Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

It’s official. Credit scores are the most confusing aspect of personal finance. The FICO formula largely remains a mystery. And don’t get me started on the multiple versions of credit scores out there. Learning how to start building credit has become critical to your financial success.

By one account, you may have 49 different FICO scores, not to mention dozens of credit scores calculated using non-FICO formulas.

So it’s understandable when folks (myself included) get a bit lightheaded when thinking about our credit. And that brings me to a great question sent in from a reader and podcast listener named Esther:

Esther’s question is a good one and one I’ve given a lot of thought to as my children are now young adults. I’ve written before on how to build credit for the first time. In this article, I’ll share some new perspectives, tips, and resources on this topic.

First Steps on How to Build Credit

Let’s start by making sure we put the question of credit and credit scores into the right perspective. There are three main financial priorities every young adult should have:

- Spend less than you make

- Invest wisely

- Avoid debt

Pretty simple. In fact, these are the three main financial priorities we all should have. Why? Because these priorities will enable us to achieve financial freedom. Financial freedom, in turn, will allow us to pursue our life’s purpose, whatever it may be.

So what’s this got to do with building credit? A lot. Building credit can involve some financially dangerous moves, particularly for those with little experience managing their finances. As we’ll see below, credit cards are a great way to build credit. They are also a great way to ruin your finances. So as we walk through credit-building strategies, keep in mind the three priorities listed above.

Become an Authorized User on a Credit Card

The first and easiest way to establish credit is to become an authorized user of a person’s credit card. For most young adults, this will mean becoming an authorized user on a parent’s credit card. There are some important things to keep in mind with this approach:

- An authorized user doesn’t have to use the card to build credit

- As an authorized user, your credit can be harmed if the account holder makes payments late

- If your credit is being harmed, you can call the credit card company and ask to be removed as an authorized user

- Not all credit card issuers report authorized user status to the credit bureaus (here’s a thread on the myFICO forum that lists credit cards that report)

As a final word of caution, avoid what is known in the industry as piggybacking. With piggybacking, an individual becomes an authorized user on a credit card for a fee. These transactions usually involve complete strangers and are brokered by financial intermediaries and credit counselors in an effort to artificially inflate an individual’s credit score. FICO has worked hard to detect these situations and to exclude them from the FICO formula.

Get a Credit Card and Use it Wisely

The next step to building credit is to obtain a credit card. Consistent with the financial priorities listed above, however, care must be used when selecting and using a credit card.

There are excellent reasons to use a credit card beyond building credit. The security of using plastic and the potential rewards are the two primary reasons. If used responsibly, however, plastic can help establish credit as well.

Here are some things to keep in mind:

- Prepaid cards and bank debit cards do not build credit

- Some credit cards are designed for those with no credit history, including student and secured credit cards

- Keeping your credit limit low to start is an excellent way to remove the temptation to overspend

- Paying the card off in full each and every month is a must

Store-branded credit cards are also an option, but not one I recommend for two reasons. First, store cards encourage frivolous spending. With a generic card, you can buy everyday essentials, such as gas and groceries. A Macy’s store credit card doesn’t qualify as essential. Second, the interest rate that comes with these cards is usually very high.

Open a Credit Builder Loan

A fairly new idea in the financial world comes in the form of a credit builder loan. Instead of opening up a personal loan with a bank in the traditional sense, you actually take a loan out with yourself here. Making on-time payments for a period of up to two years means a possible improvement to your credit and the best part is it comes at a very low cost.

The Self Credit Builder Loan is my personal favorite because it offers four different payment options and they’re all quite reasonable. When the loan has been fully paid off, the initial loan amount is returned to you minus interest and fees.

For example, if you take out a $525 loan on repayment terms of 2 years; the interest rate is 15.92%. This means that over the two-year period, you pay your loan back, you’ll pay back a total of $609; $525 in principal, and $89 in interest and fees.

- Initial loan activation fee of $9

- No prepayment penalty. Pay your loan off at any time.

- Four different loan options (payment per month) – $25, $35, $48, and $150

- All funds are FDIC-insured.

Self Disclosure: Sample loans: $25/mo, 24 mos, $9 admin fee, 15.92% APR; $35/mo, 24 mos, $9 admin fee, 15.97% APR; $48/mo, 24 mos, $9 admin fee, 15.72% APR; $150/mo, 24 mos, $9 admin fee, 15.88% APR. See self.inc/pricing

What About Other Personal Loans

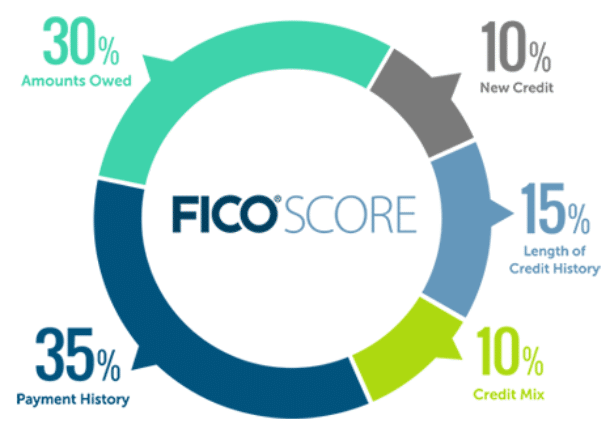

I’ve not included other types of loans, such as auto loans and student loans. These types of loans will, of course, affect your credit. Further, having different types of loans (revolving credit like credit cards and installment loans like car loans) can affect your credit score. Credit mix accounts for 10% of a FICO score.

When talking about how to build credit, taking out personal loans shouldn’t factor into the equation. The purpose of a personal loan is often to pay for a necessary expense and it is not used as a “tool” to build or improve your credit. Personal loans typically carry high-interest rates over long periods of time, so they represent an expensive line of credit.

Pay Your Debts on Time, Every Time

It is absolutely critical that every monthly payment on credit cards or other debt is paid on time. Payment history is the single most important factor in the FICO formula, accounting for 35% of the overall score. A late payment, moreover, remains on your credit history for seven years. If you don’t have the funds to pay your debts on time, try to at least make the minimum payment each payment cycle.

Now there’s a way you can use your positive payment information to increase your credit rating. The best part is it’s free! When you sign up for Experian Boost your monthly payments including utility bills and mobile phone bills can be tracked to see if you make the payment on time. When you do, this information is used to give your FICO Score a boost.

A few additional features of Experian Boost help allow you to access your FICO score and credit report, run a free identity check across the web to see if your personal info has been exposed, and have immediate access to other financial opportunities to save on everyday bills.

Read our Experian Boost Review

Establishing Credit is Different Than Repairing Credit

Finally, there are some important differences between establishing credit for the first time and repairing credit. When repairing credit, keep a few things in mind:

- Checking your credit report for errors is a must. It’s the quickest and easiest way to improve your score.

- Baggage on your credit report stays there for a long time (7 years for late payments as noted above). However, the effect this baggage has on your score decreases over time.

It’s generally harder to get a credit card with poor credit than it is with no credit. A secured credit card is generally the best option for those recovering from bankruptcy, foreclosure, or other credit mishaps.

Frequently Asked Questions (FAQ)

Do You Have to Be 18 to Start Building Credit?

Strictly speaking no – but many of the most effective ways to build credit will be limited to those 18 and over (taking on loans or owning a credit card primarily). However, many credit card companies will allow a child under 18 to become an authorized user on a parent’s credit card.

This allows the child to benefit from their parent’s prompt payments. Perhaps the best way that children under 18 can start to build good credit is through education. Children can be taught financial literacy before they turn 18 so that they know the habits to build good credit when they are able to do so themselves.

Do You Need a Credit Card to Build Credit?

No, you don’t need a credit card to build good credit. However, having a credit card, using it properly, and making payments on time is one of the most effective ways to build good credit. There are, of course, other factors that determine your credit score which don’t require owning a credit card.

Additionally, having a credit card and using it irresponsibly (carrying a balance, missing payments, etc.) will end up giving you poor credit. A credit card is a double-edged sword.

What is the Age Limit for a Credit Card?

Children cannot own a credit card, and the legal age to own a credit card begins at 18. However, children can become authorized users on their parent’s credit card, which was a process I detailed above.

Putting it All Together – Make an Action Plan

At the end of the day, a good credit score doesn’t exist in isolation. A good credit score is a combination of habits that work toward building your credit score over time and will require a persistent effort toward this goal. Excellent credit is attainable, but it requires knowing what these habits are and staying consistent over a long period.

Use all the advice I’ve given above, and turn it into a set of actionable routines. It’s much easier to stay on track toward your goals once they become habits. Here are the most important habits that I recommend:

- Make a Payment Schedule Set aside a day and time for monthly bill/loan payments. Put it on your calendar, and stick to it – every month. Pay all of your monthly obligations during this time, rather than paying them separately when they come due. This not only ensures that you don’t forget about any outstanding payments, but you’ll also save time by meeting all your obligations at once.

- Use a Fraction of Your Credit Limit A portion of your credit score is decided by your credit utilization,” which is the percentage of your credit limit that you actually use. The less you use, the better your credit score. Try to keep this number below 30-40%. Make a habit of alternating payment methods. In other words, pay with debit or cash when you can.

- Understand Your Credit Score This has been a recurring theme throughout the article, but it’s no less important to mention. A credit score is complicated, but having a general idea of what makes up that score is your safest bet toward keeping it in good standing. Understand the things that build your credit score (including all the information I’ve given above), and implement these lessons into your financial routines.

With a little effort and a lot of focus, you’ll be on your way to improving your credit, which has the potential to save you tens if not hundreds of thousands of dollars on lifetime interest payments.