Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

This is the third day in our 31-Day Money Challenge. Over 31 days we’ll publish 31 podcasts, each designed to help you move closer to financial freedom. Previously, we looked at how to set financial goals you’ll actually achieve. In this podcast, we discuss the importance of a net worth statement, how to prepare one, and how to use it to track your progress toward financial freedom.

Sponsors: The 31-Day Money Podcast is sponsored by Betterment and Empower.

Betterment and Empower are two tools to make investing easier, less expensive, and more effective.

About Your Net Worth

Do you know exactly where you stand financially? I don’t just mean how much money you have in your checking account or whether you’re up-to-date on your bills, either. I am talking about the status of your overall finances, as measured by your net worth.

Perhaps you’ve never tracked your net worth before, and wouldn’t even know how or where to start. You might not even see the value in doing so. That’s why today, we are going to spend some time talking about how and why you definitely want to track your net worth… and how it can completely transform your progress toward financial freedom.

Your Worth Isn’t Your Income

Here’s one of the most important things you need to remember as you work toward some of your biggest goals: financial freedom is not about how much you make, it’s about how much you keep.

Many of you may have never really thought about finances in that way before, but that truth has the ability to completely transform how you approach personal finance for the rest of your life. After all, it is the same reason that we hear about school janitors retiring with millions, or star athletes going bankrupt.

At the end of the day, your paycheck isn’t the biggest factor: how you manage that money is.

In fact, building lasting wealth can be summarized in just two simple steps:

- Spend less than you make, and

- Invest the difference wisely.

This is the formula for wealth regardless of whether you make $50,000 a year or $1,000,000.

Seriously, It’s That Simple

There are many Americans who earn a modest income, yet are able to achieve financial freedom. These folks are the unsung heroes of money management. They don’t often make the front page of the newspaper (except maybe this guy); instead, like my grandmother, they are nurses in small towns in Ohio, living in a home that is paid off and building a comfortable retirement nest egg.

How? By (1) spending less than they made, and (2) wisely investing the difference.

Likewise, there are countless stories of professional athletes, lottery winners, and movie stars who made millions, but wound up dead broke. Why? Because they failed to (1) spend less than they made, and (2) invest the difference wisely. Ed McMahon. MC Hammer. Vince Young (former NFL Quarterback). Sharon Tirabassi ($10 million lottery winner).

So, how do you go about using this lesson to your advantage? And more importantly, where does your net worth come into play?

All About Net Worth

Your net worth is a simple formula: it’s the sum of your assets minus the sum of your debts. This gives you a much more comprehensive picture of where you stand financially, versus simply looking at savings and retirement accounts, or credit card balances (though all of those are still important).

As you’ll notice, the net worth formula isn’t impacted whatsoever by your annual income. Your net worth doesn’t depend on whether you will make seven-figures this year or five; instead, it will simply account for how you use the money that you make.

Assets and Debts

So, what should you include in either side of your net worth calculations? Deciding which numbers to punch in–and which ones “don’t count”–can be a bit tricky.

On the assets side, you’ll want to be sure to account for your:

- Cash

- Checking account balance

- Personal savings

- Retirement savings

- Equity in a home

- Other real estate equity

- Investments

You might also have other, less-common assets that you would want to include, such as a pricey art collection, a stash of gold bullion, or high-dollar jewelry. Just keep in mind that valuing these things for the purpose of tracking your net worth can be a bit tricky.

In the debt column, you should include things like your:

- Credit card balances (yes, even if you plan to pay it off in full)

- Outstanding mortgage balance(s)

- Student loan debt

- Personal loan debt

- Auto loan balance

Essentially, if you owe it, it goes in the debt column. If you own it, it might go in the asset column.

You’ll notice that I didn’t include your car value in the asset section. That’s because vehicles depreciate rapidly and your car isn’t likely to be an asset you could readily (or effectively) pull from if needed. However, if you feel that your car’s equity is important to your net worth, feel free to include it.

Net Worth and Your Monthly Budget

I’m sure you’ve noticed that your finances change each month. Some months, you’ll need to pay insurance premiums while others, you’ll get a tax refund. Some months will see you buying Christmas presents for your whole family while you’ll make some extra cash from your side gig in others.

If you want to know where you stand in the big picture, your budget isn’t all that helpful. Instead, you’ll want to track your net worth.

Yes, a budget is still important, especially if you have a tendency to lose track of spending or even overspend. And if you’re regularly overspending, you will inevitably impact your net worth. However, your net worth trend line says a lot more about your progress than your envelope system ever will.

How Your Goals Impact Net Worth

At the end of the day, you want to have a nice, large net worth number staring back at you. However, it’s important to realize that for many of us–especially the younger crowd–this number might actually be negative for quite some time, thanks to certain financial goals.

This isn’t always a bad thing. For instance, paying for your education will likely result in higher earnings over the course of your lifetime… after all, that’s why it’s called investing in your future. It can sting in the beginning, though, as you focus on tuition payments instead of savings, or even go into debt with student loans.

Related: How to Pay Off $20,000 in Student Loans in One Year

When you take out a mortgage, your net worth will take a nosedive. Over time, though, you will build equity in your home and it will become an asset.

Some financial goals are less beneficial to our net worth than others, however.

Focusing a large percentage of your income on savings is a great thing, if you can afford it. Focusing a large percentage of your income on a too-large home? Not so much. If your goal is to drive around in a brand new car every two years, that’s your prerogative; driving a used vehicle so you can pay off student loan debt early will grow your net worth faster, though.

Take a look at your immediate and long-term goals; do your monthly spending habits help you to reach them? And more importantly, how do your goals impact your net worth each month?

Net Worth Statements

One of the easiest ways to keep track of your financial progress is through net worth statements. There are many templates available online that you can utilize or, if you’re handy with Excel, you can create your own.

It can be as simple or advanced as you’d like. You’ll just want to be sure that you include each of your assets and each of your liabilities (debts). You’ll also want to track the change in your net worth from month to month, either by numbers or a good old-fashioned graph.

When to Update

Net worth statements should ideally be updated monthly. Any longer than that, and you might miss out on accurately tracking your progress, or seeing how small changes impact the overall picture. Any sooner than that, and you’ll probably drive yourself crazy.

I know someone who updates his net worth spreadsheet weekly… and I regularly let him know that he’s adding unnecessary stress to his life. The changes that occur from one week to the next have a tendency to ebb and flow. By waiting a month before crunching numbers, you ensure that small impacts (like the electric bill coming out) don’t cause your net worth to continuously bounce around.

Plus, things like mortgage and auto loan statements come out once a month, so it makes sense to just wait.

There are some people who only update their net worth statement once or twice a year. While this can work–and is better than not tracking it at all–it does make it difficult to know where you stand throughout the year. If you have specific goals in mind, it’s important to see if you’re set to meet them or if you need to make changes to your financial approach.

A monthly update is ideal; however, try to at least punch in new numbers once a quarter, to keep yourself up-to-speed and on track.

Those Who Build Wealth vs Those Who Don’t

Many of us think that if we could just get a better job, win the lottery, or become the surprise beneficiary of some late uncle’s estate, we would meet our financial goals. However, this is rarely the case.

Sure, a larger income can help, especially if you’re living paycheck-to-paycheck just paying basic expenses. For most people, though, the key to building wealth lies not in how much one makes, but in how much they keep.

This means living below your means consistently. Save first, spend second, and eliminate wasteful expenses from your life. If you’re having trouble building savings and/or reducing liabilities, see where you could “trim the fat” in your financial life. That might mean downsizing your home, switching to a one-car family, reducing your monthly grocery bill, or all of the above.

Related: 92 Painless Ways to Save Money

Building wealth is possible for everyone, regardless of income. You can file for bankruptcy after making $30 million a year, or you can be a retired janitor with seven figures in the bank. And if you want to know which you’re on track to become, knowing (and tracking) your net worth is paramount.

And that brings us to this podcast:

Topics Covered

- What is a net worth statement and how do you prepare one

- Why you should not include your cars, furniture or other personal possessions in your net worth statement

- How to use your net worth statement to track your financial progress

- How most of the important financial goals (getting out of debt, saving for emergencies, saving for retirement) affect your net worth

- The key relationship between your net worth and your monthly budget

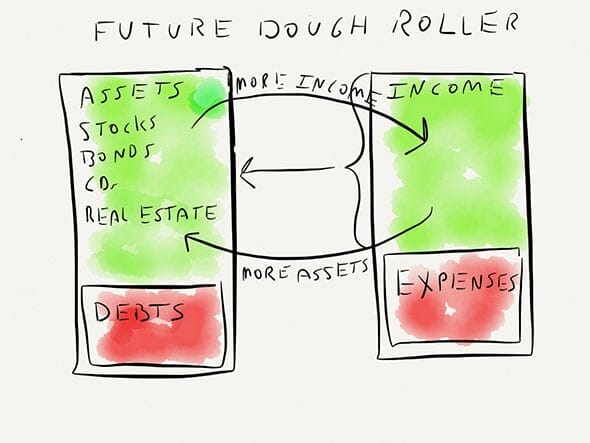

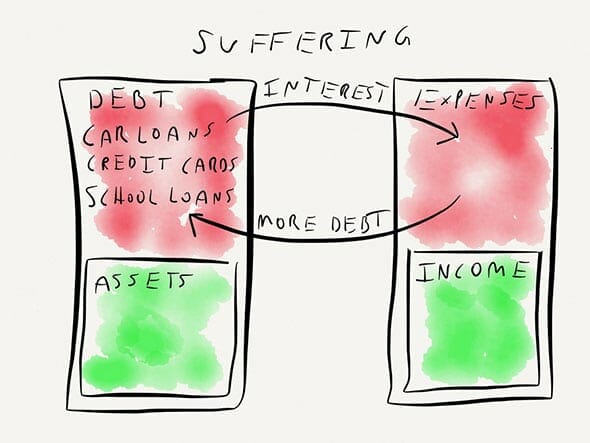

- How and why assets generate income

- How and why debts generate expenses

- The difference between those who build wealth and those who do not