Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Chime® Review–A No Monthly Fee Banking Alternative (2022)

Established in 1970, Chime® has its main office at , , . The provides primary supervision over the institution.

Snapshot

| Bank Details | |

|---|---|

| Website | |

| Founded | |

| Branches | 0 |

| FDIC Cert # | |

| Total Assets | $0thousand |

| Total Deposits | $0thousand |

Rates

Here are the rates for the accounts we track for Chime®. While we work hard to keep rates and other information current, you should confirm rates and terms with the bank or credit union before opening an account.

Savings Accounts

Checking Accounts

Chime is one of several new Fintech companies challenging the financial industry. It offers a highly rated mobile app, low fees, a secured credit builder credit card and a competitive interest rate. In this Chime review we cover its features and fees.

Chime Snapshot

I embraced online banking when it first became a thing more than a decade ago. It started with ING Direct and the Orange Account. Since then I’ve held accounts at many online banks, including CIT Bank, Ally Bank, American Express Bank, and Capital One. Chime is different.

For starters, Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

The idea is to take great technology, pair it with traditional banking, and then take over the financial industry. Let’s dig into the details to see what it offers, how much it costs, and whether it’s right for you.

[bankbox post_id=’35952′]

Pros & Cons

What we like

- Excellent mobile app

- Competitive interest rate

- No monthly fees

- 60,000+ Fee-Free˜ ATMs

- Get paid up to 2 days early^ with direct deposti

- Help build credit with free secured Credit Builder Visa® credit card. Eligibility requirements apply.²

What could be better

- No physical branches

- Past outages have prevented account access for brief periods of time

Chime Review

Chime comes with three account types: a Checking Account, an optional Savings Account and a Secured Credit Builder Visa® Credit Card. A Checking Account is required to be eligible for a Savings Account. The Checking Account includes a Visa® debit card that also serves as your ATM card.

Account Types

Checking Account

The Checking Account is your main account. There are fee-free overdrafts with SpotMe®, and no monthly fees or minimums with this account. There are also no foreign transaction fees.

How do you deposit money into your Chime account?

There are several ways you can add money to your Checking Account:

- Direct Deposit: Get access to your paycheck up to 2 days early^ with direct deposit.

- Transfers: Using your routing number and account number, you can transfer funds from another bank into your Chime Checking Account.

- Deposit Cash: You can deposit cash to your Checking Account at over 90,000 retail locations via Green Dot. You can deposit up to $1,000 in cash every 24 hours or $10,000 per month. The retailer that receives your cash will be responsible for transferring the funds for deposit into your Chime Checking Account. Cash deposit fees may apply if using a retailer other than Walgreens.

- Mobile Check Deposit: Chime will determine if you are eligible for the Mobile Check Deposit feature based on the history of any Chime-branded accounts you have, direct deposit history, direct deposit amounts, and other risk-based factors.3

How do you spend or withdraw money from your Chime account?

There are several ways to use the money in your Chime account:

- Visa® Debit Card: You can use the debit card anywhere that accepts Visa, including online.

- ATM: With your Visa debit card, you can withdraw cash at an ATM.

- Bill Pay: You can set up direct pay to a creditor using your routing and account number.

- Chime Checkbook: While checks aren’t as common as they once were, sometimes you need them. You can log into your account and request that Chime send a check anywhere in the U.S. for up to $5,000.

The Checking Account works with mobile payment platforms including Apple Pay and Google Pay.

Savings Account

With the optional Savings Account you earn 2.00%+ Annual Percentage Yield (“APY”). That’s a competitive rate as compared to the best online savings accounts. There are no monthly fees on this account and no minimum balance.4 The APY is also not capped at a certain balance.

Chime offers several ways to automate your savings:

- Round Ups: Chime will roundup transactions on the Chime debit card to the nearest dollar and transfer this amount from your Checking Account to your Savings Account.5

- Save When I Get Paid: You can set up a recurring automatic transfer of a percentage of your paycheck from your Spending Account to your Savings Account.5

Secured Chime Credit Builder Visa® Credit Card

Chime has recently introduced its first credit card. It’s a secured card designed to help Chime members build their credit. Because it’s a secured card, there is no credit check to apply. Unlike most secured cards, the Chime Credit Builder Secured Visa® Credit Card has no annual fees and no interest charges.

Chime reports your on-time payments from the card to the three major credit bureaus—TransUnion, Experian and Equifax. There’s no minimum security deposit required.6 You decide how much to transfer from your Checking Account to your secured account as collateral for the card. That becomes your limit. You can then use this money to pay for your charges at the end of the month.

Mobile App

With the Chime mobile app, you can track your spending and savings. You can also send money to anyone whether they have Chime or not and you can receive money from friends with Chime. It works on both iPhone and Android devices. The app enables you to deposit checks3 and pay bills. Alerts are built into the app. It can send you daily bank account balance notifications and instant transaction alerts when you use your debit card.

Chime’s mobile app is one of the highest rated among bank challengers. It has a 4.5 out of 5.0 star rating on Google Play and a 4.8 star rating in Apple’s App Store.

Features

Visa® Debit Card: The Chime Checking Account comes with a Visa debit card. The card can be used anywhere that accepts Visa, including online. It also serves as your ATM card.

Free ATM Withdrawals

Chime has over 60,000 fee-free~ ATMs nationwide. They work with both MoneyPass and Visa Plus Alliance networks. You can withdrawal from either network for free. Keep in mind that these fee-free~ ATMs are located only in the United States. If you travel outside the country, you will be charged for using an ATM.

If you use an ATM outside of these networks, the cost is $2.50 plus anything the ATM owner charges. Also keep in mind that there is a $500 a day limit on ATM withdrawals. Also keep in mind that there is a daily limit on card usage (whether purchases, ATM withdrawals, over-the-counter withdrawals) of $2,500.

Get Paid up to 2 Days Early with Direct Deposit

If you set up direct deposit, you can get paid up to two days early.^

SpotMe®

SpotMe® will spot eligible members up to $200* on debit card transactions and cash withdrawals. To qualify, you need to receive a qualifying direct deposit of at least $200 a month. Chime determines the limits of SpotMe® per customer based on account activity and history. The limit starts at $20 but can go up to $200 or more. If a transaction would overdraw your account above this limit, it will be declined.

Any SpotMe® overdrafts are repaid automatically with your next direct deposit.

Security

You can instantly disable your debit card via the mobile app. You can also allow or disallow international transactions.

Who Chime is Best For

Chime is designed for those wanting a no monthly fee checking and optional savings account with an excellent online and mobile app experience. It’s also ideal for those wanting to earn a competitive interest rate on savings.

Who Should Consider a Different Account Alternative

Those who need a physical branch should either open an account at a traditional financial institution or consider two accounts–one online and one traditional.

How to Get Started with Chime

Opening an Account

You can open an account online using this link. You’ll need to provide the typical information you would for opening a traditional checking account. This information includes your address, mobile telephone number, and your social security number. To qualify, you must be a U.S. citizen and at least 18 years old.

- Checking Account—What most people think of as a checking account. If you set up direct deposit, see below, your paycheck will go into this account.

- Optional Savings Account—It currently pays 2.00% APY in interest. A Checking Account is required to be eligible for a savings account.

The process takes just a few minutes. Once approved, you then decide what types of accounts you want. It’s pretty simple since there are only two:

Setup Direct Deposit

Next you’ll want to setup direct deposit of your paycheck or government assistance check. To do so you’ll need two numbers—the routing number and your account number. The routing number is a unique number that identifies the financial institution where the direct deposit should be made. The account number is the unique number that identifies your specific Checking Account.

Finding the routing number and your account number is easy:

- Log into your account online or via the Chime mobile app;

- Go to the “Move Money” section of your account and select “Direct Deposit;”

- There you’ll find both the routing number and your Checking Account Number.

Chime Rating

Chime

Summary

u003ca href=u0022/chimeu0022 target=u0022_blanku0022 rel=u0022noreferrer noopener nofollow sponsoredu0022u003eChimeu003c/au003e offers low fee Checking and Savings accounts, with competitive interest rates.

Chime Complaints

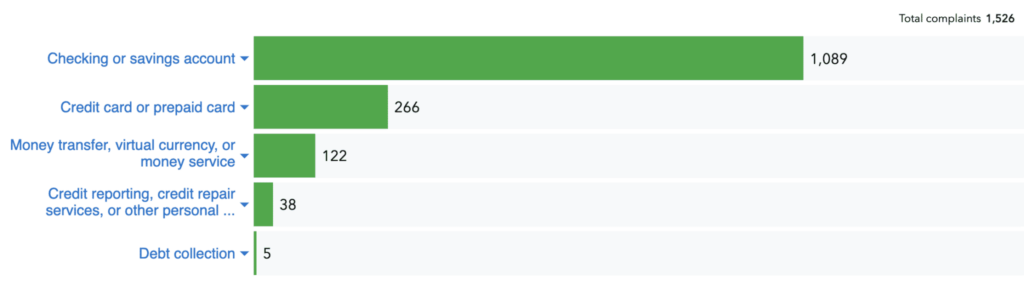

Consumers can file complaints against a financial institution with the Consumer Financial Protection Bureau. Out of more than 2.3 million complaints filed with the CFPB, just over 1,500 relate to Chime. Most of the complaints related to Chime’s Checking and Savings accounts:

While complaints are to be expected of any large financial institution, how the company responds is key. According to the CFPB, Chime responded timely to all but 26 of the complaints.

FAQs

No. It is a Visa® debit card linked to your Checking Account. If you are interest in a prepaid card, you can check out our list of the best options here.

Yes, there are more than 60,000 fee-free~ ATM locations nationwide.

Several ways, including direct deposit, mobile check deposit3, bank transfer, and cash deposits at certain retailers using Green Dot.

No, Chime is a financial technology company, not a bank, but deposits are held at one of two FDIC-insured partner banks, The Bancorp Bank and Stride Bank.

Yes. Chime offers a free credit builder secured Visa® credit card that can help build your credit with on-time payments. Eligibility requirements apply.7

Compare Chime Alternatives

There are other options to consider for those looking for a low cost online checking account experience. There are other Fintech options, such as Aspiration, Simple and Varo. Think of these as digital financial apps. You could also consider online financial institutions, most of which charge little in fees and offer competitive interest rates. If a checking account is your primary goal, however, it’s hard to beat Chime.

Chime Awards

Chime earned our best in class award in the following categories:

Remember, Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

+The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of November 17, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

*Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

~Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

1Pay Anyone transactions will be monitored and may be held, delayed or blocked if the transfer could result in fraud or another form of financial harm. Sometimes instant transfers can be delayed. Non-Chime members must use a valid debit card to claim funds.

2To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

3Mobile Check Deposit eligibility is determined by Chime in its sole discretion and may be granted based on various factors including, but not limited to, a member’s direct deposit enrollment status.

4There’s no fee for the Chime Savings Account. Cash withdrawal and Third-party fees may apply to Chime Checking Accounts. You must have a Chime Checking Account to open a Chime Savings Account.

5Round Ups automatically round up debit card purchases to the nearest dollar and transfers the round up from your Chime Checking Account to into your savings account. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account.

6Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.

7On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.