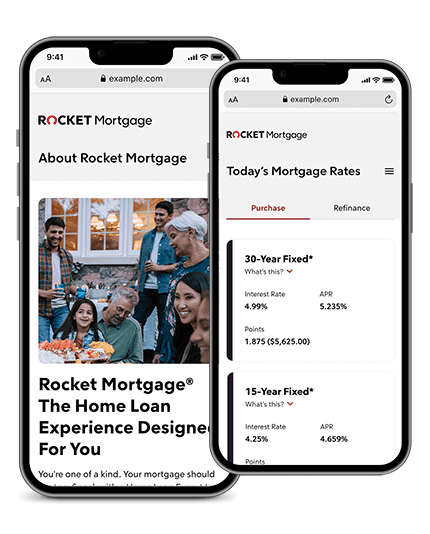

Rocket Mortgage Review – Quick Application Process and Competitive Rates

Formerly known as Quicken Loans, Rocket Mortgage is one of the best-known mortgage lenders in America, thanks in part to a comprehensive advertising campaign. But does it live up to the hype, and does it outperform its more conventional competitors? Let’s dive in and see what Rocket Mortgage does – and doesn’t do – and…