Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Buxfer is a budgeting app that claims to help you take control of your financial future. Is that true, or is it just a marketing spin? You can answer that question after you’ve read this Buxfer App review.

That’s an important consideration with any budgeting app, not just Buxfer. There are scores of budgeting apps available, but the one that will work best is the one that comes closest to matching your own financial style and personal preferences. Buxfer may prove to be the right budgeting app for you.

What is the Buxfer App?

Based in Santa Clara, California, Buxfer is a comprehensive budgeting app that allows you to aggregate all your financial accounts and create budgets. It also lets you forecast your financial situation and better prepare yourself for the best outcome. The company began operations in 2006, so it’s been around long enough to pass the test of time.

One of the factors that sets Buxter apart from the competition is its international focus. The app is available to users in over 150 countries and has over 100 currencies. Buxfer supports syncing with more than 20,000 financial institutions.

The Buxfer app has the following third-party and user ratings:

- Better Business Bureau: N/A

- Trustpilot: 2.8 out of 5 stars (“Average”) based on ten reviews

- The App Store: 3.4 out of 5 stars based on five reviews

- Google Play: 3.5 out of 5 stars based on 751 reviews

Buxfer App Features & Benefits

Buxfer provides the following features, showing that this app does much more than basic budgeting. Exactly which features you can access will depend on your chosen plan (see Pricing below).

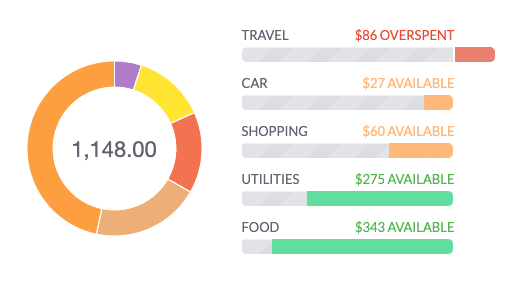

Budgeting

Buxfer uses an envelope budgeting method, enabling you to set aside a fixed amount for sporadic expenses. You can also make flat monthly payments toward variable expenses and regular contributions toward major purchases. The budgeting feature lets you set weekly, monthly, or annual spending limits and receive real-time alerts if you overspend in any category.

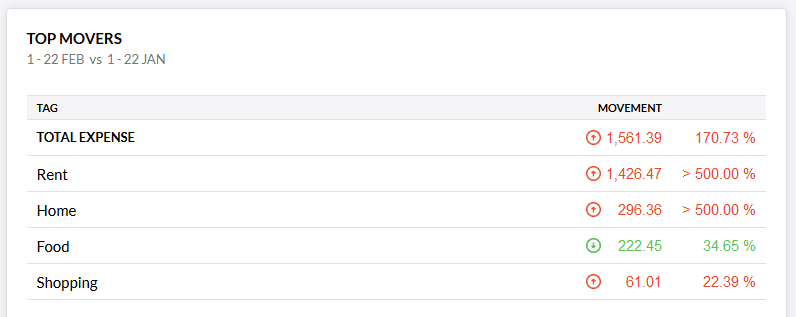

Insights

Buxfer provides visual tools to help you understand your finances and where they are going. For example, it provides a timeline to compare income and expenses with the previous period and spot major variations. A “Top Movers” feature also shows spending categories with the largest changes.

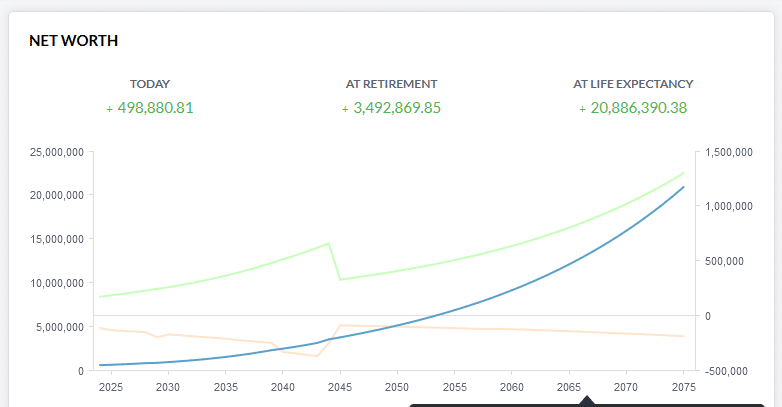

Forecasting

This feature estimates future income, spending, and financial account balances based on past spending habits, upcoming transactions, and established budgets.

Investments

Buxfer enables you to include all investment accounts on the dashboard, including brokerage and retirement accounts. It can even provide detailed information, like data on individual investments, periodic performance, and asset allocation analysis.

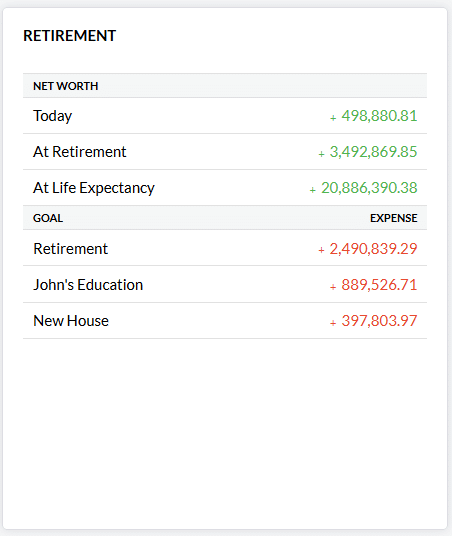

Retirement Planner

This feature helps you create a financial plan that will allow you to retire comfortably, purchase a house, and prepare for your children’s education. The planner will forecast your net worth over time and incorporate variables like inflation, investment returns, and taxes.

Rules

This is another feature that makes Buxfer unique among the best budgeting apps. The software provided is designed to assist you in managing your finances, but not to take over the job completely. Though the app automatically tags and categorizes expenses, you’re also given the ability to make manual adjustments to fine-tune the process.

Currencies

If your financial profile includes an international mix, Buxfer can track those accounts in local currencies. Even though you can set specific currencies for individual accounts, Buxfer will report your financial totals in your default currency.

Access Control

You can share your Buxfer account with family members and professionals, like your financial advisor or accountant.

Automatic Backups

Your account data is automatically saved to a storage service each night. You can choose popular storage services, like Google Drive, Microsoft OneDrive, or Dropbox.

Uploading Statements

If your financial institution is unavailable with the Buxfer app, you can update information manually or upload statements directly. Buxfer also allows you to enter historical data from Quicken, MS Money, Mint.com, YNAB, Empower, and similar services.

IOUs

This novel feature lets you track small, informal debts with family and friends. For example, it allows you to account for cash contributed toward meals and entertainment or shared housing expenses.

Mobile App

Buxfer is available for download on The App Store for iPhone (iOS 11.0 or later), iPad (iPadOS 11.0 or later), iPod touch (iOS 11.0 or later), Mac (with macOS 11.0 or later and a Mac with Apple M1 chip or later), and Apple Vision (vision 1.0 or later). It is also available on Google Play for Android devices.

Security

Buxfer uses high-grade 256-bit encryption to store sensitive information and provide secure communications with your computer. The infrastructure is compliant with industry standards, like PCI and SOC3. The company also provides daily scans and audits from independent security firms, which monitor ports, network vulnerability, and web application vulnerability.

Login information is stored by sync providers Yodlee and SaltEdge, two of the leading providers in the field. While Buxfer can access your financial information, it cannot move money in or out or even between accounts.

Customer Service

Customer service is offered by email only ([email protected]). No phone service is offered.

Pricing

Buxfer offers three different plan levels, each with its monthly fee:

| Plus | Pro | Prime |

| Annual: $3.99/month Monthly: $4.99 per month | Annual: $4.99/month Monthly: $5.99 per month | Annual: $9.99/month Monthly: $11.99 per month |

| Unlimited accounts | Everything included in the Plus plan | Everything included in the Pro plan |

| Unlimited budgets | Forecasting account balances | Investment monitoring |

| Unlimited reminders | “Top movers” highlighting the most variable categories | Retirement planner |

| Unlimited rules | Timeline comparing spending from one period to another | Access control (share your account with others) |

| Automatic bank syncing | All data is automatically saved to a backup service | |

| Automatic tagging | Ability to save your favorite pages for easy access | |

| Multiple currencies | Account customization based on your location and financial needs | |

| Manual upload | ||

| IOU tracking | ||

| Unlimited transactions |

Buxfer does not offer a free trial, but if you upgrade and cancel within the first month, you will get a full refund of the fee you paid. If you sign up for an annual plan, you can cancel the service and be refunded for the unused payment portion.

At this time, Buxfer is not offering a sign-up bonus.

How to Sign Up with the Buxfer App

You can sign up for Buxfer on the company website, Google Play for Android devices, or The App Store for iOS devices.

Whichever method you choose, you will be asked to enter your email and create a password. Alternatively, you can sign up with Google, Facebook, or Apple.

Once you sign up for an account, you can enter your accounts on the dashboard. You can add checking and savings accounts, investments, retirement plans, credit cards, the value of your house, and any cash you have on hand. Once you sync your financial accounts with Buxfer, balances, and activity will update automatically.

You can sign up for Buxfer for free but must choose one of the three plans to continue using the app.

Pros & Cons

Pros

- Available in more than 150 countries, including more than 100 currencies.

- It offers three plans, enabling users to select the one that best suits their financial situations.

- Reasonably priced, with plans ranging from $3.99 to $11.99 per month.

- Provides automatic syncing of financial account activity.

Cons

- There is no free trial period.

- Customer contact is by email only, and no phone support is provided.

Buxfer App Alternatives

YNAB (You Need A Budget)

One of the most popular budgeting apps, YNAB uses a unique “Four Rule” approach to budgeting. Loosely, 1) each dollar in your budget is assigned an expense category, 2) you will anticipate large, occasional expenses, 3) you’ll build flexibility into your budget, and 4) you’ll “age your money.”

Number 4 gradually moves you into a position where you pay this month’s bills with last month’s money. In other words, you will be one month ahead of your expenses, ending the paycheck-to-paycheck treadmill. YNAB is available with a monthly fee of $14.99 or an annual payment of $99 (the equivalent of $8.25 per month).

Empower

Empower is a financial account aggregator that provides a platform for linking all your financial accounts in one place. This includes bank accounts, investment accounts, loans, and credit cards. The financial dashboard is free of charge and provides valuable financial tools, like Investment Checkups and the Retirement Planner.

It also offers Empower Personal Cash, a savings account currently paying 4.70% APY on balances up to $5 million, with no fees. The service also offers investment accounts, managed portfolios, and wealth management services, each with its specific pricing schedule.

EveryDollar

EveryDollar is a budgeting app offered by Dave Ramsey’s Ramsey Solutions. It claims it can save you $395 – “hiding in plain sight”—and cut your monthly budget by 9%. EveryDollar starts by offering you a budget template that you can customize to match your financial situation better. You’ll add your income and expenses (as you spend), then categorize them to ensure you stay on budget.

The free version provides a customizable budget and savings funds. The Premium plan is available for $17.99 per month or $79 per year. It adds direct bank connectivity, a financial roadmap, paycheck planning, goal setting, group financial coaching, and much more.

Frequently Asked Questions (FAQ)

Is Buxfer worth it?

For a fee as low as $3.99 per month, Buxfer packs a lot of value in this budgeting app. If you’ve been unable to get control of your finances, a platform like Buxfer may be just the kickstart you’ve been waiting for. It offers an opportunity to include all your financial accounts in one place, set up a budget, and even make future projections.

How secure is Buxfer?

Buxfer uses industry-standard protocols to protect user information. In addition, while the company can access your financial information, it cannot move money in and out or in between your accounts.

What is the rating for Buxfer?

Based on the ratings we reported earlier in this review, Buxfer generally gets average ratings.

Is Buxfer free?

No. As disclosed earlier in this review, Buxfer offers three different plan levels – Plus ($3.99 – $4.99 per month), Pro ($4.99 – $5.99 per month), and Prime ($9.99 – $11.99 per month). The fee structure is quite low for budgeting apps, and since there are three, you can choose the one that best fits your financial profile.

Should You Sign Up for the Buxfer App?

There’s little doubt Buxfer is one of the most comprehensive budgeting apps. It goes beyond basic budgeting and provides financial management assistance. Given the modest pricing structure, Buxfer is worth the money, regardless of your three plans.

That’s both the strength and weakness of this app. Buxfer is a more advanced app than most other budgeting services, which may be more than you seek. For example, the alternatives presented in this review may be more user-friendly than Buxfer, especially if you are all looking for budgeting assistance. But if you want budgeting but also want to move beyond and into financial management, Buxfer can be an excellent choice.

Buxfer

Summary

Buxfer combines many of the features of other budgeting apps into a low-cost, easy-to-use interface. It’s retirement planner sets the app apart from others.