Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

When it comes to personal finance, nothing beats being able to track where your dollar goes. Sites like Mint.com and tools like You Need A Budget (YNAB) are indispensable for the savvy planner. They’re easy-to-use, simple to understand and provide great information at a glance.

But these tools fall short in one area: credit card rewards.

Your travel reward points and miles also have cash value, but Mint, YNAB, and other budgeting tools don’t (yet) have the tools to track them. Luckily, there are a few options on the market specifically for tracking credit card rewards. Let’s look at a few options that you can use to stay on top of your miles.

AwardWallet

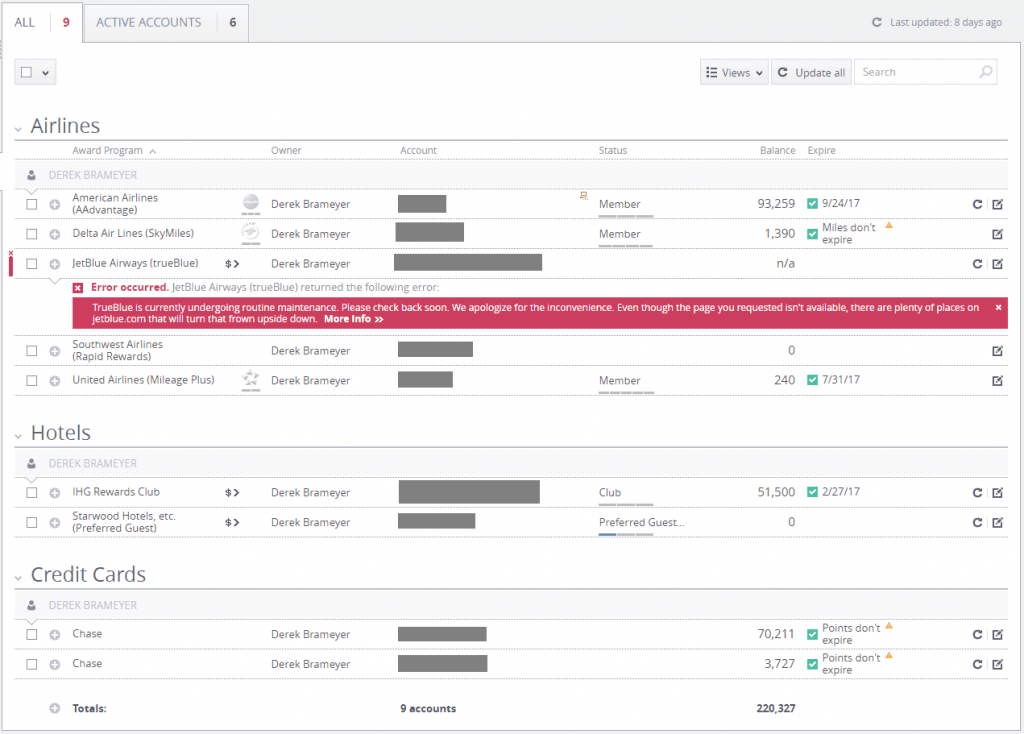

AwardWallet is the most widely-recommended application to track frequent flyer miles and other rewards points. Currently, it supports well over 600 different loyalty programs, and I was able to add all of my programs with ease.

AwardWallet is the most widely-recommended application to track frequent flyer miles and other rewards points. Currently, it supports well over 600 different loyalty programs, and I was able to add all of my programs with ease.

The web app is fairly straightforward, though some loyalty programs require a separate browser extension to function correctly. The mobile application is also very easy to use, though as an Android user I find the design to be a bit lacking. Still, the functionality is there, and it’s easy to view your mileage balances and be notified when those balances change.

Like most web services in this day and age, AwardWallet offers both free and paid tiers. Fortunately, the free tier is perfectly sufficient for most users. The paid version of AwardWallet, which will cost you $5 for six months, adds in a slew of valuable features, including the ability to view the expiration date of your points and miles. If you’re a big data fan, the paid tier will also provide you with historical account balances and transactions, which could allow you to analyze how frequently and where you’re spending points.

The most important thing about AwardWallet is that its free version ticks all of the important boxes. I equate it most to Mint, of which I’m also a big fan and daily user. I don’t check AwardWallet as frequently as Mint, but it’s nice to know there’s one place that aggregates every loyalty program I use.

UsingMiles

UsingMiles is very similar to AwardWallet and rivals it in functionality and design. With over 250 loyalty programs supported, you should have no problem adding your credit card, airline, and hotel programs.

The Basic tier of service is completely free and offers full point tracking, e-mailed statements that include redemption activity, and price notifications for hotel rooms and flights.

UsingMiles Premier will cost you $29.99 per year but adds two critical features. The first feature alerts you when your hard-earned points are about to expire, which can be a headache to track across over a dozen different loyalty programs.

The second feature allows you to actually book flights using your rewards points, which can also be a huge chore to plan and organize. Transferring rewards points is practically an art, with all sorts of partner programs to keep track of, and UsingMiles can make this much more straightforward.

Like AwardWallet, the UsingMiles free tier is perfect for most users. The Premier program is pricey compared to AwardWallet, but being able to deep-link into airlines and hotels to use your points can be very valuable, depending on how much time you want to dedicate to researching optimal redemption values. I also find myself preferring UsingMiles’ design and UI over AwardWallet. One additional note: UsingMiles currently doesn’t have a native Android or iOS app.

Traxo

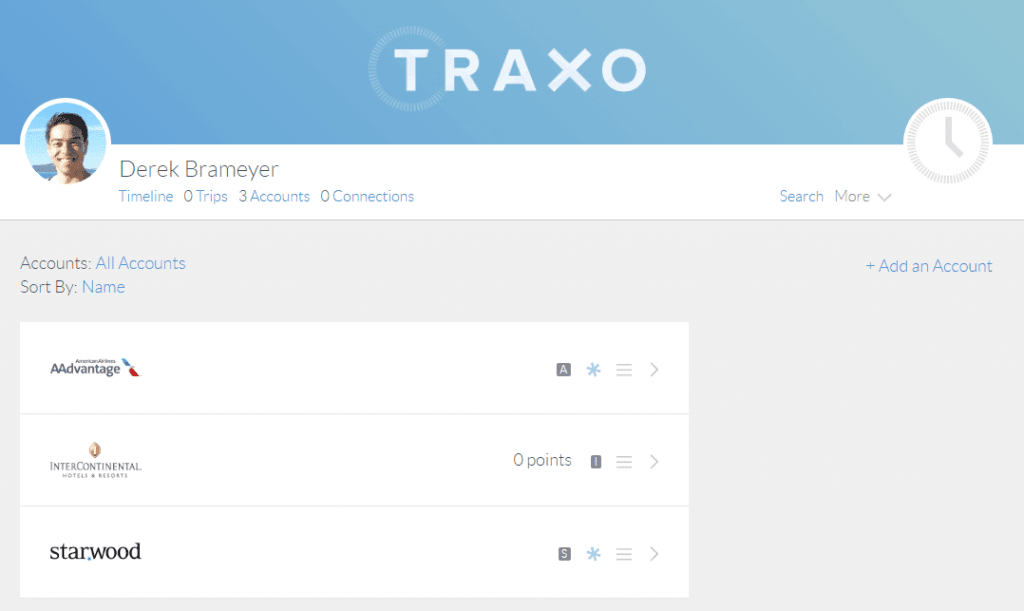

Traxo aggregates your travel plans and loyalty programs into one gorgeous interface. It provides flight alerts, itinerary planning, and rewards tracking. And it does so beautifully. It offers a web service, an iOS app, and an Android app.

Traxo aggregates your travel plans and loyalty programs into one gorgeous interface. It provides flight alerts, itinerary planning, and rewards tracking. And it does so beautifully. It offers a web service, an iOS app, and an Android app.

Traxo features UI that’s clean, simple, and frankly, way better on the eyes than the rest of the competition. It’s also completely free, but its downfall is a lack of supported partners. For example, Chase Ultimate Rewards points, a very common currency for travelers, aren’t yet supported.

I’m really excited to see Traxo add more partners, as the website and Android app are a joy to use. They provide the type of experience that makes you want to log in frequently, just to use the app and take in the design.

TripIt Pro

TripIt is a service that primarily focuses on travel itineraries and makes it easier for travelers to organize and plan their trips. TripIt provides you with one place to manage trip planning, automatically taking things like reservation and flight confirmations and turning them into an itinerary for you.

Users can then edit that itinerary if their plans change, and the itinerary syncs both on the web and on mobile devices with the application installed. TripIt also syncs your travel plans with your calendar, which is a great feature for people that live by their web calendar applications.

The Pro version of TripIt adds in point tracking, but it comes at a cost. TripIt Pro will run you $49 per year, or just a little over $4 per month. It works with over 150 loyalty programs, so your credit card points, hotel points, and airline miles should be well-supported.

I really like the idea behindTripIt and think that it serves a need for frequent travelers that don’t want the hassle of organizing their own itineraries. If you’re already a TripIt power user, it might be worth upgrading to Pro to help track your rewards points, but I still prefer the free tools like AwardWallet and UsingMiles.

Excel/Google Sheets

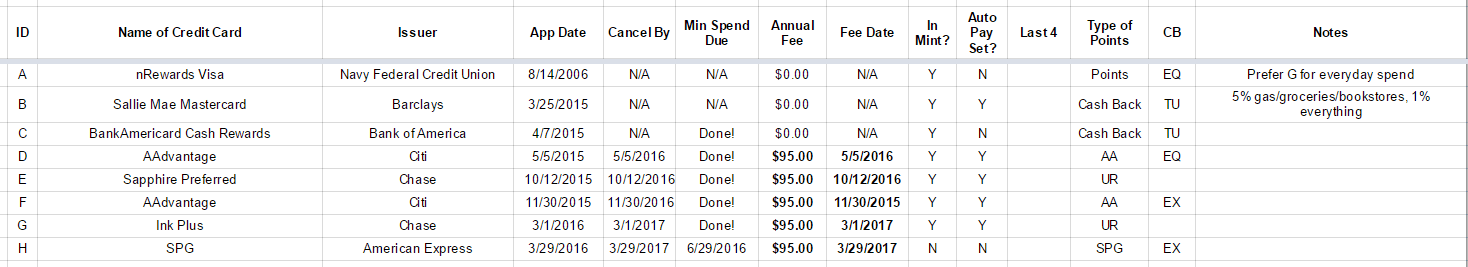

Finally, we come to the battle-tested and age-old method of using a simple spreadsheet to track your miles and points. This is tedious in this day and age, but for some, it’s the only way.

I use Google Sheets to track the many credit cards that I have to make sure I stay ahead of annual fees, mileage bonus expirations, and minimum spend requirements. It’s also helpful to track a timeline of my FICO, as a few of my credit cards and banks provide free reporting.

I like a one-two punch of AwardWallet for aggregating point values from all of my programs (and being able to do that automatically), and a spreadsheet that I check every couple of weeks to make sure things like annual fee deadlines aren’t about to hit. Here’s an image of what my spreadsheet looks like:

Check out the spreadsheet here (be sure to create a copy of the spreadsheet if you want to use it to track your own credit card rewards).

Check out the spreadsheet here (be sure to create a copy of the spreadsheet if you want to use it to track your own credit card rewards).

Try Them All!

No service is perfect for everyone. When it comes to budgeting and tracking where your money goes, Mint and YNAB (and even YNAB 4) serve different purposes and provide different value to each individual user.

I encourage anyone thinking about using one of these tools to try a few of them. You may prefer the design of one, or you may find that using a website to track this is just too much of a hassle in the first place.

AwardWallet currently seems to be leading the pack, but I really like the design and feel of Traxo and UsingMiles, and I think that more tools to help track your points and miles are on the horizon.