Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

BlueVine

Established in 2000, BlueVine has its main office at 345 N Reid St, Sioux Falls, SD 57103. The OCC provides primary supervision over the institution.

Snapshot

| Bank Details | |

|---|---|

| Website | www.thebancorp.com |

| Founded | 07/28/2000 |

| Branches | 1 |

| FDIC Cert # | 35444 |

| Total Assets | $7.92 billion |

| Total Deposits | $6.9 billion |

Rates

Here are the rates for the accounts we track for BlueVine. While we work hard to keep rates and other information current, you should confirm rates and terms with the bank or credit union before opening an account.

Checking Accounts

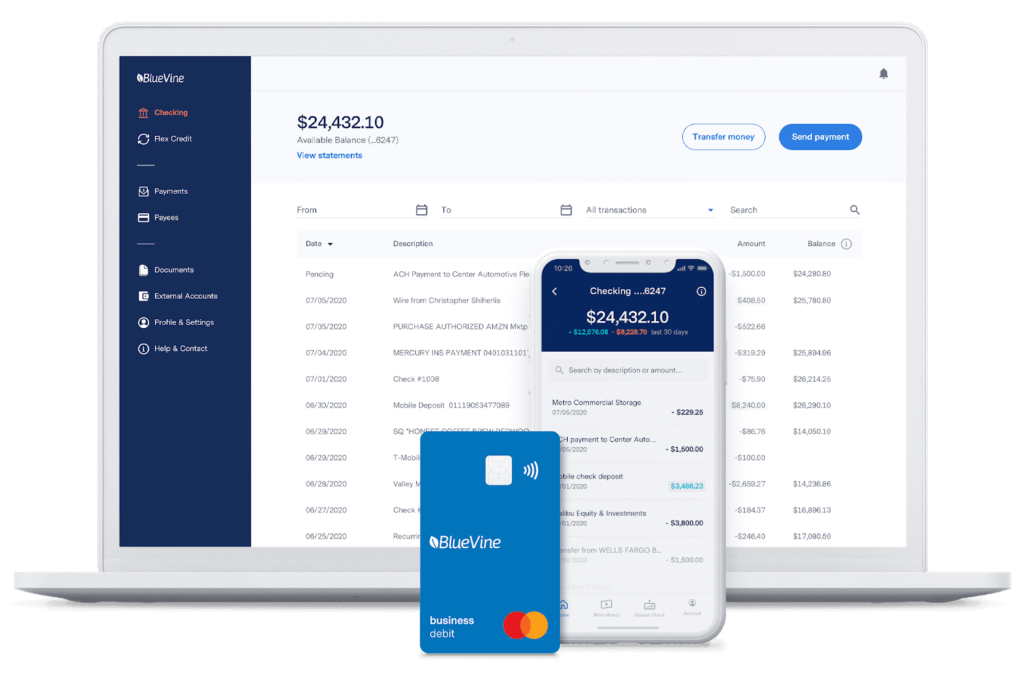

BlueVine is a business checking account and app to help small business owners run their business. It charges virtually no fees and offers 1% APY on balances of up to $100,000.

BlueVine Snapshot

[bank_url child=’37146-review-snapshot’ post_id=’37030′] is a bank challenger technology company that offers business checking for entrepreneurs. It requires no minimum deposit and charges no monthly fees. BlueVine pays up to 1% interest on balances.

[bankbox child=’37030-review-snapshot’ post_id=’37030′]

Pros & Cons

What we like

- Virtually no fees

- Up to 1% APY

- Excellent app to manage business finances

- Unlimited transactions with No minimum balance required

- Online bill pay

What could be better

- No physical branches

BlueVine Review

Founded in 2013, BlueVine’s mission is to empower small businesses through innovative banking. [bank_url child=’37030-review-rating’ post_id=’37030′] provides business checking and paycheck protection loans, as well as a line of credit and invoice factoring. It has an A plus rating from the Better Business Bureau and to date has provided small businesses with more than $9 billion dollars in financing.

Account Types

Business Checking

[checkingacct_box post_id=’37142′]

BlueVine’s primary account type is business checking. Although it doesn’t offer a separate savings account, it does pay % APY on checking balances of up to $100,000. BlueVine charges virtually no account fees. There is no monthly fee, no NSF fee and no incoming wire fee. In addition, there is no ATM fee when you use one of BlueVine’s 38,000 in-network ATM locations. They are on the MoneyPass Network.

Paycheck Protection Loans

It also offers a paycheck protection loan. Last year it provided paycheck protection loans to more than 155,000 small businesses. These loans are up to $2 million at an interest rate of just 1%. They also do not require payments for 10 months. BlueVine has an extensive FAQ section for those interested in a PPP loan.

Lines of Credit

BlueVine also offers invoice factoring and a line of credit, although at present, they are on hold while BlueVine processes paycheck protection loans.

A line of credit can have payment terms of 26 weeks (called Flex6) or 12 months (called Flex12).

To qualify for a Flex6 line of credit you must meet the following requirements:

- 650+ FICO

- 3+ years in business

- $40,000 per month in revenue

- Not available in North Dakota, South Dakota or Vermont

Lines of credit range from $6,000 to $250,000.

Invoice Factoring

Invoice factoring enables businesses to obtain short-term (1 to 13 weeks) lines of credit secured by their accounts receivable. Loan amounts range from $20,000 to $5,000,000.

To qualify, a business and its owner must meet the following requirements:

- 530+ FICO

- 3+ months in business

- $120,000 in annual revenue

BlueVine integrates with Quickbooks Online, Quickbooks desktop 2009 or later, Xero and Freshbooks.

Mobile App

The BlueVine mobile app is available for both iOS and Android. With the app customers can deposit checks, find free ATMs. The app also enables customers to check balances, see banking activity and receive real-time alerts. Unfortunately, the app has received mediocre reviews. On the Apple App Store it has a rating of 2.1 out of 5, although that’s based on just 149 ratings. It fairs slightly better on the Google Play, with a 2.7 star rating based on 166 reviews.

Features

- Business Checking with up to 1% APY

- Paycheck Protection Loans

- Invoice Factoring

- Lines of Credit

- Online Bill Payment

- Recurring Payments

- Business Debit Card

- No Monthly NSF or Incoming Wire Fees

- Unlimited Transactions

- No Minimum Balance Required

- Online Transfers to Other Accounts

- Deposits are FDIC Insured

- Free Bill Payment

Who BlueVine is Best For

BlueVine is ideal for entrepreneurs and small business owners. It’s frankly one of the best business checking accounts I’ve seen anywhere. This is due to virtually no fees, no minimum balance requirement and % APY on checking balances of up to $100,000. In addition, the website and mobile app make managing business cash flow extremely easy.

Who Should Consider a Different Bank

The only business that BlueVine would not be ideal for is one that needs a physical bank branch. Even in that case, however, it might be ideal to have two business bank accounts, one at a traditional bank, and one with BlueVine. It’s easy to set up transfers between BlueVine and other bank accounts.

How to Get Started with BlueVine

To open a BlueVine account you must be a small business owner at least 18 years old. You also must be a U.S. citizen or resident with a verifiable U.S. address. In addition, businesses in the following industries will not be approved: adult entertainment, gambling, weapons and firearms, illegal substances.

According to BlueVine, the signup process takes approximately 60 seconds. I confirmed with BlueVine support that it does a soft pull on an applicant’s Experian credit report to verify their identity.

BlueVine Rating

BlueVine

Summary

The [bank_url child=’37030-review-rating’ post_id=’37030′] Business Checking Account earns a top rating due to its low fees, excellent interest rate and award winning mobile app.

FAQs

Yes, BlueVine’s Business Checking Accounts are offered through Bancorp, which is an FDIC member. Deposits are insured to at least $250,000.

Yes. ATM withdrawals are free at any of BlueVine’s 38,000+ in-network ATMs through its partnership with the MoneyPass Network.

Yes, you can deposit checks using the BlueVine mobile app by taking a picture of the check.

Yes, you can deposit cash at any of over 90,000 retail locations through BlueVine’s partnership with Green Dot.

Yes. Founded in 2013, BlueVine has helped over 100,000 small businesses streamline their cash flow through no fee business checking accounts, and various financing products.