Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

We all know that saving for the future is important. No matter your goals, a solid savings plan can help you make the most of your money — and help you avoid falling behind.

The earlier you start your savings habit, the better off you’re likely to be in the long run. An early savings habit allows you to build up a better emergency fund, as well as take advantage of compound interest to allow your retirement portfolio to grow over time.

Using Your Age for Benchmarks

One way to estimate how much you should set aside is to use your age to set benchmarks. Of course, not everyone is in the same place, and there is no one-size-fits-all approach to finances.

However, if you think about it, your age can give you something to shoot for. As you plan for the future, keep in mind that you might need to tweak based on circumstances, and that could mean playing catch-up later.

No matter what you end up doing, though, it’s a good idea to bake savings into your budget and start the habit sooner rather than later, even if you don’t feel like you can save a lot of money right now.

Building Your Emergency Fund

In general, an emergency fund can help you save up for unexpected expenses. You can use an emergency fund for car repairs, to make hospital copays or to help supplement your income if your hours are cut at work.

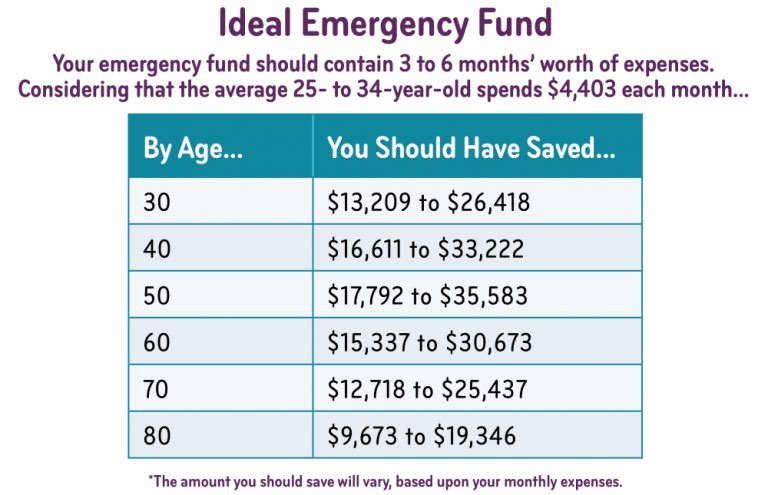

Many experts suggest that you have three to six months’ worth of expenses in your emergency fund, but you might feel more comfortable with nine or 12 months’ worth, especially when you feel like a recession or some other economic event is on the way.

During your 20s, it’s a good time to build a solid foundation and put aside what you can so that by the time you reach age 30, you’re meeting your goals.

Ally offers this handy visual to provide you with a benchmark for building your emergency fund.

However, you might come up with a different goal, based on your monthly expenses. If you’re living frugally, maybe you only spend $3,000 per month. In that case, you can adjust your numbers based on your actual expenses.

However, you might come up with a different goal, based on your monthly expenses. If you’re living frugally, maybe you only spend $3,000 per month. In that case, you can adjust your numbers based on your actual expenses.

On the other hand, though, creating a stretch goal for the upper end of the range can encourage you to save more–and build a fund that is more likely to get you through some tougher times.

Where Should You Keep Your Emergency Fund?

For the most part, an emergency fund should be kept in a high-yield savings account that is liquid and accessible. There are institutions like Everbank and Discover® Bank that can help you open accounts that pay a reasonable rate of return.

It’s also possible to use short-term CDs to build an emergency fund ladder that can allow you regular access to your money and potentially higher yields.

Related: How (and Why) to Create a CD Ladder

Finally, there are some people, like me, who use a tiered approach to emergency savings. I keep three to four weeks’ worth of expenses in a liquid savings account, while the rest of my emergency fund is in a taxable investment account. Betterment is great for this. You can take care of immediate needs from the savings account while you liquidate stocks as needed and transfer them.

Where you keep your emergency fund depends on your goals, as well as your risk tolerance.

Saving for Retirement at Any Age

Of course, you also need to be saving for retirement. Building your retirement portfolio is important at any age, but your best results come when you start earlier.

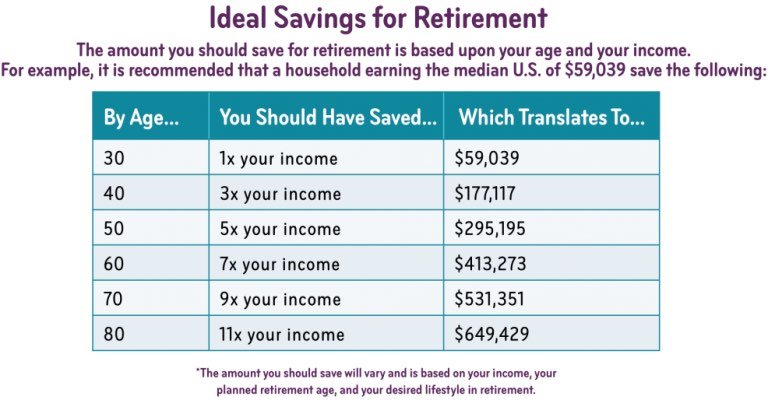

Once again, how much you save depends on your long-term goals and what you expect to do in retirement. Ally provides a basic benchmark for retirement savings goals by age, based on your income.

Another rule of thumb to consider is how much you expect to spend during retirement. Some experts suggest that you base your retirement savings on a withdrawal rate of 4%. This rate assumes the annualized inflation rate will be 3%, while your annualized returns are 7%. According to the theory, you should be able to avoid running out of money when you follow this rule.

Another rule of thumb to consider is how much you expect to spend during retirement. Some experts suggest that you base your retirement savings on a withdrawal rate of 4%. This rate assumes the annualized inflation rate will be 3%, while your annualized returns are 7%. According to the theory, you should be able to avoid running out of money when you follow this rule.

If you think you’ll need $50,000 to live on each year, you’ll need $1.25 million in your portfolio when you retire, if you accept the 4% rule. If you apply the 4% rule to the amounts shared by Ally, you’ll have to manage your money a little more frugally — or rely on Social Security to make up the gap.

Applying the 4% rule to your retirement savings at age 60 on the chart only allows you to withdraw $16,530.92 a year. If you don’t care about drawing down your principal and spending money at a faster rate, that $413,273 will last you just over eight years if you spend $50,000 per year.

As you can see, determining how much you should have in your retirement savings is a little more complicated than just following a rule of thumb. While benchmarks can give you something to think about and a place to start, the reality is that you might need to save much more, depending on the lifestyle you expect to live, and whether you want to retire early.

Where Should You Keep Your Retirement Portfolio?

Where you keep your retirement portfolio depends on your situation and your long-term goals. If you have a company 401(k), there’s a good chance you’re already saving money in a retirement account. Review your options to make sure you’re getting what you need.

If necessary, you might be able to roll your money into an IRA for more options and to help you better meet your goals.

Carefully consider your options, and what you hope to accomplish with your money as you determine the best place to keep your retirement portfolio. You’ll also want to think of your asset allocation, shifting your investments as you approach retirement.

How to Catch Up if You’re Behind

While these numbers are guidelines and not hard and fast rules, you might still be interested in doing what you can to catch up if you feel like you’ve fallen behind.

For those in their 50s, it’s possible to make extra contributions to your IRA or 401(k) in order to catch up. However, if you’re younger and hoping to supercharge your emergency fund and/or retirement savings, you might have to take other steps.

- Pay down high-interest debt: You can pay that down and then divert what you were paying before to your savings. This can be effective in the long run since you’ll no longer be stuck with high rates.

- Increase your income: You can earn more money through a side gig, second job or by getting a new job or a raise. Bank the additional money. You can stick with the extra income indefinitely, or quit when you feel like you’re back on track for your goals.

- Cut back on some of your spending: If there’s room in your budget to cut back, you can take the money you save and put it toward your savings goals.

- Use windfalls to beef up your savings: Tax returns, bonuses, inheritances and other windfalls can all be used to increase what you set aside for savings.

In some cases, you might need to find ways to prioritize your savings so that you automatically move the money to retirement or emergency accounts before you spend on other items.

The most important thing, though, is to take the time to figure out what your needs are, and then take the time to create a plan to help you reach your goals.