Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Sometimes managing your finances is harder than earning the money in the first place. Thanks to our modern technology, though, there are now a lot of interesting and creative ways for you to keep track of your spending with budgeting apps. In this article, we look specifically at the best calendar-based money management apps.

The Best Calendar-Based Personal Finance Apps

We evaluated more than a dozen calendar-based personal finance apps and narrowed our list down to seven that we believe to be the best. The table below shows the seven apps, and what we believe each is best for. A deeper analysis of each app will follow.

| Calendar Budget App | Best Feature |

| Money Calendar | Best All-Around |

| Calendar Budget | Desktop Users |

| PNC Virtual Wallet | Full Banking Suite |

| Google Calendar | Free |

| Dollarbird Pro | Small Business Budgets |

| Budget Calendar from Monelyze | Simplicity |

| PocketSmith | Plan Options |

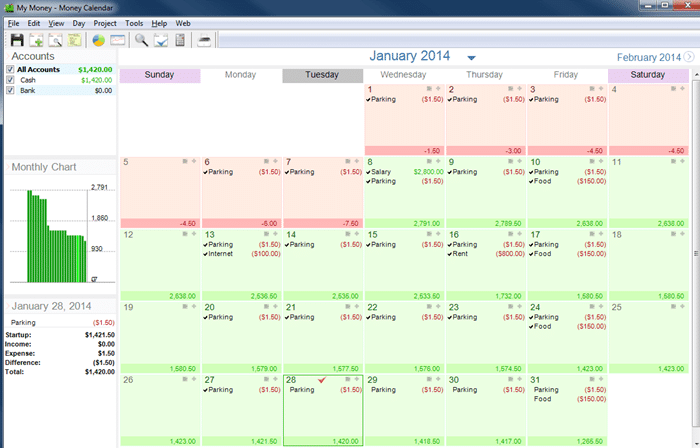

1. Money Calendar

Money Calendar is the best for managing personal expenses, but it can also work for simple business income and expenses. It’s a desktop-based app that lets you project your account balances and overall savings easily. You can divide your expenses into different categories. And it gives you several auto-generated charts to keep tabs on your spending month by month.

With Money Calendar, managing and maintaining multiple accounts is a little easier. It has multi-currency support, so you won’t have problems when transferring money between accounts. Monthly budgets and expenses are easy to monitor because of the clean layout of the calendar.

The images are colorful and attention-getting. You’ll find the graphics good and easy on the eyes. This simple-looking layout holds more than meets the eye.

- App Store Rating: 3.7 out of 5 stars among 608 iOS users.

- Google Play Rating: 3.7 out of 5 stars among 104 Android users.

- Price: One-time fee of $19.95 – no subscription fee.

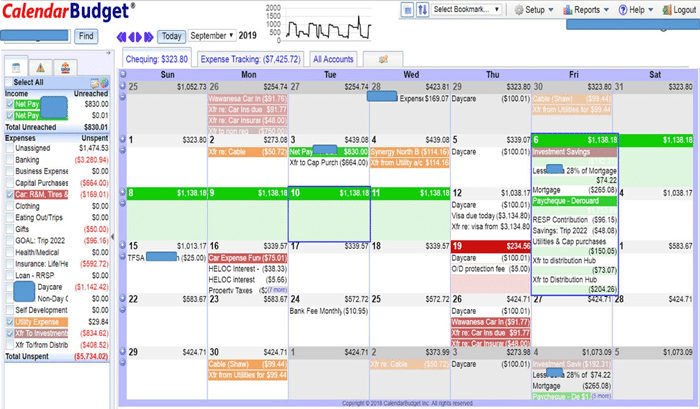

2. Calendar Budget

Calendar Budget is best for your desktop. It’s a simple app that allows you to do a lot of things for your finances. You can keep track of your money using a calendar that acts as a financial planner. Your budget is categorized, so it’s easy for you to take note of every financial move you make.

You can set your expenses to different frequencies: one-time only or repeat. If you repeat a particular expense, it will automatically update according to the time that you set it to. No need for you to worry about forgetting to set it up.

Calendar Budget also shows your daily expenses. What’s more, you can program future expenses and set financial goals. It provides bill and transaction reminders, planning up to 10 years into the future, and the ability to attach receipts to your transactions. You can also bookmark important financial events the same way you do with all those parties you attend. Finally, to make sure that you never pay a bill late, you’ll get email reminders before your bills are due.

- App Store Rating: 3.3 out of 5 stars among 43 iOS users.

- Google Play Rating: 3.7 out of 5 stars among 104 Android users.

- Price: $7.99 per month or $56.99 per year, after a 30-day free trial

3. PNC’s Virtual Wallet

This budgeting tool requires an actual bank account with PNC. But it can be a good option if you’re also in the market for a new checking account. Virtual Wallet comes with several budgeting tools, including a money bar that lets you quickly see how much you have in spending, saving, and long-term savings categories. But it also has a calendar that shows your upcoming transactions and a projected account balance.

If there’s a particular time of the month when it’s easier for you to overdraft your account, you’re in luck. Virtual Wallet will alert you with “Danger Days.” These are days coded red on your calendar when you’re likely to have a very low account balance and are most likely to unintentionally overdraft.

In all, these are great tools to budget with, especially if you need a simple way to budget through your joint checking account with your spouse or significant other.

- App Store Rating: 4.8 out of 5 stars among 1.4 million iOS users.

- Google Play Rating: 4.5 out of 5 stars among 241,000 Android users.

- Price: $7 per month but waived with at least $500 in qualifying monthly deposits.

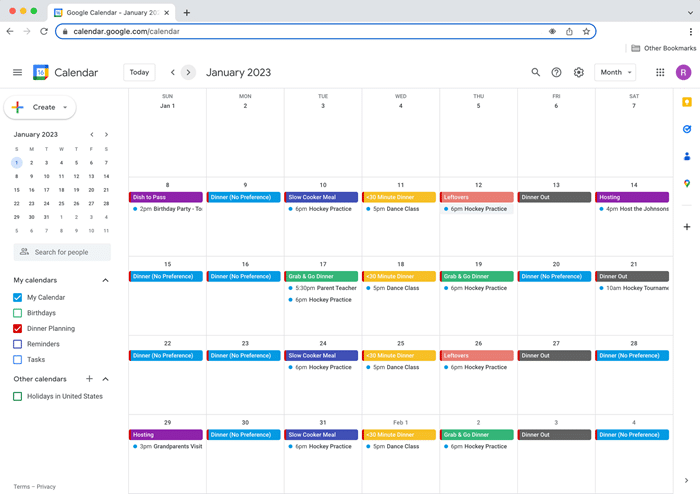

4. Google Calendar

If none of these apps sounds appealing to you, you can sort of create your approximation of a calendar-based budgeting app with Google Calendar. You color code a budget calendar with scheduled incoming and outgoing transactions, as well as scheduled bills due. You won’t get fancy alerts or balance projections. But this is a simple way to keep track of the ebb and flow of your finances. You can get a more in-depth tutorial here.

Calendar budgeting certainly isn’t the only option. And you might even decide to use a calendar-based budgeting tool in tandem with another of our favorite budget tools. But these options can help you more easily track. Best of all, Google Calendar is free to use.

Since it is a Google app, you can also incorporate it with other Google products, like Google Workspace and Gmail.

- App Store Rating: 4.6 out of 5 stars among 113,000+ iOS users.

- Google Play Rating: 4.4 out of 5 stars among 2.5 million+ Android users.

- Price: Free

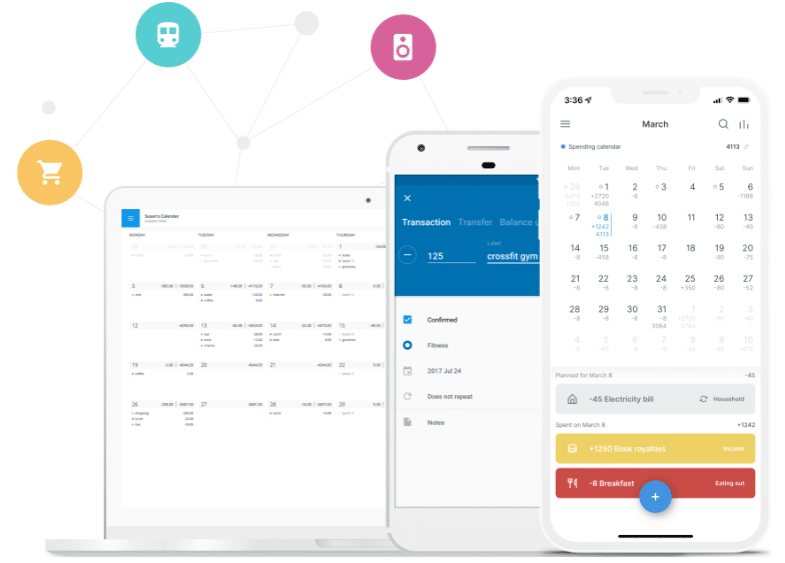

5. Dollarbird

Dollarbird Pro bills itself as “calendar-based personal finance management designed for real life”. Using some help from AI, you can add past, future, or recurring transactions. Among the premium calendar-based finance apps, Dollarbird is one of the least expensive.

Dollarbird offers two different plans, Pro and Pro Unlimited. Pro offers 20 calendars for three team members, while Pro Unlimited offers unlimited calendars and unlimited team members. They also offer a Business version, with custom pricing, that provides collaborative financial tracking and planning, as well as unlimited calendars and team members.

- App Store Rating: 4.7 out of 5 stars among 3,300+ iOS users.

- Google Play Rating: 3.2 out of 5 stars among 531 Android users.

- Price: Pro, $3.33 per month or $39.99 per year; Pro Unlimited, $5 per month or $59.99 per year.

6. Budget Calendar

Budget Calendar from Monelyze is an expense tracker and daily budget app. It enables you to enter present purchases as soon as you buy and provides an analysis of your finances with animated graphs. You can also customize your preferences, including report notifications so you can make the app a habit. Provides a scrollable calendar with secure backup on iCloud.

The premium version allows you to select theme colors, the ability to enter from bookmarks, repeat events, advanced search, all charts, analytics, and CSV export – all while it keeps ads hidden.

- App Store Rating: 4.6 out of 5 stars among 246 iOS users.

- Google Play Rating: 4.6 out of 5 stars among 427 Android users.

- Price: Free version and premium plan at $2.99 per month.

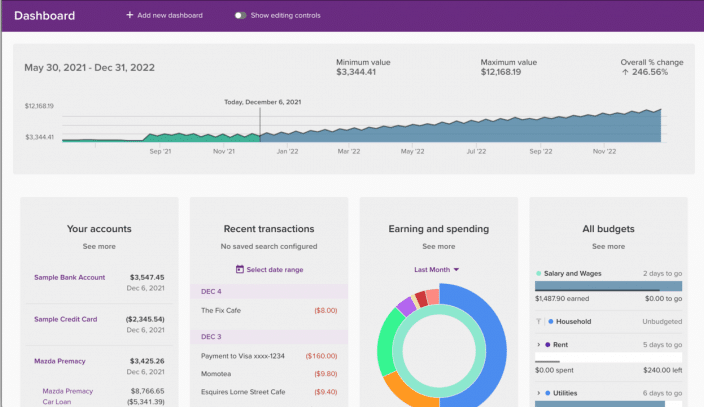

7. PocketSmith

PocketSmith is our top choice if you are looking for a variety of plans since they offer no fewer than four. Each provides a different service level and pricing structure.

The Free plan provides manual imports, two dashboards, up to 12 budgets, two accounts, and six-month projections. The next level up is Foundation, which adds automatic bank feeds, email support, six connected bank accounts, six dashboards, 10-year projections, and unlimited accounts and budgets.

The Flourish plan has 18 connected banks from all countries, 18 dashboards, 30 years of projections, and unlimited accounts and budgets. Finally, the Fortune plan provides priority email support, unlimited connected banks from all countries, unlimited dashboards, 60-year projections, and unlimited accounts and budgets.

- App Store Rating: 3.3 out of 5 stars among 43 iOS users.

- Google Play Rating: 3.4 out of 5 stars among 135 Android users.

- Price: Free version; Foundation, $14.95 monthly/$120 annually; Flourish, $24.95 monthly/$200 annually; Fortune, $39.95 monthly/$320 annually. (33% discount on all plans if you pay annually)

What is a Calendar-Based Personal Finance App?

A calendar-based finance app is essentially a budgeting app that enables you to track and plan proper management of your finances. But where calendar-based finance apps differ from more generic budgeting apps is in their visual representation through the use of a calendar. Since most of us are familiar with calendars, it’s often easier to track and plan financial activities grouped by days, weeks, or months.

Calendar-based personal finance apps assemble similar information from budgeting apps into a calendar format, making it easy to track finances with a quick glance of the day or even a week ahead.

Why Use a Calendar Based Personal Finance App?

The strength of calendar-based personal finance apps is in the visual presentation. It’s one thing to follow a to-do list of upcoming financial transactions or even to get reminders by email or text. But for many people, the ability to simply glance at a calendar – and see any upcoming financial events – is much more impactful than looking at a list or getting an alert.

The calendar method gives you the ability to know what’s coming up well in advance, as well as to plan many months into the future. For many consumers, a calendar-based personal finance app can provide just the type of discipline needed to stay on top of all things financial.

Frequently Asked Questions (FAQ)

What is the calendar app that tracks payments?

Virtually any of the calendar-based personal finance apps included in this guide can track payments.

What is the budget app with due dates?

Once again, the calendar-based personal finance apps included in this guide provide due dates for bills and other obligations.

Is there an app to organize finances for free?

Yes. Several of the apps in this guide offer a free version, though the functionality of each is limited. By contrast, Google Calendar is a completely free app.

But if you are looking for an effective calendar-based personal finance app, your best strategy will be to take advantage of one of the premium services. Yes, you will pay a fee for the service. But it will include a much larger number of functions, most likely the ones you need to properly manage your finances.

How do I create a finance calendar?

Creating a finance calendar is a simple matter of organizing your income and expenses in a calendar-based app. That means creating a list of paydays, which should include both the date of receipt and the anticipated amount, as well as expenses – similarly, including due dates and amounts.

You should be careful to include both recurring expenses and irregular bills so that your calendar will be comprehensive.

How We Chose the Best Calendar-Based Budgeting Apps

We created this list of the best calendar-based personal finance apps by considering the many that are available and whittling it down to a handful we believe to be the best.

The criteria used to make this determination include:

Ratings from iOS users on The App Store.

- Ratings from Android users on Google Play.

- Pricing.

- Features.

- Ability to customize the app.

- Potential integration with other apps and services.

- What each app does better than the competition.

Final Thoughts

As you can see, there are plenty of calendar-based personal finance apps available. While this list represents what we believe to be the best apps available, you’ll need to determine for yourself which will work best for you. Carefully evaluate the features and benefits of each, as well as the cost (if any), before choosing the right app for you.

Related: Best Expense Tracker Apps