Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Freelancers, like myself, often have a lot of plates to juggle. We may wear the hats of CEO, marketer, accountant, and IT technician all within the same workday.

You work hard as a freelancer and it’s only right that your bank should work hard for you. That’s the main idea behind Lili, a banking app designed specifically for freelancers. Lili offers a virtually fee-free banking experience with a lot of built-in tools to save you time and money.

In our Lili review, we’ll review the app in detail, so you can decide if it’s a good option for you. Here’s what you need to know.

What Is Lili?

Lili is a new mobile app that launched in 2019 with the mission to “empower freelancers with tools and services designed to improve their work, their life, and their balance.” Its co-founders are CEO Lilac Bar David and CTO Liran Zelkha.

Not long after Lili was formed, the pandemic hit and caused many people who lost their day jobs to turn to freelance. And this shift benefited Lili in a major way. The app has generated hundreds of thousands of opened accounts and transactions are up 1,000%+ since the beginning of the coronavirus crisis.

Related: Online Resources For Freelancers

Lili Basic Key Features

Lili’s Basic account doesn’t earn interest or offer rewards. That said, there are three additional Lili accounts a user can sign up for. However, those accounts all charge a monthly fee and their added benefits aren’t worth the squeeze so we’re going to stay focused on Lili Basic.

So what value is Lili Basic offering freelancers that has triggered so much growth in such a short period of time? Below we break down its most notable features.

Mobile Banking

Lili isn’t a bank that happens to have an app. Instead, it’s a mobile banking app (available on iOS and Android) that sits at the core of its customer experience.

New customers are required to download the app to complete the account opening process after submitting their applications. Once you’re inside, the app can handle all your banking needs including:

- Accessing account and routing numbers

- Initiating online deposits and transfers

- Paying bills

- Categorizing transactions

- Depositing paper checks

- Reviewing transaction history

- Modifying debit card usage settings

- Generating expense reports

- Finding local ATMs

In my own experience with the app, I found it to be well-designed and easy to use. It should be noted, however, that currently there is no way for a customer to access his or her account from a computer.

Visa Business Debit Card

As soon as you’ve opened your business checking account with Lili, it will send a Visa debit card to you in the mail. Lili says that the card should arrive within 10 business days and its shipping status can be tracked inside the app.

Thankfully, you don’t have to wait until your physical card arrives in the mailbox to begin using it. Lili will provide your card number immediately so you can begin making online purchases. Plus, the card can be linked to several third-party payment apps, including Cash App, Venmo, PayPal, Google Pay, and Apple Pay.

Lili customers can spend up to $5,000 per day with their Visa business debit card. The card can also be temporarily deactivated at any time from inside the app.

Helpful Tax Tools

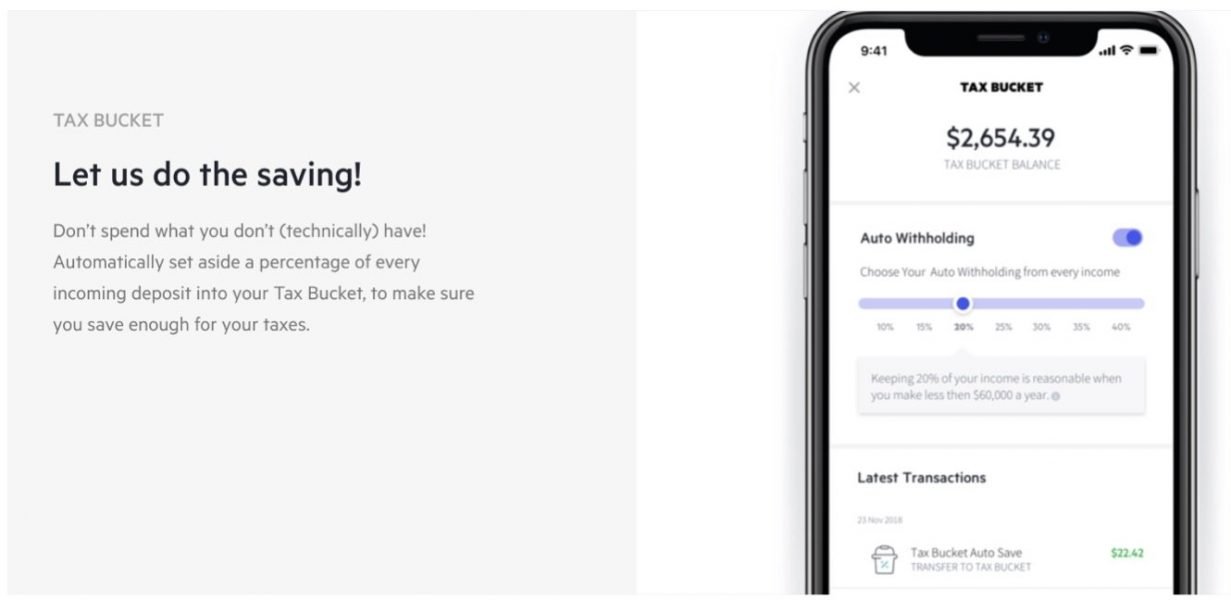

Lili offers a variety of tax features setting it apart from other online banking apps. For one, it can automatically set aside a portion of each deposit for taxes so that you don’t accidentally spend money that you owe to Uncle Sam.

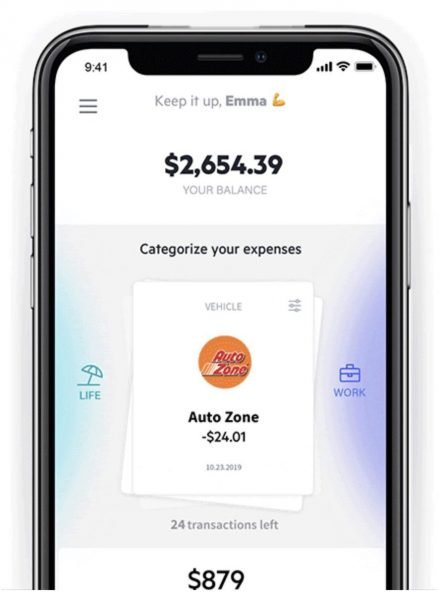

One of the coolest features is its expense categorization tool. As you spend money with your Visa debit card and the transactions appear in your account, you can simply swipe left or right to categorize them as personal or business expenses.

Then, at tax-filing time, Lili can use your expense data to help you file your taxes accurately as a freelancer and claim the business deductions that you deserve. That not only saves you time but also money if you can reduce your tax preparation cost.

Online Deposits and Transfers

As with other checking accounts, you can accept direct deposits from your clients as a Lili customer. But unlike some other bank accounts, Lili offers Early Payments. With this feature, customers can receive their direct deposit payments up to two days earlier than they would arrive at a traditional bank.

In addition to direct deposits, Lili Basic customers can transfer money from a lot of external bank accounts. Some of the banks that are supported include:

- Bank of America

- BB&T

- Capital One Financial

- Charles Schwab

- Citigroup

- Citizens Financial Group

- Fidelity

- JP Morgan Chase and Co

- Navy Federal

- PNC Financial

- Services Group

- SunTrust Banks

- TD Bank

- U.S. Bancorp

- USAA

- Wells Fargo

It should be noted that there are daily and monthly limits for transfers between accounts. The current limits are $1,000 per day and $5,000 per month.

ATM Access

Lili offers fee-free ATM access at the over 32,000 ATMs that are part of the MoneyPass network. Cash withdrawal limits are set at $500 per day.

To find an ATM near you, simply navigate to the ATM locator inside the app and search for the nearest one to your location.

Cash deposits are also convenient and affordable. To deposit cash, simply visit a participating Green Dot location. Lili provides a link to find a deposit location near you and additional details regarding deposits here. While Lili doesn’t charge any fees for cash deposits, retailer fees can vary with a maximum charge of $4.95.

Lili Pricing and Fees

Lili’s terms and fees are consumer-friendly. There is no minimum deposit and no monthly maintenance fee regardless of your account balance.

Additionally, you won’t be charged any of the following fees with Lili Basic:

- Overdraft fee

- Returned item fee

- Stop payment fee

- Deposit item returned fee

- Inactive account fee

- Funds transfer fee

All of the fees that Lili does charge can be avoided. These include:

- Deposited check return fee: $25

- Express mail fee: $20

- Card replacement fee: $5 after the first replacement

Additionally, customers will incur a $2.50 fee for using a domestic out-of-network ATM and a $5 fee for international ATM withdrawals.

Opening an Account

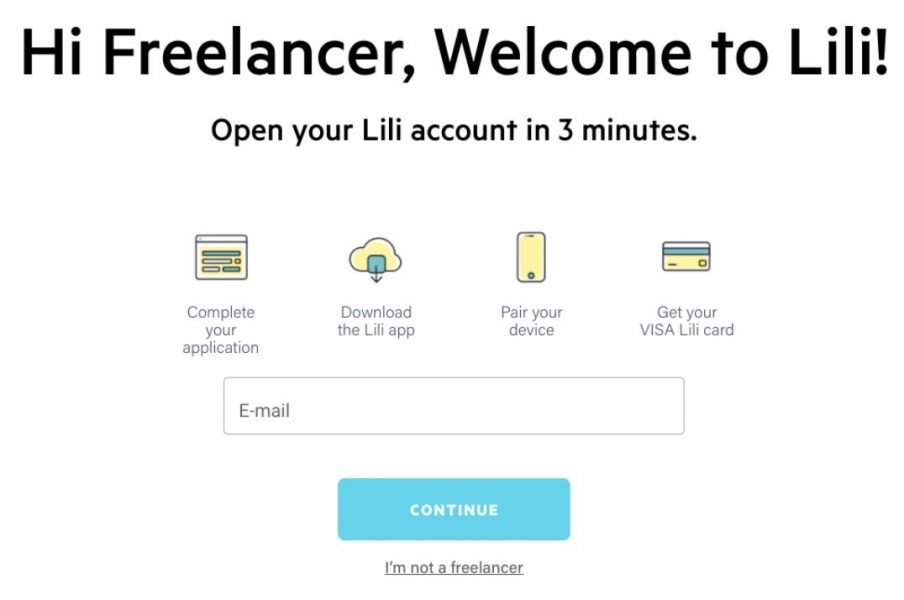

Lili says that new accounts can be opened within 3 minutes. In my own test, I found their estimate to be fairly spot-on. I opened a sole proprietorship with my social security #.

To open an account, simply navigate to the Lili website and click “Get started.” First off, you’ll be asked to provide your email address.

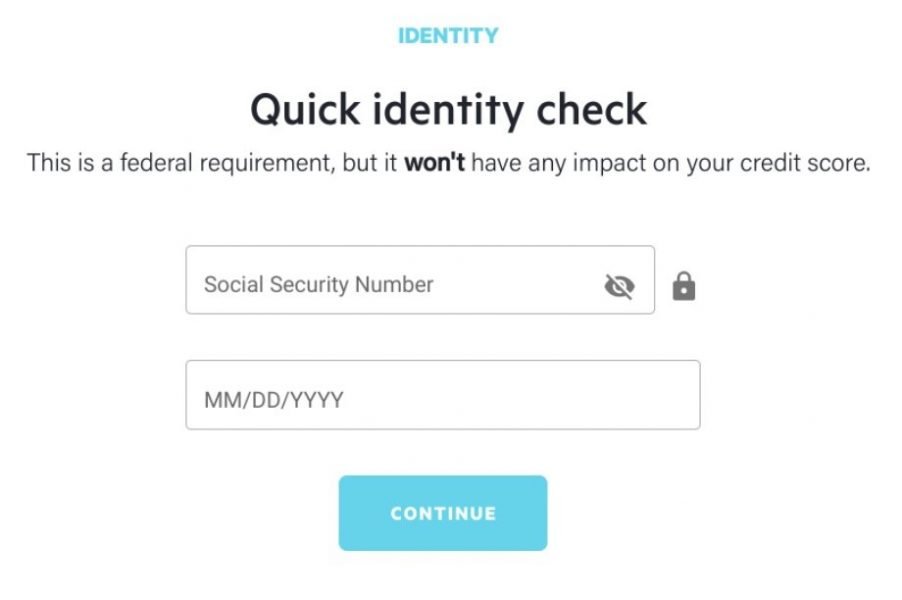

Next, you’ll need to give your name and phone number and create a password before confirming your identity with your Social Security number and birthdate. Note that your SSN is only used for identity verification purposes and your credit score will not be impacted.

Next, you’ll need to select the kind of freelance work that you do from a drop-down menu.

Then simply click continue to submit your application! And that’s it! Within seconds your account should be created. Finally, Lili will text you a link to download the app so that you can finish the account setup process and begin using your card online.

*If you are looking to open an LLC, S-Corp, or Partnership account, you may be asked to provide additional documentation to verify your business.

Lili Security

When it comes to deposit protection, Lili customers receive full FDIC insurance through its sponsor bank, Choice Financial Group. That means $250,000 in deposits (which is also the maximum account balance) will be federally protected.

Lili has also taken measures to protect its customers’ data privacy. It says it uses industry-leading encryption and uses multiple layers of security. Customers can also use biometric authentication, such as fingerprint, face, or iris scanning.

Lili Customer Service

Customers can contact support in multiple ways. For written support, you can submit a request inside the “Help Center” or send an email to [email protected]. Phone support is also available Monday through Friday from 9 a.m. to 7 p.m. (EST) at 1-855-545-4380.

What Others Are Saying About Lili

As of article writing, Lili has a 4.7/5-star rating from 6,000+ ratings on the Apple Store and a 4.4/5 rating on the Google Play store out of 10,000+ customer reviews.

The app continues to impress users with its ease and functionality.

How We Rated Lili

Factors that were considered in the review of Lili Basic included:

- Fees: An overview of all the fees that are charged and not charged.

- Features: This includes mobile accessibility and account management, deposit and transfer options, access to cash, third-party software integration, and more. This also included its lack of interest rates and rewards.

- Ease of Use: Includes the application process, website and app design and functionality, and access to local branches and ATMs.’

- Mobile Access: How quickly a user can log in and access banking data and what information was readily available via the app

- Customer Service: Includes phone and messaging support as well as in-person support at brick-and-mortar locations.

Lili was given an overall editorial rating of 4.3 stars (out of five) based on how it compared to other top freelancer bank accounts and apps.

Lili Pros & Cons

Pros

- Low fees — With Lili, you’ll never pay a wide variety of fees including monthly maintenance fees, overdraft fees, or fund transfer fees.

- Tax tools — You can automatically save for taxes and categorize your expenses as work or personal without ever leaving the Lili app.

- Fast direct deposit — Receive your direct deposit funds up to two days earlier with Lili’s Early Payments feature.

- Large fee-free ATM network — Withdraw cash for free at over 38,000 MoneyPass network ATMs.

Cons

- No interest or rewards — Lili pays no interest on deposited funds and there is no cashback rewards program for its debit card.

- Bank transfer limits — You won’t be able to transfer more than $1,000 per day or $5,000 per month from another bank into your Lili account.

Alternatives to Lili

Not sure that Lili is the right business banking option for you? Here are a few alternatives.

Novo is another one of the top choices in the business banking space. Its business checking accounts come with no monthly fees or minimum balance requirements. However, a $50 minimum deposit is required to open an account.

Where Novo really shines is in the number of third-party business software services that it’s able to integrate with. Freelancers who need to transfer funds overseas will love that Novo is able to connect with TransferWise. Other notable integrations include QuickBooks, Slack, Xero, and Stripe.

Impressively, Novo refunds all ATM fees for its customers. And bank-to-bank electronic transfers are always free too. Check out our complete review of Novo.

NorthOne offers several benefits for freelancers and business owners. It makes it easy to create sub-accounts for things like your taxes, payroll, and rent. And it works with a large number of third-party services including Quickbooks, Freshbooks, Gusto, Wave, Xero, and more.

But for some freelancers, the one feature that could tip the scales in NorthOne’s favor is it can accept cash deposits for free. Customers can deposit or withdraw fee-free from any NYCE or MoneyPass ATM nationwide.

NorthOne’s pricing falls a bit short, however. All customers are charged a monthly maintenance fee of $10. Other fees include an overdraft fee ($5), non-sufficient funds (NSF) fee ($25), wire transfer fee ($10), and international wire transfer fee ($25).

Is Lili Right for You?

In my first-hand experience, I found that Lili’s application process couldn’t have been easier. The app was also thoughtfully designed. All of the most important information and tasks were easy to find, without having to wade through multiple sets of menus.

I also loved that it was truly as easy as Lili promised to categorize transactions, set up direct deposit, and pay bills. As someone who currently exports my bank transactions to a third-party software provider for expense categorization, I could easily see the benefits of being able to cut out this extra step and cost.

The lack of earned interest or rewards wouldn’t be a problem for me as I could continue to use my savings account for that while using Lili for day-to-day transactions. The lack of physical branches also wouldn’t bother me as I already do nearly all of my banking from my phone and cash deposits are still an option at 90,000 Green Dot locations.

If you’re a freelancer in need of a largely fee-free account, Lili is absolutely right for you. But should you need other small business banking perks, you may want to consider looking at our Best Business Checking Accounts For Freelancers and Entrepreneurs.

Lili Basic Checking Account

Summary

Lili Basic can offer your business a fee-free banking experience with excellent features and customer service. Unfortunately, there’s no bonus or interest earned.