Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

If you’ve been struggling to teach your children and teenagers about money, GoHenry is a resource that can help you do so. It covers everything from earning money to budgeting, saving, and spending. It’s all about learning by doing, perhaps the best way to learn any skill—especially money.

For a single low monthly fee, you can provide each child with an account and a debit card to help them learn to master money early in life. That will help them avoid the many pitfalls confronting young adults forced to learn about money in early adulthood.

GoHenry Features & Benefits

GoHenry is an app that helps families become more financially savvy, especially kids and teenagers. The app was created to help kids and teens learn about money in ways that better relate to them. Parents can use the app to monitor and assist with their kids’ financial habits.

The service began in 2012 and now has more than 2 million members.

GoHenry Debit Cards

These are at the core of the GoHenry app. The app and debit cards are designed for kids between six and 18. Each child in the family is given a debit card to teach him or her how to begin spending and managing money. Kids can choose from dozens of different debit card designs. Since it is a MasterCard, it can be used anywhere MasterCard is accepted.

Community Federal Savings Bank, an FDIC member bank in New York, issues debit cards.

The debit card acts like a kid’s bank account, ultimately teaching them how to be independent and smart with their money. This is done by giving them the ability to track their spending and to create budgets and savings goals the way they would as young adults. Parents can set real-time spending notifications to stay on top of developments as they occur.

Each debit card comes with zero liability protection by MasterCard and FDIC insurance on account balances up to $250,000. Cards have chip and PIN-protected transactions, secure PIN recovery, bank-level encryption, and the ability to block and unblock cards.

Allowance and Chores

Parents can set up a weekly allowance or even specific amounts for their children’s chores. The latter is designed to show kids the value of earning money. You can set a chore, a payment amount, then tick off when that chore has been completed.

Savings

GoHenry lets your child set savings goals with target dates and an optional autosave feature. Goals like car savings can be set for small purchases or larger goals. You can even set up parent-paid interest to provide an additional incentive for your child to save.

You can lock in a savings goal or unlock it as a parent. If you unlock the goal, your child can withdraw the funds for the intended purpose. The funds can then be spent through the debit card.

Additional Resource – The Best Bank Accounts for Kids

Parental Controls

Your child will have as much control over the debit card as you allow. Otherwise, you will receive real-time notifications of your child’s activity with the card. You can set spending limits and even choose where the card is used. As discussed earlier, parents can also lock and unlock savings.

Parental controls enable you to control the card as much or as little as possible. For example, you may maintain tight control for a young child just starting with the card, but as she gains experience and responsibility, you can relax those controls.

More specifically, you can block the app and the card from working with certain merchants (“merchant block”) or even block the card in the app if it is lost or stolen.

Money Missions

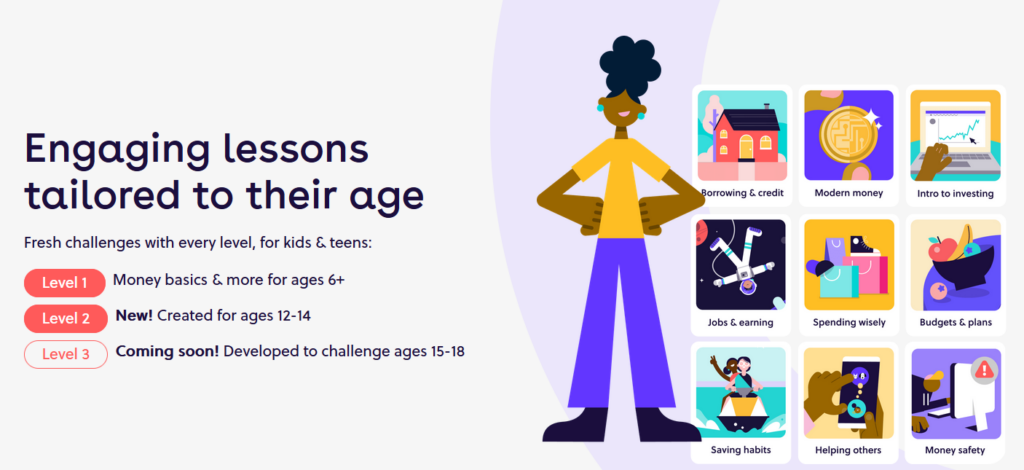

This is a unique feature of GoHenry. It’s designed to enhance the app’s educational aspect further. It allows parents to pay their children to learn more about money through lessons tailored to their age ranges.

They’ll start with Money Basics, which will help them learn the fundamentals of money, such as when it was invented and how banks and cards are used today. They will also learn about the basics of using bank accounts and the future of money.

From there, they’ll move on to other topic categories, like saving habits, budgets and plans, jobs and earning, spending wisely, and borrowing and credit. There’s even an intro to investing category that teaches kids how to make their money grow, including discussions of investing in stocks.

Giftlinks

GoHenry has added a feature that enables family and friends to participate in the app. Others can use the Giftlinks feature to send money to your child, complete with special notes explaining the nature of the gifts. The feature can also send congratulatory notes when your child has achieved a specific goal.

Gifts can be set up as special occasions or at regular intervals to help your child build savings. Because it’s done online, family and friends from anywhere in the country can send a gift to your child. They need to be provided with their login details, and they can set up payments anytime. Gift transfers are free, and parents will be notified when one has been sent.

Money Talk

This feature has been set up specifically for mom and dad. Since parents may be new to introducing money and finances to their kids, specific topics are set up to help parents learn the details.

Topics include discussions on allowances, chores, online money safety, money management, financial education, and news.

GoHenry Mobile App & Security

The GoHenry mobile app can be downloaded on Google Play for Android users and on The App Store for iOS devices (version 13.0 and later).

The app is rated 4.3 out of five stars among over 25,000 Android users on Google Play and 4.5 out of five stars among 8,700 iOS users on The App Store.

Account balances held with GoHenry are protected by FDIC insurance for up to $250,000 for each depositor.

GoHenry takes reasonable precautions to protect your child’s financial information. As a parent, you can review, change, or delete your child’s personal information by logging into the account and visiting the profile page.

Customer Service

Customer service is available only by in-app email. No phone support or live chat is offered.

GoHenry Pricing

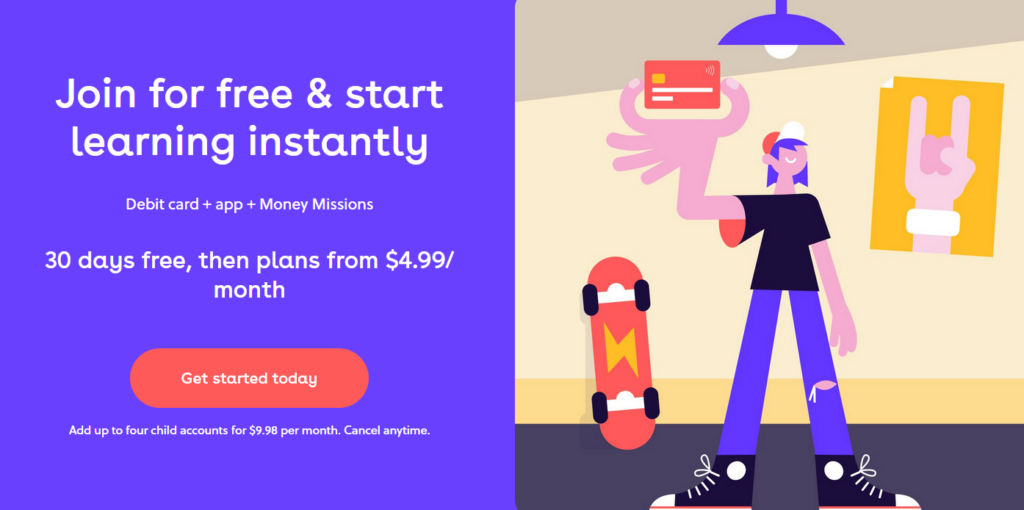

GoHenry offers two pricing plans: $4.99 per child or $9.98 monthly for families with up to four kids. Either plan comes with a 30-day free trial.

The GoHenry debit card comes with free transfers between family and friends, no transaction fees, no ATM fees, and no foreign transaction fees. You can also cancel your subscription at any time.

GoHenry Pros & Cons

Pros

- It is designed to teach children and teens how to spend, save, and budget money.

- Parents maintain control over the account, with the ability to set spending limits and lock savings.

- MasterCard debit card that can be used anywhere MasterCard is accepted.

- FDIC insurance up to $250,000 for funds held in the account.

- No ATM or foreign transaction fees.

- It can accommodate a family with up to four children on one plan.

- Family and friends can gift money to your child through the app.

Cons

- No interest is paid on savings; parents pay interest into the child’s account.

- Customer service is by email only; there is no live support.

Alternatives to GoHenry

Famzoo

FamZoo works similarly to GoHenry because it’s a money management app for kids with a debit card. The debit card is a prepaid card for kids and teens with FDIC insurance. The card permits direct deposit for teens, access from any browser, a cash reload option, instant card-to-card transfers, and even discounted pricing options.

FamZoo allows parents to set up sub-accounts for spending, savings, investing, and giving. It also helps kids become more money-savvy by teaching them financial literacy. FamZoo offers four different payment plans: $5.99 per month, $25.99 for six months, $39.99 for 12 months, or $59.99 for 24 months.

Greenlight

Greenlight is another debit card for kids, helping to teach them how to become familiar with money. The app claims more than 6 million members, with $198 million saved by participating families. The debit card provides allowances tied to chores (which can be set up as a direct deposit), savings rewards, investing in stocks and exchange-traded funds, and 1% cash back when spending with the card. It also offers the Level Up program to teach kids about money with bite-size challenges.

Greenlight has three different programs. Core provides 1% interest on savings and is available at $4.99 monthly. Max comes with 1% cash back on the debit card, 2% interest on savings, and a cost of $9.98 per month. Infinity comes with 1% cash back and 5% interest on savings for $14.98 monthly.

Frequently Asked Questions (FAQ)

How much does GoHenry cost monthly?

GoHenry is $4.99 per month per child or $9.98 per month for a family with up to four children. Either plan offers a 30-day free trial.

How much does it cost to withdraw money from GoHenry?

There are no fees for withdrawing money from GoHenry. That includes making withdrawals from ATMs. However, the owner of the ATM may charge a fee for using the terminal, but GoHenry does not charge it.

Is GoHenry better than Greenlight?

The two programs are very similar and provide almost identical features. Greenlight does offer 1% cash back on debit card spending and up to 5% interest on savings. But those features will cost a higher monthly fee. You’ll need to carefully evaluate whether the cashback and interest earned will justify the higher price paid for the Greenlight service.

Is there a free version of GoHenry?

No, but a 30-day free trial is offered with the paid versions.

Final Thought on GoHenry

In reality, kids don’t learn about money and finance in school. The only way they will ever learn about it is if you teach them yourself. If you do, GoHenry can be an excellent resource to help you get the job done. That’s because it creates a framework of earning, spending, budgeting, and saving money that can help set positive patterns for the rest of your child’s life.

At $9.98 per month for a family of four children, that’s a small price for such a comprehensive financial training tool for your kids.

GoHenry

Summary

GoHenry is an excellent financial app for kids and teens that can better organize their finances and teach them how to prepare themselves and their financial futures.