, as well as your monthly income and bills, to the app.

You can then set spending categories and savings goals and customize your budget. In the future, you’ll be notified whenever you spend 50% or 75% of your budget or go over it. That feature is designed to prevent you from exceeding your budget and running out of money.

For example, if any of those methods work for you, you can customize your budget by implementing the 50-30-20 rule, zero-based, or envelope method.

Budget categorization

PocketGuard allows you to create unlimited spending categories. You can group expenses by adding #hashtags to make the process automatic. There is even a budget tracker to see exactly where your money is going.

Bill payment tracker

This feature helps you manage subscriptions and pay your bills on time to avoid late fees. It does this by monitoring your bills and subscriptions and providing automatic reminders before each is due. PocketGuard is also capable of automatically negotiating your regular bills to lower them.

Fraud detection

PocketGuard comes with personal anti-fraud detection. It’s an algorithm that detects potential fraud and notifies you so you can contact your bank. You can create your blacklist to prevent repeated fraud attempts from the same sources.

Spending insights

PocketGuard provides visual aids, like pie charts, bar graphs, and merchant pie charts, so you can see exactly where you’re spending – and sometimes overspending – within your budget. As you gain greater insight into your spending habits, you can make adjustments to stay within your budget.

Debt payoff plan

One of the primary goals of adopting a budget is to become debt-free, and PocketGuard can help you reach that goal. It does this by helping you establish a concise debt payoff plan. That means incorporating the payoff within your overall budget strategy. PocketGuard will give you the option of various debt paydown plans, including the avalanche and snowball methods. The app algorithm will calculate the most efficient debt payoff strategy.

Savings goals

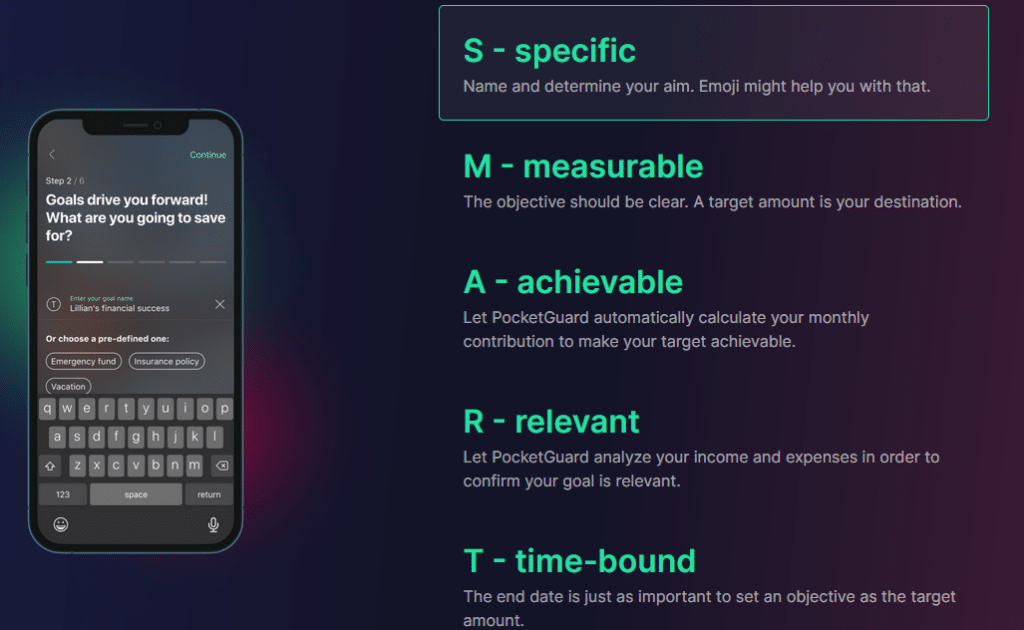

PocketGuard uses a question-and-answer format to help you establish savings goals. You can run scenarios where you ask if saving a certain amount of money each month will enable you to reach a savings goal and how long it will take. You’ll then receive the necessary tools to help you reach your goal.

PocketGuard uses the SMART method to help you define and achieve your goals.

In My Pocket

Once you’ve entered your recurring expenses and income items and set your savings goal, this feature uses an algorithm to calculate based on all three inputs. It will then let you know what you have left over each day for spending. In other words, it first commits funds to your necessary expenses and savings and then gives you free access to what’s left over.

In My Pocket uses the following formula to calculate your free cash:

- Income – Bills – Savings Goal – Ongoing Spending = In My Pocket

Calculators

PocketGuard provides a budget calculator and a debt payoff calculator to help you establish your budget and set up a debt payoff plan. With a few steps, you can enter information, such as your estimated income, monthly bills, debt payments, and other financial information, to see the numbers in your budget.

The debt calculator enables you to run various “what if” scenarios to determine how quickly you can pay off a debt by making additional payments or using other strategies.

Lower your bills

PocketGuard partners with BillShark to help you save hundreds of dollars yearly on bill payments. The company claims an 80% success rate, with an average yearly savings exceeding $650. BillShark does this by negotiating with your vendors to lower your bills. This strategy is often recommended on financial blogs, but many people don’t have the experience to do it successfully. BillShark can do it without your participation.

Signing Up for PocketGuard

You can sign up for PocketGuard on the website, The App Store, or Google Play. You’ll first be asked for your email address and then to create a personalized password.

Once you’ve opened your account, you’ll connect your bank accounts, credit cards, and other loan and investment accounts. As is typical with third-party financial management platforms and apps, you must provide your login credentials for each account you add to the app.

PocketGuard Pricing

PocketGuard can be downloaded for free. Although it may once have had a free version, the website does not refer to this, and it is not disclosed on Google Play or The App Store, where it can be downloaded.

PocketGuard Plus is the paid version, available at a monthly subscription rate of $12.99 or an annual subscription of $74.99, the monthly equivalent of $6.25.

Customer Support

Customer contact is available directly through the app or at [email protected]. Unfortunately, phone support is not an option.

Security

PocketGuard uses a 256-bit secure sockets layer to ensure all information and data transferred remains encrypted. Your login credentials are not stored on PocketGuards servers; they can never change your accounts.

PocketGuard Pros & Cons

Pros

- The ‘In My Pocket’ feature focuses on what you have available for free spending. Knowing that you have some free cash makes sticking to a budget easier.

- The Spending Limits tool will help you to stay within budget, alerting you when you’re close to going over.

- PocketGuard Plus allows you to track cash transactions. This is unique in the budgeting universe, where most competing apps track only what runs through financial institutions.

- Provides an anti-fraud feature to notify you of suspicious activity in your financial accounts.

Cons

- No phone support.

- PocketGuard uses your financial information to generate offers for financial services and products. That means ads and email solicitations.

- Does not support multiple currencies, as many competitors now do. Available only for users in the U.S. and Canada.

PocketGuard Alternatives

Empower

If you want to get serious about managing your money, we recommend Empower. This tool isn’t focused as much on budgeting as it is on building your wealth. With Empower, you can track your money, investments, and net worth all in one place. Be sure to review our list of top money management apps to find the one that best fits your needs.

Empower provides a free financial dashboard where you can enter and track all your financial accounts in one place. It also offers its Retirement Planner and Investment Checkup tools to help you better control your financial future. On a more immediate level, Empower Personal Cash is currently paying 4.70% APY on savings up to $5 million, with no fees. They also offer multiple investment programs, including investment accounts, managed portfolios, and a wealth management service.

YNAB

YNAB is one of the top budgeting apps in the industry. It’s available for a monthly fee of $14.99 or a single annual payment of $99, equivalent to just $8.33 monthly. YNAB uses a simple four-rule budgeting approach that ultimately leads to paying this month’s bills with last month’s money.

That will remove you from the paycheck-to-paycheck cycle and put you on the road to better control and even financial independence.

Buxfer

One of the major drawbacks of PocketGuard is that it doesn’t support currencies and accounts outside the U.S. and Canada. Buxfer is an excellent alternative if your financial situation does involve international financial activity. The app can accommodate more than 100 currencies in over 150 countries. It also provides forecasting, investment tracking, and retirement planning.

Buxfer has three different plans, each with its features and benefits.

- Plus is the basic plan, available at $4.99 per month or $3.99 per month for the annual plan.

- Pro is the mid-level plan, available at $5.99 per month or $4.99 monthly for the annual plan.

- The top offering is the Prime plan, available at $11.99 per month or $9.99 per month for the annual plan.

Some people prefer to manage their finances the same way they manage their schedules–with a calendar. If this sounds appealing, check out our list of the Best Calendar-based Personal Finance Apps.

Frequently Asked Questions (FAQ)

What are the cons of PocketGuard?

There aren’t many negatives associated with this financial app. There is a lack of live phone support, and your information could be sold to third parties. If you engage in international transactions or have financial accounts outside Canada and the U.S., PocketGuard cannot include those transactions and accounts. Otherwise, this is a pretty solid financial app.

Is PocketGuard a safe app?

PocketGuard uses industry-standard protocols to protect your information, including a 256-bit secure socket layer (SSL) to protect data transmission. In addition, PocketGuard cannot access funds in your accounts or make transfers.

Does PocketGuard sell my data?

Yes and no, but mostly yes. According to its privacy policy, PocketGuard does not provide your financial information to third-party sources. However, it does provide your information to third-party sources for marketing purposes.

Should You Sign Up for the PocketGuard App?

PocketGuard is a solid budgeting app. If you’ve been short each month and unable to save money, PocketGuard can help you reverse that trend. Remember, before you can hope to attain financial independence, you must first master financial control. PocketGuard is a step in that direction.

PocketGuard Plus is inexpensive as premium budgeting services go, at just $74.99 per year. It adds valuable services, particularly tracking cash income and expenses. Though most people work through financial institutions, debit, and credit cards, some still prefer cash. If you’re one of them and want a budgeting app to help you manage it, PocketGuard Plus is virtually alone in the budgeting software space.

PocketGuard

Summary

PocketGuard offers a variety of tools to help you get your finances in order. Create budgets, use calculators, and monitor your spending in real time.