Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

As an online bank, LendingClub Bank’s consumer checking, savings, and CD accounts can be opened online. It’s easy to apply and takes less than five minutes.

What is LendingClub Bank?

Based in Boston, Massachusetts, LendingClub Bank is an online, digital bank providing personal and business banking services to consumers throughout the U.S. Founded in 1987, the bank has more than $1.4 billion in assets. Operating entirely online, it provides checking, savings, and CDs–as well as third-party loan services–for both individuals and businesses.

What’s more, LendingClub Bank provides a checking account with a cash back debit card, allowing you to earn 1% cash back rewards on purchases, while also earning interest on their account balances.

LendingClub Bank has a Better Business Bureau rating of A+, the highest rating on a scale of A+ to F. The Bank is also rated 4.5 stars out of five by more than 500 users at The App Store, and 4.7 stars out of five by more than 500 users on Google Play.

Read more: Best Online Banks

LendingClub Bank Features

Available accounts: Checking, savings, and CDs for both business and personal accounts, plus business banking services. Loans are made available through partnerships with other lending institutions.

Availability: All 50 states

ATM Network: Access more than 325,000 MoneyPass, NYCE, and SUM ATMs nationwide. Unlimited out-of-network ATM fee reimbursements, potentially saving you hundreds of dollars each year.

Financial Tool Set: You can use the platform to link external accounts, as well as create budgets, track spending, and analyze that spending to better understand and direct your spending habits. It can also track your net worth, and help you create a plan to pay off your debts using different strategies.

LendingClub Bank Mobile Banking: Available for download at The App Store for iOS devices 9.0 and later, and is compatible with iPhone, iPad, and iPad touch. Available for download at Google Play for Android devices, 4.1 and up. The app is available for both personal and business banking.

Related: Best Mobile Banking Apps

Early Direct Deposit: Set up direct deposit into your LendingClub account and you’re eligible to receive your money up to two days early.

Related: Banks That Offer Early Direct Deposit

On-the-go Deposits: Make fee-free deposits at thousands of deposit-taking NYCE and MoneyPass ATMs across the U.S., or deposit checks with the LendingClub Bank Mobile app

Mobile Wallet: You can add Apple Pay, Google Pay or Samsung Pay to your LendingClub Bank Debit Card. By using a mobile wallet, your debit card number is not stored on your mobile device, providing extra security when using the card.

Pay Bills & People: Pay almost any company or individual in the U.S. The service is free to use with both online and mobile banking.

Overdraft protection: You can link your checking account to up to three other LendingClub Bank accounts as well as a line of credit.

Customer service: Available by phone or by live chat, Monday through Friday, from 8:30 am to midnight, and Saturdays and Sundays, from 8:00 am to 8:00 pm (all times Eastern).

Account security: All account balances are insured by FDIC for up to $250,000 per depositor. The bank uses 256-bit secure socket layer (SSL) encryption to ensure that data is protected with the highest level of security.

Refer a Friend Program: LendingClub Bank is offering a $50 referral fee–payable to both you and the person you refer to the bank–if that person opens a valid Rewards Checking account. The referred friend must have an open, active account in good standing with at least $500 in deposit balances on the 60th day after opening the account. If so, you’ll each get $50. There is no limit on how many people you can refer, or how many bonuses you can earn.

LendingClub Bank Checking Accounts

LendingClub Bank offers a choice of three different personal checking accounts. You must enroll in free online banking and choose to receive eStatements instead of paper statements for each account.

LendingClub Bank Rewards Checking

The LendingClub Rewards Checking account is available with the following features:

- The minimum opening deposit is $100, then no minimum balance requirement

- Interest paid: 0.10% APY on balances of $2,500 to $99,999.99, then 0.15% APY on balances of $100,000 or more (Note: no interest is paid on the first $2,499.99 in your account)

- Earn unlimited 1% cash back rewards on signature-based purchases every month using your LendingClub Bank debit card (requires a minimum balance of $2,500 OR $2,500 worth of direct deposits)

- No monthly maintenance fees

- Free debit card no ATM fees charged by LendingClub Bank

- Unlimited rebates for ATM fees charged by other banks that can save you over $200 per year

- The first order of checks is free

LendingClub Bank Superhero Checking

This account has the following features:

- The minimum opening deposit is $100, then no minimum balance required.

- Earn 0.05% APY on balances of $2,500 and up (no interest is paid on the first $2,499.99 in your account) – all interest earned will be accompanied by a matching contribution to the March of Dimes by LendingClub Bank

- 1% of your total debit card purchases each month will be donated by the Bank to the March of Dimes

- No monthly maintenance fees

- Free debit card no ATM fees charged by LendingClub Bank

- Unlimited rebates for ATM fees charged by other banks that can save you over $200 per year

- The first order of checks is free

LendingClub Bank Essential Checking

Essential Checking is a second-chance checking account you can open even with a less-than-perfect banking record. If you’ve been unable to qualify for a checking account at other banks, Essential Checking may be the solution.

The account has the following features:

- $9 monthly service charge

- $500 daily debit card limit

- $1,000 daily mobile check deposit limit, and $2,000 every 10 days

- After 12 months of good banking history, you may be eligible to upgrade to a Rewards Checking Account

LendingClub Bank Deposit Products

LendingClub High-Yield Savings Account

- Minimum opening deposit: $100, then no minimum balance is required

- Earn up to 0.15% APY on balances of $2,500 to $24,999.99, then 0.25% APY on balances of $25,000 or more (no interest is paid on the first $2,499.99 in your account)

- No more than six pre-authorized transactions per statement period (as per federal regulation, which applies to savings accounts at all banking institutions

- No monthly maintenance fees

- Free ATM card

- Free ATM withdrawals from participating ATM networks

Certificates of Deposit (CDs)

LendingClub Bank offers CDs with terms ranging from three months to five years. The minimum balance required to open a CD is $1,000 for terms of less than one year or $500 for terms of one year or more.

Interest rates currently being paid are as follows:

- Terms of three to nine months: 0.25% APY

- Terms of one year or more: 0.50% APY

See the schedule of early withdrawal penalties that apply to LendingClub Bank CDs below under LendingClub Bank Fees.

Related: Best CD Rates

LendingClub Bank Fees

The following fees apply to LendingClub Bank accounts:

- Overdraft fee: $5 per day

- Deposited item return: $8

- Foreign item collection: $30

- Money orders: $3

- NSF or Returned Item charges: $25 per item

- Stop payment: $25

- Treasurers check: $8

- Domestic wire in: $10

- Domestic wire out: $20 consumer, $18 business

- International wire in: $10

- International wire out: $40

Early withdrawal penalties on CDs are as follows:

- CD terms of three and six months: 3 months simple interest

- Nine-month CDs: 180 days of simple interest

- Terms of one year or more: 365 days simple interest

Small Business Banking

LendingClub Bank offers its Tailored Checking account for small businesses. The account comes with the following features:

- $100 minimum opening balance, with no minimum maintenance requirement

- Earn 0.10% APY on balances of $5,000 or more (no interest is paid on balances below $5,000)

- Standard business checks available

- Unlimited transactions

- No per transaction fee

- Free ATMs worldwide

- Free business debit card

- Free bill pay

- $10 monthly maintenance fee for account balances below $5,000, waived with higher balances

The account comes with the LendingClub Business App for both Android and iOS devices, and provides the following features:

- Monitor your account from the app

- Reorder checks

- Deposit checks

- Make internal account transfers

- Make wire transfers

- Payments to businesses and individuals

- Place stop payments

- Set custom alerts and travel notifications

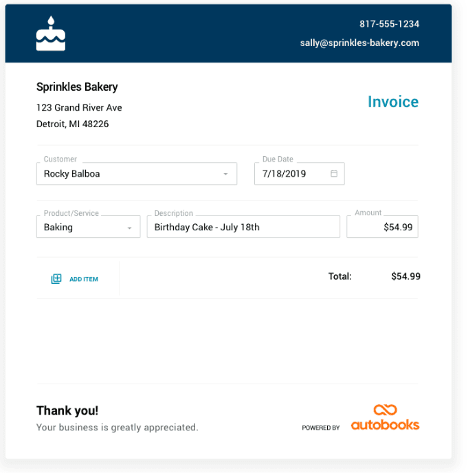

The account also comes with Autobooks providing an integrated suite of services that can be customized for your business. It can be used to accommodate receivables, payables, payments and accounting.

Commercial Banking

For businesses of all sizes, LendingClub Bank offers four different checking accounts, including Tailored Checking as described above. They also offer a money market, statement savings, and IOLTA/IOLA accounts. CDs are available for larger balances, as well as CDARS for account balances over $250,000.

The Bank also offers business lending, cash management services, remote deposit capture, merchant services, ePayment Solutions, business debit cards, account reconciliation, payroll services, and sweep accounts.

LendingClub Bank also provides Small Business Administration (SBA) loans, equipment financing, and participated in the Paycheck Protection Program to help small businesses keep their employees during the coronavirus crisis.

LendingClub Bank Loan Programs

Credit Cards

LendingClub Bank offers credit cards through Elan Financial Services. There are currently offering three Visa cards:

- Visa Real Rewards- Offers 1.5 points for every dollar spent on eligible purchases, as well as a 0% introductory APR for the first six billing cycles and no annual fee.

- Visa Platinum- Comes with a 0% introductory APR for the first 20 billing cycles, which is one of the most generous 0% offers in the industry. The card also comes with no annual fee.

- Visa Secured- A credit card secured by your LendingClub Bank High-Yield Savings Account, designed specifically for those who want to establish or improve their credit.

Personal Loans & Student Loans

See Credible description under LendingClub Bank Marketplace below.

Yacht Loans

LendingClub Bank has carved out a niche in this lending specialization, with more than 30 years of experience in the yacht financing market. It provides fixed, adjustable, and interest-only financing options with flexible loan terms. The maximum vessel age is 20 years, but they even have foreign vessel registration available.

LendingClub Bank Marketplace

You’re not limited to banking services with LendingClub Bank. Through the LendingClub Bank Marketplace, you can participate and other financial services from third-party service providers.

Billshark

This bill negotiating service helps reduce your monthly bills for cable, Internet, wireless and home security services. You can use it simply by uploading your recent bill into the LendingClub Bank Mobile App, and Billshark will take it from there.

Ladder

You can apply for life insurance and receive approval within minutes from the life insurance fintech, Ladder. It’s the future of life insurance but without the lengthy application process and high premiums.

Lemonade

Yet another insurance fintech company, Lemonade is an online source for renters and homeowners insurance. Premiums start at just $5 per month for renters insurance and $25 per month for homeowners insurance. And best of all, Lemonade has a reputation for paying claims fast often in a matter of minutes.

Credible

Credible provides access to prequalified rates for personal loans, student loans and student loan refinancing. Shop for a loan right from your mobile app.

Personal loans are available in loan amounts from $1,000 to $100,000, and you can be prequalified in as little as two minutes. You can get rate quotes from multiple lenders, with rates [ct_brand_render field=ctinterest_rate id=128000413 /] See Terms*.

Booking.com

Book your travel through Booking.com and get 6% cash back when you pay for the purchase using your LendingClub debit card.

How to Open an Account with LendingClub Bank

To apply for a LendingClub Bank personal account, complete the entire application online in just a few minutes.

You’ll need to provide your full name, email address, and mobile phone number, then provide the required personal identifying information, as required by federal law to open any financial account.

Once your basic information has been supplied, you’ll need to set up your funding source. You can link to an external bank account for this purpose and fund your account by direct transfer.

Pros and Cons

- No monthly fees — I love that there are no monthly fees on their accounts.

- Full-service — Full-service online bank, including business banking accounts and services.

- Low minimum required — $100 minimum required to open an account, then no minimum ongoing balance requirement.

- Combines interest and cash back — Rewards Checking Account offers both interest and 1% cash back rewards.

- ATM fee reimbursements — These are unlimited, with a potential savings of hundreds each year.

- Low rates — LendingClub Bank interest rates are not among the highest paying online banks.

- Loans are outsourced — Most loan programs are offered through third-party providers.

- Minimum requirement for interest — No interest is paid on account balances below $2,500.

- Hefty overdraft fees — Overdraft fee is charged on a daily basis – which can add up quickly.

to LendingClub Bank

If LendingClub Bank isn’t the bank for you, you may want to consider any of the following:

Chime® is an award-winning financial app. It comes with a Visa debit card that enables you to round up your purchases, then deposit the round-up into savings. The interest rate on the account is very low, but there’s no minimum account balance, no monthly fees, and no in-network ATM fees.

Chime® is an award-winning financial app. It comes with a Visa debit card that enables you to round up your purchases, then deposit the round-up into savings. The interest rate on the account is very low, but there’s no minimum account balance, no monthly fees, and no in-network ATM fees.

TD Bank doesn’t offer free checking, but they are currently paying a $150 sign-up bonus to new customers on their TD Convenience Checking account once you make a direct deposit of $500 or more within 60 days of opening your account. The $15 monthly maintenance fee is waived with a minimum daily account balance of $100. They pay an even more generous $300 on their TD Beyond Checking when you make direct deposits of $2,500 or more within 60 days of opening your account. The $25 monthly maintenance fee is waived when you have at least $5,000 in direct deposits or maintain a minimum $2,500 daily balance. To qualify for this offer, you must be a U.S. resident and apply for the offer online. Offer is available in these states: CT, DC, DE, FL, MD, ME, MA, NC, NH, NJ, NY, PA, RI, SC, VT, VA.

TD Bank doesn’t offer free checking, but they are currently paying a $150 sign-up bonus to new customers on their TD Convenience Checking account once you make a direct deposit of $500 or more within 60 days of opening your account. The $15 monthly maintenance fee is waived with a minimum daily account balance of $100. They pay an even more generous $300 on their TD Beyond Checking when you make direct deposits of $2,500 or more within 60 days of opening your account. The $25 monthly maintenance fee is waived when you have at least $5,000 in direct deposits or maintain a minimum $2,500 daily balance. To qualify for this offer, you must be a U.S. resident and apply for the offer online. Offer is available in these states: CT, DC, DE, FL, MD, ME, MA, NC, NH, NJ, NY, PA, RI, SC, VT, VA.

Ally Bank offers full-service online banking, including savings accounts and CDs, as well as various loan products. And they offer one thing many banks don’t, which is investing through their Ally Invest investment platform. Their Interest Checking Account is currently paying 0.10% on balances up to $14,999.99, and 0.25% with a minimum account balance of $15,000. Both balance levels require no minimum opening deposit and no monthly fees.

Ally Bank offers full-service online banking, including savings accounts and CDs, as well as various loan products. And they offer one thing many banks don’t, which is investing through their Ally Invest investment platform. Their Interest Checking Account is currently paying 0.10% on balances up to $14,999.99, and 0.25% with a minimum account balance of $15,000. Both balance levels require no minimum opening deposit and no monthly fees.

Is LendingClub Bank for You?

LendingClub Bank is targeted at younger users, who are focused primarily on managing their spending and maximizing spending-related rewards. They may have high incomes and are working toward building that large financial portfolio. But as everyone knows, before you get to that point, you first have to get control of the basics. That includes spending and budgeting, and that’s where LendingClub Bank shines.

First, none of the LendingClub Bank accounts have monthly maintenance fees, enabling consumers to save money every month. But the Rewards Checking Account also offers 1% cash back on eligible debit card purchases–in addition to paying interest–that enables consumers to earn additional cash on their spending activity and balances. In addition, the cash back rewards are an advantage to anyone who travels frequently and prefers using a debit card rather than a credit card. You’ll be able to use your debit card and earn cash back on just about everything you do while you are away.

We also note that LendingClub Bank is one of a very small number of online banks that also offers business banking. This is an important quality in a world where an increasing number of people are developing side hustles that may eventually become full-time businesses. You can use LendingClub Bank for your personal banking needs, but also run your business activity through the same institution.

Who LendingClub Bank will not work for our customers who have large bank balances and are mostly looking to maximize interest returns. If this describes you, check out one of the banks listed in the LendingClub Bank Alternatives section above.

Bottom Line

If you’re young, tech-savvy, and looking to minimize your banking costs while maximizing your spending rewards, LendingClub Bank is well worth trying out. But even more, if you’re a small business owner or you have a growing side business that needs business banking services, LendingClub Bank is the ideal choice. They offer flexible personal banking products with a full range of business banking solutions.