Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

The best budget apps for couples can help manage your money and investments together. Some tools, however, are better than others when it comes to joint finances. We look at some of the best budgeting apps for couples.

Everybody who has been in a committed relationship knows how important money is to the couple’s quality of life together. There’s even a theoretical framework for the importance money plays in a relationship. It’s called Couples and Finances Theory (CFT).

Studies have found what couples already know–how couples handle money goes a long way to determining the quality of their relationship. For that reason, we examined dozens of budgeting and financial management apps to bring you what we think are the best for those managing money with a significant other.

The Best Budget Apps for Couples

| Budget App | Best Feature for Couples |

| Empower | Robust Investment Tracking |

| Rocket Money | Subscription Cancellation |

| PocketGuard | Custom Categorization |

| Honeydue | Enhanced Personal Privacy |

| HomeBudget | Include Kids |

| EveryDollar | Goal Planning |

| myFICO | Thorough Credit Reports |

| Splitwise | Manage Shared Expenses |

1. Empower

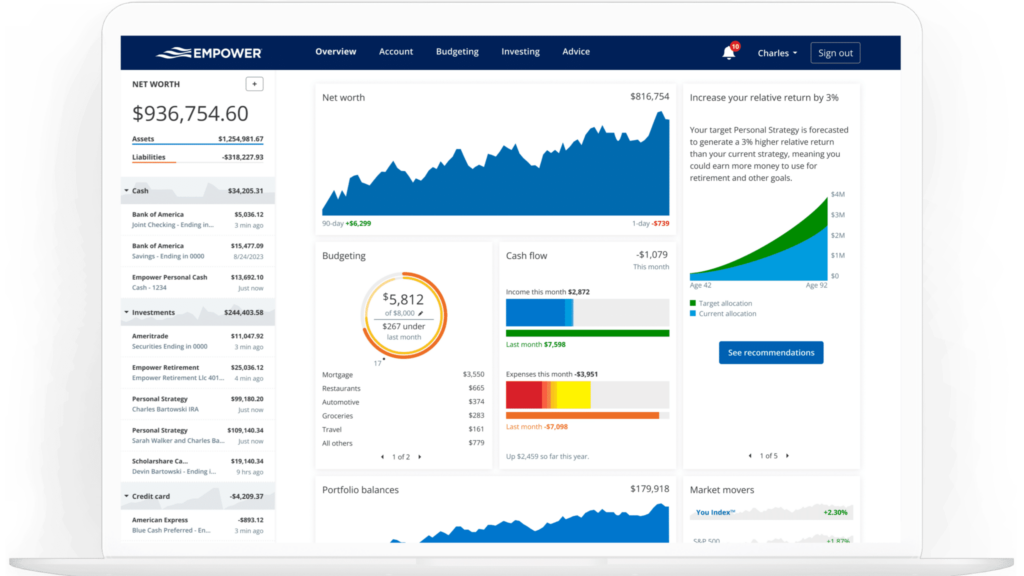

If you’re looking for a complete picture of your finances, Empower is a great choice. It pulls in your bank account, credit card account, and investment information and provides an overall view of what’s going on with your finances.

As a couple, this can be a great way for you both to see what’s going on and monitor your overall financial health. You can see your joint and separate accounts, including your separate retirement accounts in one place. Empower gives you a holistic view of your money, allowing you to make financial plans together. There’s even a free tool that analyzes the retirement account fees you’re paying and helps you find a better way to invest.

- Monthly Fee – FREE

2. Rocket Money

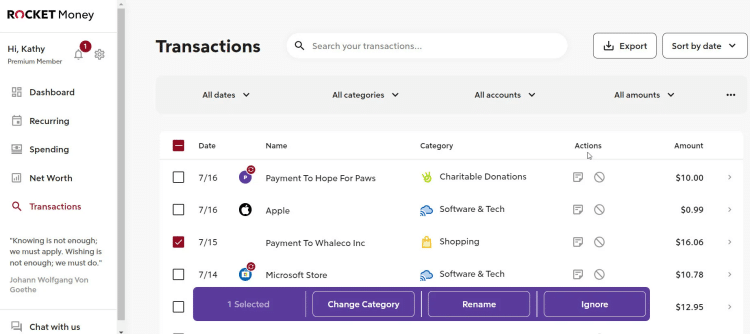

Rocket Money is quickly becoming one of our favorite budgeting apps. It offers an excellent smartphone app and desktop version. It handles budgets with ease, and can also help you track and cancel subscriptions and lower the cost of recurring bills.

For couples, it offers shared access. The primary Rocket Money member can share access with their significant other. This gives both of you complete access to the budgeting app and all of its tools.

It can, however, be tricky to find the sharing feature. You must be on the smartphone app, not the desktop. From the app, follow these steps:

- Tap on the Settings (⚙️) icon in the upper left corner of the Dashboard

- Select Profile from the menu

- Scroll down and tap on Enable under Share with your Partner

- Enter the full name and email address of the person that you’d like to share your account with.

- Tap Share My Account and then you’ll be taken to a confirmation screen. Select Done to go back to your Profile page

- Monthly Fee – Free for basic platform / $4-$12 per month for premium.

3. PocketGuard

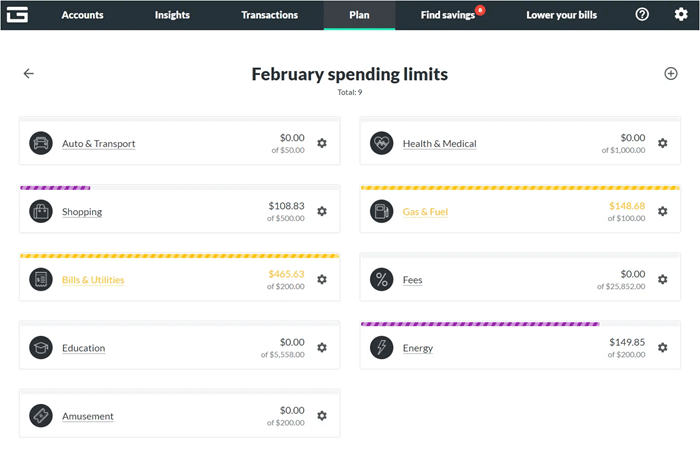

Looking to take things a step further with budget analysis? PocketGuard is a great tool that can help your joint finances in a way that takes things to the next level. In addition to allowing you to pull information from bank accounts, credit card accounts, and investment accounts, this app also uses advanced categorization.

With the help of this categorization, you can see where the money is going–including where it might be wasted on unused subscriptions.

PocketGuard will also help you find cost savings by recommending simple actions you can take to reduce what you spend. A personalized budget, based on your goals as a couple, as well as your bills and spending, can be automatically generated by PocketGuard, making it fairly easy to get moving with the financial conversation and make the most of your money.

- Monthly Fee – Free for basic platform / $74.99 annual fee for Plus.

4. Honeydue

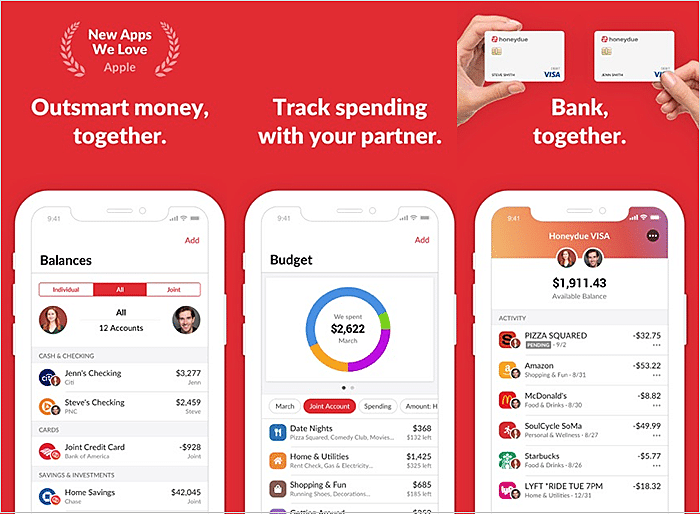

With Honeydue, couples can make big-picture plans together, track shared expenses, and even make comments. Plus, it’s possible to restrict what information you share, so you can still surprise your significant other.

You can also use Honeydue to remain focused on the most important goals you have together and track your progress so you don’t spend too much time on the little things that don’t matter as much to your long-term goals and needs.

- Monthly Fee – FREE

5. HomeBudget

Just what it sounds like, HomeBudget is an app designed to help your entire household get on the same page. Once you get it set up, you can sync your bank accounts and see spending in various categories. Everyone involved can check in and see what you’ve got available, and even keep track of recurring bills and due dates.

Plus, another great thing about HomeBudget is that you can invite others in, including kids and other household members.

- Monthly Fee – None ($5.99 app download cost)

6. EveryDollar

For couples interested in zero-based budgeting, EveryDollar can be a good way to make sure that the whole household remains on the same page and that every dollar has a job, as Dave Ramsey says. Every Dollar is developed by Dave Ramsey.

You can group all budget items, and use them for goal planning to make sure your money is working for you. On top of that, if you decide you need a little extra help with your finances, you can use the local providers feature to help you find experts in your area that can help you meet your goals.

- Monthly Fee – Free for basic platform / $79.99 annual fee for premium (w/ 14-day free trial)

7. MyFICO

While you don’t have a joint credit score, your finances will be better as you both improve your credit situations. Tracking your credit and identifying problem areas (and fixing them), as a couple can help you improve your finances down the road and open you up for additional opportunities. myFICO offers a family plan that allows for quarterly credit score updates and monitoring.

The biggest benefit of myFICO is its thorough credit reports. myFICO offers many different credit report options and you can bet that every detail of your financial credit history is located in those reports. When planning a future with your spouse, getting a handle on your credit is a priority.

- Monthly Fee – Basic Plan $19.95 per month / Advanced Plan $29.95 per month / Premier Plan $39.95 per month

8. Splitwise

Maybe you like to keep your finances separate and split expenses. Splitwise can easily help you keep track of bills and divvy them up in a way that you agree to. It’s a good way to keep track of your shared expenses and make sure you’re both paying as agreed.

Similarly, you can use an app like Venmo to ask your partner to send you money or you can send payment through Venmo as well. However, when you use these apps, you still need to touch base regularly and talk about money.

- Monthly Fee – FREE for basic / $2.99 per month for PRO

How We Chose the Best Budget Apps for Couples

Allowing someone else to view your finances is always a little dicey. The best budget apps for couples that take a few important details into account:

- Dual Account Access – The most important feature that we considered was whether or not the app allowed access to more than one set of login details. You can’t have a budget app for couples without at least two people having access.

- Budget Capabilities and Features – The best budget apps are the ones with the best features. Automated alerts, unlimited account linking & multiple budget capability are just a few of the features we wanted to see in our evaluation process. With each app on our list, you should have more than enough functionality to properly track your finances and make smart decisions.

- Price – Last but not least, we emphasize apps that offer a free version and a low-cost premium version. Budgeting apps lose their value if your finances are worse off from using them, so every app you find on our list is either free or reasonably priced.

Frequently Asked Questions (FAQ)

Can I Keep Some Transaction Separate from My Spouse?

Depending on the app you choose, yes you can. Sometimes, if you want to surprise your spouse with a purchase (vacation, gift, etc.) a few of the apps above will allow you to manually hide a transaction so the other person does not see it.

Can I Create Multiple Budgets in the Same App?

In most of the apps we’ve highlighted above, yes you can. Many of the best budgeting apps for couples allow you to create multiple budgets but in most cases, you’ll have to upgrade your plan from the free one to the premium one.

Do I Pay More So More People Can Share My Account?

No. When signing up and setting up a budget, the best apps for couples above will allow you to share your account with a spouse, significant other, child, or just about anyone you wish.

Account sharing is included in all premium services and a few free ones.

Final Thought on the Best Apps for Couples

In the end, managing your money as a couple is all about finding an app that fits your style. Whether you keep separate accounts or have a big pot, or whether you use a hybrid system, there’s an app that can help you and your partner set goals and make progress together.