Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Empower and YNAB are popular financial applications. There are plenty of similarities between the two. Both provide budgeting capabilities, as well as various tools to help you better manage your finances.

But that’s where the similarities end.

Empower does offer budgeting capabilities, but it’s mainly focused on overall financial management. This includes, first and foremost, investment management. They even offer a premium version that provides wealth management. But even their free financial software offers extensive investment management tools.

YNAB, by contrast, is a pure budgeting platform. But it’s one of the very best on the market in that specific category. If you’re looking for help with the basics–budgeting, money management, getting out of debt, and reaching savings goals–YNAB is an excellent choice.

Below is a chart to compare key features of Empower and YNAB:

EmpowerYNAB

| Review Rating | 9.5/10 | 8.6/10 |

| Investment Tracking | Yes | No |

| Budgeting | Yes | Yes |

| Retirement Planner | Yes | No |

| Net Worth Tracker | Yes | No |

| Bill Tracking | Yes | No |

| Bill Pay | No | No |

| Reconcile Transactions | No | Yes |

| Track the Market Value of Your Home | Yes | No |

| Free Credit Score | No | No |

| Promotions | Free | Free for 34 days |

| Synchronization | Link to any U.S. based financial account | Able to sync with more than 12,000 banks |

| Accessibility | Desktop, tablet, iOS and Android mobile devices | Desktop, tablet, iOS and Android mobile devices |

| Customer Service | 24/7 contact by phone or email | Email support and live workshops |

| Pricing | Free | $6.99/month, $83.99/year |

About Empower

Empower combines financial software and wealth management. The financial software is completely free to use, while the wealth management part is a premium service. That gives you the advantage of being able to sign up for general financial management, including budgeting, but to transition into wealth management, if that’s your primary goal.

And even if you don’t take advantage of the premium wealth management service, Empower includes a very large number of investment management tools in the free version. More than 1.6 million people have signed up for Empower, so you know they’re doing something right!

Empower Free Financial Software Features

The financial software enables you to assemble your entire financial situation on the Empower app. That includes bank accounts, investment accounts, retirement plans, and loans, such as mortgages and credit cards.

There, you can create a budget, develop long-term goals and strategies to reach them, and even manage your investments and retirement accounts. They provide income reports, spending reports, including spending by category, and alerts of bills coming due.

Specific tools and features include:

Investment Checkup Tool

Empower analyzes your current portfolio, then makes recommendations designed to improve your investment performance, and better enable you to reach your goals.

Fee Analyzer

You’re probably aware you’re paying certain fees in connection with your investments. Yet not all fees charged in an investment account are totally visible to the naked eye. But whether you can see them or not, they can amount to thousands of dollars in lost investment income over many years. The Fee Analyzer identifies these hidden fees, and can make recommendations for alternative investments with lower fees.

Tracking Your Net Worth

There are many numbers that make up your overall financial situation. But the one that’s the most important is your net worth. That’s the difference between your assets and your liabilities. It’s the single best number letting you know your financial progress. Empower regularly tracks your net worth. This allows you to compare it to the median U.S. household net worth for your age bracket, letting you know how you’re doing compared with your peers.

Retirement Planner

This tool will enable you to track your progress toward your retirement goals. If you’re in danger of not reaching your goals, you can make adjustments that will correct the situation. Empower even incorporates other retirement income sources, like your projected Social Security income, income from pensions, or any rental income you expect to receive in retirement.

The planner can also be used to help you develop a budget for covering major expenses. That can include making the down payment on a new house or providing for your children’s college educations.

Cryptocurrency Tracker

If you’re someone who invests in cryptocurrency – like Bitcoin or Ethereum for example – you will love the newest feature that Empower has just rolled out. You can now track thousands of different cryptocurrencies across hundreds of different crypto exchanges right from within the Empower dashboard.

Empower noticed that not only were more people investing in crypto, but users linked 28% more assets to their platform in 2020. So it just made sense to give people the ability to track the value of their crypto – especially since it fluctuates in price so rapidly.

One major disadvantage of the financial software is that it doesn’t allow you to reconcile transactions or accounts. That, however, is a feature that YNAB does provide.

Empower Wealth Management

Even though it offers financial management software, Empower is best known as a wealth management platform. And though it functions much like a robo-advisor, it’s really more of an automated investment platform that competes with traditional human investment advisors.

See More: Best Robo Advisors

That’s because Empower goes beyond simply managing your investments. It also offers many of the services typically provided by full-service investment management firms, including financial planning. They take a comprehensive view of your financial situation, and work to optimize it at every level.

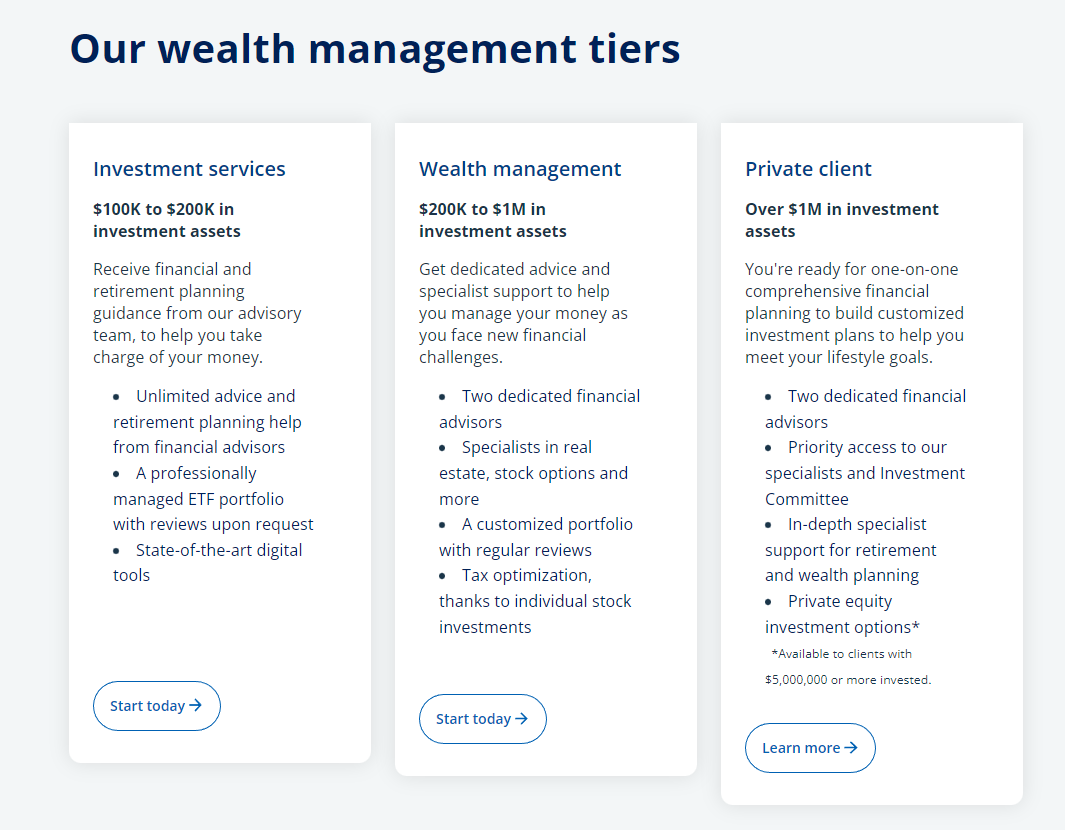

Empower offers three different levels of investment management:

About YNAB

YNAB is a moniker for You Need a Budget. It was started way back in 2003 (which is a long time ago in cyber years) by CPA Jesse Mecham. He designed it so he and his wife could create and maintain a workable budget. It worked well enough that he was able to begin marketing it to the general public. Its since grown to be one of the most popular budgeting apps available.

They advertise that new users save an average of $600 in the first two months, and more than $6,000 in the first year. YNAB goes beyond the mechanics of budgeting, and provides support and tutorials to help you overcome financial problems. They also allow you to reconcile transactions and accounts, a feature Empower doesn’t provide.

YNAB starts with four rules, each designed to give you a deeper understanding of the functionality of money, and your need to allocate it properly.

Rule #1: Give Every Dollar A Job

This rule requires that you decide in advance exactly what you want your money to do in your life. It asks the question What should this money do before I’m paid again? This step assigns each available dollar in your budget a spending category. It gives you an opportunity to decide in advance exactly how your money will be spent.

Rule #2: Embrace Your True Expenses

This is the forward-looking capacity of YNAB. You have expected expenses, but one may be particularly large. This rule forces you to budget for that large expense, even before it’s due. It can include less frequent expenses, like holidays, anticipated medical expenses, or a large insurance payment.

The idea is to prepare in advance for large expenses that have the potential to throw your budget off course. You do this by creating a goal, which includes the dollar amount that you need to reach by the time the expense comes due.

Rule #3: Roll With The Punches

This rule builds flexibility into your budget. For example, if you spend too much in one category in a given month, you cull through your budget to find another expense you can cut. You then move that amount into the category where you overspent.

It enables you to stay on budget, even if you go overboard with one or two expenses. In the process, you’re able to maintain your budget discipline despite overspending in one or two categories.

Rule #4: Age Your Money

This is probably the most unique feature of YNAB. The basic idea is to build toward a point where you’re spending money today that you earned at least a month ago. In other words, it sets you up to always be at least one month ahead of your expenses. It’s almost like setting up a rolling emergency fund.

YNAB believes this will reduce financial stress, by keeping you farther away from living on the financial edge. In effect, you’ll be living out of your savings rather than your paycheck. And that will eliminate the paycheck-to-paycheck financial lifestyle so many struggle with.

YNAB Budgeting Features and Tools

Goal Tracking

YNAB helps you to set goals, and then provides you with the tools to help you reach them. YNAB provides three ways to reach specific goals, including monthly funding goals so you can break your long-term goals down into more manageable monthly increments.

Debt Paydown

YNAB provides you with the education and tools to help you get out of debt, and stay out. You set your budget to pay off a credit card balance by a certain date, or to pay a specific amount each month until the job is done.

YNAB Classes

YNAB provides daily online classes to help you manage your finances. Some of the topics include:

- Set Up Your Budget

- Master Credit Cards with Your Budget

- Credit Card Overspending

- Create a Debt Paydown Plan

- Reach Your Savings Goals

- Pay for Big Expenses without Borrowing

- Break the Paycheck to Paycheck Cycle

YNAB Investment Features

Unlike Empower, YNAB doesn’t offer investment support. It is purely a budgeting application.

Pricing

Empower

If you’re just looking for budgeting and financial management software, Empower has these features available completely free of charge.

The Wealth Management function is the premium version. It starts with an annual management fee of 0.89% of assets under management with Empower, but drops as low as 0.49% on the largest accounts. It’s also worth noting that while you can include your employer-sponsored retirement plan on the platform–and get investment recommendations–no fee will be charged on the account balance, since it’s not directly controlled by Empower.

The full Wealth Management fee structure is as follows:

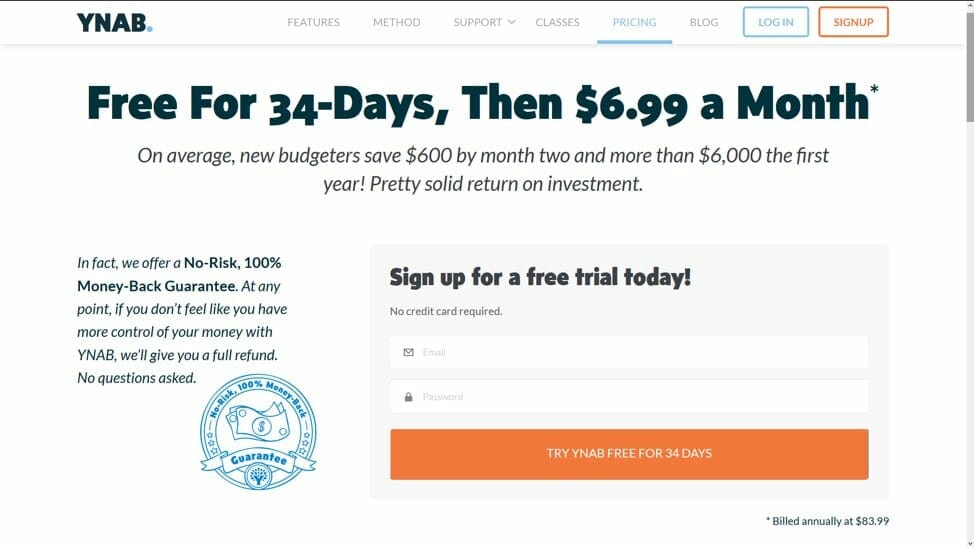

YNAB

YNAB offers a single pricing structure–$6.99 per month. However, rather than billing you monthly, instead they collect $83.99 to cover an entire year of the service. It’s a good arrangement for those who are looking to improve their budget without the additional monthly expense of the budgeting software itself.

Customer Service

Empower

Empower provides 24/7 contact by phone and email. They also provide a FAQ page mostly for wealth management. A more detailed Support Portal provides more information on the financial software.

YNAB

Customer service is a glaring YNAB weakness. There is no phone or email contact capability. But they do offer live chat (We usually respond within 24 hours), as well as a community forum, and Help Docs and FAQ pages that will answer most of your general questions. In fact, when you click the Contact Us button at the bottom of the page, you’re brought to the FAQ page.

Synchronization

Empower

Empower enables you to link any financial account you have online access to. You must provide the username and password for each account so the app can include it and track the activity. Most accounts will already be available on the platform, but you can add any that aren’t. Once they’ve been synced, any other account you have with that institution will automatically be added to your Empower account.

Empower has an advantage over YNAB when it comes to importing data. Empower will import up to three months’ transactions from each account (YNAB doesn’t retrieve any previous transactions). Empower doesn’t support foreign-based financial institutions, but you can link just about any U.S.-based company there is.

YNAB

You can download accounts into the app through the YNAB Direct Import tool, which can connect with over 12,000 banks. You can import the account using either the name or the URL of the institution. Once you do, you’ll need to enter your login credentials for that account. You can then edit the account name if you choose to, then click Save to complete the import.

YNAB will import the most recent balance from your financial institutions, and nothing more. Previous transactions will not be included. Any pending transactions will be available for import within 24 hours of clearing. A number next to the Import button at the top of the account register will alert you that you have transactions that need to be imported.

If you cant locate your financial institution, you can use File-Based Import instead. This feature will be particularly useful if you live outside the U.S. or Canada. QFX, OFX, QIF and CSV files can then be imported.

To make this happen, you first have to go to your bank’s website and get the file you want to import. You can then click the Import button on any individual account or group of accounts from that institution. Alternatively, you can also drag and drop your file(s) anywhere onto the YNAB app.

You can select the account you want the transactions imported into, and even include or exclude transactions before your account start date.

Read More: Alternatives for Empower

Accessibility

Empower

Empower is available for desktop, tablet and mobile devices. The mobile app is available for iOS and Android devices, as well as Apple Watch, and can be downloaded at the App Store or on Google Play.

YNAB

In addition to the web version, YNAB is also available for Android and iPhone mobile devices, as well as iPad, Apple Watch and Alexa. They can be downloaded on Google Play or iTunes.

Promotions

YNAB

YNAB is currently offering users the ability to try the service free for 34 days.

Bottom Line – Empower vs. YNAB

As stated at the beginning of this comparison, Empower and YNAB have a large number of overlapping services. In truth, you could be well served by either app. But your decision may come down to what area of your financial life most needs improvement at this stage?

If you’re looking for an app that will help you get control of your budget, as well as deal with debt issues and develop savings priorities, YNAB is the better choice. It provides detailed budgeting support, and a wealth of educational resources to help you better save money, and eliminate debt.

In particular, their Age Your Money rule–which will allow you to gradually transition over to living on last month’s income–is a perfect strategy for turning a non-saver into a committed saver. Not to mention, the amount of financial stress that a single strategy will eliminate in your life.

YNAB does have an annual fee for its service, compared to similar but less comprehensive financial management for free by Empower. But it may be a fee well worth paying for all the benefits you’ll get.

If your ultimate financial goal is to become a better investor, then Empower is the obvious choice. It doesn’t have as many money management features as YNAB, but even the free version has numerous tools to help you become a better investor, and increase your portfolio.

And should you decide you need professional investment management, Empower is ready with its premium wealth management services. Not only will they manage your investments for you, but they will provide financial planning services at substantially less than what traditional investment managers and financial planners charge.

Depending on what your specific financial needs are, you really can’t go wrong with either of these services.