GoHenry Review – An Easy Way to Teach Kids About Finances

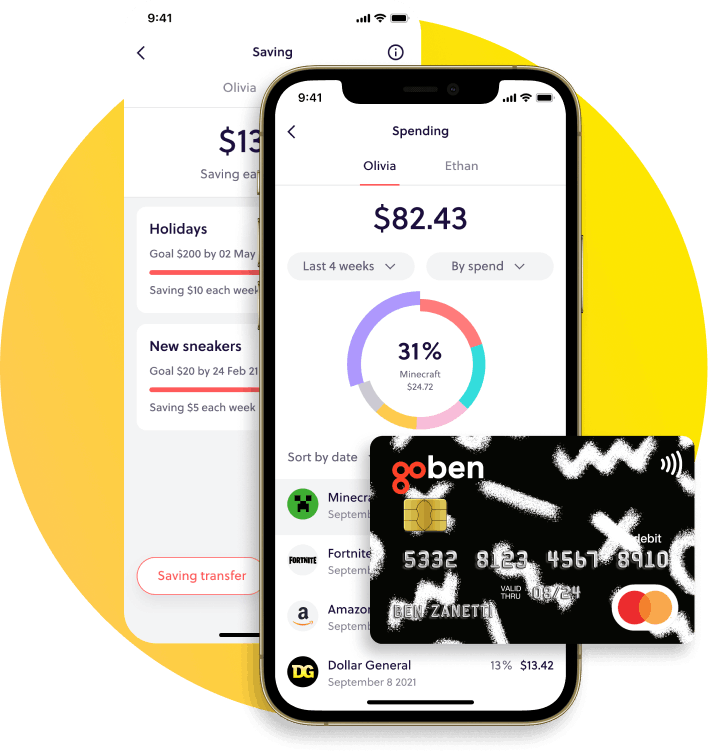

If you’ve been struggling to teach your children and teenagers about money, GoHenry is a resource that can help you do so. It covers everything from earning money to budgeting, saving, and spending. It’s all about learning by doing, perhaps the best way to learn any skill—especially money. For a single low monthly fee, you…