Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Lili Review (2022) | Free Business Checking for Freelancers

Established in 1970, Lili has its main office at , , . The provides primary supervision over the institution.

Snapshot

| Bank Details | |

|---|---|

| Website | |

| Founded | |

| Branches | 0 |

| FDIC Cert # | |

| Total Assets | $0thousand |

| Total Deposits | $0thousand |

Rates

Here are the rates for the accounts we track for Lili. While we work hard to keep rates and other information current, you should confirm rates and terms with the bank or credit union before opening an account.

Savings Accounts

Checking Accounts

Lili Overview

Lilac Bar David founded [bank_url child=’37268-review-rating’ post_id=’37268′] in 2018. Headquartered in New York City, the company has received $25 million in funding. More than 100,000 freelances have opened a Lili account since 2019.

Features

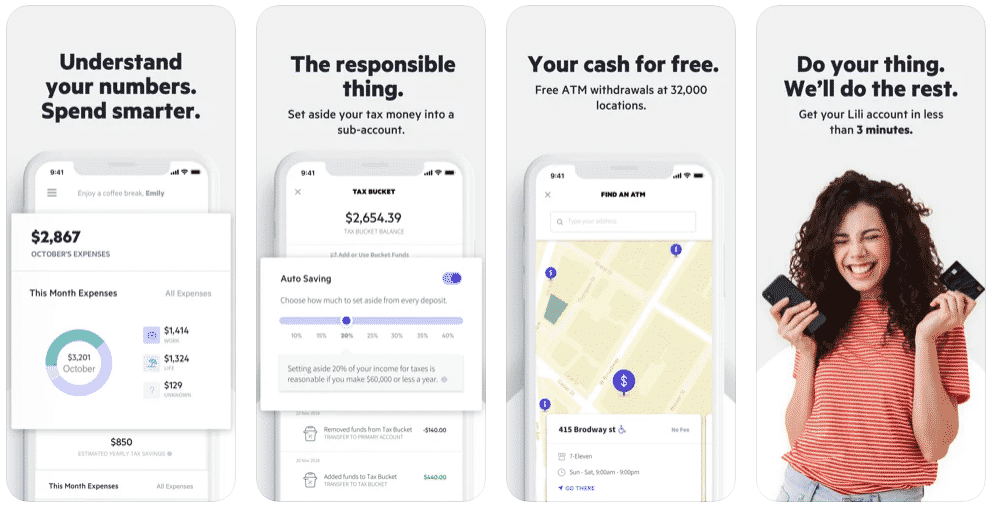

Tax Tools: Lili offers several tools to help freelancers manage taxes. It automatically creates an income and expense report that shows a freelancer net taxable income. It also enables freelancers to track their expenses in real time.

Perhaps most importantly, it has a feature that allows freelancers to automatically set aside a certain percentage of every incoming deposit into a tax bucket. When estimated taxes are due you’ll have the money already saved.

Mobile Banking App: Lili comes with a Visa Debit Card and a mobile banking app. When freelancers set up direct deposit they can get paid up to two days early. You can get push notifications to your phone every time money comes in or goes out of your account. Freelancers can deposit checks by taking a picture with the mobile app. Alternatively, they can deposit cash at more than 90,000 retail locations in the U.S., such as Rite Aid, CVS, and Walmart stores.

The Lili app is rated 4.7 out of 5 for the iPhone and 4.4 out of 5 for Android devices.

Mobile Payments: The Lili Business Debit Card works with both Apple Pay and Google Pay. As such, there’s no need to carry the physical card with you.

Online Payments: Lili works with a number of online payment platforms to have income deposited directly into your account. These platforms include PayPal, Shopify and Cash App.

ATM Withdrawals: You can get cash out of ATMs without paying a fee at more than 38,000 ATMs across the U.S. and Puerto Rico. Lili uses the MoneyPass network.

Automatic Savings: Lili comes with a feature that allows freelancers to set aside a certain percentage of every income deposit. This is a great feature to use for saving for estimated tax payments. You can use this feature to save a business emergency fund.

Lili is a business checking account and technology platform specifically designed for freelancers. It includes totally free business checking, tax tools, a business Visa Debit Card, and an award winning mobile app. We’ll break all of this down in this details Lili review.

How to Get Started With Lili

To open an account with Lili you just need your social security number and about three minutes of time. Believe it or not, Lili actually timed the process it takes customers to open an account. And yes, it came in at about three minutes. In addition, creating an account with Lili will not affect your credit score.

FAQs

Is Lili legit?

Yes. Founded in 2018 and headquartered in New York City, Lilli is a business online bank account designed specifically for freelancers.

Are my deposits FDIC insured?

Yes. All Lili accounts are FDIC insured by its sponsor bank, Choice Financial Group.

Do I Earn interest on a Lili Account?

You can earn interest on a Lili savings account. This feature, however, is available only to Lili Pro members, which comes with a monthly fee.

Does my business have to have a tax ID to open a Lili account?

No. All that’s necessary is your social security number.

u003cstrongu003eHow do I deposit money to my Lili account?u003c/strongu003e

You can deposit money to a Lili account in several ways. First, you can connect your account to Venmo, PayPal or other online platforms to receive direct deposit. You can also transfer money into your account from other linked bank accounts. You can deposit checks by taking a picture of the check with your mobile app. And you can deposit cash at more than 90,000 retail locations in the United States.