Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Debt has become THE four-letter word of the financial world. And while you may have been taught to avoid debt at all costs, not all debt is created equal. That simplifies the concept of debt into a single lump of undesirable financial burden. In reality, most debt is lumped into two categories and a struggle ensues – good debt vs. bad debt.

How much and the type of debt you have can impact your finances and your credit. It can affect the type of home you are able to purchase, the interest rates you qualify for, and even the type of home you are able to afford. Learn the differences between good debt and bad debt, examples of each, plus tips to avoid bad debt.

What Is Good Debt?

Good debt is low-interest debt that will increase your net worth or income in the future. Think of student loans for a college education or graduate degree or a mortgage for a home that will likely appreciate. Put simply, it’s a debt that will eventually convert into an asset, or increase your net worth.

Mortgage Debt

If you own a home, chances are, you have a mortgage. In fact, 78 percent of all home purchases were financed with a mortgage in 2022. While it can be nerve-wracking to take on that much debt, a mortgage technically falls under the good debt category. (That’s provided you take out a mortgage that’s roughly 2 to 3 times your income, which experts recommend.)

Mortgages are considered good debt because the loan is secured by your home, which to creditors, means you are much more likely to make payments on time. A mortgage can also help you improve your credit long-term, since, again, you’ll likely be paying it on time. In short, having a mortgage is a good indicator of responsible credit use.

Your mortgage will also likely be the lowest interest rate you’ll ever get, compared to other debt. For example, mortgage rates as of October 2023 were 8.471%, personal loan rates range from 6%-36%, and the average credit card APR is around 25%.

Another reason why a mortgage is considered good debt? Your borrowing on an asset that will likely increase in value. While your home’s appreciation will vary based on the original price, neighborhood, age, and various other factors, many homes get more valuable as time goes by. In fact, homeowners who bought their homes 7 to 10 years ago could see as much as a 47% appreciation rate.

Student Loan Debt

Student loan debt has increased 66% in the past decade, now totaling more than $1.77 trillion. With the cost of attending a four-year college or university increasing at such a breakneck pace, it’s fair to wonder if getting a bachelor’s degree is still worth it.

And the answer is still empirically, yes.

A recent study from the Federal Reserve Bank of New York shows that the average bachelor’s degree holder earns an average of $78,000 annually, compared to the $45,000 average salary of a high school graduate.

Apart from the long-term financial benefits of a college degree, student loans are also considered good debt since they offer lower interest rates than other types of debt, and the interest can be tax-deductible. Plus, a college or graduate degree is an asset that will appreciate, as it often translates into greater financial success in the future.

Small Business Loans

Let’s face it. Most startups need money. If you’re not in a position to find investors to put funds into your million-dollar idea, you may be considering a small business loan. While this can be daunting, even scary, a small business loan is considered good debt.

This one can be tricky since not all loans obtained for your small business are good. Generally speaking, debt earmarked to pay for things that will help your business grow and be successful long-term is considered good, while debt obtained for your small business that doesn’t contribute to its growth isn’t.

It’s worth noting that small business loans are notoriously difficult to obtain. A lender will examine your credit history, time in business, cash flow, and other financials. They may also require a small business plan. Our best small business loans guide breaks down the right type of loan for your business as well as how to prepare before applying.

What Is Bad Debt?

Bad debt is debt with a high (or variable) interest rate that drains your income or finances and doesn’t contribute to your overall net worth or income. Bad debt is also debt incurred to pay for assets that don’t hold their value, like a high-interest credit card used for non-essential expenses.

Generally speaking, bad debt is also debt that, because of its high balance or interest rate, you are unable to repay. That means you could fall into a cycle of making payments that only cover interest, hence getting stuck with a bad debt that drains your finances for years to come.

High-Interest Credit Cards

If you struggle with high-interest credit cards, you’re not alone. Recent data from the Federal Reserve Bank of New York reports that credit card balances in the U.S. have reached a record $1.05 trillion, while a staggering 30% of Americans report having between $1,001-$5,000 in credit card debt.

But just because you can pay for it, doesn’t mean you can afford it. With the average credit card APY hovering around 24.99%, paying for that luxury item or nonessential purchase costs more than just the initial price tag.

Credit card debt is considered a bad debt due to its high-interest rates, low minimum payments (many times just used to pay the interest on those purchases), and the fact that they’re likely used to buy items that aren’t increasing in value, or depreciating assets.

That’s not to say all credit card usage is bad. If you’re paying off your credit card in full each month, it could help improve your credit history and credit utilization.

Predatory Payday Loans

While a payday loan may seem like a good idea when you’re short on cash and payday is still days away, these high-interest loans are typically not your best option. In addition to a tight turnaround in terms of due dates, these loans have a staggering 400% APR.

In most cases, you’d be better off securing a small personal loan or using a low-interest credit card to bridge the gap, as you’ll have a much lower interest rate and a more forgiving due date.

Auto Loans

Your car may seem like a necessary expense. It’s how you get to and from your job, which allows you to earn an income. It could be your transportation to and from school, which opens up earning power in the future, or even how you get groceries to feed your family. So, why is it considered a bad debt?

In short, a car loan is a bad debt because it’s a loan on a depreciating asset. Within the first year of owning your car, it loses about 20% of its value. Plus, most car loans. With the average car loan hovering around 72 months or six years, chances are, you’re going to pay quite a bit of interest on a car purchase. Worst case scenario, you may even owe more on your car than it’s worth, depending on your loan term and interest rate.

Tips to Avoid Bad Debt

- Avoid high-interest debt, such as consumer credit cards. Using credit cards is a great way to earn rewards and save on everyday purchases but always pay the balance off each month.

- Build an emergency fund so you won’t have to resort to high-interest debt like payday loans.

- If you use your credit card, pay off the balance each month.

- Keep your borrowing under control. Don’t get a mortgage for more house than you need just because you can. The same goes for personal loans. If you must take one out, take the lowest amount possible to cover the needed costs.

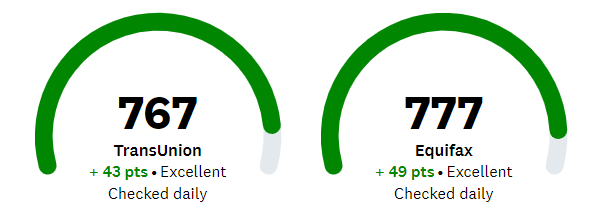

If you don’t have a handle on your credit report to track the debt in your name, opening a Credit Karma account is a great idea. They’ll give you two of your credit scores (Equifax and TransUnion) and will also show you your credit report.

Use the information to put together a monthly budget that allows you to get rid of the bad debt you have as quickly as possible. As the debt begins to fade, you should notice a positive impact on your score.

Frequently Asked Questions (FAQ)

Can I Have Too Much Good Debt?

Absolutely. Just as important as the distinction of good debt vs. bad debt is your debt-to-income ratio. If you have an overwhelming amount of good debt in your credit profile, your credit score is likely to be negatively impacted.

How Important Is Avoiding Bad Debt?

When you’re looking to take out another line of credit, your credit score can determine the interest rate you receive. In a high-rate environment, your credit score could mean the difference between a 6% mortgage and an 8% mortgage. Over the life of the loan, that could mean savings of tens if not hundreds of thousands of dollars in interest.

Final Thoughts on Good Debt vs. Bad Debt

Most of us are conditioned to believe all debt is bad debt. But it’s not quite so black and white. Good debt exists, like student loans and mortgages. Good debt also can help you increase your income or net worth down the line.

The trick to managing debt is to ensure you never find yourself in a position where you fall behind. Whether the debt is good or bad, it’s still debt and when you start missing payments, all of it turns into bad debt. Make sure that before you decide to open a new line of credit, you’re in a strong financial position and know that payments will come on time, every time.