Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

SoFi is known as one of the best low-interest-rate lenders, especially with student loan refinances. But a few years ago, they also became a bank. Today, SoFi Bank offers a savings and checking account that boasts a high savings APY and little to no fees.

Our SoFi Bank review will outline its core, and only current product (savings and checking) and pit that product up against industry leaders to see how they stack up.

SoFi Bank Savings and Checking

Owning a savings account is critical for anyone looking to take advantage of high-interest rates and SoFi Bank currently sports a 4.60% APY in its savings account. That APY put it in the top 1% of all savings accounts nationwide and the interest is accrued daily (paid monthly).

The SoFi Checking portion of the account currently yields a 0.50% APY. That is not nearly as strong and so because both Checking and Savings is part of a single account, always make sure to have the majority of your money on the savings side, with enough to cover expenses on the checking side.

In addition to the APY for savings, the biggest selling point of this account is its fee structure. Virtually every account action comes with no charge, including:

- No ATM fees for in-network OR out of-network withdrawals

- No monthly fee

- No paper statement fee

- No insufficient funds fee

- Overdraft protection

- No returned deposit fee

- No wire transfer fee

When looking through the list (or more than 40 different services), the only noted fee I could find was a $20 stop payment fee. This happens if/when you schedule a payment or write a check you wish SoFi Bank to void.

BONUS OFFER – Right now, SoFi Bank is offering a bonus when you open a new savings and checking account. If you can have $5,000 or more in direct deposits show up in your account within the first 25 days from account opening, you’ll earn a $300 bonus. If you have between $1,000 and $4,999 in direct deposits within the same time frame, you’ll earn a $50 bonus.

How to Open a SoFi Bank Account

It’s easy to open a SoFi Bank account. The process shouldn’t take more than five minutes. You don’t have to visit any bank branches and can open an account from the comfort of your home.

Visit the SoFi Bank site and open an account online. You’ll only need your basic personal details and after you sign up, you’ll have the ability to add external accounts to transfer funds into your new Sofi Bank savings and checking account.

There is a minimum age requirement–the account holder must be at least 18 years old. The person must also be a permanent resident or citizen of the United States.

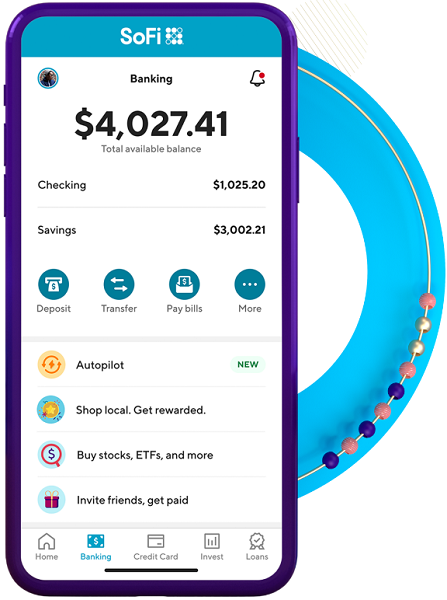

The SoFi Bank App + Features

After opening an account, all new users will receive a debit card and have access to the SoFi Bank app. In addition to the 4.40% APY savings accounts earn, cardholders will also earn cash back on select purchases.

The amount of cashback varies, but SoFi Bank states that up to 15% cashback can be awarded when you shop at local retailers. When you download the app, you’ll be able to enroll in the cash-back program and a list of available retailers will be shown. In order to receive your points, don’t forget to select ‘credit’ when checking out.

The Sofi Bank debit card can be used abroad and does not charge a foreign transaction fee. However, Visa charges a 1% fee for foreign conversion that doesn’t get reimbursed by Visa.

SoFi Bank members will also have two additional perks that a lot of other banks cannot provide:

- When you set up direct deposit, you’ll get paid up to 2 days faster than those who are paid with a check.

- While SoFi Bank provides the standard $250,000 in FDIC insurance, the SoFi Insured Deposit Program can provide up to $2MM in insurance through participation.

SoFi Bank Checking and Savings Alternatives

If you’re in the market for a new savings or checking account, I think there are a few alternatives to SoFi Bank you should consider. One shoulders fee-free banking with a lot of perks and the other provides brick-and-mortar branches (with a strong brand so you have better access to your funds.

Like SoFi Bank, Chime is another FinTech account that focuses on a no-fee banking experience. There is no minimum account balance to open a Chime Checking Account and there are no monthly fees, overdraft fees, or transfer fees to worry about.

Account holders will get paid up to 2 days early, can withdraw money (without a fee) from over 60,000 ATM’s and will earn a 2.00% APY on all savings balances. The SpotMe feature allows you to overdraw your account by up to $200 and not be charged a fee (activates after your first $200 direct deposit hits your account).

Chase Total Checking offers the best brand in consumer banking and an upfront $300 offer when you open an account and set up direct deposit within the first 90 days. Unlike SoFi Bank or Chime, you’ll have thousands of in-person branches you can visit to ask questions, make deposits or withdraw your funds free of charge.

The negative side of the Chase Total Checking account is that it charges a $12 monthly service fee. That fee can easily be waived however by making at least $500 in direct deposits to the account every month OR by maintaining a balance of at least $1,500. If you own a Chase Savings account, you can also have the fee waived by having at least $5,000 in that account.

Pros and Cons of SoFi Bank

Pros

- No Account Fees – SoFi does not have a minimum balance limit and no fee is charged to the users.

- High Yield Return and Low Account Requirements — Many high-yield savings accounts require account holders to maintain a minimum balance.

- Up to $2 Million in FDIC Insurance — SoFi Bank account holders can get up to $2 million in total FDIC insurance.

- ATM Fee Reimbursement — Another major plus is that SoFi Bank does not charge ATM fees for transactions.

- Membership with SoFi — Your SoFi Bank account functions as a membership that offers a wide variety of other financial products.

Cons

- Withdrawal Limits — One concerning factor for the SoFi Bank savings and checking account is the withdrawal limit. You can only take out a maximum of $610 in cash from an ATM each day. As for online transactions, you can only send a maximum of $250 in peer-to-peer transactions per day.

- The full $2MM is not directly insured by the FDIC — The FDIC will cover up to $250,000 per depositor, but the promoted $2MM FDIC insurance comes from the SoFi Insured Deposit Program.

Bottom Line

Experts believe that the days of plain old checking accounts with 0% APY and hidden charges on transactions are over. Businesses like SoFi Bank have millions of active online user accounts, and the volume of transactions is only getting higher.

Given all the benefits offered by companies like SoFi Bank; the higher APY interest rate and reduced charges; it would not surprise us if these companies do well. If you’re in the market for a new savings and checking account, now might be the time to look at SoFi Bank.

Related: The Best Free Online Checking Accounts

SoFi Savings and Checking

Summary

SoFi Bank does everything really well. Earn a $300 bonus, a high APY on your savings, and rewards on your everyday checking purchases. All without a monthly fee.