Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Today, you’ll find plenty of budgeting and finance apps on the market, some of them free. If you’ve been struggling to get control of your budget, a good budgeting app may be the solution to your problem. If so, you should consider Monarch Money.

Not only does it offer basic budgeting and goal setting, but it also provides investment tracking and projections. That will help you to develop a plan to reach short-term, medium-term, and long-term savings goals, helping you to build the financial future that’s been eluding you up to this point.

What is Monarch Money?

Monarch Money is a budgeting app launched in 2018 and based in Walnut, California. It is a financial aggregator where you can include all your financial accounts on the dashboard. From there, you will have a high-altitude view of the big picture in your finances. It also allows you to set goals and provides a framework for reaching them.

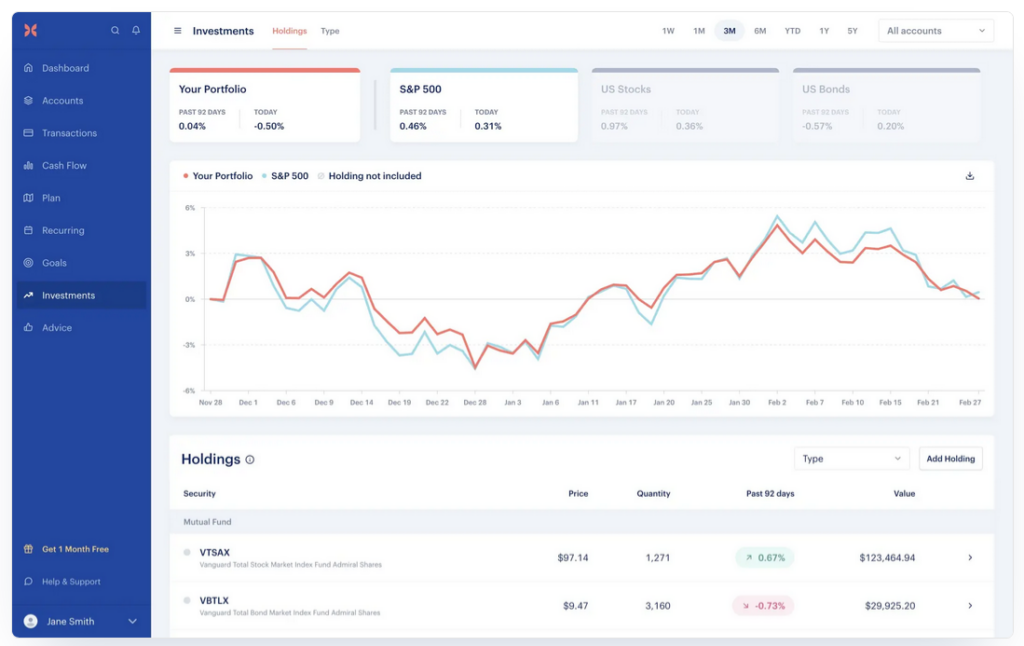

Monarch Money does delve into investments, unlike many budgeting apps that stop establishing savings goals. It allows you to link your investment accounts to the platform. The accounts will then be analyzed, enabling you better to balance your asset allocations and project future account valuations. In that way, Monarch Money goes beyond budgeting and into overall financial management.

Monarch Money is a fee-based budgeting app that allows users to add unlimited household members to their accounts. This feature is important to get the entire family on board with your financial plans.

Monarch Money has the following third-party and user ratings:

- Better Business Bureau: Not rated

- Trustpilot: 3.3 out of 5 stars (“Average”) based on two reviews

- The App Store: 4.8 out of 5 stars based on 10,200 reviews

- Google Play: 4.7 out of 5 stars based on 1,680 reviews

Monarch Money Features & Benefits

When you sign up with Monarch Money, you’ll enjoy the following features and benefits:

Budgeting

The app provides fully customizable monthly and annual budgets. The app can track, categorize, and forecast future spending by syncing all your bank accounts on the platform. You can use this capability to develop a budget and track your progress as you advance.

Recurring

With this feature, all your recurring bills and subscriptions will appear in a single calendar. That will give you a heads-up on approaching bill deadlines to be better prepared and avoid late fees. Monarch Money uses a calendar method to provide a visual representation. You’ll also be notified three days in advance of upcoming charges.

Reports

Track your spending to identify trends and make improvements. You can also identify where you’re spending the most and track your savings rate.

Dashboard

Monarch Money offers a customizable dashboard where you can link all your financial accounts. You can also create customized widgets to drag and drop into the dashboard. You can even turn off the widgets’ function if it is unnecessary.

Goals

Monarch Money allows you to set and track goals for your money. For example, you can allocate your savings toward multiple goals, like an emergency fund, retirement, paying off your mortgage, or covering an upcoming major expense. You can even assign specific accounts to each goal. There is no limit on the number of goals you can create with the app.

Transactions

Monarch Money allows you to search through your transactions easily. You can save receipt images or attachments, add notes, or reclassify a transaction into a different category. You can filter your transactions by specific criteria, like merchants, dates, and accounts. The app can split transactions into multiple categories if needed.

Investments

You can track all your investments in one place, chart and view them, and adjust your asset allocation.

Net Worth

You can track your net worth by syncing your financial accounts to Monarch Money. There’s even a provision to track the value of your home through Zillow Zestimates to give a full picture of your financial situation.

Calculators

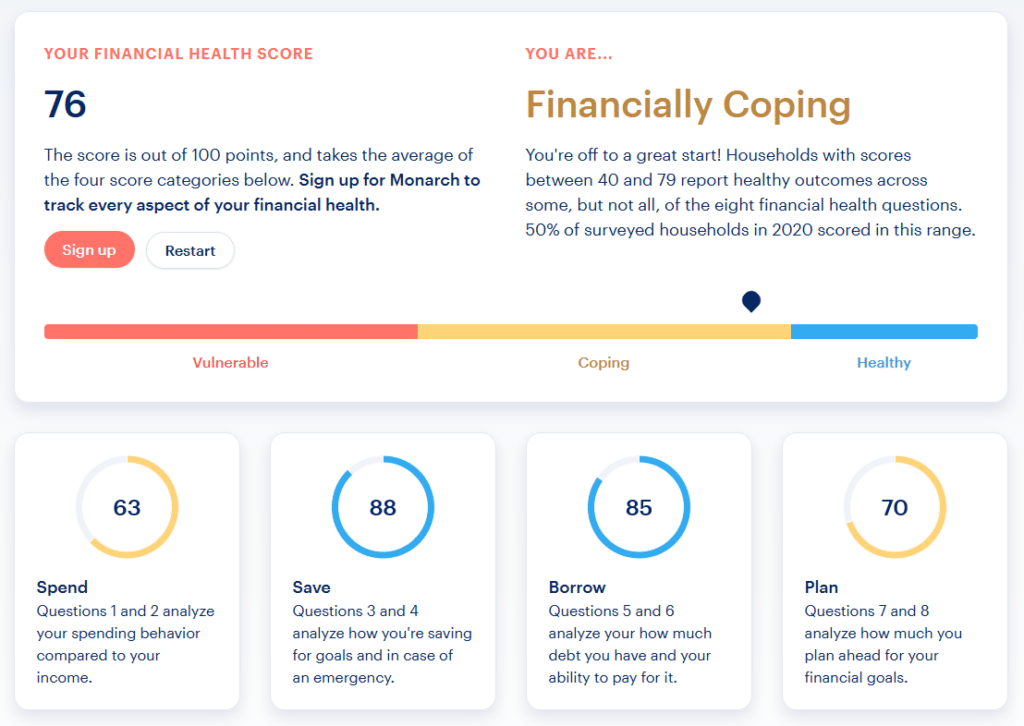

Monarch Money offers four different calculators for mortgages, debt paydown, retirement, and overall financial health.

The Financial Health calculator may be the most interesting. By answering eight questions, the app will determine your overall financial situation. Your situation can be classified as vulnerable, coping, or healthy. When you complete the questions, you’ll receive a profile analyzing your situation and assigning a score between zero and 100. It offers a way to quantify your household’s financial condition.

Collaboration

Once you have a plan, you can invite unlimited “collaborators” within your household at no extra cost. Each family member will have access to all features on the platform.

Mobile App

Monarch Money is available for iOS devices on The App Store, including iPhone, iPad, and iPod touch (all requiring iOS 14.0 or later), and Android devices on Google Play.

Security

Monarch Money offers multi-factor authentication to minimize the likelihood of unintended third parties gaining access to your account. Monarch starts by collecting only the minimum amount of financial data necessary to make a feature work. They employ industry-leading security practices to protect your data and the transfer of information. Monarch does not sell your data to other companies to make money.

Monarch does not store your username and password and has only read-only access. That means they cannot access or remove the money in your accounts. Connection with financial accounts is done through Plaid and Finicity, similar to bank practices. Those providers maintain access control, publish a SOC 2 Type 2 report, and implement API traffic control. They also employ one of the strongest bug bounty programs in the industry.

Customer Service

You can contact Monarch Money by email, and your question will be answered in the order it is received. Unfortunately, the app does not offer live phone support.

Monarch Money Pricing

Monarch Money can be downloaded for free. It offers Monarch Premium, a single plan with a monthly fee of $14.99, or $99.99 if paid annually ($8.33 per month equivalent). The plan has a seven-day free trial.

Monarch Money offers Referral Rewards. They’ll pay $14.99 when you refer someone who signs up for the service.

Sign-on bonus: None indicated at this time.

How to Sign Up with Monarch Money

You can download the app from the website for your home computer or on either Google Play or The App Store for your mobile device. When you click to sign up, you’ll enter your email address and then create a password.

You can then connect your financial accounts to the app by connecting them with the app or entering them manually. For extra security, you can activate multi-factor authentication.

Monarch Money provides a multistep guided program for setting up. For example, you will be directed to add accounts, customize categories, create goals, and plan how to reach those goals.

Pros & Cons

Pros:

- Create budgets and set multiple spending goals.

- Tracks investments and offers retirement projections.

- Provides continuous network tracking.

- Can be shared with an unlimited number of users within your household.

- Pays $14.99 for each referral who signs up for the app.

- There are no ads on the app.

Cons:

- Monarch Money does not offer a free version, as some competing budgeting apps do.

- No phone service for customer service.

Monarch Money Alternatives

YNAB (You Need A Budget)

If your primary financial concern is budget development, YNAB is one of the best apps you can sign up for. Using four simple rules helps you implement and follow a budget. The rules are:

- Each dollar in your budget is assigned an expense category.

- You will anticipate significant, occasional expenses.

- You’ll build flexibility into your budget.

- You’ll age your money.

#4 allows you to pay this month’s bills using money accumulated from the previous month, ending the paycheck-to-paycheck cycle that traps many consumers.

YNAB is available with a monthly fee of $14.99 or an annual payment of $99 (the equivalent of $8.33 per month).

Empower

If you are looking for an app that includes all your financial accounts in one place, Empower lets you do that for free on its financial dashboard. You can list bank accounts, investment accounts, credit cards, loans, and other accounts there. It provides a high-altitude look at your entire financial picture and offers valuable financial tools, like Investment Checkups and the Retirement Planner. It’s all free of charge.

If you’re looking for investment help, Empower also has you covered. That starts with the Empower Personal Cash account, currently paying 4.70% APY on balances up to $5 million with no fees. From there, Empower also offers premium investment accounts, managed portfolios, and wealth management services. This flexible platform gives you access to just about any level of service you need.

Wally GPT

If you’re looking for a truly cutting-edge budgeting app that doesn’t stop at budgeting, Wally GPT is worth investigating. It’s an AI-powered personal finance app designed to help you improve nearly every area of your financial life. As an AI-driven app, Wally streamlines Internet searches. Using a question-and-answer format, you can ask Wally about loans, credit cards, budgeting, investing, etc. Wally will pull the most relevant information from the Internet, saving you many hours of research.

Wally doesn’t provide direct personal finance or investment advice, but it gets you to the places that can help you make your own decisions. It lets you get summaries of websites, web pages, and YouTube videos. Wally can also be used with Gmail and popular social media, enabling you to auto-respond to messages and even help you design emails and social media posts.

Frequently Asked Questions (FAQ)

Is Monarch Money trustworthy?

The app uses standard financial industry protocols to protect your information and data but also offers multi-factor authentication if you’re interested in a higher level of security. Meanwhile, Monarch Money has no access to the funds included in your account.

Is Monarch worth the cost?

At under $100 for the annual plan, Monarch is in the middle of the price range for budgeting apps. You’ll need to compare what they offer to the competition and see if that fee is justified based on the budgeting features they provide.

Does Monarch Money sell your data?

Monarch Money states on its website that they do not sell your data to third parties.

How does Monarch Money make money?

Monarch Money earns its revenue through the subscription fees paid by product users. That means they don’t need to bombard you with multiple ads, as is common with many free budgeting apps.

Should You Sign Up for Monarch Money?

Budgeting is not a discipline that comes easily to many people, even though it’s necessary if you want to improve your financial life. An app like Monarch Money can be just the service you need to finally get serious about creating a budget. It provides the framework, the goals, and the tools to help you reach them.

Yes, you will pay a fee for this service. However, paying approximately $100 annually to improve your finances and save thousands each year is potentially worth it.

Monarch Money

Summary

Monarch Money is an inexpensive app that allows you to create a budget to track your expenses, set limits, and monitor your investments.